Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Tag Archive: marginal productivity of debt

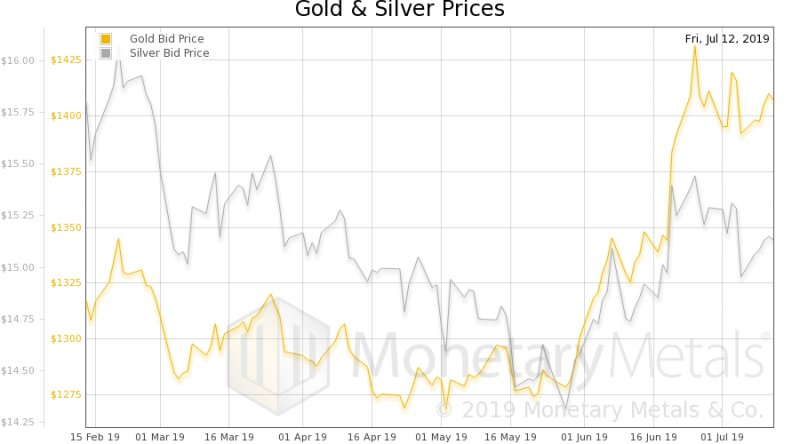

More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

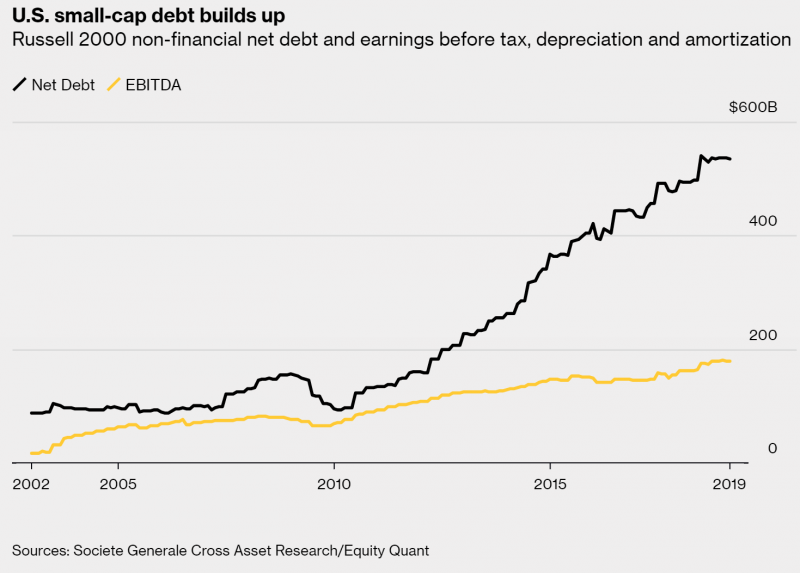

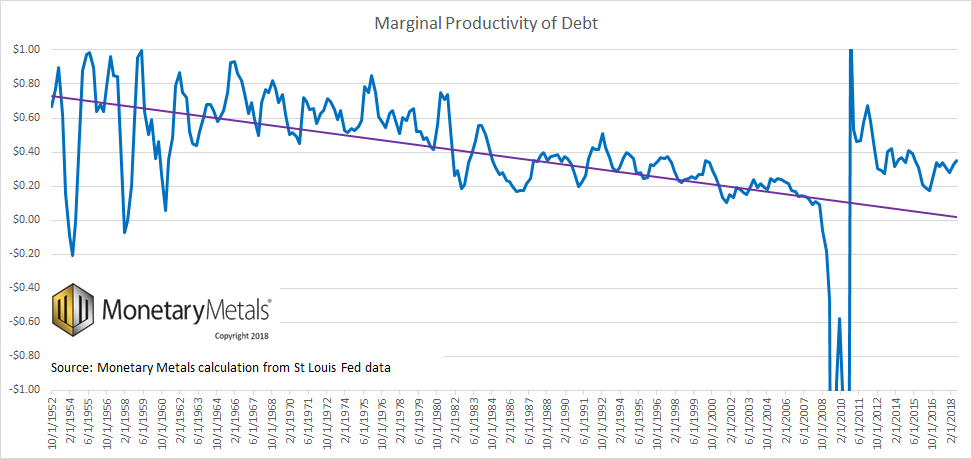

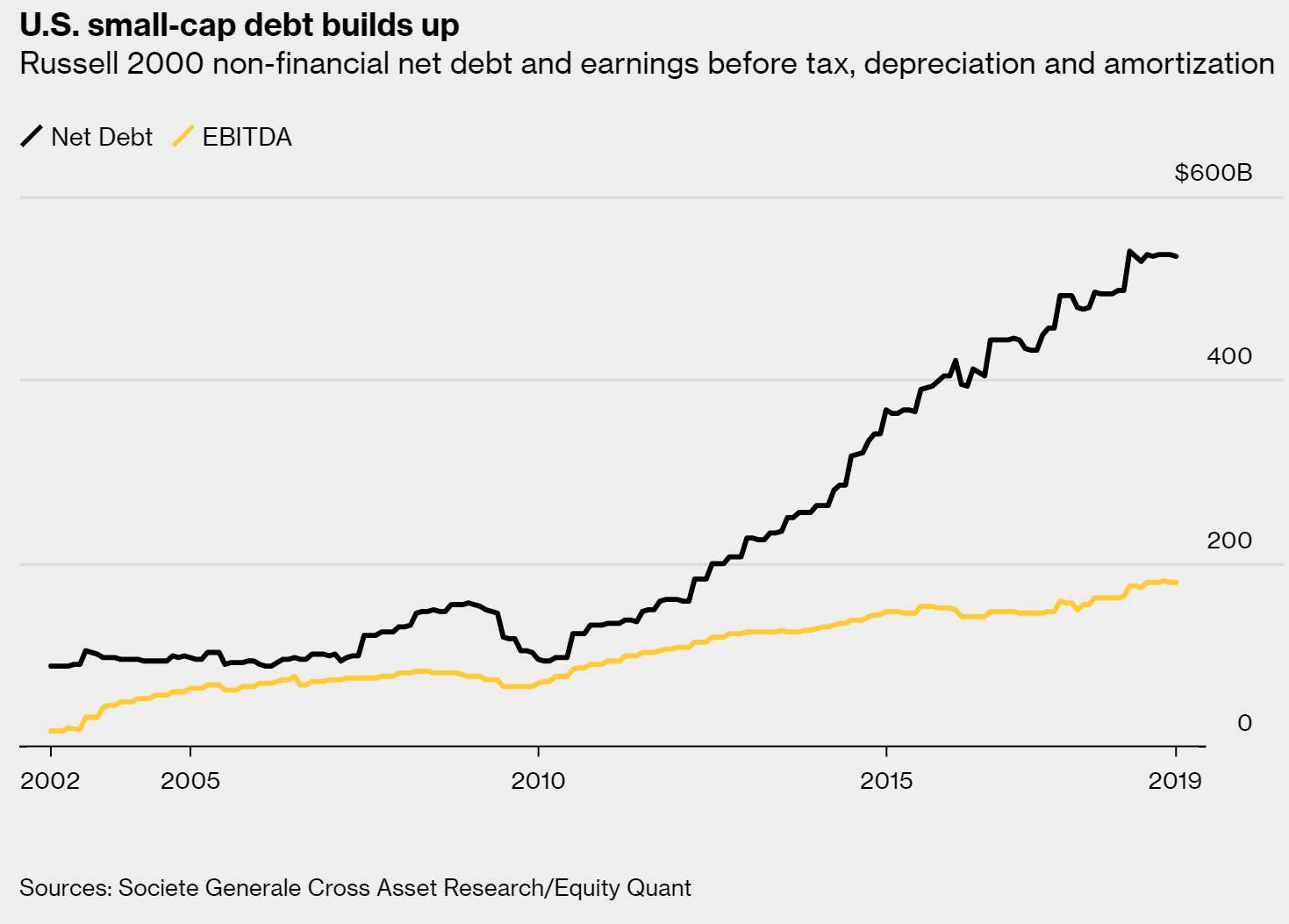

Debt and Profit in Russell 2000 Firms

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic).

Read More »

Read More »

The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings.

Read More »

Read More »

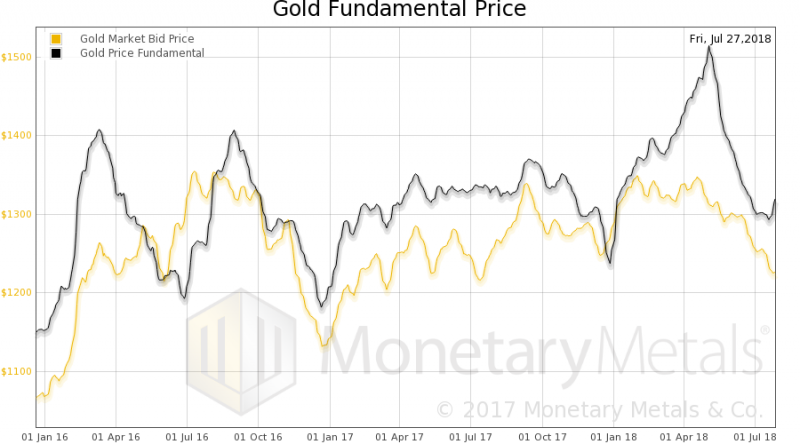

A Dire Warning, Report 29 July 2018

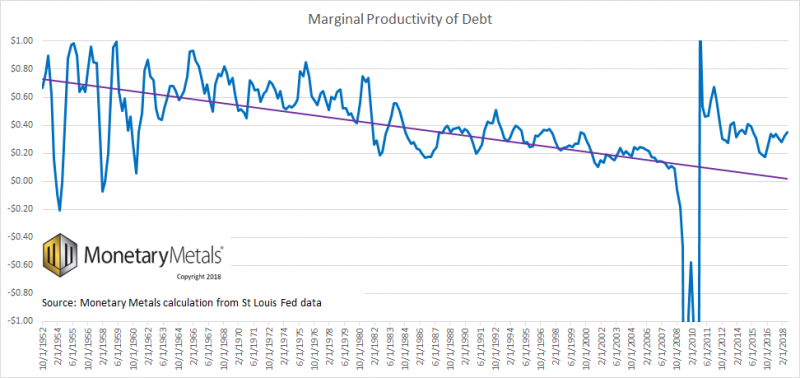

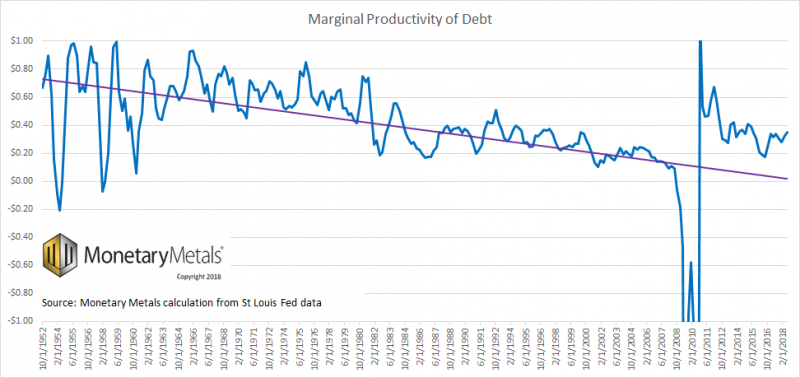

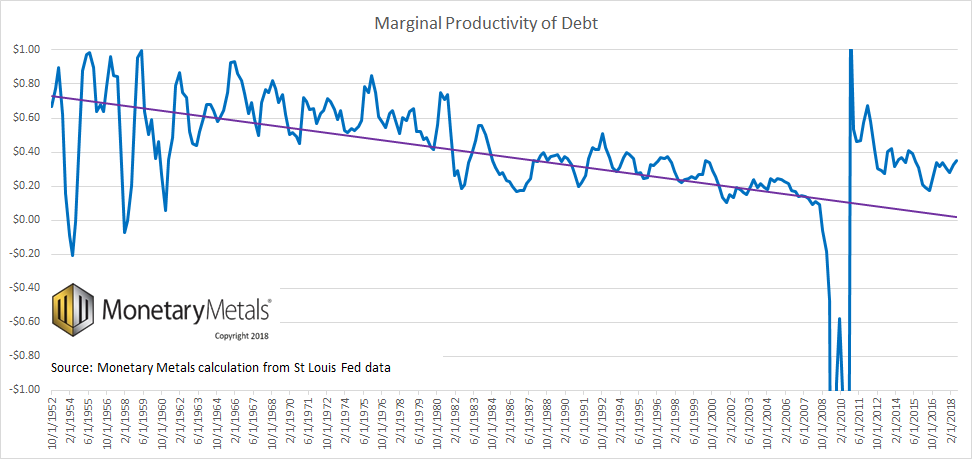

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

13 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

13 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

-

Hat Russland überhaupt Interesse an Krieg mit Europa? #thorstenwittmann #krieg #russland

-

March 2026 Monthly

March 2026 Monthly -

Krypto-Kriminalität erreicht 2025 Rekordwerte: CertiK meldet milliardenschweren Schaden

Krypto-Kriminalität erreicht 2025 Rekordwerte: CertiK meldet milliardenschweren Schaden -

BREAKING: Trump und Israel greifen IRAN an! Trump eskaliert in Rede!

BREAKING: Trump und Israel greifen IRAN an! Trump eskaliert in Rede! -

Market Topping Process?

Market Topping Process? -

Wie professionelle Trader wirklich Geld verdienen

Wie professionelle Trader wirklich Geld verdienen -

Wenn du denkst, dass finanzielle Freiheit einfach ist… #thorstenwittmann #finanziellefreiheit

-

Das gab es noch nie! Kaufchance des Jahres?

Das gab es noch nie! Kaufchance des Jahres? -

Jittery Stock Markets Leery of AI & Private Debt Market Blowup

Jittery Stock Markets Leery of AI & Private Debt Market Blowup

More from this category

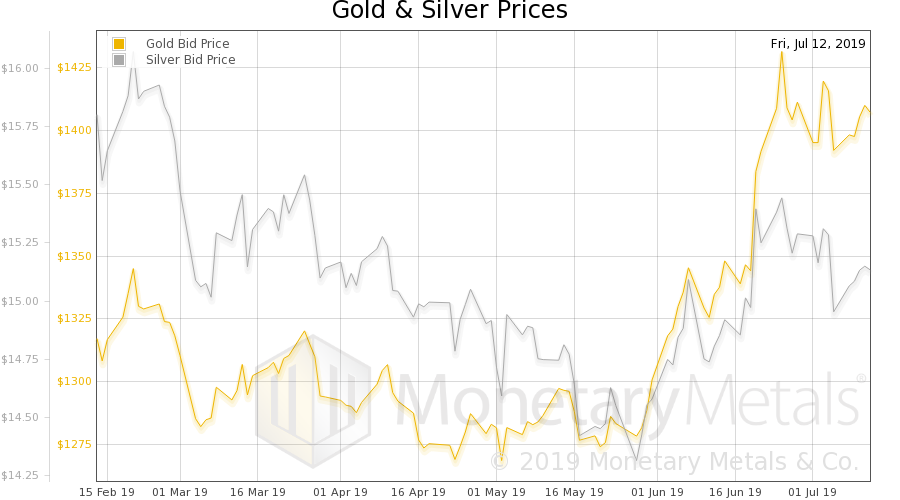

How to Fix GDP, Report 14 Jul

How to Fix GDP, Report 14 Jul16 Jul 2019

More Squeeze, Less Juice, Report 7 Jul

More Squeeze, Less Juice, Report 7 Jul8 Jul 2019

Debt and Profit in Russell 2000 Firms

Debt and Profit in Russell 2000 Firms12 Apr 2019

The Duality of Money, Report 10 Mar

The Duality of Money, Report 10 Mar11 Mar 2019

A Dire Warning, Report 29 July 2018

A Dire Warning, Report 29 July 201831 Jul 2018