Tag Archive: John Maynard Keynes

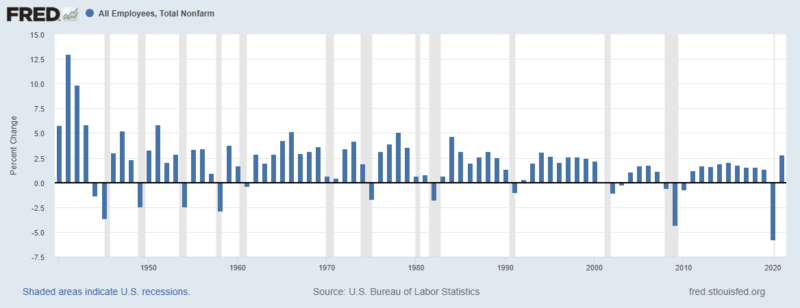

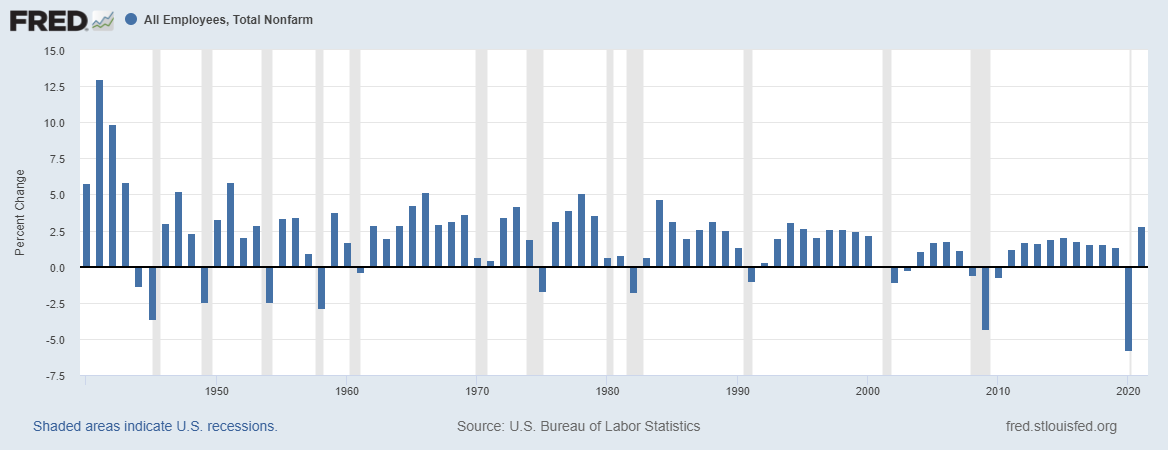

Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around.

Read More »

Read More »

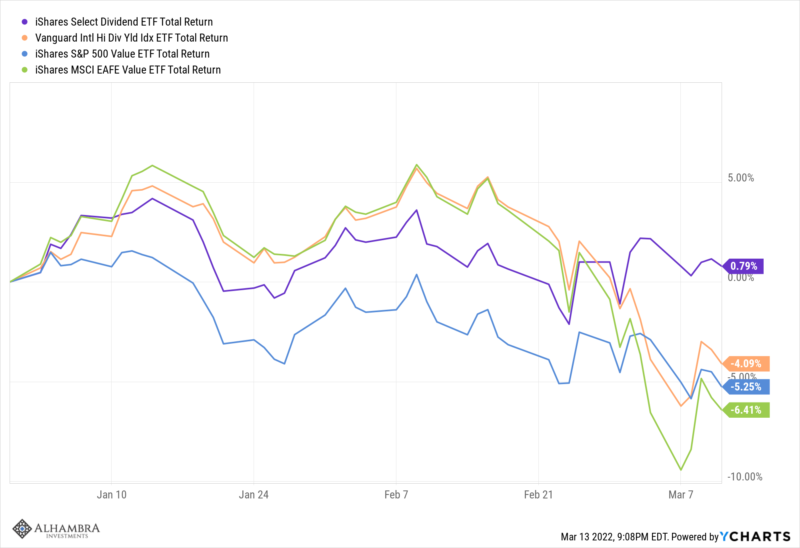

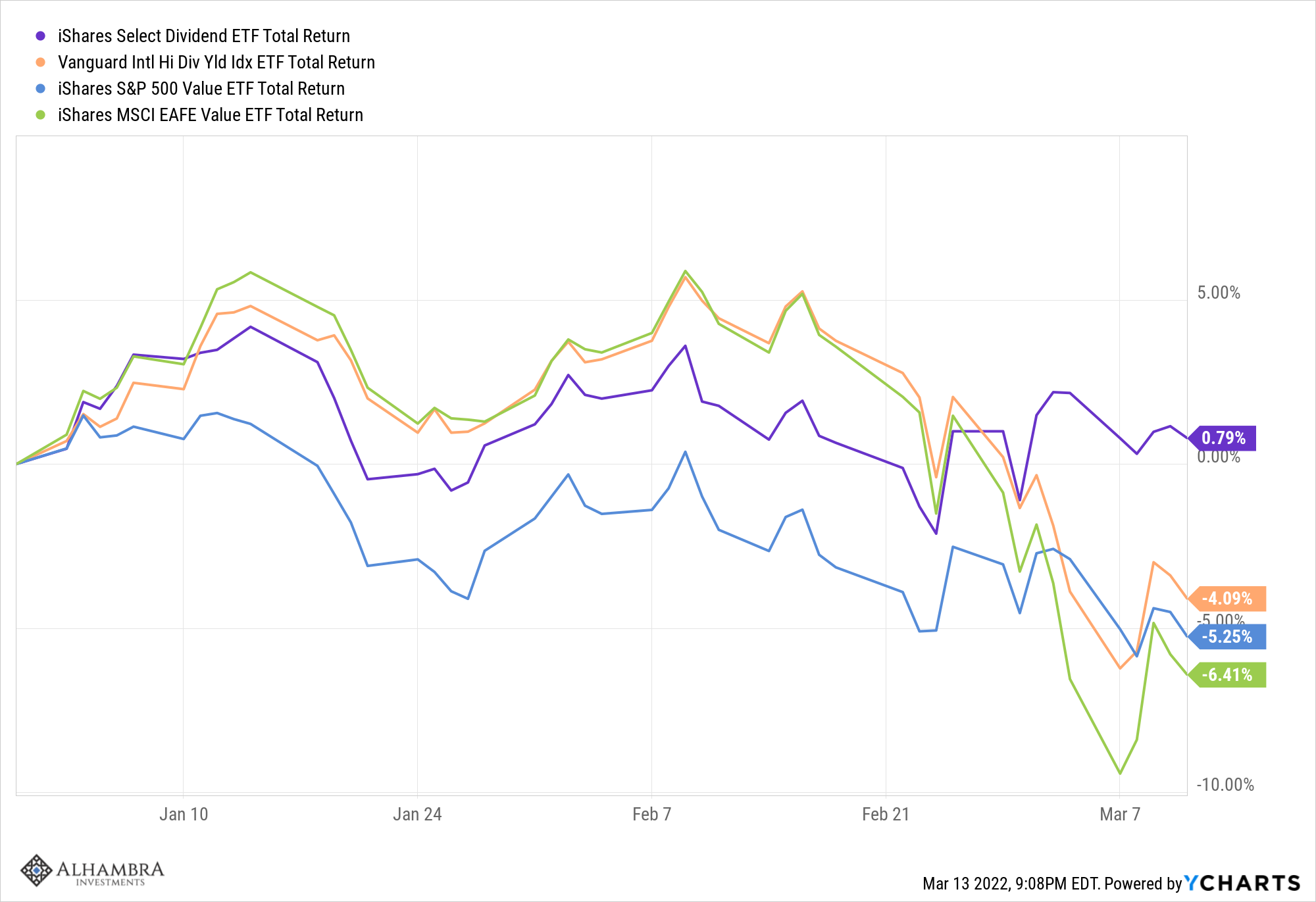

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

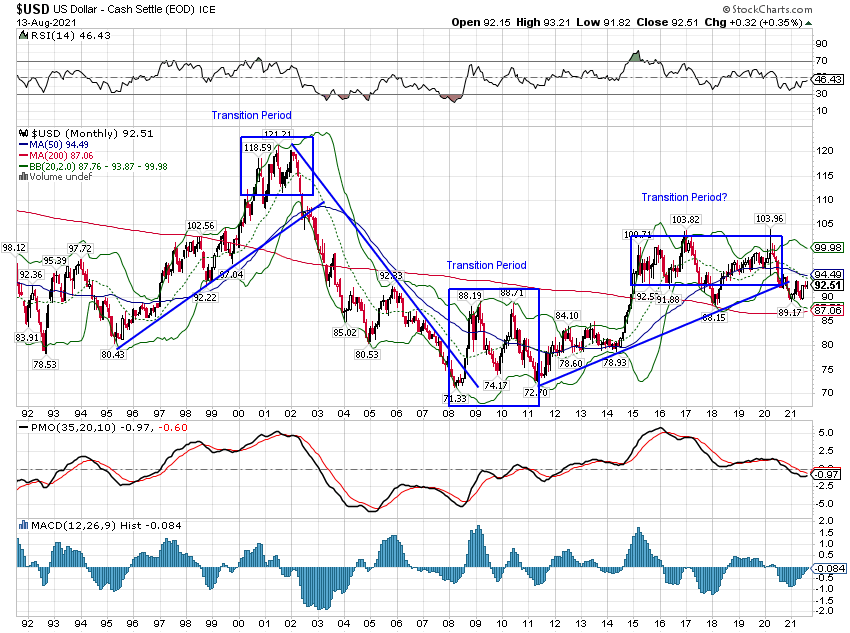

Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar.

Read More »

Read More »

How Keynesian Ideas Weaken Economic Fundamentals

Whenever there are signs that the economy is likely to fall into an economic slump most experts advise that the central bank and the government should embark on loose monetary and fiscal policies to counter the possible economic recession. In this sense, most experts are following the ideas of the English economist John Maynard Keynes.

Read More »

Read More »

Don’t Want a Liquidity Trap? More Saving Is the Answer

With interest rates in many countries close to zero or even negative, some commentators are of the view that monetary policy of the central banks are likely to become less effective in navigating the economy. In fact it is held that we have most likely reached a situation that the economy is approaching a liquidity trap. But what does this mean?

Read More »

Read More »

Le retour de l’or sur la scène monétaire mondiale?

Mars 2009, le gouverneur de la Banque populaire de Chine M Zhou Xiaochuan revint dans le cadre d’une conférence intitulée Reform the international Monetary System sur la vision de Keynes au sujet du bancor.Pour lui, le système centré sur le dollar américain et les taux de changes flottants, plus ou moins librement, devrait être repensé.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

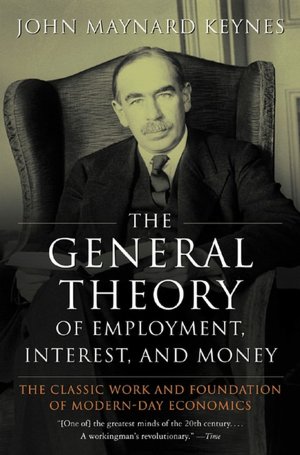

John Maynard Keynes’ General Theory Eighty Years Later

The “Scientific” Fig Leaf for Statism and Interventionism. To the economic and political detriment of the Western world and those economies beyond which have adopted its precepts, 2016 marks the eightieth anniversary of the publication of one of, if not, the most influential economics books ever penned, John Maynard Keynes’ The General Theory of Employment, Interest and Money.

Read More »

Read More »

Bretton Woods: RIP

Some romanticists want to have another Bretton Woods fixed exchange rate regime. Bretton Woods had difficulty from nearly the day it went operational. It is misguided to think a new rigid regime is needed or is appropriate.

Read More »

Read More »

America Needs The Gold Standard More Than Ever

The United States needs the gold standard more than ever. The gold standard is neither barbaric nor impractical, and it is more urgently needed every day. This is because the standard of paper money is failing. It has set in motion an accelerating series of crises, each worse than the previous. The nation cannot continue to borrow to infinity, nor can the U.S. endure zero interest much longer.

Read More »

Read More »