Tag Archive: Italy Industrial Production

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

FX Daily, April 10: XI’s Day, but Not So Good for Putin

It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump's lawyer's office, house and hotel were the subject of search warrants. A Bloomberg report citing people who knew said that China would consider devaluing the yuan.

Read More »

Read More »

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

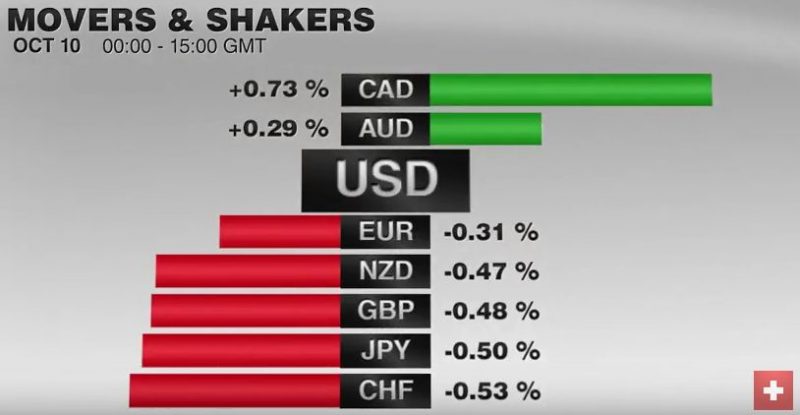

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »

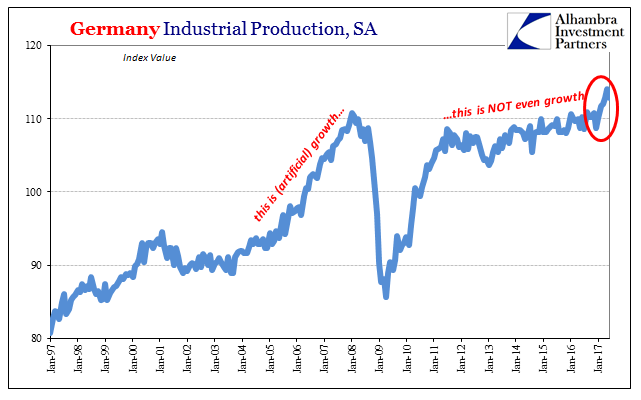

Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year.

Read More »

Read More »

FX Daily, August 09: North Korea lets EUR/CHF Collapse

The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended. Turning to Asia first, the Korea's equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%).

Read More »

Read More »

FX Daily, July 11: Markets Looking for Next Cue

Investors await fresh policy clues as the Bank of England's Broadbent is seen as a key vote on a closely balanced MPC, while the Fed's Brainard, is also seen as a bellwether, will speak shortly after midday in NY. Broadbent has not spoken since the election, and his current views are not known.

Read More »

Read More »

FX Daily, June 12: Ahead of Central Bank Meetings, Politics Dominates

The US dollar is trading within its pre-weekend range against the major currencies as participants await the central bank meeting starting in the middle of the week. The Federal Reserve, Bank of England, and the Bank of Japan meet.

Read More »

Read More »

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

FX Daily, March 13: Bonds and Equities Rally, Dollar Heavy

Hit by profit-taking ahead of the weekend, despite US jobs data that remove the last hurdle to another Fed hike this week, the greenback remains on the defensive. It has softened against all the major currencies and many of the emerging market currencies. The chief exception is those in eastern and central Europe.

Read More »

Read More »

FX Daily, February 10: US Dollar Holding on to Week’s Gains

The US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week's decline. The Aussie is the strongest on the day, up about 0.2% to trim the week's loss to about 0.45%.

Read More »

Read More »

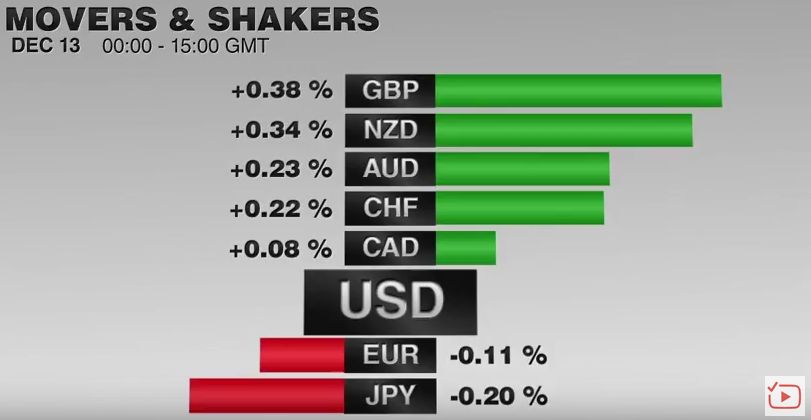

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

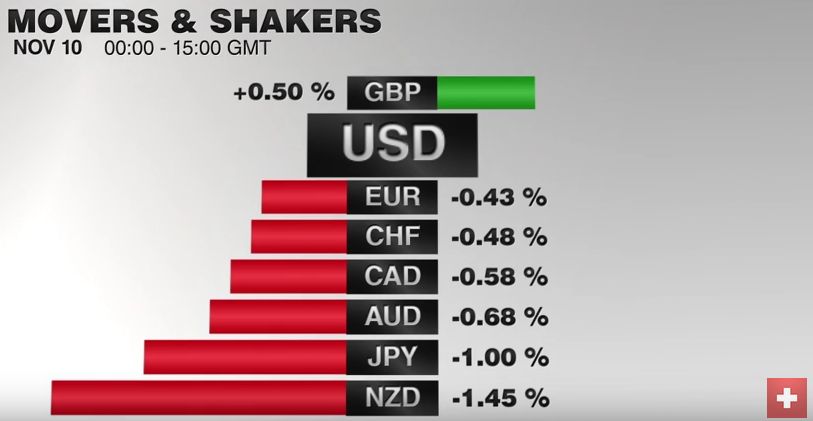

FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better...

Read More »

Read More »

FX Daily, October 10: Dollar after the Second Debate

The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar's gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US political developments, the main feature of which is the implosion of the Trump campaign.

Read More »

Read More »

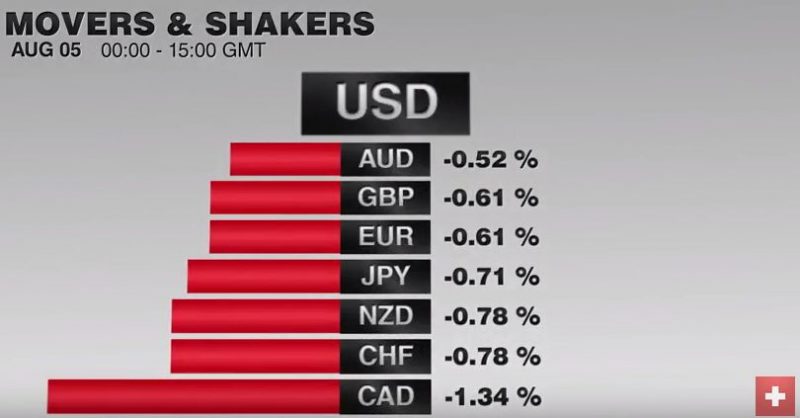

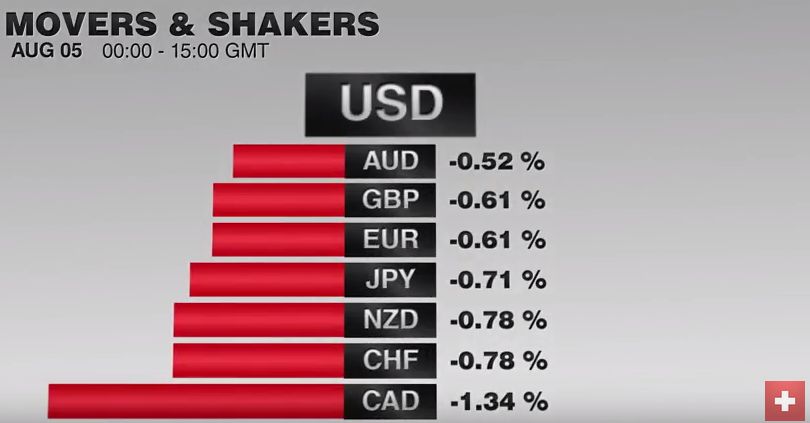

FX Daily, August 05: US Jobs Data on Tap, but Don’t Expect Miracles

The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday's Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday.

Read More »

Read More »

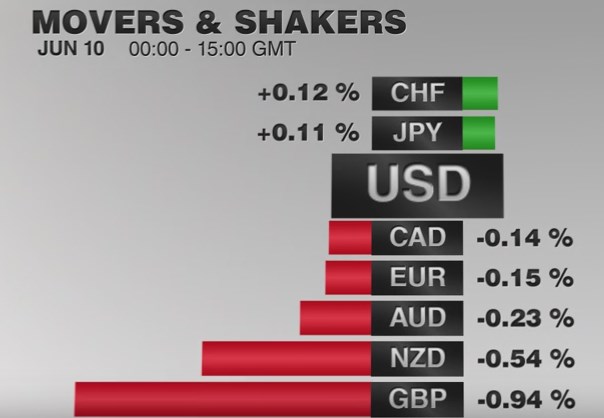

FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Once again, CHF was one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular "Weekly SNB sight deposits" report. For the week, it is the dollar-bloc and franc that have maintained weekly gains.

The US dollar weakened in the first half of the week as

participants continued to react to the shockingly poor jobs report and shift in Fed...

Read More »

Read More »

FX Daily, 03/11: Dollar Recovers Against the Euro and Yen

The euro is paring the recovery that began in the middle of the ECB's press conference yesterday. The markets had reacted as one intuitively would expected to broad easing of interest rates and credit conditions.

The market reversed, and viol...

Read More »

Read More »

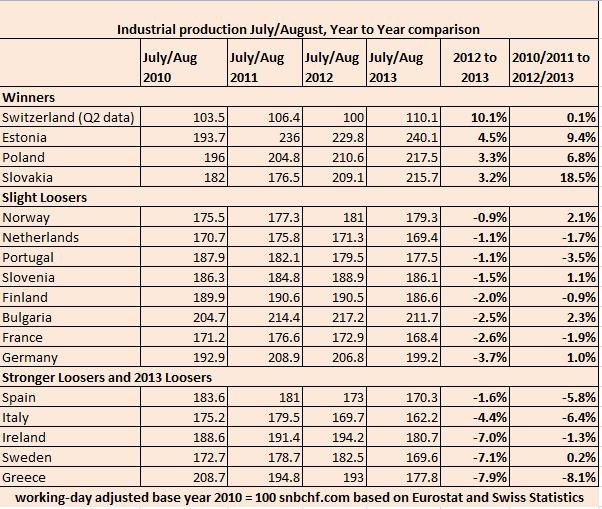

European Industrial Production Still Contracting, Switzerland Expanding Again

Swiss industrial production is rather insensitive to price changes and to the recent slowing of global demand thanks to the concentration on pharmaceuticals and luxury products. Based on Eurostat’s industrial production for July and August , we compared the values from 2010 to 2013 for these two summer months. This aggregated two-months comparison is …

Read More »

Read More »

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »