Tag Archive: Italy Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, February 28: Markets Little Changed as Breakout is Awaited

The capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges.

Read More »

Read More »

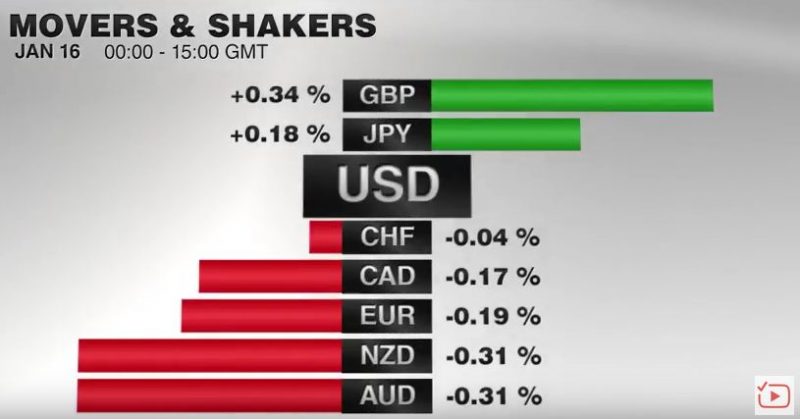

FX Daily, January 16: Hard Exit Talk Sent Sterling Below $1.20

The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO was obsolete and that other countries will leave the European Union, which is largely a German project.

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »