Tag Archive: Investing

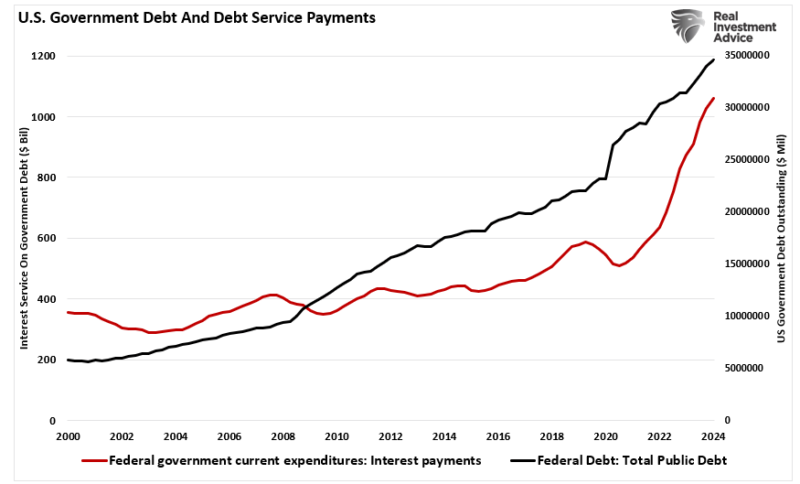

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

Yield Curve Shifts Offer Signals For Stockholders

The level of U.S. Treasury yields and the changing shape of the Treasury yield curve provide investors with critical feedback regarding the market’s expectations for economic growth, inflation, and monetary policy. Short- and long-term yields have recently fallen, with short-term maturities leading the charge. The changes result in what bond traders call a bull steepening yield curve shift. The shift is due to weakening economic conditions,...

Read More »

Read More »

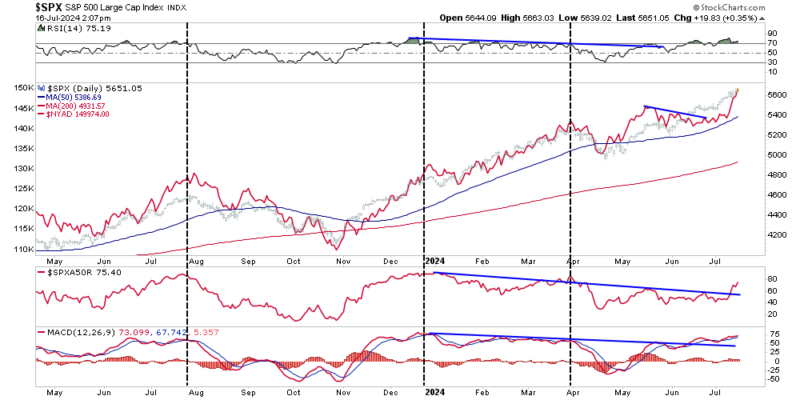

Overbought Conditions Set Up Short-Term Correction

As noted in this past weekend’s newsletter, following the “Yen Carry Trade” blowup just three weeks ago, the market has quickly reverted to more extreme short-term overbought conditions.

Note: We wrote this article on Saturday, so all data and analysis is as of Friday’s market close.

For example, three weeks ago, the growth sectors of the market were highly oversold, while the previous lagging defensive sectors were overbought. That was not...

Read More »

Read More »

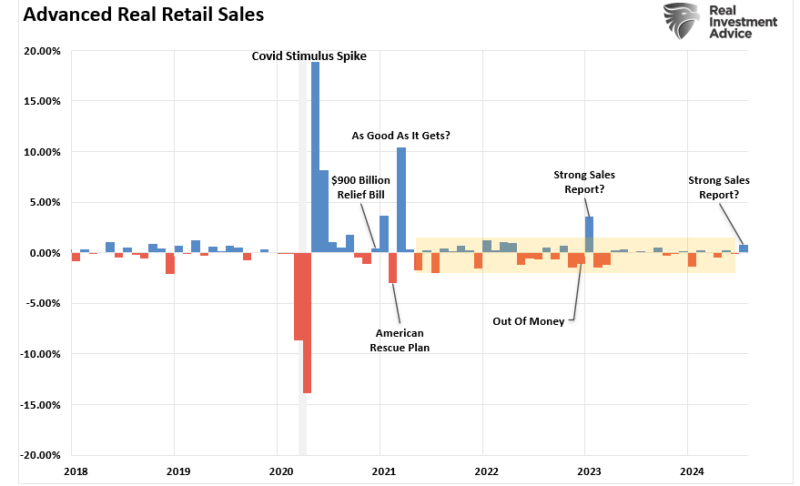

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Fed Funds Futures Offer Bond Market Insights

Profitable bond trading opportunities arise when your expectations about Fed policy differ from those of the market. Therefore, with the Fed seemingly embarking on a series of interest rate cuts, it behooves us to appreciate how many interest rate cuts the Fed Funds futures market expects and over what period. Equally important, Fed Funds futures help us assess the market’s economic growth and inflation expectations.

Currently, Fed Funds futures...

Read More »

Read More »

Market Decline Over As Investors Buy The Dip

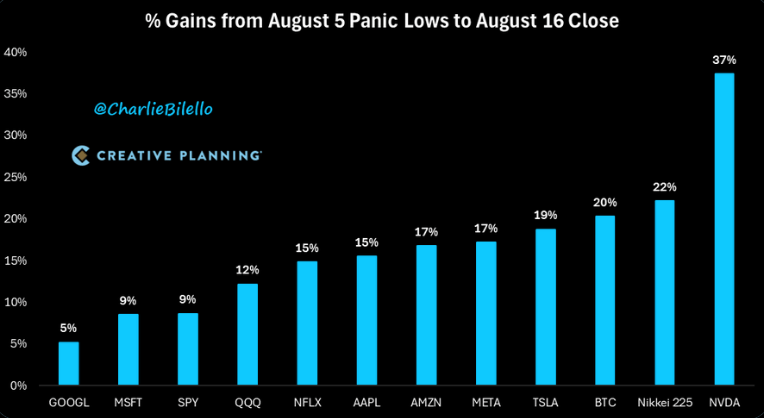

The market’s 8.5% decline during August sent shockwaves through the media and investors. The drop raised concerns about whether this was the start of a larger correction or a temporary pullback. However, a powerful reversal, driven by investor buying and corporate share repurchases, halted the decline, leading many to wonder if the worst is behind us.

However, the picture becomes more nuanced as we examine the technical levels and broader market...

Read More »

Read More »

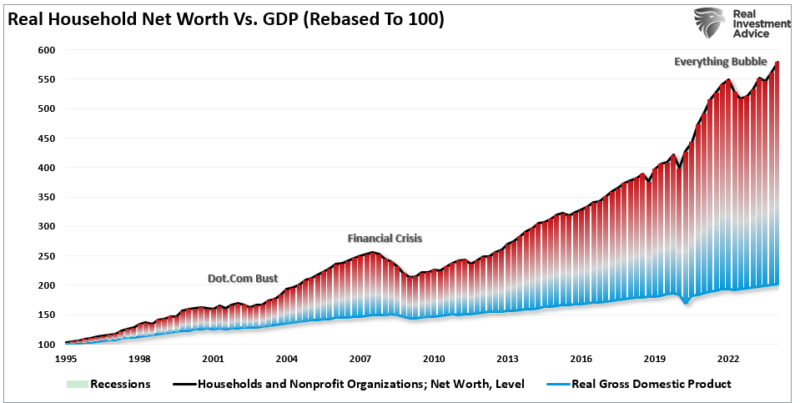

Economic Growth Myth & Why Socialism Is Rising

I was recently asked about the seemingly strong “economic growth” rate as the Federal Reserve prepares to start cutting rates.

“If economic growth is so strong, as noted by the recent GDP report, then why would the Federal Reserve cut rates?”

It’s a good question that got me thinking about the trend of economic growth, the debt, and where we will likely be.

Since the end of the financial crisis, economists, analysts, and the Federal...

Read More »

Read More »

Stealth QE Or Rubbish From Dr Doom?

A recent article co-authored by Stephen Miran and Dr. Nouriel Roubini, aka Dr. Doom, accuses the U.S. Treasury Department of using its debt-issuance powers to manipulate financial conditions. They liken recent Treasury debt issuance decisions to stealth QE. Per the first paragraph of the article’s executive summary:

By adjusting the maturity profile of its debt issuance, the Treasury is dynamically managing financial conditions and through...

Read More »

Read More »

Are Mega-Caps About To Make A Mega-Comeback?

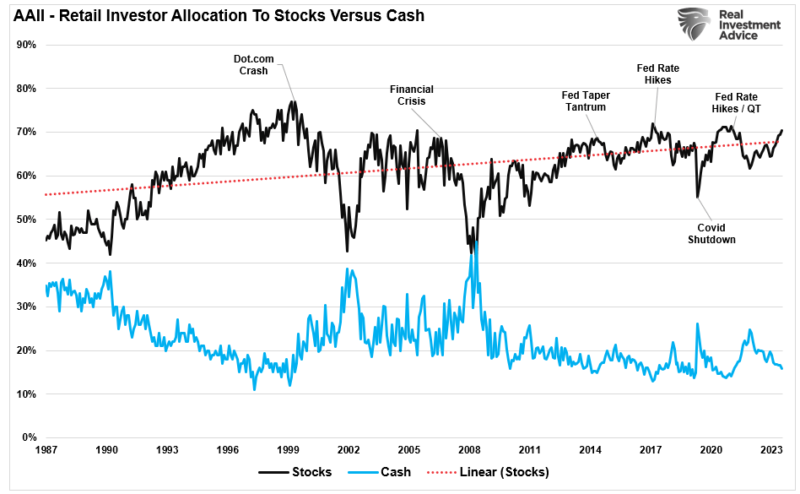

Are the “Mega-Cap” stocks dead? Maybe. But there are four reasons why they could be staged for a comeback. The recent market correction from the July peak certainly got investors’ attention and rattled the more extreme complacency. As we noted previously:

“While there have certainly been more extended periods in the market without a 2% decline, it is essential to remember that low volatility represents a high “complacency” with investors. In...

Read More »

Read More »

UBI – Tried, Tested And Failed As Expected

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be.

What Is A Universal Basic Income (UBI)

To understand why the theory of universal basic income (UBI) is heavily flawed, we need to...

Read More »

Read More »

Confidence Is The Underappreciated Economic Engine

Ask economists how they forecast economic activity. It’s likely they will mention productivity, demographics, debt, the Fed, interest rates, and a litany of other elements. Economic confidence is probably not at the top of the list for most economists. It is tricky to gauge as it can be inconsistent. However, confidence can sometimes change quickly and often with significant economic impacts.

Look at the two pictures below. Can you spot a...

Read More »

Read More »

Yen Carry Trade Blows Up Sparking Global Sell-Off

On Monday morning, investors woke up to plunging stock markets as the “Yen Carry Trade” blew up. While media headlines suggested the sell-off was due to fears of a recession, slowing employment growth, or fears over Israel and Iran, such is not the case.

Read More »

Read More »

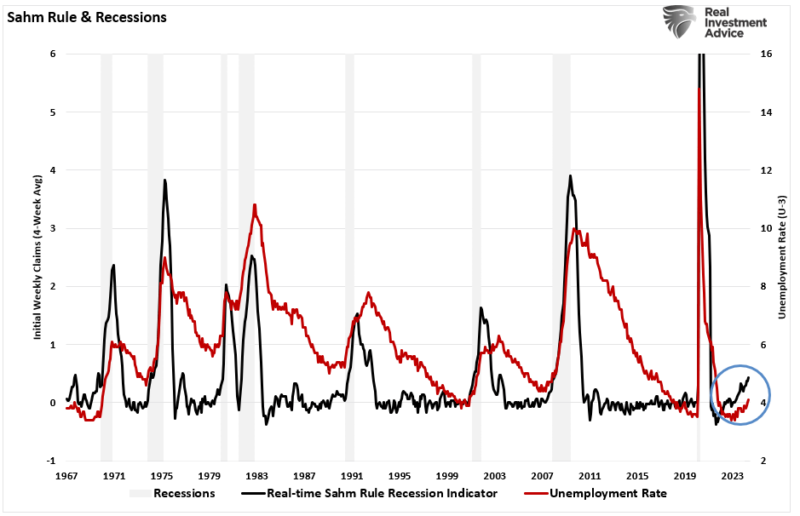

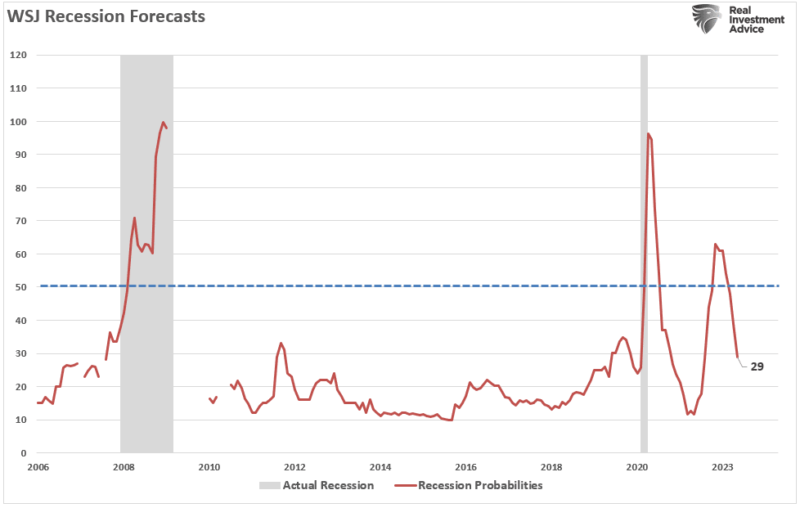

The Sahm Rule, Employment, And Recession Indicators

Economist Claudia Sahm developed the “Sahm Rule,” which states that the economy is in recession when the unemployment rate’s three-month average is a half percentage point above its 12-month low. As shown, the latest employment report has triggered that indicator.

So, does this mean a recession is imminent? Maybe. However, we can now add this indicator to the long list of other recessionary indicators, also flashing warning signs.

As...

Read More »

Read More »

The Bull Market – Could It Just Be Getting Started?

We noted last Friday that over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) stocks have dominated market returns and driven the bull market. In that article, we questioned whether the dominance of just a handful of stocks can continue to drive the bull market. Furthermore, the breadth of the bull market rally has remained a vital concern of the bulls.

Read More »

Read More »

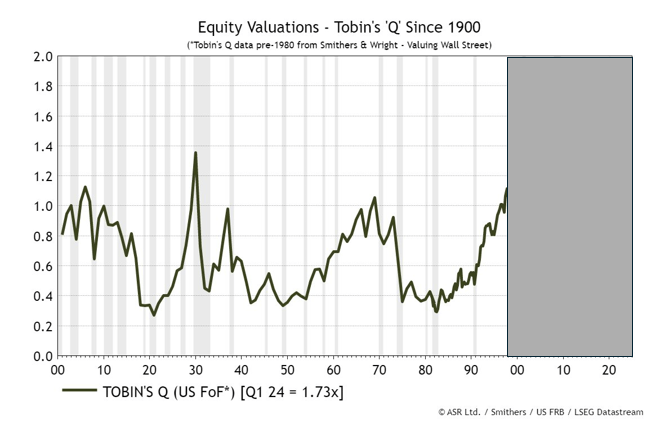

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

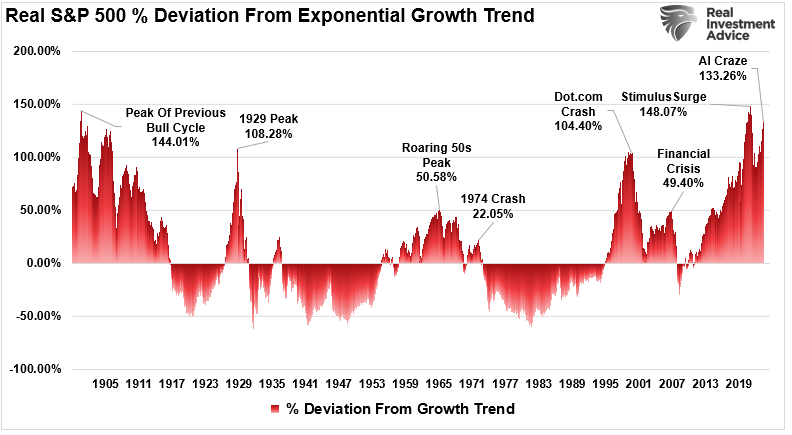

Deviations From Long-Term Growth Trends Back To Extremes

In 2022, we discussed the market’s deviations from long-term growth trends. That discussion centered on Jeremy Grantham’s commentary about market bubbles.

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

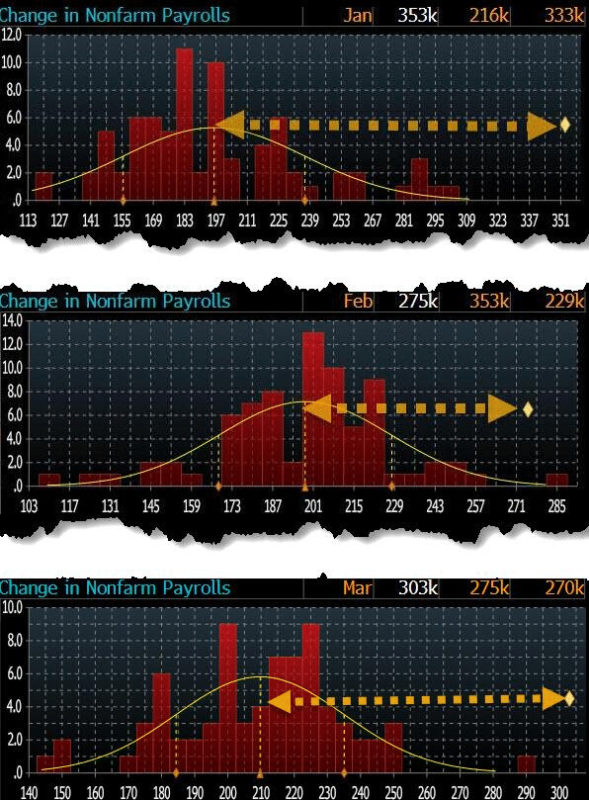

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer, measuring the level of anxiety in the economy, inflation, currency, and geopolitics.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »