Tag Archive: Investing

Iran Stuck By U.S.: Markets, Risk, and Rational Investing

Over the weekend, the U.S. launched strikes against Iran's nuclear facilities. Currently, I only have the details reported by major mainstream outlets. However, given that stock market futures are trading sharply lower on Sunday, I wanted to get something in print before the market opens relating to navigating this event over the next few days.

Read More »

Read More »

The Dollar’s Death Is Greatly Exaggerated

The narrative surrounding the "dollar's death" as the world's reserve currency has been on the rise recently. However, this happens whenever the dollar declines relative to other currencies. We previously wrote about the false claims of the "dollar's death" in 2023 (see here, here, and here). The recent decline in the dollar relative to other currencies is well within historical norms.

Read More »

Read More »

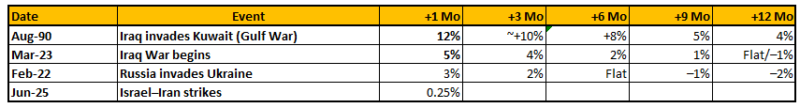

The Iran-Israel Conflict And The Likely Impact On The Market

The Iran-Israel conflict and equity markets are now in sharp focus. As direct strikes escalated in June 2025, global financial markets responded immediately. Israel’s airstrikes on Iranian nuclear and energy infrastructure triggered retaliatory missile and drone attacks from Iran. The Dow dropped nearly 2%, the S&P 500 lost over 1%, and oil prices surged by …

Read More »

Read More »

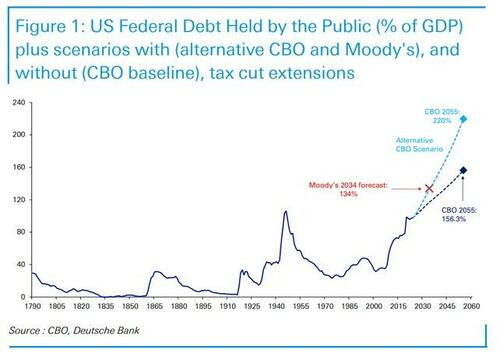

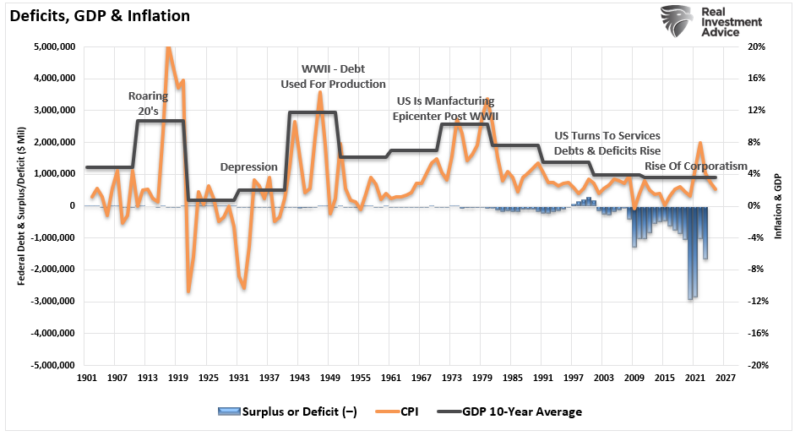

The Deficit Narrative May Find Its Cure In Artificial Intelligence

Lately, the "deficit narrative" has dominated much of the financial media, particularly those channels that are continual "purveyors of doom." In this post, we will discuss the "deficit narrative," the likely outcomes, and why the cure for the deficit may be found in Artificial Intelligence. The "deficit narrative" has dominated the media lately as President …

Read More »

Read More »

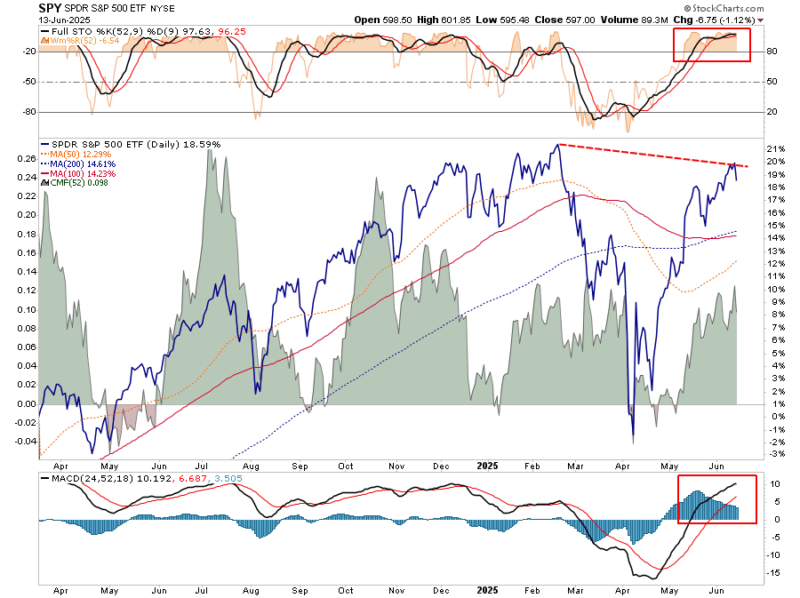

“Buying The Dip” – Here’s A Technical Way To Do It

Recently, I did an interview about "buying the dip" in the market, which generated many comments. Most were, "You're stupid; the market is going to crash," but one comment deserved a more thorough discussion. "When buying the dip, how do you know when to do it, or not?" That is the right question. Of course, you will never know … Continue...

Read More »

Read More »

Does Consumer Spending Drive Earnings Growth?

It would seem evident that most investors would understand that consumer spending drives economic growth, ultimately creating corporate earnings growth. Yet, despite this somewhat tautological statement, Wall Street appears to ignore this simple reality when forecasting forward earnings. As discussed recently, S&P Global's current estimates show earnings are growing far above the long-term exponential growth …

Read More »

Read More »

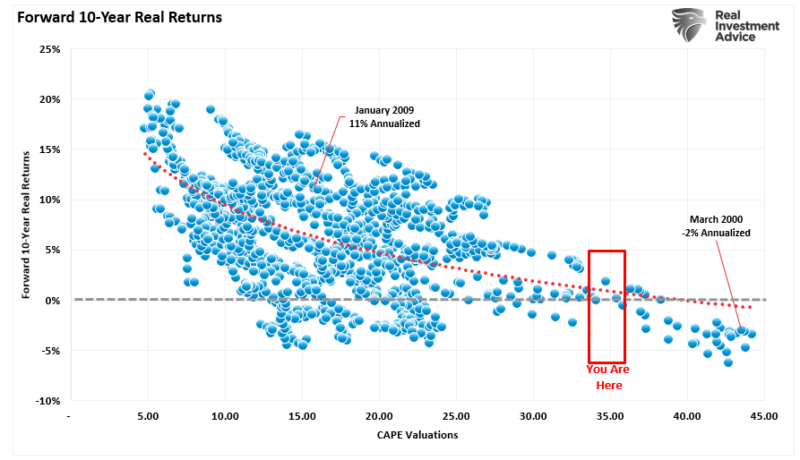

Buying Stocks Is Always Hard

Buying stocks is always hard. Particularly during corrections. Or, near market peaks. Or, when stocks are falling. And when they are rising. Oh, buying stocks is also tricky when valuations are high. And when they are low. You get the point. There is never the right time when it comes to buying stocks. I recently … Continue reading »

Read More »

Read More »

Ray Dalio Is Predicting A Financial Crisis…Again.

Ray Dalio, the former head of Bridgewater Associates, is back in the media, trying to stay relevant by claiming the "deficit has become critical." " “It’s like ... I’m a doctor, and I’m looking at the patient, and I’ve said, you’re having this accumulation, and I can tell you that this is very, very serious, and …

Read More »

Read More »

The Stealth Bear Market

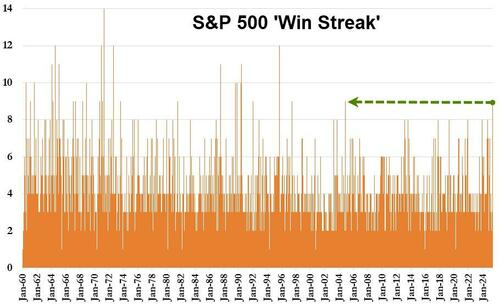

Is this a "stealth" bear market? Of course, you may be asking yourself what I mean by that. Historically, bear markets have tended to be pretty evident, as highlighted in the chart below. These bear markets are often more protracted affairs that lead to investors developing profoundly negative sentiment towards markets. This article will use …

Read More »

Read More »

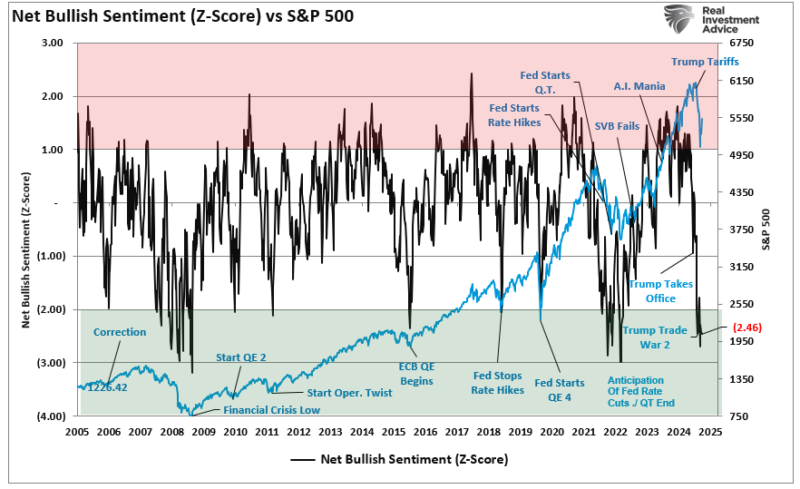

The Anchoring Problem And How To Solve It

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment. Notably, we …

Read More »

Read More »

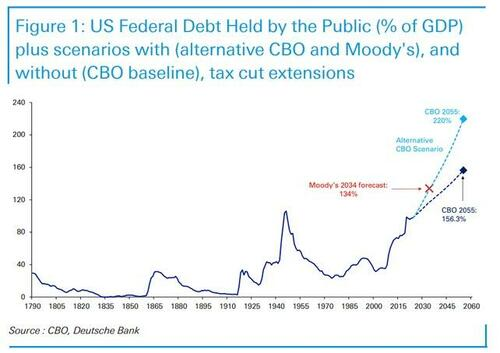

Moody’s Debt Downgrade – Does It Matter?

This morning, markets are reacting to Moody's rating downgrade of U.S. debt. For those promoting egregious amounts of "bear porn," this is nirvana for fear-mongering headlines that gain clicks and views. However, as investors, we need to step back and examine the history of previous debt downgrades and their outcomes for both the stock and …

Read More »

Read More »

Corporate Stock Buybacks – Do They Affect Markets?

Fisher Investments recently wrote an interesting article asking whether corporate stock buybacks affect markets. Here is their conclusion: "Yes and no? Stocks move on supply and demand. Stock buybacks, where a company buys and takes shares off the market, theoretically reduce supply.

Read More »

Read More »

A Bear Market Rally? Or, Just A Correction?

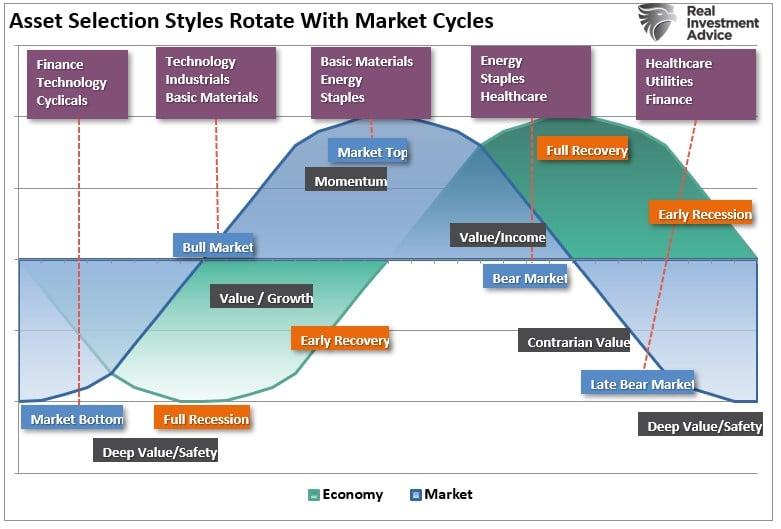

Assessing a bear market rally proves challenging when you experience it firsthand. It is only in hindsight that the complete picture reveals itself to investors. Of course, after a bear market rally, investors tend to review their investments and speculate on what they should have done differently.

Read More »

Read More »

Weekly Market Pulse: On The Road Again

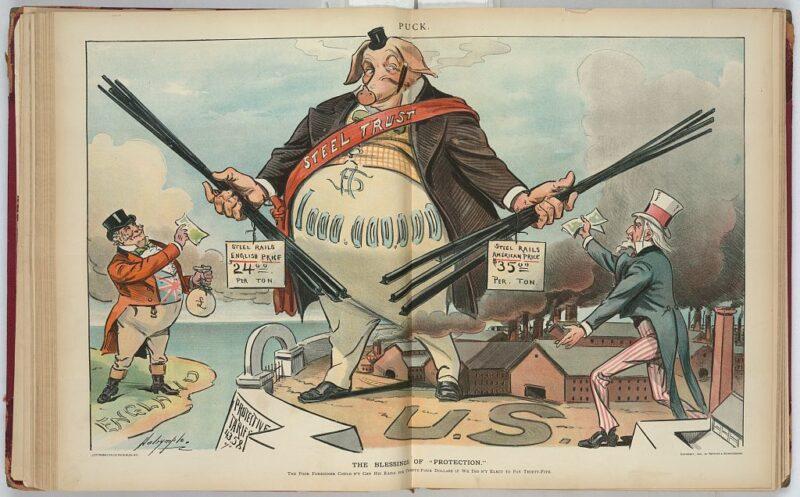

“Our freedom of choice in a competitive society rests on the fact that, if one person refuses to satisfy our wishes, we can turn to another. But if we face a monopolist we are at his absolute mercy.

Read More »

Read More »

Employment Data Confirms Economy Is Slowing

While coming in much stronger than expected, the latest employment data confirmed what we already suspected: the economy is slowing. The reason the employment data is so important is that without employment growth, the economy stalls. It takes, on average, […] The post Employment Data Confirms Economy Is Slowing appeared first on RIA.

Read More »

Read More »

“Resistance Is Futile” – For Both Bulls And Bears

"Resistance is futile" was a sentence that struck fear in the hearts of Trekkie fans during "Star Trek: The Next Generation," specifically in both of the "Best Of Worlds" and "First Contact" episodes. In those episodes, the "Starship Enterprise" crew encountered a species called the "Borg." The Borg's primary purpose was to achieve "perfection" by assimilating other beings …

Read More »

Read More »

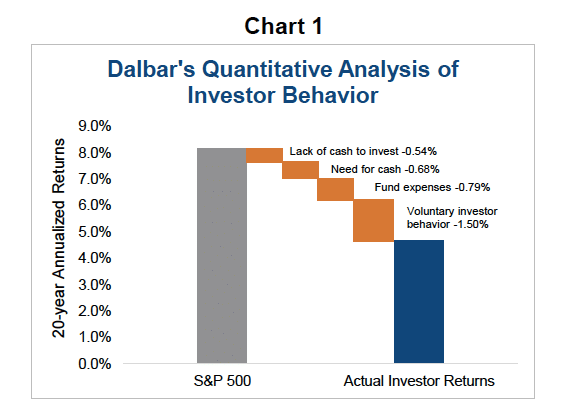

The Awards You Never Get When Investing

In investing, success is often judged by numbers—returns on investment, percentage gains, and the ability to outperform benchmarks like the S&P 500. However, some investors frequently pursue a peculiar set of "awards" without realizing the pitfalls they embody. These unspoken goals, while tempting, rarely lead to sustainable investment success. If there were awards for some of these …

Read More »

Read More »

Correction Continues – The Value Of Risk Management

Despite the recent rally, the correction continues. While wanting to "buy the dip" is tempting, there has been enough technical damage to warrant remaining cautious in the near term. As we have discussed, managing risk requires discipline and the emotional ability to navigate more volatile markets until a more straightforward path for risk-taking emerges. The …

Read More »

Read More »

Speculator Or Investor? 10-Rules From Legendary Investors

Are you a "speculator" or an "investor"? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles.

Read More »

Read More »

The Death Cross And Market Bottoms

In financial markets, few technical patterns generate as much attention and anxiety as the death cross. This ominous-sounding term refers to a crossover on a price chart when a short-term moving average, most commonly the 50-day moving average (50-DMA), drops below a long-term moving average, usually the 200-day moving average (200-DMA). The "death cross" is a fantastic …

Read More »

Read More »