Tag Archive: inflation

Sentiment Remains Fragile

Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US...

Read More »

Read More »

Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix.

Read More »

Read More »

The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID.

Read More »

Read More »

Flash PMIs Play Second Fiddle to US PCE Deflator and Accelerating Inflation

The flash November PMIs would be the main focus in the week ahead if it were more normal times. But these are not normal times, and growth prospects are not the key driver of the investment climate. This quarters' growth is largely baked into the cake. The world's three largest economies, the US, China, and Japan, are likely to accelerate for different reasons in Q4 from Q3. Europe is the weak sibling, and growth in the eurozone and UK may slow...

Read More »

Read More »

European Gas Jumps, while the Euro and Yen Slump

Overview: The prospects that the 6.2% CPI will prompt the Fed to move quicker continue to underpin the dollar. The euro fell to about $1.1265, its lowest level since last September, and the Japanese yen slumped to a fresh four-year low. The JP Morgan Emerging Market Currency Index tumbled 1% yesterday, the largest decline since February. A more stable tone is evident in Europe, as the euro has recovered above $1.13, and the JP Morgan Index is...

Read More »

Read More »

China’s CPI Accelerated to 1.5%, US CPI to Approach 6%

Overview: As bond yields slumped yesterday, stocks snapped their advancing streak. The Stoxx 600 fell for the first time in nine sessions yesterday and is lower today. The S&P 500 ended a nine-session advance, and the NASDAQ snapped a 12-session rally. Futures on the indices point to a lower open. Bonds are paring yesterday's gain, which saw the US 10-year yield fall below its 200-day moving average (~1.45%) and may explain the soft auction...

Read More »

Read More »

US and China’s October Inflation Featured in the Week Ahead

The cycle of the major central bank meetings has passed. The Anglo-American central banks and Norway are ahead among the high-income countries in the adjustment of monetary policy. Meanwhile, the pandemic continues to scar, and flare-ups are extending the economic and social disruption in some large countries, including China and Russia. Parts of Europe are experiencing another wave, including Ireland, the UK, and Germany. From the RBA and ECB to...

Read More »

Read More »

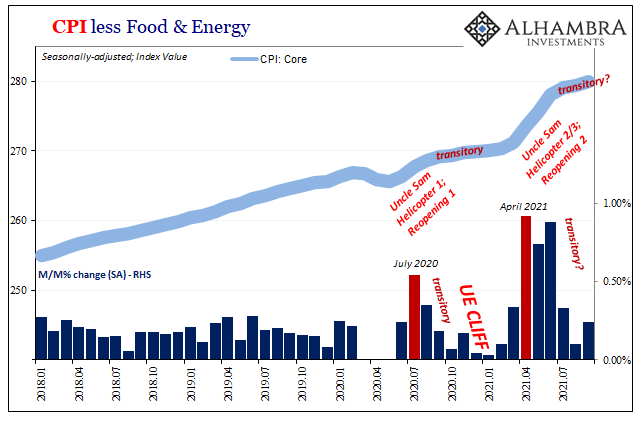

The Wile E. Powell Inflation: Are We Really Just Going To Ignore The Cliff?

Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed.

Read More »

Read More »

Gold is Boring – That’s Why You Should Own It!

Gold and silver price actions have been the opposite of dramatic for months now, they have been boring. In the last 100 days, gold has moved sideways in the US$100 range between $1725 and $1825.

Read More »

Read More »

Corruption of the currency and decivilization – Part II

Many rational economists and students of history have written countless analyses on the gold standard and the terrible impact that its end has had on the world economy. However, as the Fall of Rome clearly demonstrates, the implications of the introduction of the fiat money system and of the limitless manipulation of the currency by the State reach much further.

Read More »

Read More »

The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup?

Read More »

Read More »

Weekly Market Pulse: Growth Scare?

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved.

Read More »

Read More »

GDP Red Flag

There were no surprises in today’s US GDP data. As expected, output sharply decelerated, modestly missing much-reduced expectations. The continuously compounded annual rate of change for Q3 2021 compared to Q2 was the tiniest bit less than 2% (1.99591%) given most recent expectations had been closer to 3%.

Read More »

Read More »

Short Run TIPS, LT Flat, Basically Awful Real(ity)

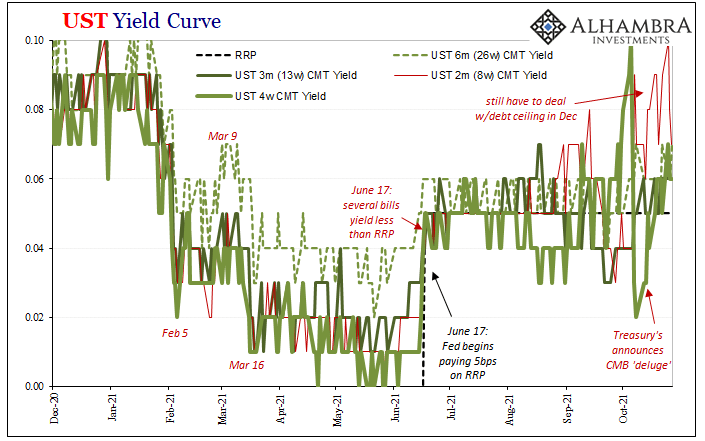

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

What *Seems* Inflation Now Is Something Else Entirely

This is yet another one of those crucial recent developments which should contribute much clarity about the economic situation, yet is exploited in other ways (political) adding only more to the general state of economic confusion. The shelves may be empty in a lot of places around the country, leaving anyone with the impression there just aren’t enough goods.

Read More »

Read More »

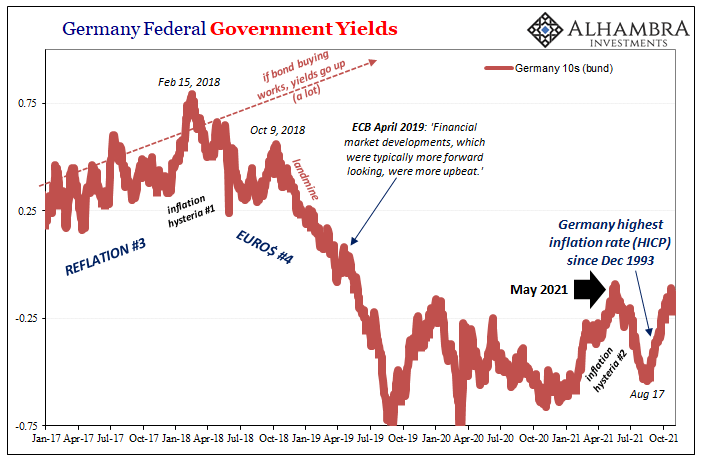

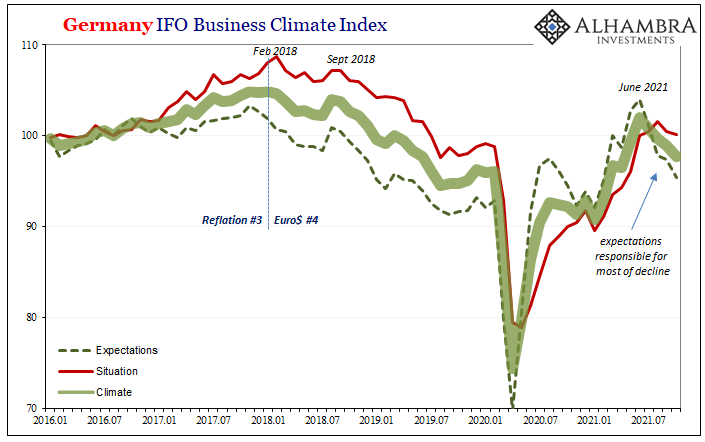

An Anti-Inflation Trio From Three Years Ago

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential.

Read More »

Read More »

Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached...

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

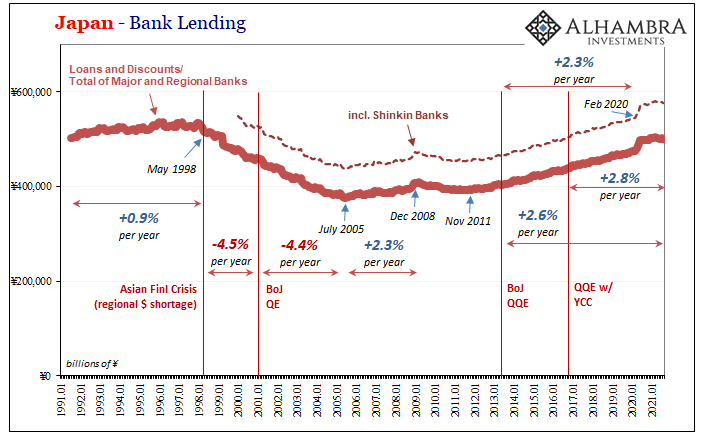

You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s.

Read More »

Read More »

Why Governments Hate Gold

2021-11-27

by Stephen Flood

2021-11-27

Read More »