Tag Archive: Hungary

FX Daily, May 17: US and Europe may Announce Tariff Truce

There are two general developments as the busy week gets underway. First, despite accelerated price readings in the US (CPI, PPI, import prices, and University of Michigan survey), US rates are soft. The 10-year yield is near 1.61% after rising to 1.70% after the CPI surprise last week.

Read More »

Read More »

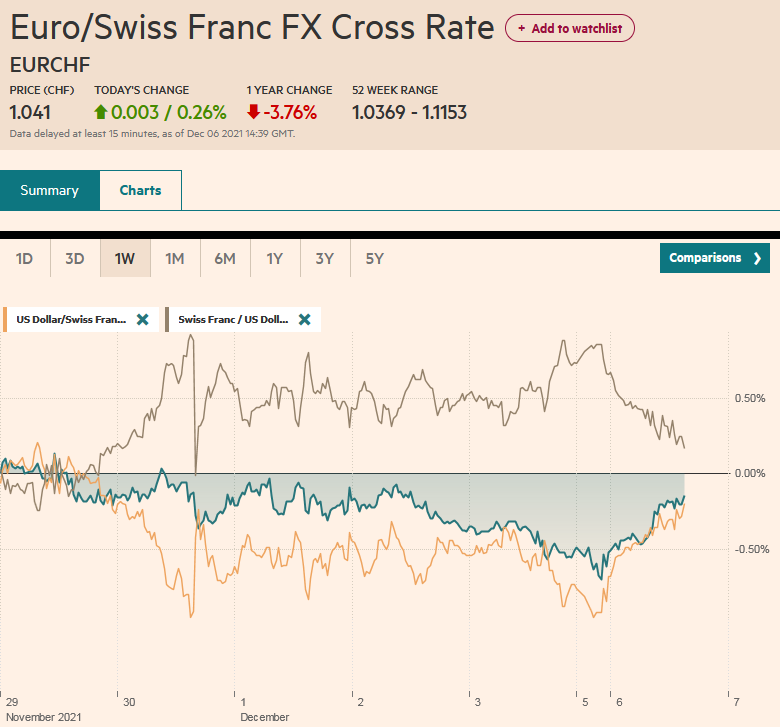

FX Daily, December 9: Hope Burns Eternal

The market is hopeful today. The Johnson-von der Leyen dinner is seen as evidence that both sides see one more opportunity, and sterling is among the strongest currencies today. Hopes of a $900 bln+ fiscal stimulus package in the US helped stir animal spirits and lift US stocks to record highs yesterday.

Read More »

Read More »

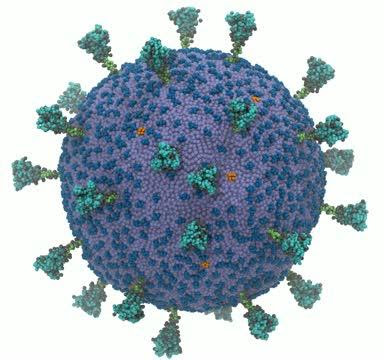

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »

FX Daily, October 14: Optimism Took the Weekend Off

Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a 2.3% rally before the weekend, the Dow Jones Stoxx 600 is about 0.75% lower in the European morning.

Read More »

Read More »

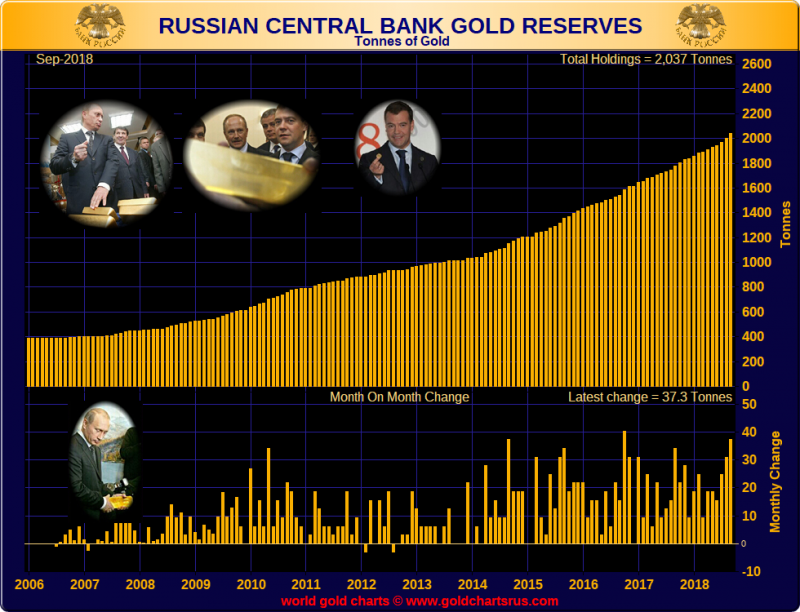

Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the highest quarterly level since Q4 of...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Market Week Ahead Preview

EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish markets are closed this week for holiday.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity just starting to emerge. We remain...

Read More »

Read More »

Emerging Markets: What Changed

Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody's cut the outlook on Pakistan's B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term.

Read More »

Read More »

Emerging Markets: What Changed

US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain.

Read More »

Read More »

Emerging Markets Preview: The Week Ahead

EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential retaliatory measures in response to US...

Read More »

Read More »