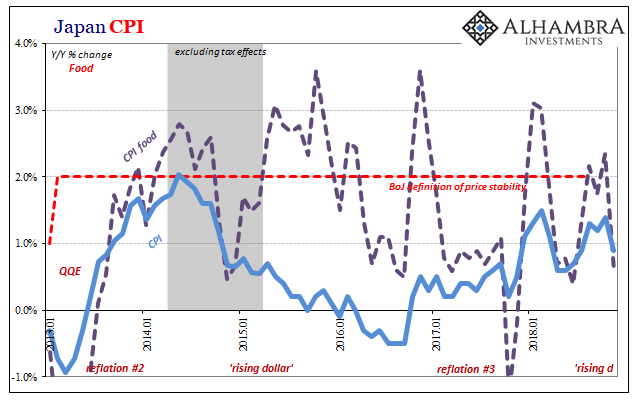

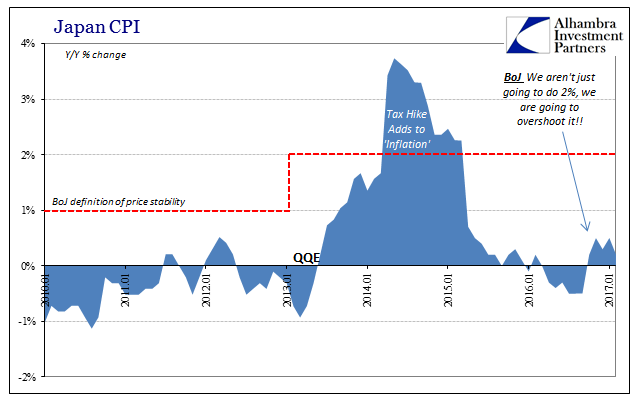

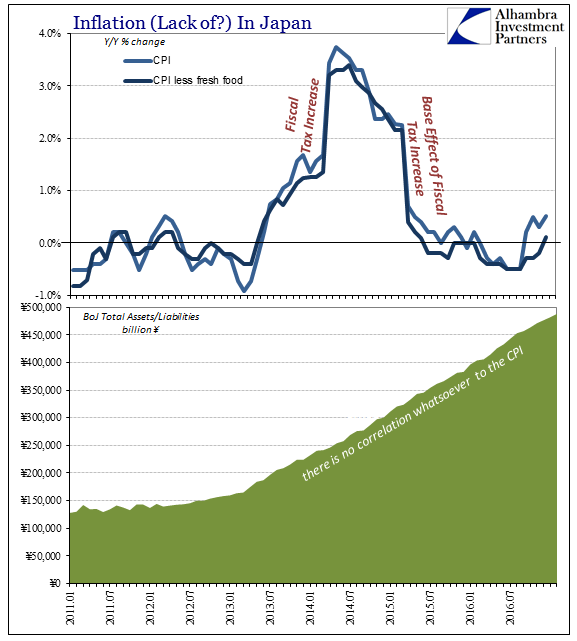

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

Read More »

Tag Archive: household income

Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results.

Read More »

Read More »

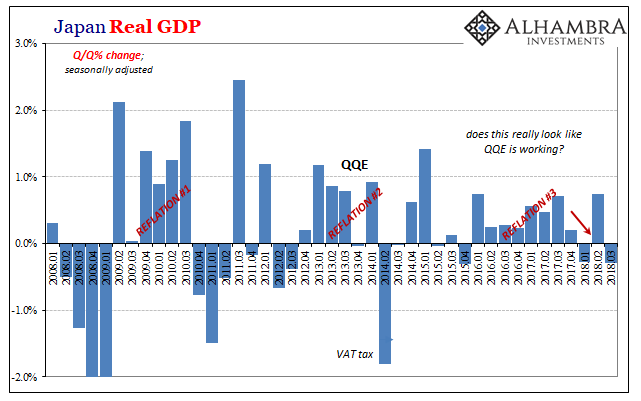

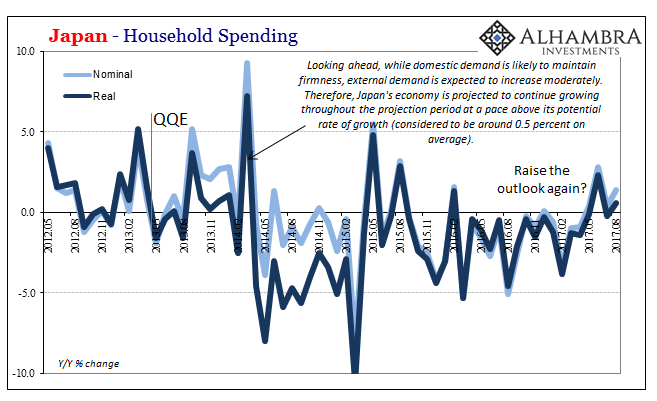

Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of investment research at SMBC Nikko...

Read More »

Read More »

Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy”. UK banks are “dicing with the spiral of complacency” again. Bank of England official believes household debt is good in moderation. Household debt now equals 135% of household income. Now costs half of average income to raise a child. Real incomes not keeping up with real inflation. 41% of those in debt are in full-time work. £1.537 trillion owed by the end of May...

Read More »

Read More »

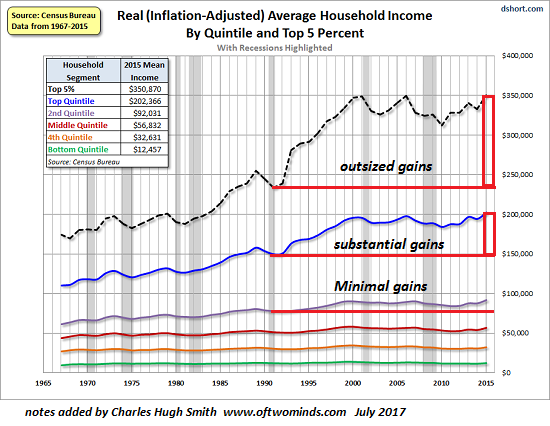

The Two Charts That Dictate the Future of the Economy

The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable household income, i.e. the real income remaining after debt service (interest and principal), rent, healthcare co-payments and insurance and other essential living expenses.

Read More »

Read More »

Systemic Depression Is A Clear Choice

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group.

Read More »

Read More »

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »