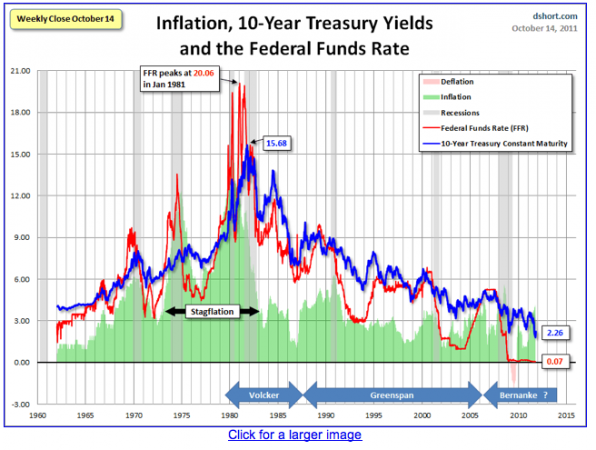

For us the five major drivers of government bond yields are:

Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag.

Wealth: The higher the wealth of a country, the...

Read More »

Tag Archive: Government bond

Is the Safe-Haven Government Bond Bubble Finally Bursting?

The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well

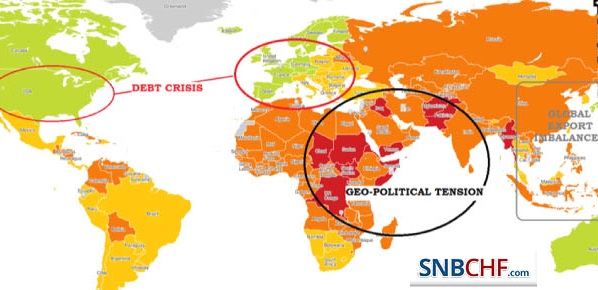

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century?

Read More »

Read More »

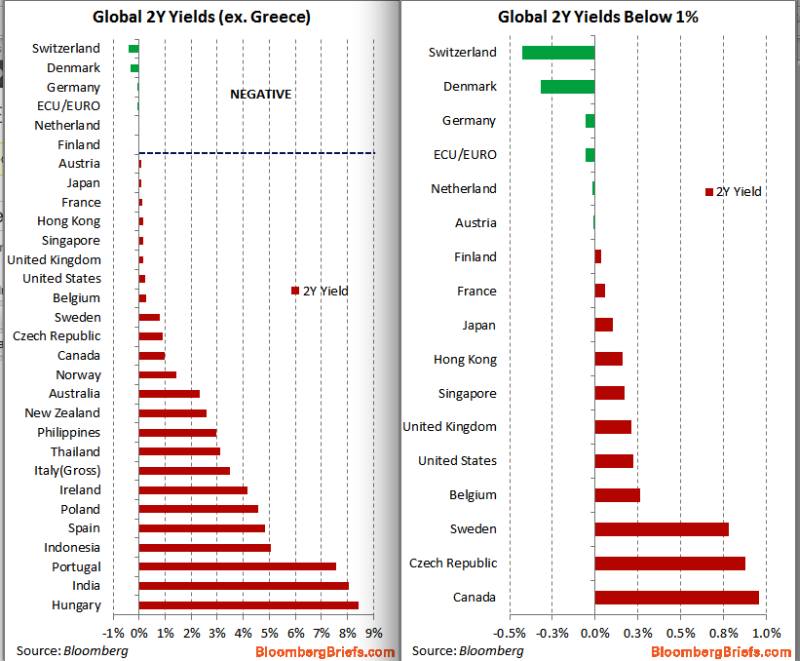

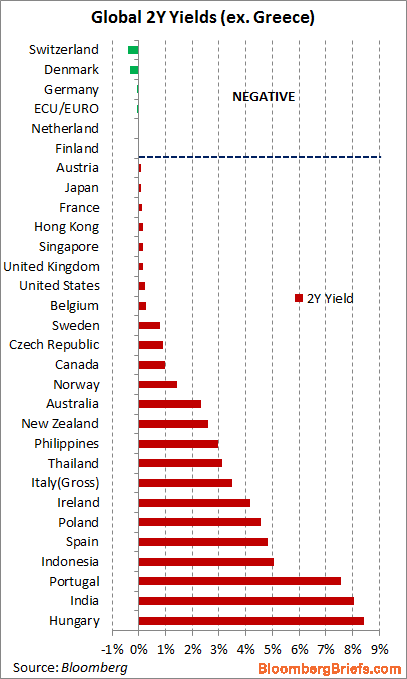

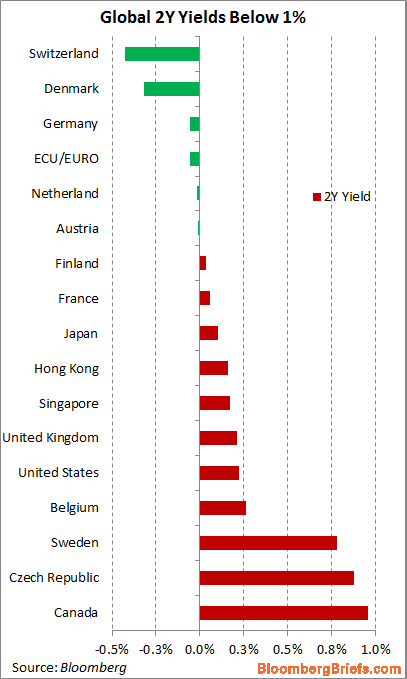

Negative and Close to Zero Yields of Government Bonds and the Reasons

We judge that negative or close to zero yielding government bonds reflect three points: Risk off environment, long-run currency gains on currency with low inflation, insufficient supply of government bonds for bank refinancing purposes.

Read More »

Read More »

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

German Schatz turns negative again

After the first time End May, the German Schatz turns negative:

German June 2014 Schatz Average Yield -0.06% vs 0.10% on June 20

Swiss Eidgenossen 2yrs still at -0.4%

Read More »

Read More »