Tag Archive: Gold

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

New Month, New Trends?

The dollar fell against all the major currencies and most of the emerging market currencies last week. The Dollar Index fell by 1.3%, the biggest loss since the last week of March, and posted its lowest close in nearly three weeks ahead of the weekend. There seemed to be a change in the market after key equity benchmarks, like the MSCI ACWI Index of both emerging and developed markets put in a recovery high in the middle of last week.

Read More »

Read More »

Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable.

Read More »

Read More »

THE BITCOIN HALVING REVISITED – With Ann Rhefn

What is the Bitcoin Halving and What Might it Mean for the Price Watch “THE BITCOIN HALVING REVISITED – With Ann Rhefn”

Read More »

Read More »

Nothing Is What It Seems

My latest interview about Corona, Liberty, Private Property, Authoritarism, and a fear-mongering global media campaign, which I call borderline criminal

[embedded content]

Read More »

Read More »

Is gold still a safe haven?

There have been moments in recent months when many gold owners, myself included, have asked themselves whether gold might have lost its safe haven status, at least in the western world. Was it enough for two generations, who grew up in a paper money system, to forget the history and the 5000-year-old status of gold as real money?

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »

Modern Monetary Theory is an old Marxist Idea

Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970).

Read More »

Read More »

Gold is the 7th sense of financial markets

Claudio Grass (CG): Looking at the interest rate policy of the last years, it would seem that central banks are backed into a corner. They cannot hike borrowing costs without risking a domino effect, as both government and corporate debt have reached record highs, encouraged by the central banks’ own NIRP and ZIRP policies. In your view, is there a “safe” way out of this vicious circle?

Read More »

Read More »

Gold is the 7th sense of financial markets

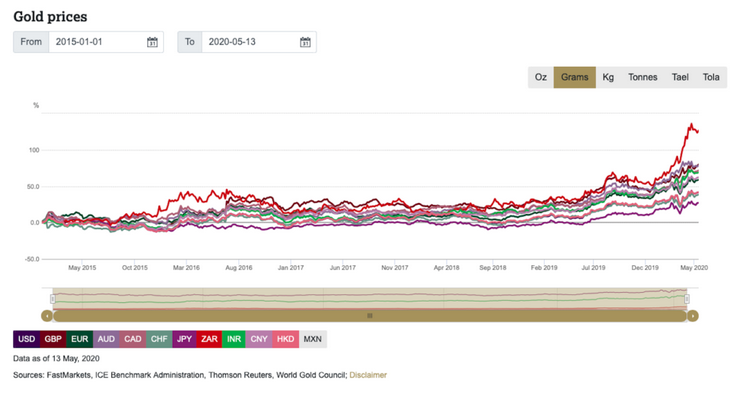

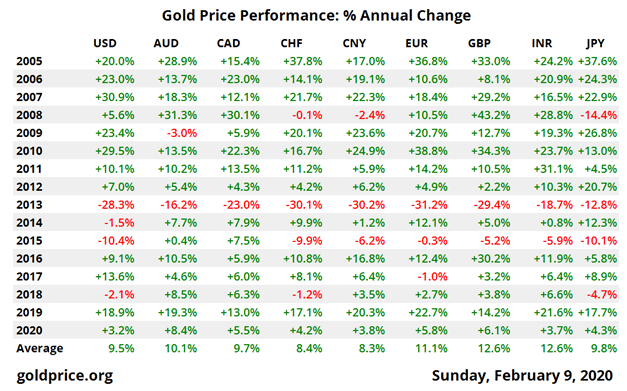

As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion.

Read More »

Read More »

Das Internet – die dezentrale (R)Evolution

Menschen werden durch unterschiedliche Motive angetrieben. Die einen sehen das höchste Glück in der Ansammlung von materiellen Werten, und andere sind von geistigen Werten angetrieben. Eine Idee kann genauso wie eine Rolex Glücksgefühle und Ansporn auslösen. Mich persönliche treiben Ideen an.

Read More »

Read More »

What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time.

Read More »

Read More »

The owl has landed: Lagarde’s new vision for the ECB

On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new President of the ECB. On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged.

Read More »

Read More »

Corporate Debt Time Bomb

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US.

Read More »

Read More »

The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself.

Read More »

Read More »

The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies.

Read More »

Read More »

“We don’t have to behead the king if we can just ignore him” – Claudio Grass

“Negative interest rates are unsustainable and once investors decide to stop paying for the privilege of holding government debt, a banking crisis could result, says James Grant.” Returning SBTV guest, Claudio Grass, speaks with us about the unsustainable pensions, crumbling fiat currencies and a looming financial crisis in a world of insane central bank monetary policies.

Read More »

Read More »

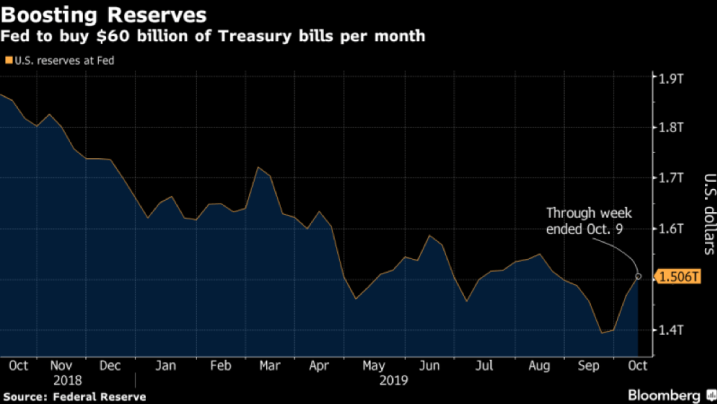

QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since.

Read More »

Read More »

Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations.

Read More »

Read More »