The loan is denominated in gold with interest and principal paid in gold. Scottsdale, Ariz., June 9, 2020—Monetary Metals® announced today that it has loaned gold to Sector Resources Canada Ltd., a British Columbia based gold mining company. The private transaction was conducted off-market, and the interest rate and terms were not disclosed.

Read More »

Tag Archive: gold interest

Monetary Metals Leases Gold to Brite Metals

Scottsdale, Ariz, April 7, 2020—Monetary Metals® announced today that it has leased gold to UK-based Brite Metals. The lease enables Brite Metals to buy gold from Latin American gold miners, and sell it to European refiners.

Read More »

Read More »

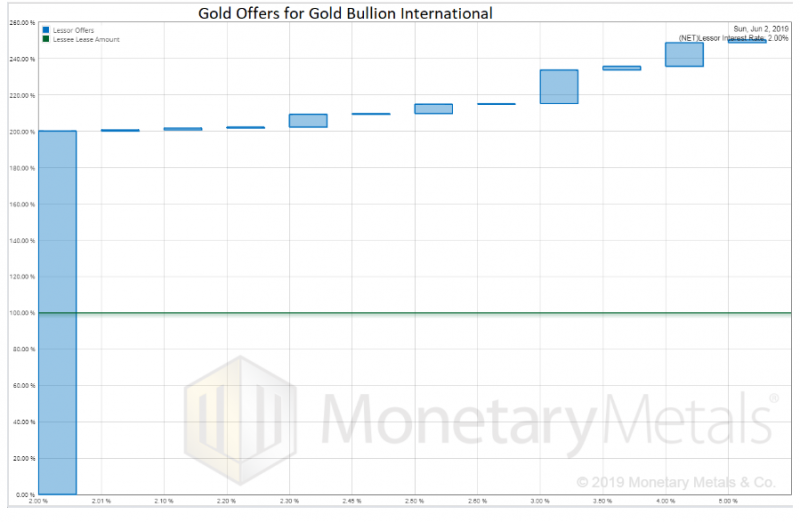

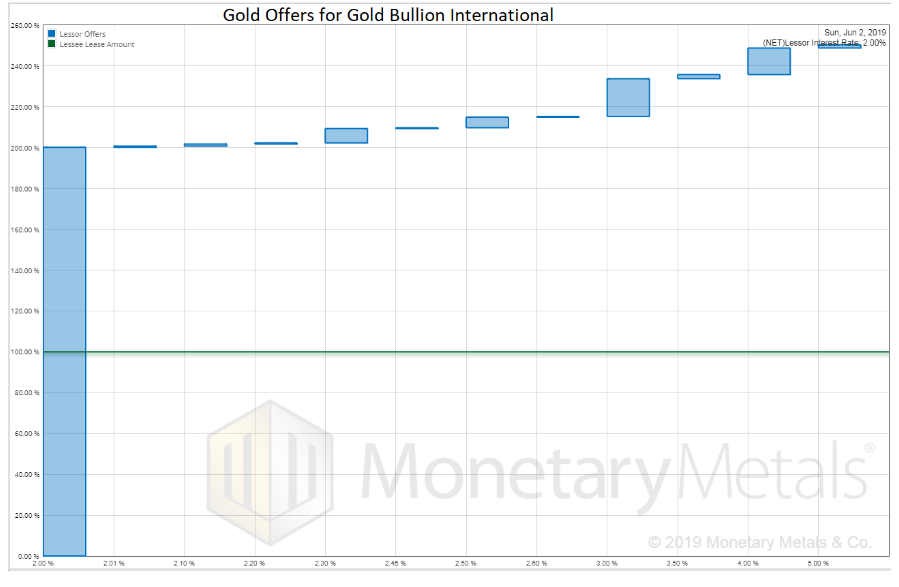

Gold Bullion International Lease #1 (gold)

Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository.

Read More »

Read More »

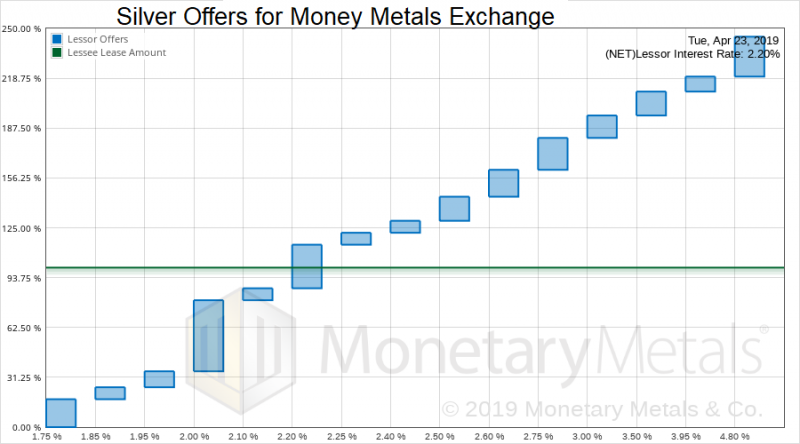

Money Metals Exchange Lease #1 (silver)

Monetary Metals leased silver to Money Metals Exchange, to support the growth of its gold and silver bullion business. The metal is held in the form of inventory in its vault. For more information see Monetary Metals’ press release.

Read More »

Read More »

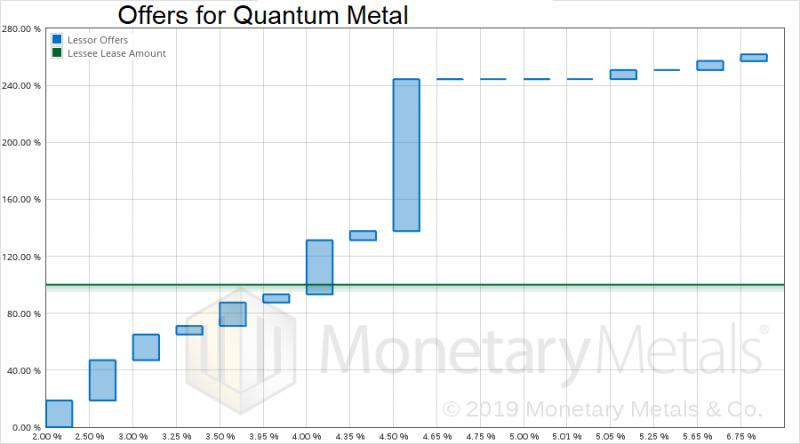

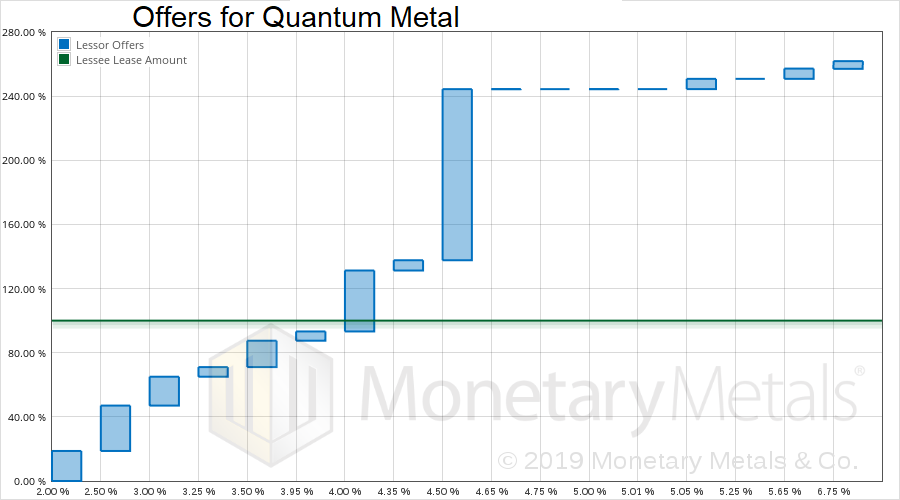

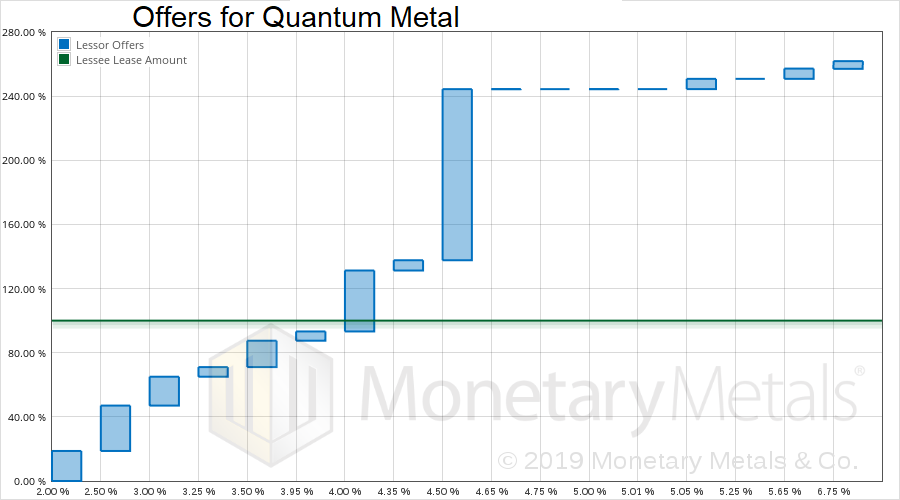

Quantum Metal Lease #1 (gold)

Monetary Metals leased gold to Quantum Metal, to support the growth of its gold distribution business through retail bank branches. The metal is held in the form of retail Perth Mint bars.

Read More »

Read More »

Monetary Metals Leases Gold to Quantum Metal

Scottsdale, Ariz, February 8, 2019—Monetary Metals® announces that it has leased gold to Quantum Metal, to support the growth of its business of selling gold through retail banks. Investors earn 4.5% on their gold, which is held as Perth Mint minted gold bars in inventory. Monetary Metals has a disruptive model, leasing gold from investors who own it and subleasing it to businesses who need it, typically for inventory or work-in-progress.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

10 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

10 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

5 Lehren aus einem Jahr Trump

5 Lehren aus einem Jahr Trump -

Trump tariff rebuke, thoughts of a 100-year-old banker, and designer babies

Trump tariff rebuke, thoughts of a 100-year-old banker, and designer babies -

Staatlich gefördertes Altersvorsorge Depot – besser als Dein ETF?

Staatlich gefördertes Altersvorsorge Depot – besser als Dein ETF? -

Gold, Bitcoin & Aktien – wohin geht die Reise?

Gold, Bitcoin & Aktien – wohin geht die Reise? -

CUBA NO SE HA QUEDADO SIN PETRÓLEO

CUBA NO SE HA QUEDADO SIN PETRÓLEO -

Software Stocks: Navigating The SaaSpocalypse

Software Stocks: Navigating The SaaSpocalypse -

Homesellers Dwarf Homebuyers: Home Prices At Risk

Homesellers Dwarf Homebuyers: Home Prices At Risk -

Fastenzeit gilt nicht für Value-Titel

Fastenzeit gilt nicht für Value-Titel -

Geld ist getauschte Lebenszeit – wirklich reich bist du, wenn du gesund aufwachst.

Geld ist getauschte Lebenszeit – wirklich reich bist du, wenn du gesund aufwachst. -

EU-Parlament umgeht Veto | State of the Union Rede | Waffen für Nazis (Morning News #545)

EU-Parlament umgeht Veto | State of the Union Rede | Waffen für Nazis (Morning News #545)

More from this category

Monetary Metals Provides Gold Loan to Sector Resources

Monetary Metals Provides Gold Loan to Sector Resources10 Jun 2020

Monetary Metals Leases Gold to Brite Metals

Monetary Metals Leases Gold to Brite Metals11 Apr 2020

Gold Bullion International Lease #1 (gold)

Gold Bullion International Lease #1 (gold)20 Jun 2019

Money Metals Exchange Lease #1 (silver)

Money Metals Exchange Lease #1 (silver)6 May 2019

Quantum Metal Lease #1 (gold)

Quantum Metal Lease #1 (gold)13 Feb 2019

Monetary Metals Leases Gold to Quantum Metal

Monetary Metals Leases Gold to Quantum Metal8 Feb 2019