Tag Archive: Gold Exchange Report

Gold Outlook 2024 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year.

Read More »

Read More »

The Russians (Propaganda) Are Coming!

The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh?

Read More »

Read More »

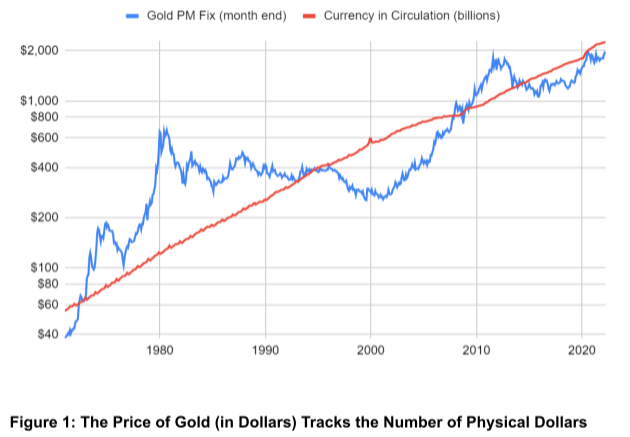

Buy Gold, Because…

It’s pretty, isn’t it? Gold, Liquid Gold, and Inflation. Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. It’s just an inch and a quarter in diameter yet weighs 0.075 pounds. Everyone should hold one in his hand (and own a few).

Read More »

Read More »

Unit of Account and Current Valuations by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com.

Read More »

Read More »

Investments, Speculations and Money by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals.

Read More »

Read More »

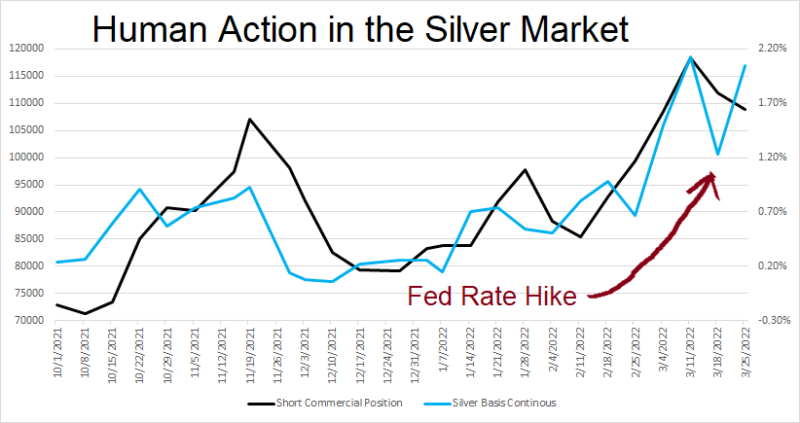

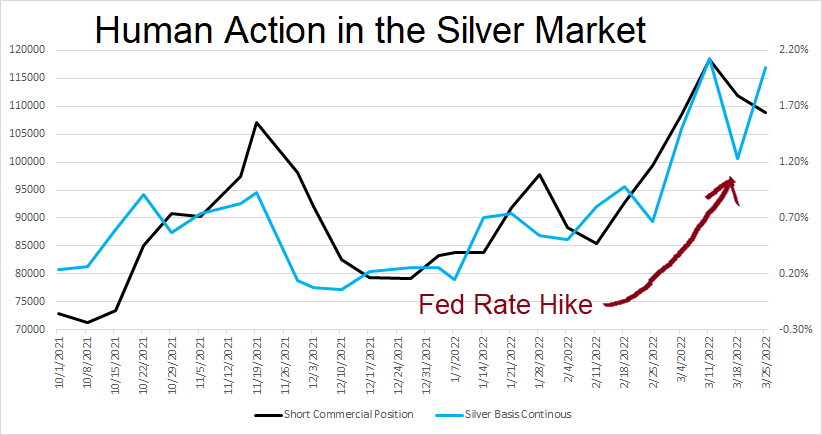

Human Action in the Silver Market

We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon? And doesn’t their shorting of silver push down the price?

Read More »

Read More »

The Zombie Ship of Theseus

The Ship of Theseus is an old philosophical thought experiment. It asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship? We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system.

Read More »

Read More »

What’s In Your Loan?

“Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

Read More »

Read More »

Perversity Thy Name is Dollar

Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

Read More »

Read More »

Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold.

Read More »

Read More »

Transitory Inflation and Useless Ingredients

Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…)

Read More »

Read More »

How Do They Get Away With It?

Picture, if you will, a government that deliberately inflicts bad policy on the people. I know this sounds crazy, and could never happen, but please bear with me. Suppose the government criminalizes hiring someone who produces less than an arbitrary threshold. Or it forces the closure of all businesses deemed to be non “essential”.

Read More »

Read More »

What Trick did Tricky Dicky Pull 50 Years Ago Today?

Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one.

On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments.

Read More »

Read More »

Inflation or Lockdown Whiplash?

Mainstream analysis sees rising consumer prices, and looks for a monetary cause. Also, when it sees an increase in the quantity of dollars, it looks for rising consumer prices. It is a fact that the quantity of what the mainstream calls money (i.e. the dollar) has risen at an extraordinary rate.

Read More »

Read More »

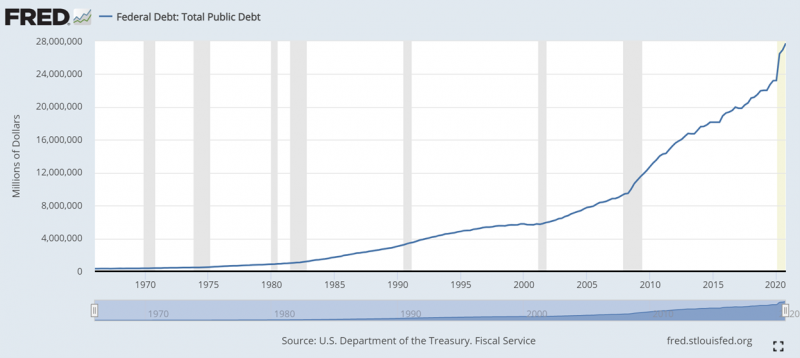

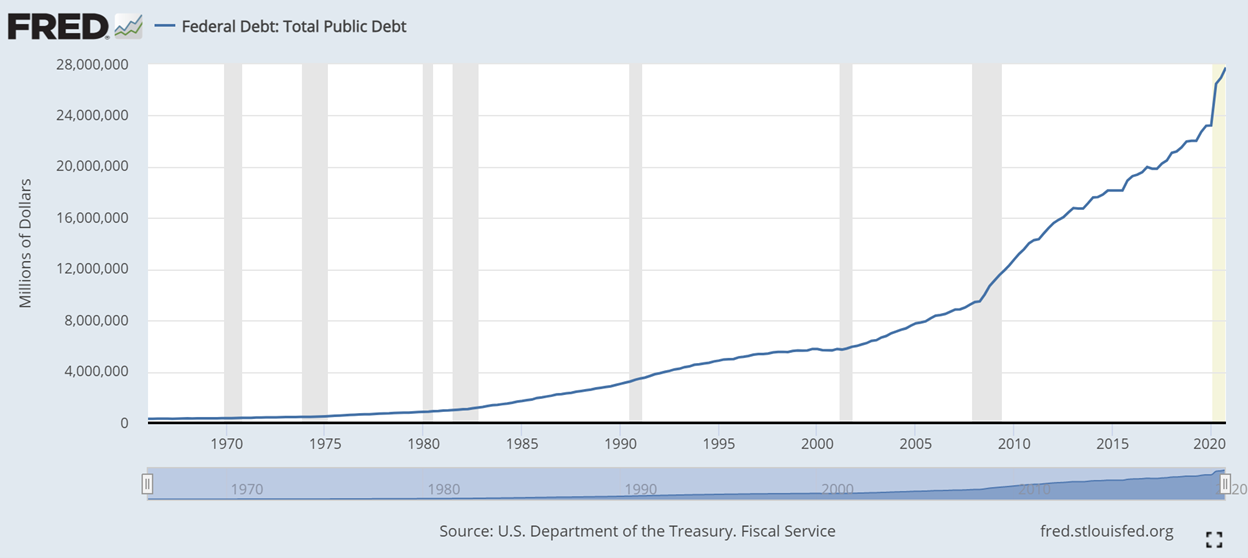

Resetting the Federal Debt

According to the US Treasury, the federal government owes $28.2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under $25 trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist -

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”! -

Switzerland, the country of four seas

Switzerland, the country of four seas -

The Business Cycle Narrative & War With Iran

The Business Cycle Narrative & War With Iran -

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen -

Cash für Medaillen

Cash für Medaillen -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

Achtung: Elon Musk zerstört gerade Wikipedia!

Achtung: Elon Musk zerstört gerade Wikipedia! -

1776 Patriot Silver Bars Are Selling Out

1776 Patriot Silver Bars Are Selling Out

More from this category

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

The Russians (Propaganda) Are Coming!

The Russians (Propaganda) Are Coming!15 Sep 2022

Buy Gold, Because…

Buy Gold, Because…11 Aug 2022

Unit of Account and Current Valuations by Paul Belanger

Unit of Account and Current Valuations by Paul Belanger27 Jun 2022

Investments, Speculations and Money by Paul Belanger

Investments, Speculations and Money by Paul Belanger24 Jun 2022

Human Action in the Silver Market

Human Action in the Silver Market29 Mar 2022

The Zombie Ship of Theseus

The Zombie Ship of Theseus4 Jan 2022

What’s In Your Loan?

What’s In Your Loan?23 Nov 2021

Perversity Thy Name is Dollar

Perversity Thy Name is Dollar16 Nov 2021

Why a Yield on Gold Matters

Why a Yield on Gold Matters3 Nov 2021

Transitory Inflation and Useless Ingredients

Transitory Inflation and Useless Ingredients5 Oct 2021

How Do They Get Away With It?

How Do They Get Away With It?14 Sep 2021

What Trick did Tricky Dicky Pull 50 Years Ago Today?

What Trick did Tricky Dicky Pull 50 Years Ago Today?16 Aug 2021

Inflation or Lockdown Whiplash?

Inflation or Lockdown Whiplash?29 Jun 2021

Resetting the Federal Debt

Resetting the Federal Debt8 Jun 2021