Tag Archive: Gold as an investment

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

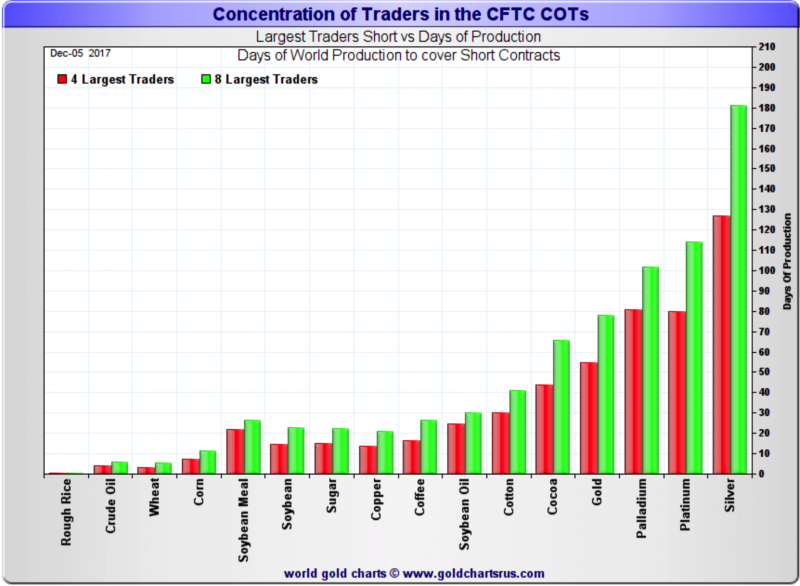

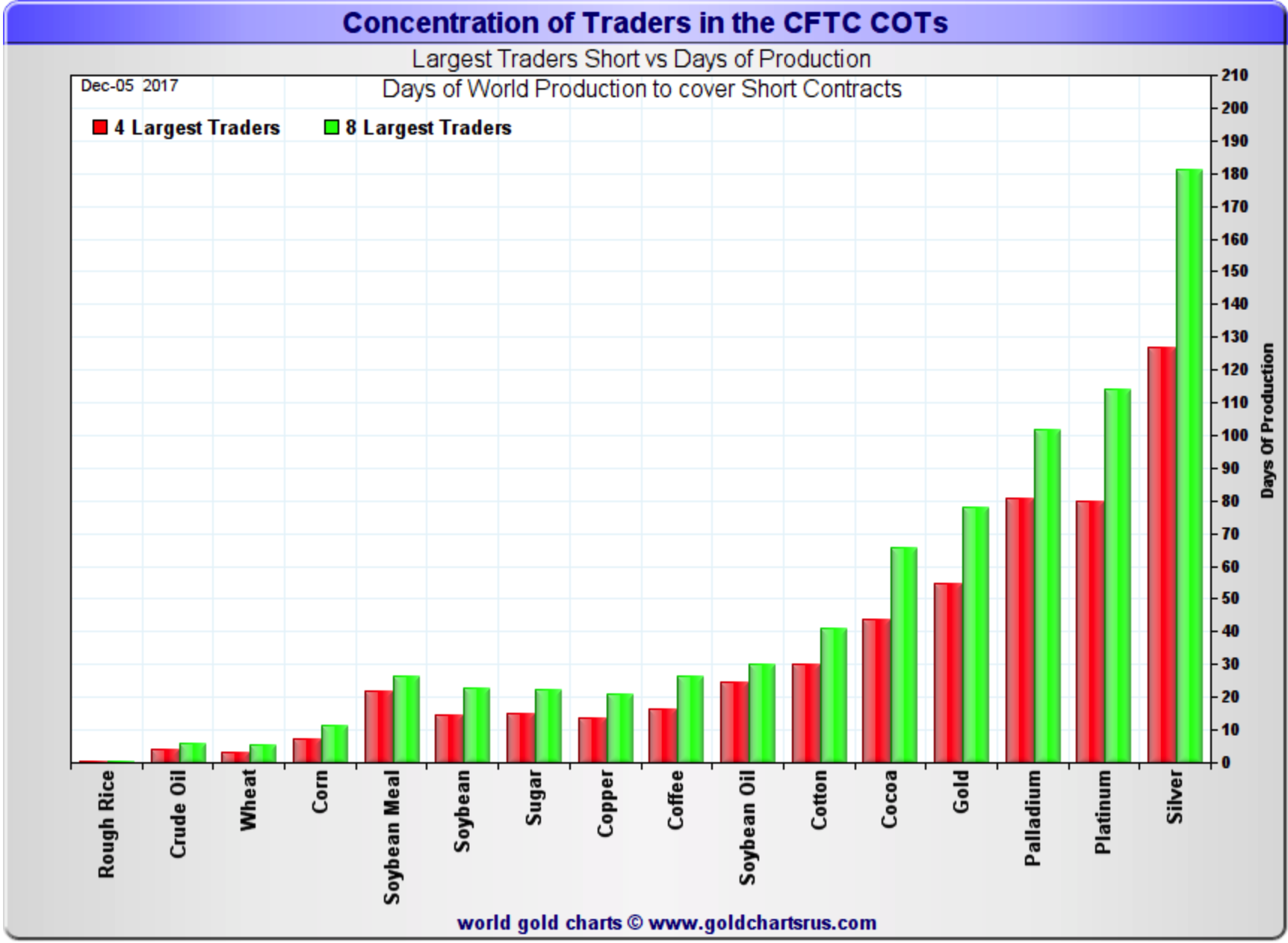

Gold and silver COT suggests bottoming and price rally coming. Speculators cut way back on long positions and added to short bets. Commercials/banks significantly reduced short positions. Commercial net short position saw biggest one-week decline in COMEX history. ‘Big 4’ commercial traders decreased their short positions by 28,800 contracts. Seasonally, January is generally a good month to own gold (see table). "If history is still reliable,...

Read More »

Read More »

Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Don't let "traditional biases" stop you from diversifying into gold - Dalio on Linkedin. “Risks are now rising and do not appear appropriately priced in” warns founder of world's largest hedge fund. Geo-political risk from North Korea & "risk of hellacious war". Risk that U.S. debt ceiling not raised; technical US default. Safe haven gold likely to benefit by more than dollar, treasuries.

Read More »

Read More »

Goldman, Citi Turn Positive On Gold – Despite “Mysterious” Flash Crash

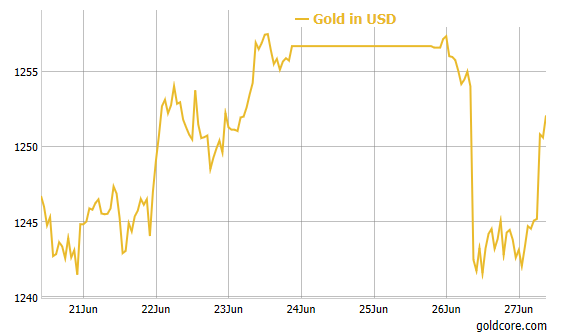

Gold in USD - 1 Week - Massive selling at 0400 EST when U.S. markets closed and thin trading amid holidays in Muslim countries including Turkey, Singapore and Malaysia.

- Mystery is that "fat fingers" in gold market are always sell trades that push prices lower

Read More »

Read More »

New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

A central bank Gold Pool which many people will be familiar with operated in the gold market between November 1961 and March 1968. That Gold Pool was known as the London Gold Pool.

Read More »

Read More »

Negative Rates: The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension).

Read More »

Read More »

Digital Gold – For Now Caveat Emptor

Bitcoin surpasses gold price - a psychological and arbitrary headline. Royal Mint blockchain gold asks you to trust in the UK government. Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers. Invest in a gold mine using cryptocurrency - but wait until 2022 for your gold and trust the miners that it is there. Blockchain and gold will likely make a "good...

Read More »

Read More »

Are Rate Hikes Bad For Gold?

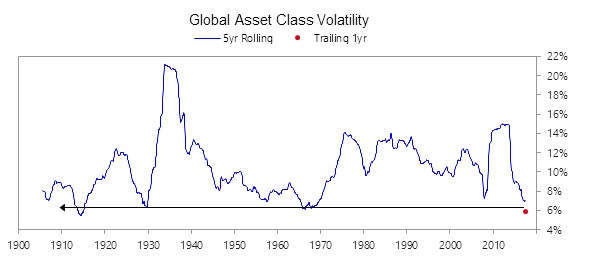

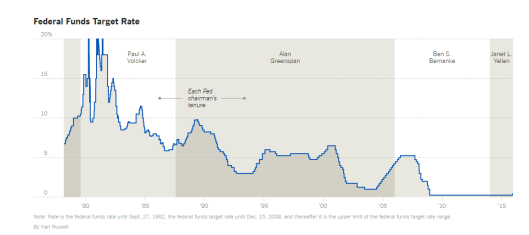

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Let’s take the fist chart and see what correlations exist between rate hikes and the US dollar index.

Read More »

Read More »

Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland's Gold Exports To China Surge To 158 Tonnes In December. Switzerland's gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November - a jump of 416%.

Read More »

Read More »

Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system.

Read More »

Read More »

Gold Bars Worth $800,000 Owned By Prince

Gold Bars Worth $800,000 Owned By Prince. Prince, RIP, owned gold bars worth just over $800,000 according to the statement filed in a Minnesota court last Friday.

Read More »

Read More »

Gold Price In GBP Up 4 percent On Brexit and UK Risks

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks. Pound fell 2% against gold yesterday after Theresa May created Brexit concerns. May's 'Hard Brexit' denial does not calm markets growing fears. Investors concerned about lack of government strategy and uncertainty. UK Prime Minister bizarrely blames media and "those who print things" for sterling depreciation. GBP gold builds on 31% gain in 2016 with 4% gain so far in 2017.

Read More »

Read More »

Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY. Gold gains in CNY, INR & most emerging market currencies. Gold surges 31.5% in British pounds after Brexit shock. Gold acted as hedge and safe haven in 2016 … for those who need safe haven. Furthers signs of market having bottomed and bodes well for 2017. What drivers will gold respond to in 2017? EU elections and contagion risk, Geo-politics, terrorism, war and cyber war. Outlook for gold good...

Read More »

Read More »

Gold Market Charts – A Month in Review

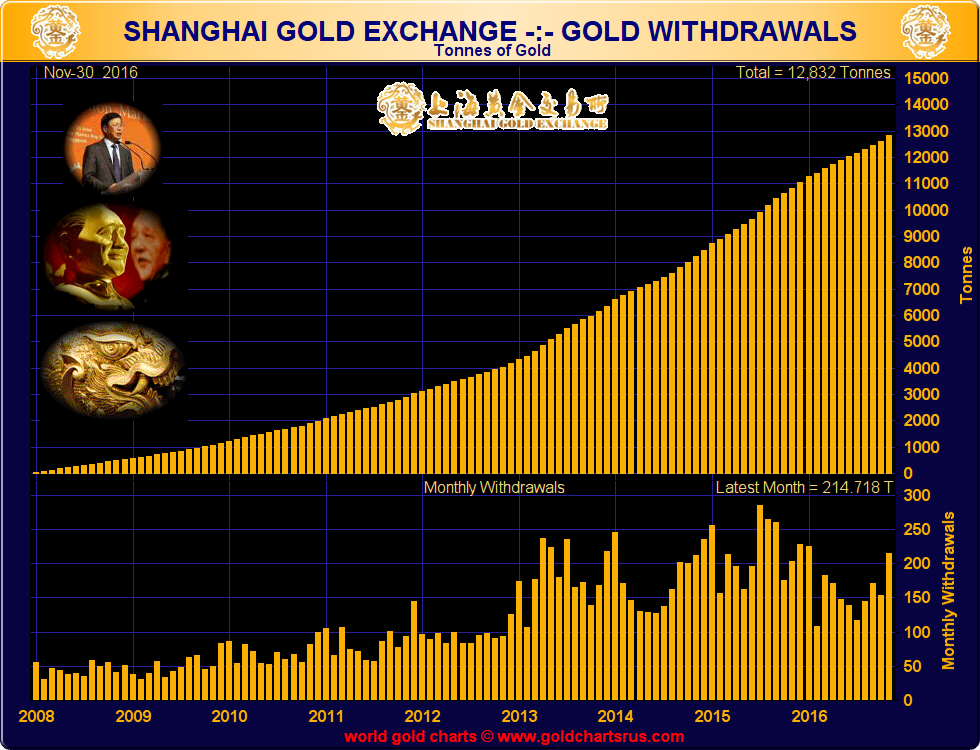

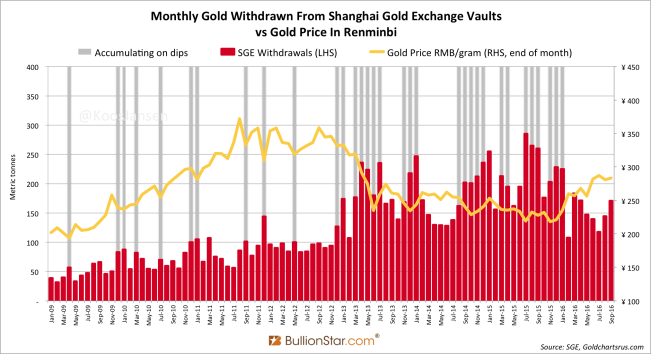

BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs).

Read More »

Read More »

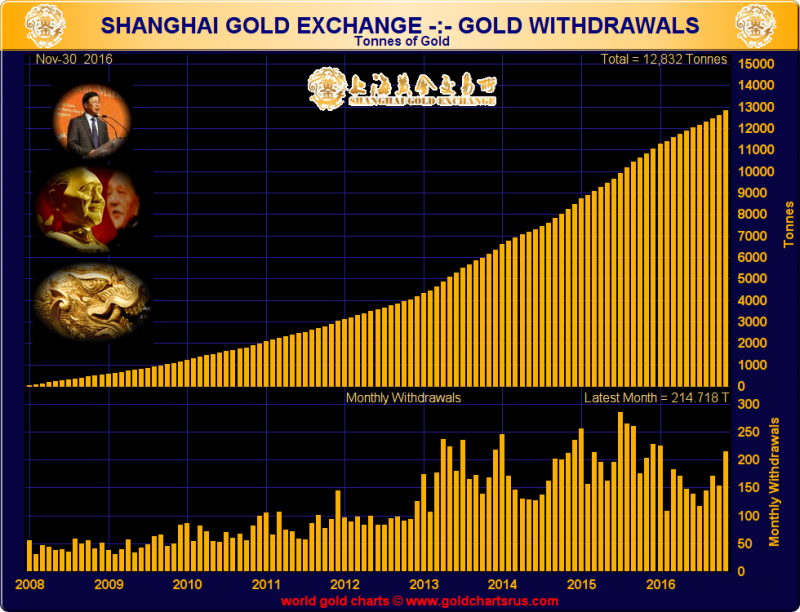

Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled through the exchange.

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

Wie du 100 € skalierst und wirklich unabhängig wirst

Wie du 100 € skalierst und wirklich unabhängig wirst -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

More from this category

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts17 Dec 2017

Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”18 Aug 2017

Goldman, Citi Turn Positive On Gold – Despite “Mysterious” Flash Crash

Goldman, Citi Turn Positive On Gold – Despite “Mysterious” Flash Crash28 Jun 2017

New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers

New Gold Pool at the BIS Switzerland: A Who’s Who of Central Bankers13 Jun 2017

Negative Rates: The New Gold Rush… For Gold Vaults

9 Jun 2017

Digital Gold – For Now Caveat Emptor

Digital Gold – For Now Caveat Emptor20 Mar 2017

Are Rate Hikes Bad For Gold?

Are Rate Hikes Bad For Gold?24 Feb 2017

Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tons In December28 Jan 2017

Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

Declassified CIA Memos Reveal Probes Into Gold Market Manipulation20 Jan 2017

Gold Bars Worth $800,000 Owned By Prince

Gold Bars Worth $800,000 Owned By Prince11 Jan 2017

Gold Price In GBP Up 4 percent On Brexit and UK Risks

Gold Price In GBP Up 4 percent On Brexit and UK Risks10 Jan 2017

Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP6 Jan 2017

Gold Market Charts – A Month in Review

Gold Market Charts – A Month in Review4 Jan 2017

Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes28 Nov 2016

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.17 Nov 2016