Tag Archive: Germany

Fragile Calm Casts a Pall over the Capital Markets

Overview: There is a fragile calm in the capital

markets today ahead of the long holiday weekend for many. The poor US economic

data yesterday and third consecutive decline in the KBW bank index weighed on

risk sentiment. Most of the large bourses in the Asia Pacific region fell, with

Hong Kong and India notable exceptions. In Japan, the Topix bank index fell

1.1% after a 1.9% decline yesterday and is now lower on the week. Europe's

Stoxx 600 is...

Read More »

Read More »

RBA Holds Fire, Sterling Reaches Best Level since last June, and the Dollar Struggles to Find Much Traction

Overview: The jump in oil prices is the newest shock and the May

WTI contract is holding above $80 a barrel as it consolidates yesterday's

surge. A week ago, it settled near $73.20. Australian and New Zealand bond

yields moved lower, partly in catch-up and partly after the RBA stood pat. South

Korean bonds also rallied on the back of softer inflation (4.2% vs. 4.8%). But

European and US benchmark yields is 2-4 bp higher. The large equity markets...

Read More »

Read More »

Dollar Soft but Stretched

Overview: While bank stress seems to continue

to ease, the dollar languishes against most of the major currencies. The

Japanese yen is the notable exception. It is off about 1.5% this week. The

Dollar Index has given back the gains scored at the end of last week but

remains inside the range set last Thursday and Friday (~101.90-102.35). Perhaps

the participants are waiting for Friday. In addition to month-, quarter, and

fiscal-year ends, it is...

Read More »

Read More »

Calmer Markets to Start the New Week

Overview: There did not appear to be any negative

surprises over the weekend, and this is helping calm investors' nerves at the

start of the new week. Deutsche Bank shares have recovered most of the

pre-weekend loss in the German market, and Stoxx bank index is posting a gain

for the first time in four sessions. The AT1 ETF is slightly softer. In Japan,

the Topix bank index slipped around 0.5%, its fourth decline in the past five

sessions. Asia...

Read More »

Read More »

Yen Jumps Despite Poor GDP Ahead of Tomorrow’s BOJ Outcome

Overview: Seeing the drama he inspired on Tuesday,

the Fed chair tried soft-pedaling the idea that he was signaling a 50 bp hike

in March. The market did not buy it. And the odds, discounted by the Fed funds

futures rose a little above 70% from about 62% at Tuesday's close. The two-year

note yield solidified its foothold above the 5% mark. With the Bank of Canada

confirming its pause, the Reserve Bank of Australia does not seem that far

behind, and...

Read More »

Read More »

US Dollar is Better Bid Ahead of Powell, while Aussie Sells Off on Dovish Hike by the RBA

Overview: The US dollar is trading with a firmer bias against

nearly all the G10 currencies ahead of Federal Reserve Chairman Powell's

semi-annual testimony before Congress. Speaking for the Federal Reserve, the

Chair is likely to stay on message which is higher rates are necessary to cool

the overheating economy. This comes on the heels of the Reserve Bank of

Australia's 25 bp hike and indication that it is not pre-committing to an April

hike. The...

Read More »

Read More »

Markets Catch Collective Breath

Overview: After last week's flurry of activity that saw the US

dollar extend its recovery, it has begun off the new week largely consolidating

in relatively narrow ranges. The Australian and New Zealand dollar's remains

softer, and the Swiss franc is virtually flat, but the other G10 currencies,

led by sterling are posting small gains. A break-through on the Northern

Ireland protocol, which has been rumored for a more than a week may be

announced...

Read More »

Read More »

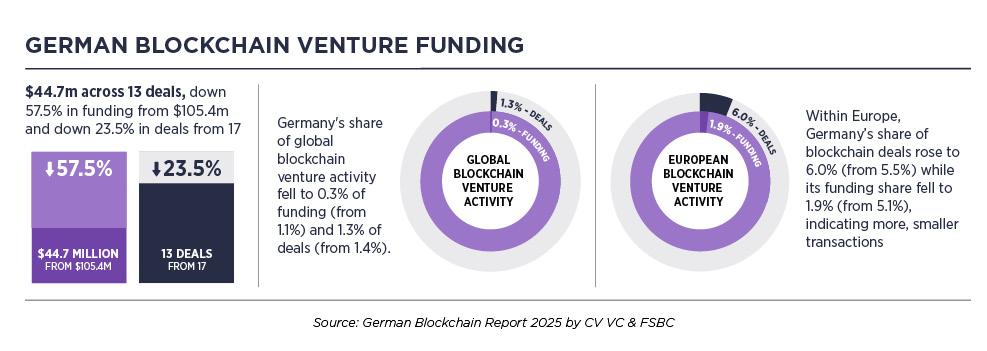

Siemens Issues First Digital Bond on Blockchain

Siemens is one of the first companies in Germany to issue a digital bond, in accordance with Germany’s Electronic Securities Act.

Read More »

Read More »

Yen Retreats Ahead of Formal BOJ Announcement Tomorrow and US CPI

Overview: A consolidative tone is mostly the theme of the day. The revisions to the US CPI announced before the weekend add to the uncertainty and focus on tomorrow's report. At the same time, investors watch ongoing air space activity that has led to a few objects being shot down over the US and Canadian airspace.

Read More »

Read More »

US Interest Rate Adjustment Post-Jobs is Over as the 2-Year Yield Backs Away from 4.50%

Overview: The capital markets have shrugged off the

more than 1% loss of the Nasdaq and S&P 500 yesterday and have jumped back

into risk assets. The stocks and bonds have been bought and the dollar sold. Chinese

and Hong Kong shares gained more than 1% today. Japan was mixed and Taiwan and

South Korean equites saw minor losses. Europe's Stoxx 600 is up over 1%. Nasdaq

futures are up nearly 1.2% while the S&P 500 is lagging slightly....

Read More »

Read More »

Anti-Climactic Return of China

Overview: The re-opening

of China's mainland market amid reports of strong activity during the holiday,

was relatively subdued. The CSI 300 rose less than 0.5% and the Shanghai

Composite eked out less than a 0.2% gain. The 0.5% gain in the yuan was largely

in line with the performance of the offshore yuan. Indeed, it seems like a bit

like "buy the rumor sell the fact" type of activity as Hong Kong's

Hang Seng tumbled 2.75%, to give back...

Read More »

Read More »

Bank of Canada may say Pause, but the Market Hears Finished

Overview: Amid sharp losses in the US equity futures, the US dollar is mostly firmer against the G10 currencies. The notable exception is the Australian dollar, where high-than-expected inflation boosts the risk of a more aggressive central bank.

Read More »

Read More »

Euro Pokes Above $1.09. Will it be Sustained?

Overview: The Lunar New Year holiday has shut many centers in Asia until the middle of the week, though China's mainland is on holiday all week. The signaling of a downshift in the pace of Fed tightening by some notable hawks helped lift risk appetites ahead of the weekend and saw the

S&P 500 snap a four-day decline.

Read More »

Read More »

With Trepidation, the Market Awaits the BOJ

With the market nearly ruling out a 50 bp hike by the Federal Reserve on February 1, the interest rate adjustment appears to have largely run its course. This may be helping to ease the selling pressure on the greenback.

Read More »

Read More »

Monday and Beyond

Monday Ranges: Euro: $1.0802-$1.0874JPY/$: JPY127.23-JPY128.87GBP: $1.2172-$1.2289CAD/$: CAD1.3353-CAD1.3418AUD: $0.6941-$0.7019MXN/$: MXN18.7313-MXN18.8566Rumors of an emergency BOJ meeting sent the dollar to its lows in Tokyo, slightly below the pre-weekend low (~JPY127.46). The on-the-run (most current) 10-year yield settled above the 0.50% cap and the generic 10-year bond has not traded below the 0.50% level since January 5. The market...

Read More »

Read More »

Dollar Index Gives Back Half of 21-Month Gains in 3 1/2 Months

Overview: The continued easing of US price pressures

has strengthened the market's conviction that the Federal Reserve will further

slow the pace of rate hikes and that the terminal rate will be near 5.0%. The

decline in US rates has removed a key support for the US dollar, which has

fallen against all the G10 currencies this week. The Dollar Index has now retraced half of what it gained since bottoming on January 6, 2021. Meanwhile, there are...

Read More »

Read More »

Greenback’s Sell-off may Stall Ahead of Powell Tomorrow

Overview: Don't fight the Fed went the manta as the

market took the US two-year yield back up to 4.50% in the aftermath of the FOMC

minutes last week, the highest in over a month. The minutes warned of a

premature easing of financial conditions. And then bam, softer than expected

hourly earnings and a weak service PMI and bonds and stocks rallied, and the

dollar was sold. This is a key part of the backdrop for this week, for which

several Fed...

Read More »

Read More »

USD Stretched Ahead of Employment Report, while Yuan Jumps on Hopes of New Property Initiatives

Overview: The US dollar extended yesterday's gains

as the market adjusts positions ahead of the jobs data. Yesterday and today's

price action looks to have strengthened the near-term technical outlook for the

greenback. However, the intraday momentum indicators are stretched. This warns

of the risk of a counter-intuitive move after the data, barring a significant

surprise. Meanwhile, one of the Fed's leading hawkish voices, St. Louis Fed

President...

Read More »

Read More »

The Market Appears to Shrug Off the Fed’s Warning

Overview: The US dollar is consolidating in a mixed

fashion today. The FOMC minutes drew much attention but failed, at least

initially, to spur a significant shift in expectations. The pricing in the Fed

funds futures strip is still consistent with a cut later this year, which the

minutes were clear, no officials anticipate. Today's US ADP jobs estimate, and

November trade balance are being overshadowed by tomorrow's nonfarm payroll

figures. The...

Read More »

Read More »

US CPI ahead of FOMC Outcome Tomorrow

Overview: The dollar

softer against the G10 currencies ahead of today’s CPI report and the FOMC meeting

the concludes tomorrow. Emerging market currencies are most mixed. The

Hungarian forint leads the complex with around a 1% gain on news of a

preliminary deal struck with the EU. The South African rand is the worst

performer, off around 0.8%, as impeachment proceedings against Ramaphosa

proceed. Global equities are mostly higher today after the...

Read More »

Read More »