Tag Archive: Germany

Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil.

Read More »

Read More »

FX Daily, February 25: Capital Markets Remain Fragile after Yesterday’s Bloodletting

Overview: Yesterday's bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday's moves were in excess. Japanese markets, which were closed on Monday, played catch-up today, and the Nikkei shed 3.3%.

Read More »

Read More »

FX Weekly Preview: Sources of Imbalance and the Pushback Against New Divergence

The US dollar's surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven

yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some...

Read More »

Read More »

FX Daily, February 18: Apple’s Warning Weighs on Sentiment

Overview: Apple's warning that it will miss Q1 revenue due to the knock-on effects of the coronavirus seemed to be a modest wake-up call to investors, who, judging from the equity market, were looking beyond. Equities have fallen, and bonds have rallied. Japan, Hong Kong, and South Korean stocks fell by more than 1%, and only China and Indonesia were able to post gains.

Read More »

Read More »

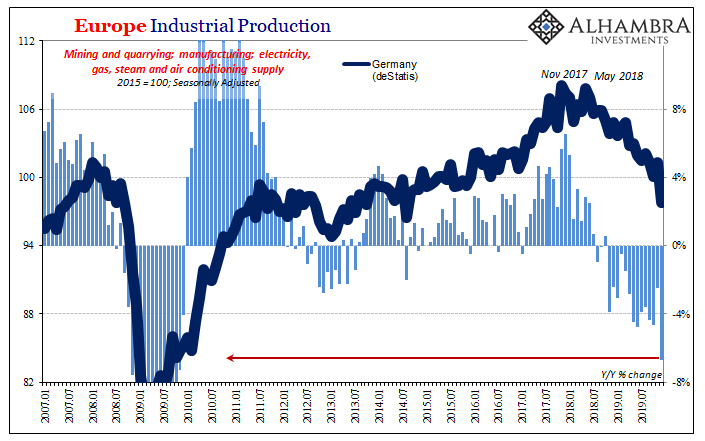

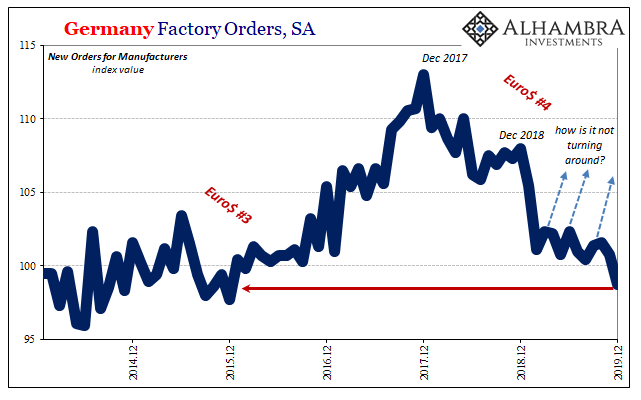

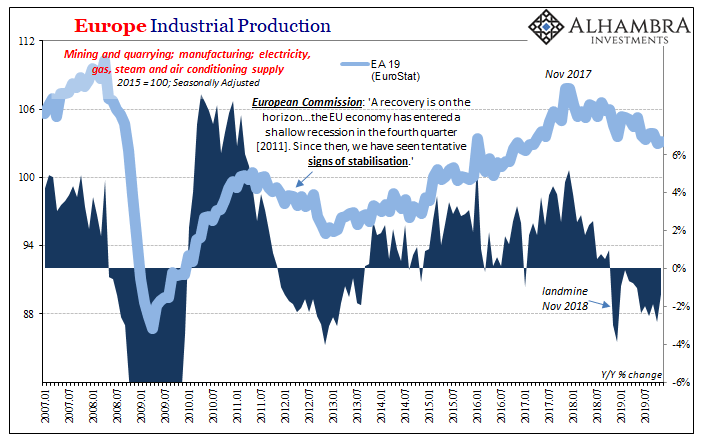

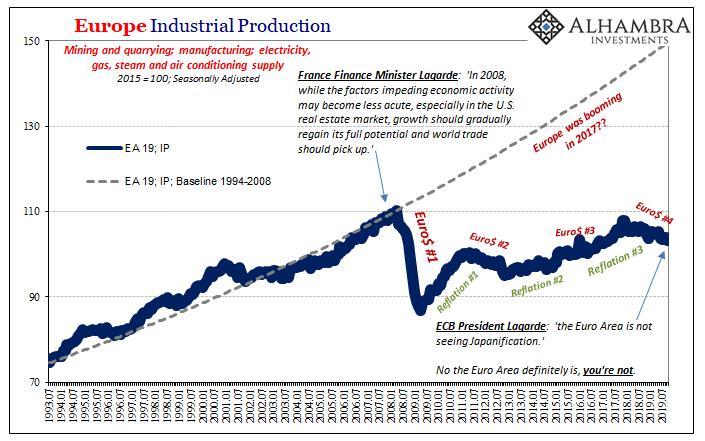

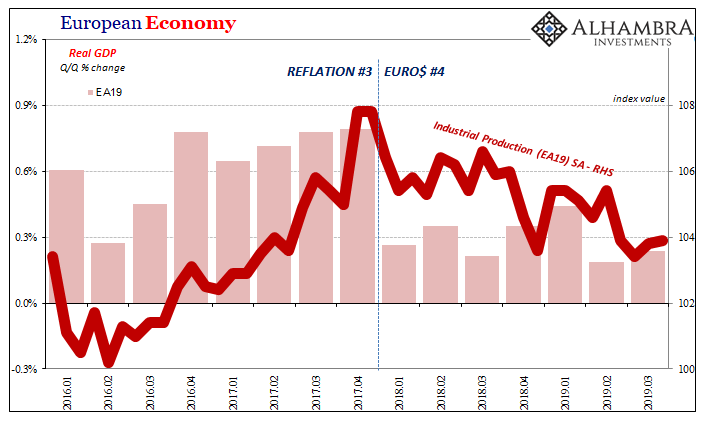

European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way.

Read More »

Read More »

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

Two Years And Now It’s Getting Serious

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

COT Black: German Factories, Oklahoma Tank Farms, And FRBNY

I wrote a few months ago that Germany’s factories have been the perfect example of the eurodollar squeeze. The disinflationary tendency that even central bankers can’t ignore once it shows up in the global economy as obvious headwinds. What made and still makes German industry noteworthy is the way it has unfolded and continues to unfold. The downtrend just won’t stop.

Read More »

Read More »

FX Daily, February 6: Stocks Push Higher but more Cautious Tone may be Emerging

Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe's Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer.

Read More »

Read More »

FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard.

Read More »

Read More »

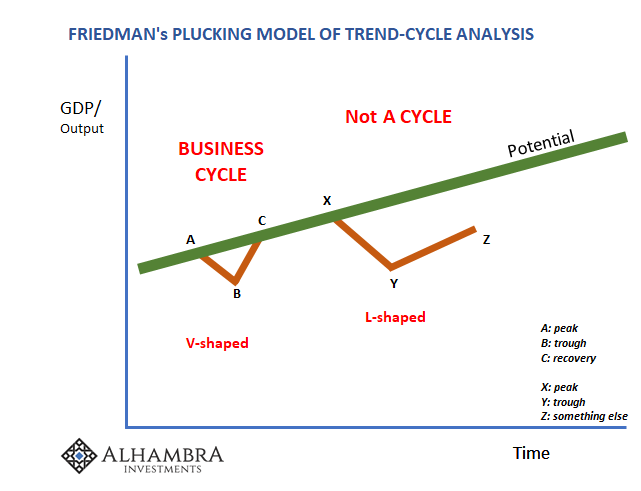

With No Second Half Rebound, Confirming The Squeeze

It’s a palpable impatience. Having learned absolutely nothing from the most recent German example, there’s this pervasive belief that if the economy hasn’t fallen apart by now it must be going the other way. The right way. Those are the only two options for mainstream analysis (which means it isn’t analysis).

Read More »

Read More »

Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global...

Read More »

Read More »

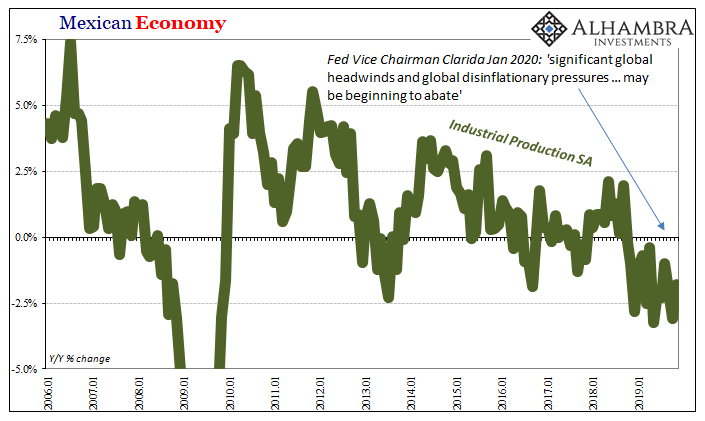

Not Abating, Not By A Longshot

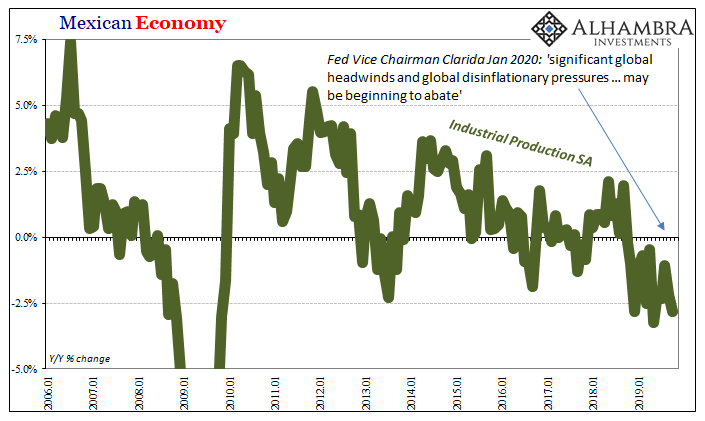

Since I advertised the release last week, here’s Mexico’s update to Industrial Production in November 2019. The level of production was estimated to have fallen by 1.8% from November 2018. It was up marginally on a seasonally-adjusted basis from its low in October.

Read More »

Read More »

Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts).

Read More »

Read More »

FX Daily, January 9: Animal Spirits Roar Back

Overview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei's 2% advance leading the way. More broadly, the markets in Taiwan, South Korea, Hong Kong, India, and Thailand all rose more than 1%.

Read More »

Read More »

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

You Will Never Bring It Back Up If You Have No Idea Why It Falls Down And Stays Down

It wasn’t actually Keynes who coined the term “pump priming”, though he became famous largely for advocating for it. Instead, it was Herbert Hoover, of all people, who began using it to describe (or try to) his Reconstruction Finance Corporation. Hardly the do-nothing Roosevelt accused Hoover of being, as President, FDR’s predecessor was the most aggressive in American history to that point, economically speaking.

Read More »

Read More »

FX Daily, December 09: China’s Steps-Up Import Substitution Strategy while USMCA Comes Down to the Wire

The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for the last three sessions.

Read More »

Read More »

European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before.

Read More »

Read More »

FX Daily, December 5: Sterling Sent Higher as Market Discounts Next Week’s Election

Overview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday's strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a two-day decline today with nearly all the market with the notable exception of South Korea advanced.

Read More »

Read More »