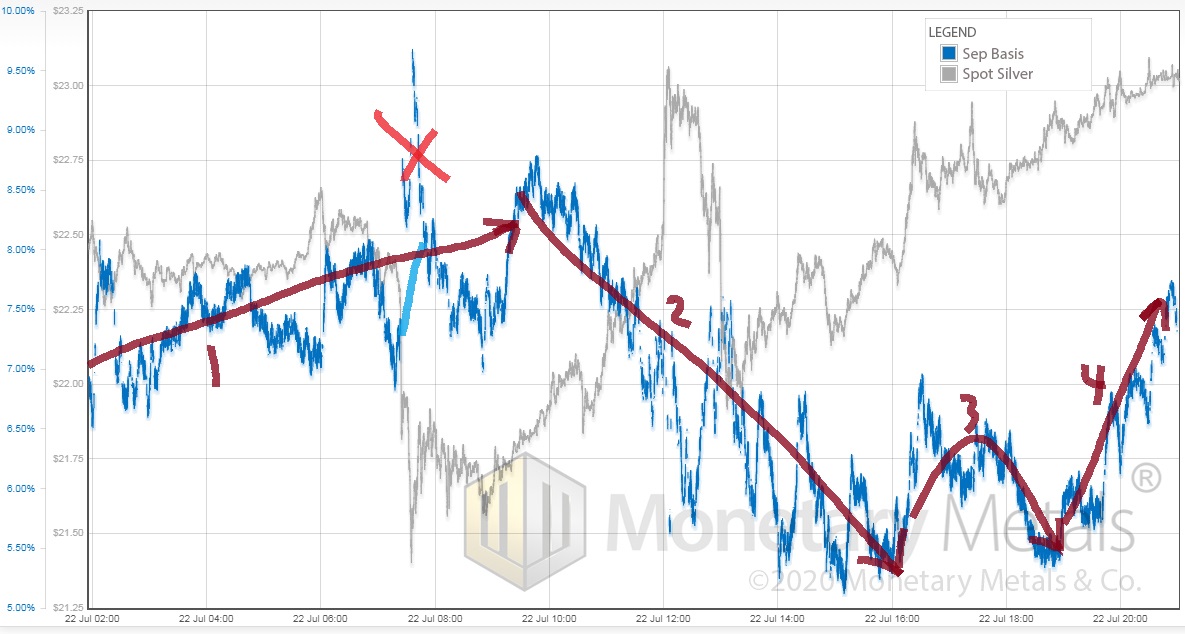

Yesterday, the price of silver spiked about 10%. We wrote that it was driven by: “…buying of physical metal.” And we added: “This is a pretty good signal that a bull market may be returning to silver. Let’s watch the basis and price action closely and see how it develops, before we join the pack…”

Read More »

Tag Archive: Friedman

America Needs The Gold Standard More Than Ever

The United States needs the gold standard more than ever. The gold standard is neither barbaric nor impractical, and it is more urgently needed every day. This is because the standard of paper money is failing. It has set in motion an accelerating series of crises, each worse than the previous. The nation cannot continue to borrow to infinity, nor can the U.S. endure zero interest much longer.

Read More »

Read More »

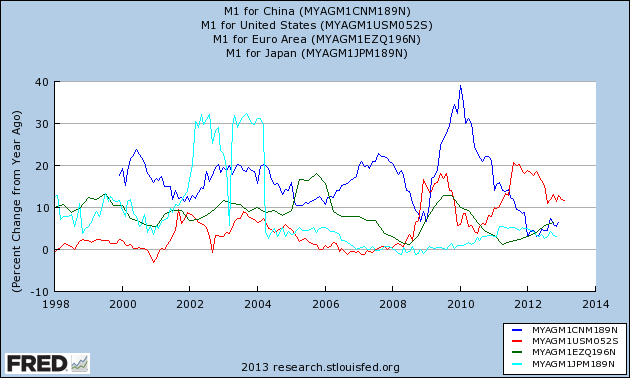

The Inflation Lie? Why and When Inflation Will Come Back

The so-called "inflation lie" : money printing does not create inflation. The cyclical slowing in emerging markets shows that it actually did cause inflation, just not in developed economies yet.

Read More »

Read More »