Tag Archive: Federal Reserve/Monetary Policy

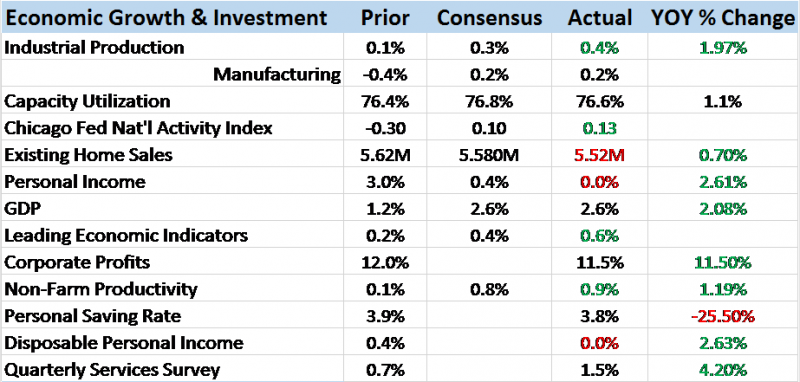

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

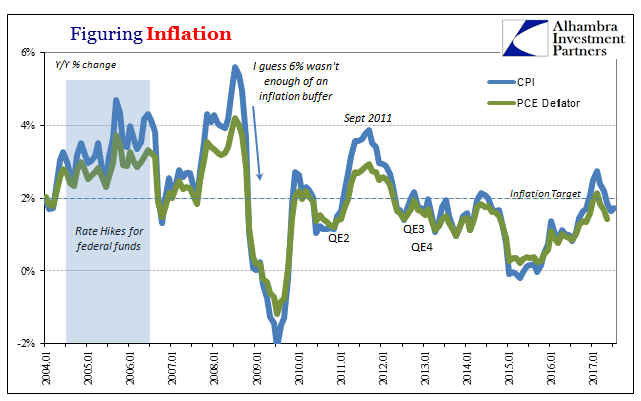

Oil Prices, CPI: Why Not Zero?

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish...

Read More »

Read More »

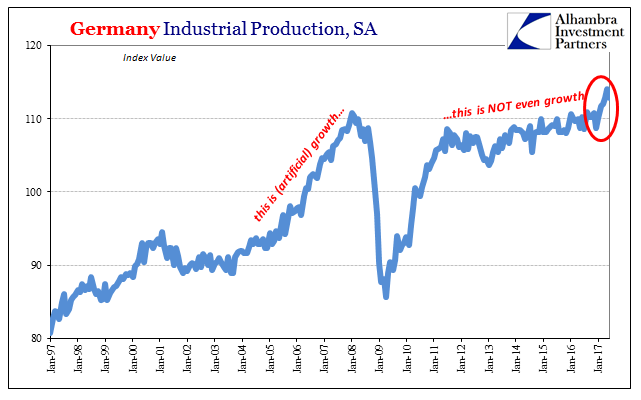

Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year.

Read More »

Read More »

Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions.

Read More »

Read More »

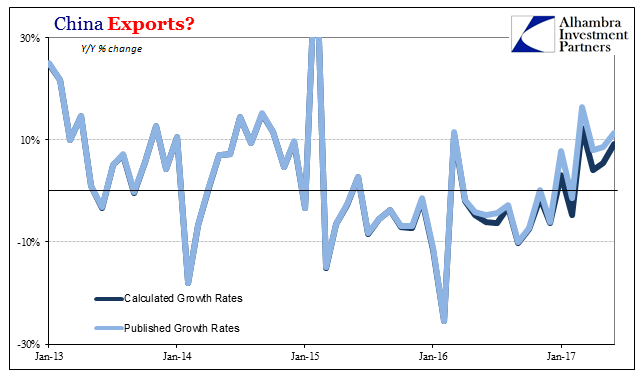

China Exports, China Imports: Textbook

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »

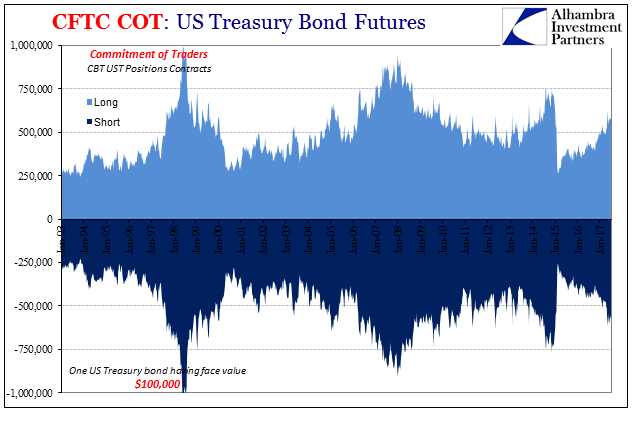

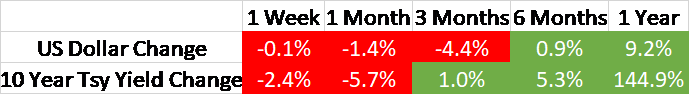

U.S. Treasuries: Not Really Wrong On Bonds

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014.

Read More »

Read More »

Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook.

Read More »

Read More »

U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing what is just one quarter shy of...

Read More »

Read More »

Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why...

Read More »

Read More »

China’s Economy Shorthand the Largest Asset Bubble in Human History

The term “ghost city” is a loaded one, often deployed to skew toward a particular viewpoint. In the context of China’s economy, it has become shorthand for perhaps the largest asset bubble in human history. While that may ultimately be the case, in truth China’s ghost cities aren’t about the past but its future.

Read More »

Read More »

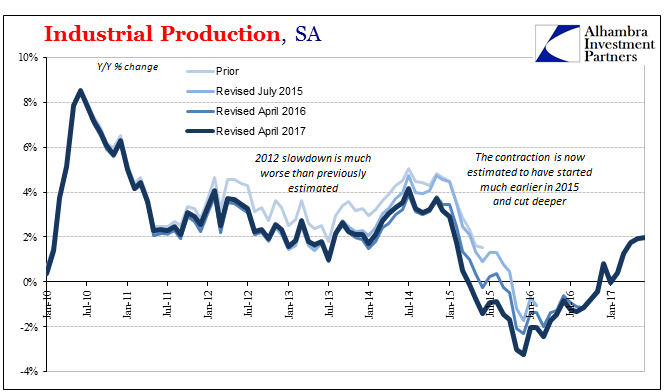

U.S. Industrial Production: Industrial Drag

Completing a busy day of US economic data, Industrial Production was, like retail sales and inflation data, highly disappointing. Prior months were revised slightly lower, leaving IP year-over-year up just 2% in June 2017 (estimates for May were initially 2.2%). Revisions included, the annual growth rate has been stuck around 2% now for three months in a row, suggesting like those other accounts a pause or even possible end to the mini-improvement...

Read More »

Read More »

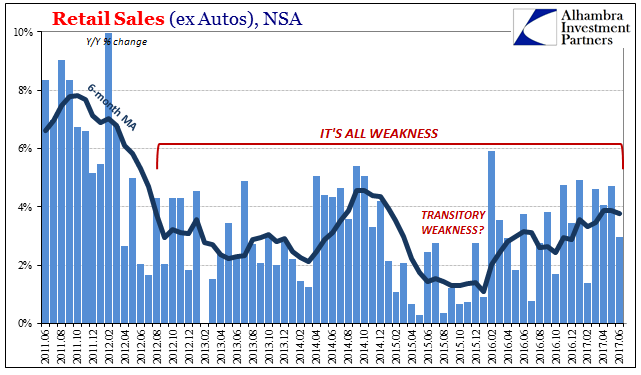

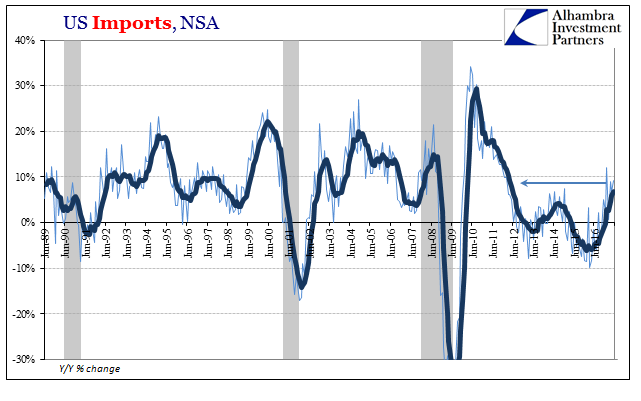

Retail Sales Conundrum

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January.

Read More »

Read More »

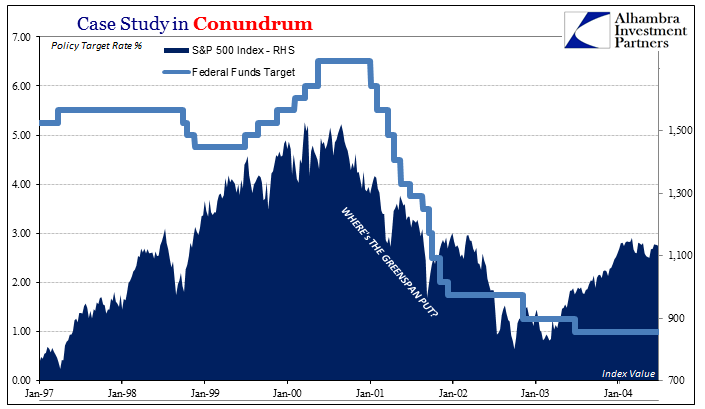

US S&P 500 Index, Federal Funds Target, Manufacturing Payrolls, US Imports and US Banking Data: All Conundrums Matter

Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s.

Read More »

Read More »

China Imports and Exports: The Ghost Recovery

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with.

Read More »

Read More »

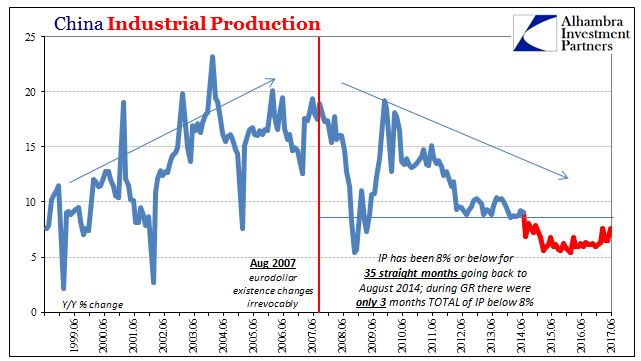

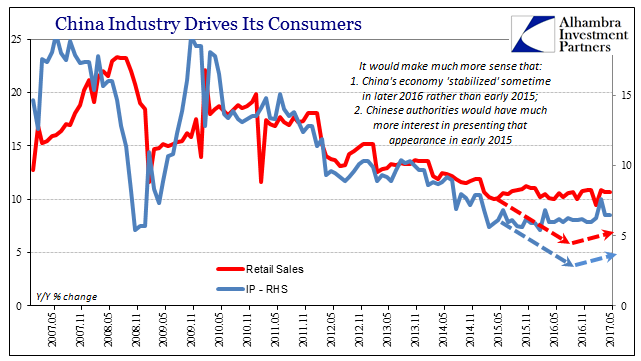

Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level.

Read More »

Read More »

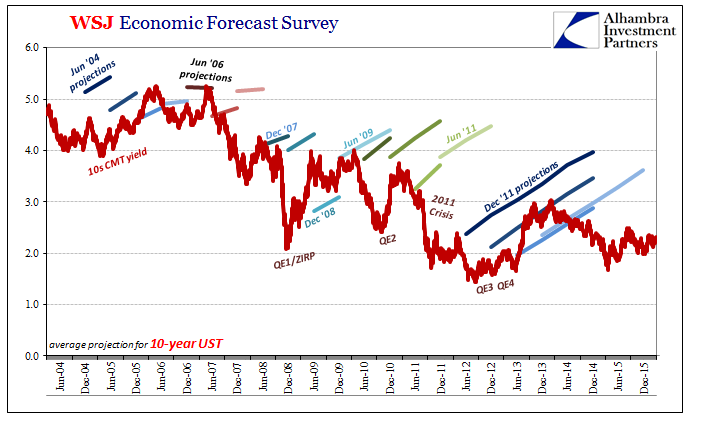

US Federal Funds, Bond Market and WSJ Economic Survey: The Hidden State of Money

Correctly interpreting the bond market is more than just how and when to invest your money in UST’s. Not that it isn’t useful in such a money management capacity, but interest rates starting at the risk-free tell us a lot about what is wholly unseen. There is simply no way to directly observe inside an economy what is taking place at all levels and in all transactions. We try to estimate as best we can in the aggregate, but the real economy works...

Read More »

Read More »

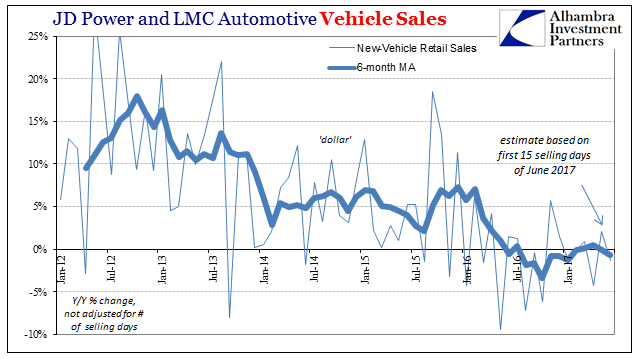

Vehicle Sales, Consumer Price Index and Average Weekly Hours: More Than Minor Auto Potential

According to Edmunds.com, in June 2017 the average length of a new vehicle loan has been stretched to a record 69.3 months. JD Power says that incentives last month were running at more than 10% of MSRP, the eleventh time over the past twelve months where manufacturers have so heavily discounted. And yet, the auto industry would have us believe that the problem is one of fleet sales rather than of consumers.

Read More »

Read More »

US Imports, Exports and Trade Stalls, Too

US imports rose year-over-year for the seventh straight month, but like factory orders and other economic statistics there is a growing sense that the rebound will not go further. The total import of goods was up 9.3% in May 2017 as compared to May 2016, but growth rates have over the past five months remained constrained to around that same level. It continues to be about half the rate we should expect given the preceding contraction.

Read More »

Read More »

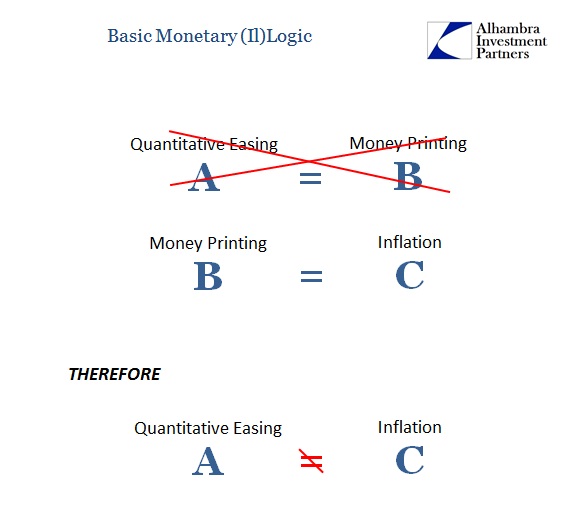

Global Manufacturing PMI’s, Inflation and CPI: Some Global Odd & Ends

When it comes to central bank experimentation, Japan is always at the forefront. If something new is being done, Bank of Japan is where it happens. In May for the first time in human history, that central bank’s balance sheet passed the half quadrillion mark.

Read More »

Read More »

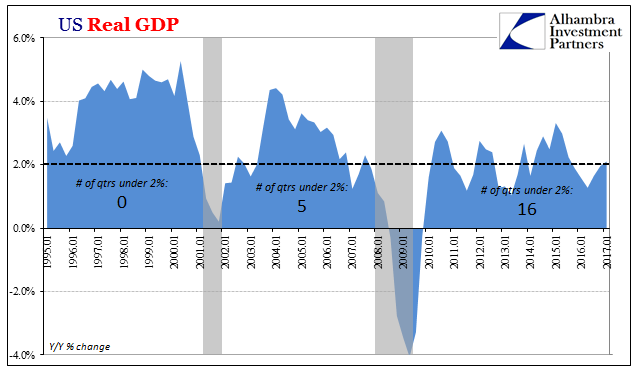

U.S. Gross Domestic Products: Near Record Expansion (Really Reduction)

Real GDP in the US was revised up to 1.41% quarter-over-quarter (annual rate), still the fourth of the last six to be less than 1.5%. While economists and policymakers have taken to judging the economy by its downside, that is only because the extent of the global problem is revealed by complete absences of an upside. The occasional decent quarter doesn’t come close to making up for the more plentiful disappointing ones, let alone to still resolve...

Read More »

Read More »