Tag Archive: federal-reserve

FX Daily, August 3: Stronger EMU PMIs Fail to Recharge the Euro’s Upside Momentum

Overview: The capital markets are decidedly mixed today as investors are pulled between rising infections, heightened tensions between the US and China, lack of progress on new US stimulus, and technical forces as the new month begins.

Read More »

Read More »

FX Daily, July 30: Greenback’s Bounce is Likely Short-Lived

A wave of profit-taking is seen through most of the capital markets today, with the exception of the bond market, where yields continue to trend lower. The US 10-year is now yielding 55 bp, a new low since early March, and the five-year yield set a new record low near 23 bp. European yields are 2-4 bp lower.

Read More »

Read More »

FX Daily, July 27: Dollar Slide Continues, while Gold Soars

The US dollar's dramatic sell-off continues. It is off against nearly all currencies. Among the majors, the Swedish krona and Japanese yen are leading the money, and the euro surged through $1.17. Emerging market currencies are fully participating, with the JP Morgan Emerging Market Currency Index posting its fifth gain in six sessions.

Read More »

Read More »

FX Daily, July 21: Europe and Tech Lift Risk Appetites

Overview: The continued domination of the tech sector and Europe's tentative agreement are lifting equities and risk assets more generally today. Australia and Hong Kong's 2.3%-2.5% rally led Asia Pacific markets. The Dow Jones Stoxx 600 is higher for a third session and above its 200-day moving average for the first time since February.

Read More »

Read More »

FX Daily, July 17: Markets Limp into the Weekend

Chinese stocks stabilized after yesterday's sharp fall and most Asia Pacific equity markets, but Tokyo rose today. European shares are little changed, but the Dow Jones Stoxx 600 is still poised to hold on to modest gains for the third consecutive week.

Read More »

Read More »

FX Daily, July 10: Surge in Coronavirus Spooks Investors as China Takes Profits

Record fatalities in a few US states, coupled with new travel restrictions in Italy and Australia, have given markets a pause ahead of the weekend. News that two state-backed funds in China took profits snapped the eight-day advance in Shanghai at the same time as there is an attempt to rein in the use of margin.

Read More »

Read More »

FX Daily, June 30: When Primary is Secondary

The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday's gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3%...

Read More »

Read More »

FX Daily, June 29: USD is Offered in Quiet Start to the New Week

The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets re-opened from a two-day holiday at the end of last week.

Read More »

Read More »

FX Daily, June 26: Investors Wrestle with Notion that More Covid Cases mean More Stimulus

It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull.

Read More »

Read More »

FX Daily, June 22: Dollar Begins Week on Back Foot

Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe's Dow Jones Stoxx 600 is recovering from an early dip to four-day lows. US shares are trading higher after the S&P 500 closed below 3100 ahead of the weekend after reaching 3155.

Read More »

Read More »

FX Daily, June 16: Correction Scenario Tested

Overview: Shortly after the US stock market opened sharply lower, the Federal Reserve announced that it's Main Street facility was up and running. US stocks never looked back. After the S&P 500 recouped its full decline, the Fed announced it would begin buying corporate bonds. Up until now, it had been buying representative ETFs. Stocks rallied further on the news before pulling back into the close. The rally in risk assets carried into Asia.

Read More »

Read More »

Cool Video: A Quick Review of the the FOMC and a Look to Next Week

Sometimes the news drives the price action, but sometimes the price action drives the news. If the initial rally in US stocks after the FOMC meeting had been sustained and if the dollar had continued to decline, observers would drawing a different conclusion.

Read More »

Read More »

FX Daily, June 11: Are Risk Appetites Satiated, or Simply Taking the Day Off?

Many observers are attributing the sell-off in risk assets today to the Federal Reserve's pessimistic outlook, yet, as we note below, the Fed's median GDP forecast this year is better than many international agency forecasts, including the OECD's that was issued yesterday. Moreover, some near-term trends were already in place.

Read More »

Read More »

FX Daily, June 10: Corrective Forces Still Seem in Control Ahead of the FOMC Outcome

The pullback ins US shares yesterday has not derailed the global advance. Japanese and Chinese markets were mixed, the Hang Seng slipped, and Indonesia was hit with profit-taking, but the MSCI Asia Pacific Index eked out a small gain. It has fallen once past two and a half weeks. The Dow Jones Stoxx 600 opened higher but is falling for the third consecutive session.

Read More »

Read More »

FX Daily, June 9: Profit-Taking Gives Turn Around Tuesday Its Name

Overview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia's 2.4% rally and the 1.6% gain in Hong Kong stood out. Europe's Dow Jones Stoxx 600 was off for a second day (~1.3%), and US stocks are trading heavily, warning that the S&P 500 may give...

Read More »

Read More »

FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today's activity has been minor. The heightened tensions weighed on China and Hong Kong markets, but Japan, South Korea, Taiwan, and Indian equity markets rose.

Read More »

Read More »

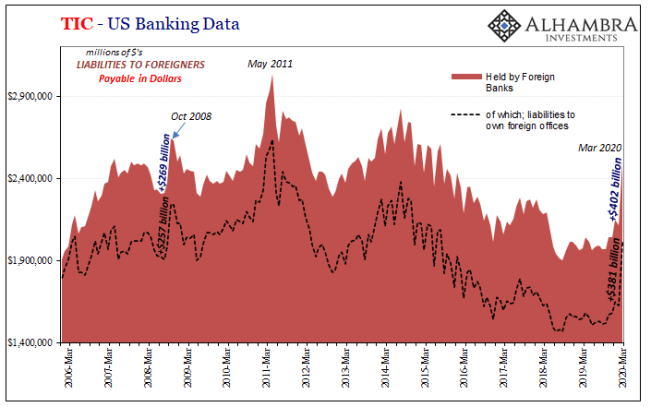

So Much Dollar Bull

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered.In second place (now third)...

Read More »

Read More »

FX Daily, May 22: US-China Escalation Sinks Hong Kong and Hits Risk Appetites

Overview: The US has ratcheted up pressure on China on several fronts and has sapped risk appetites ahead of the weekend. Equity markets are lower across the world. Even in India, where the central bank unexpectedly cut the repo rate 40 bp, shares fell 0.7%. It was Hong Kong's 5.5% that led the region lower. Europe's Dow Jones Stoxx 600 is off around 1% in late morning turnover to pare this week's gain to about 2.5%.

Read More »

Read More »

FX Daily, May 21: Markets Pull Back after Flirting with Breakouts

Overview: New two and a half month highs in the S&P 500 yesterday failed to have much sway in the Asia Pacific region and Europe today as US-China tensions escalate and profit-taking set in. Perhaps it is a bit of "buy the rumor sell the fact" type of activity on the back of upticks in the preliminary PMI reading and hesitancy about pushing for what appeared to be breakouts.

Read More »

Read More »