Tag Archive: Federal Reserve

Central Banks = Welfare for the Wealthy

The fact that central banks provide welfare for the wealthy is now entering the mainstream. The fact that all central bank policies since 2008 have dramatically increased wealth and income inequality is now grudgingly being accepted as reality by mainstream economists and the financial media. The central banks' PR facade of noble omniscience on behalf of the great unwashed masses has cracked wide open.

Read More »

Read More »

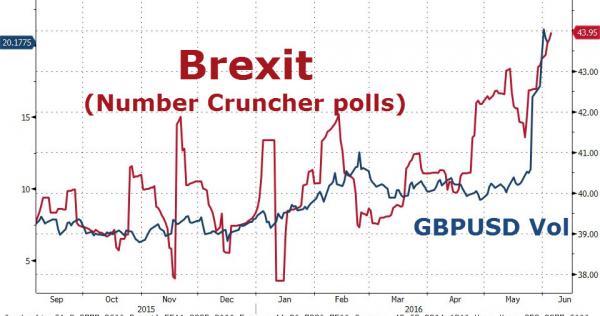

FX Weekly Preview: Yellen Pushes Divergence Front and Center

The summer dynamics of the capital markets has changed by the enhanced prospects of a Fed hike. Equity markets and other risk assets look particularly vulnerable. Sterling may do better against the euro than the dollar.

Read More »

Read More »

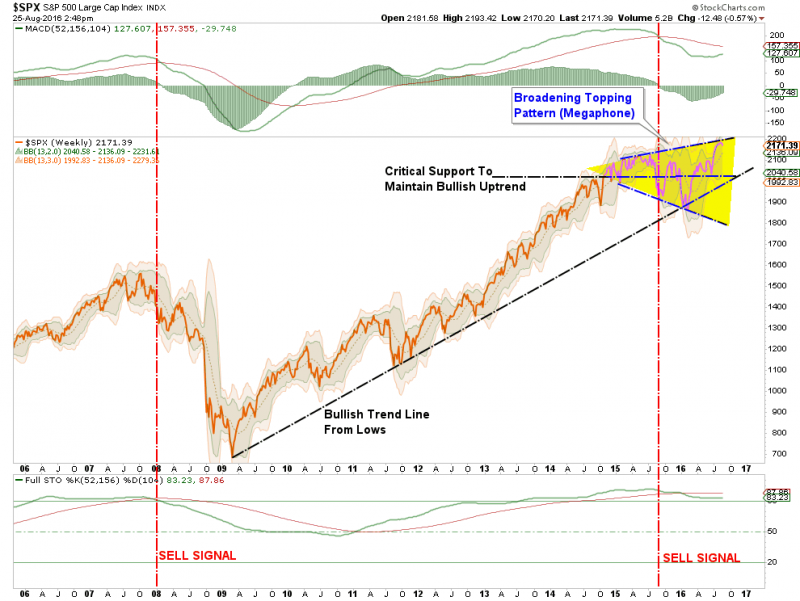

Weekend Reading Negative Rates: The Coin Flip Market

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party.

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »

Effective Fed Funds and Money Markets

Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers.

Read More »

Read More »

The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. Many, maybe most, of young America's citizens were illiterate. "Liberty" may have been the first word they ever learned to read.

Read More »

Read More »

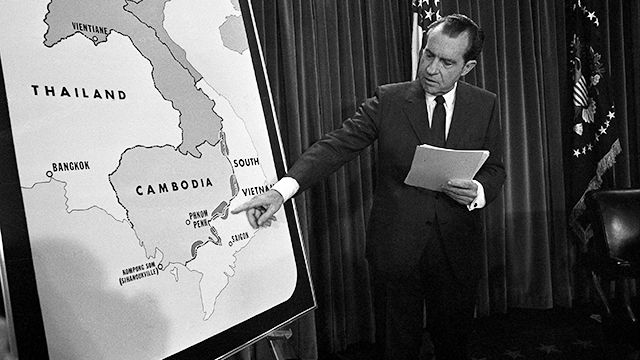

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

The British Referendum And The Long Arm Of The Lawless

Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law.

Read More »

Read More »

Bullard’s New Paradigm and the Federal Reserve

There is much to like in Bullard's new paradigm.

The problem is that it does not reflect the Federal Reserve's view or approach.

Policy emanates from the Fed's leadership, but be confused by the noise.

Read More »

Read More »

US Negative Interest Rate Bets Surge To Record Highs

As the "deflationary supernova" sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the 'cheapness' of Treasury bonds lures the world's yield-hunters dragging ...

Read More »

Read More »

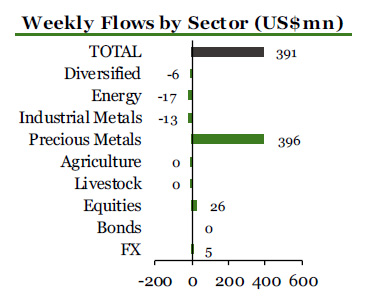

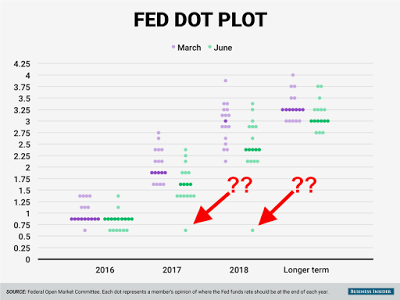

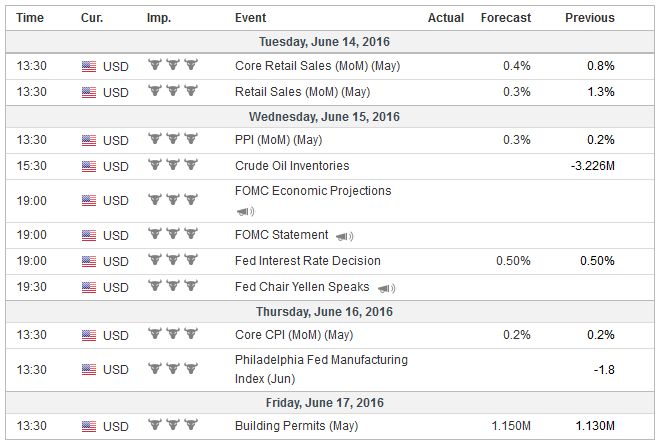

Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely …

Read More »

Read More »

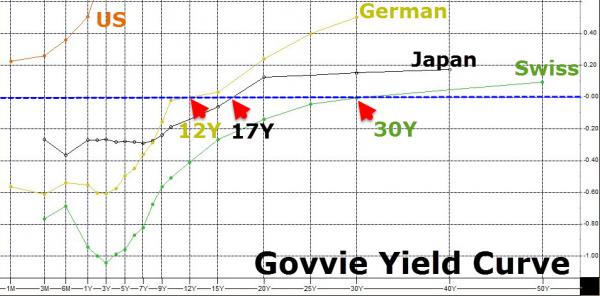

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

Fed Softens Stance Slightly

The immediate reaction was driven by the Fed's dot plots. Although the median continues to expect two hikes this year, six officials now see only one hike. Only one official anticipated one hike this year in the last forecasts made in March. The m...

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »