Tag Archive: Featured

Bodensee Kreis e.V. – Bericht Prof. em. Dr. Hans-Werner Sinn

Der Bodenseekreis - Unser Beitrag für eine gute Zukunft Deutschlands.

Was hat es mit der steigenden Inflation auf sich? Das sagt Prof. em. Dr. Hans-Werner Sinn zu diesem Thema.

Read More »

Read More »

Nach der FED Entscheidung: Jetzt müssen Anleger reagieren!

Nach der FED Entscheidung hat die Börse überraschend stark reagiert. Was genau in den Charts passiert und welche Gründe diese Reaktion des Marktes hat, zeigt dir Jens Rabe in diesem Video.

Read More »

Read More »

Jetzt Aktien kaufen?

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

👉🏽 Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Monetary Assessment Meeting, Introduction

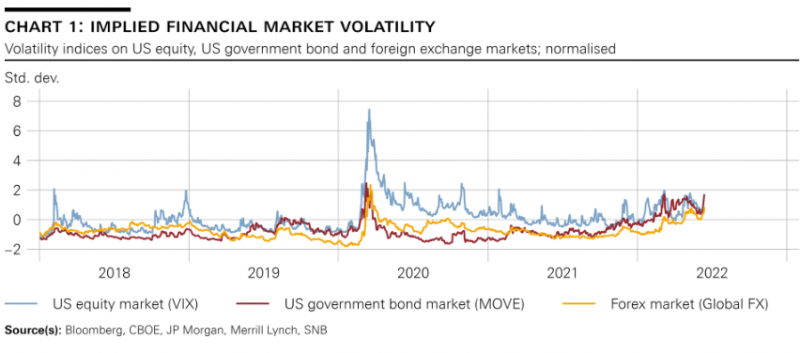

I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan.

Read More »

Read More »

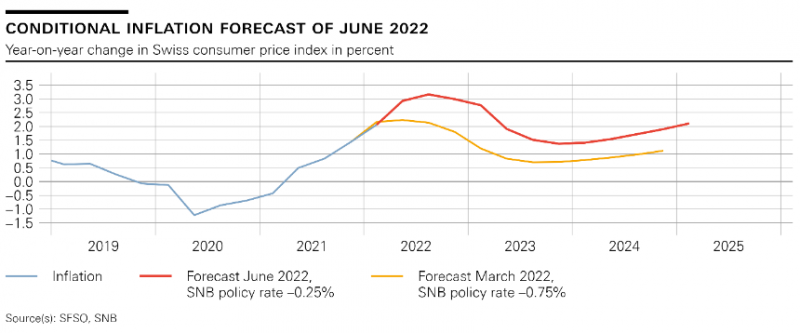

Тhomas Jordan: Introductory remarks, news conference

It is my pleasure to welcome you to the Swiss National Bank’s news conference. In my remarks, I will begin by explaining our monetary policy decision and our assessment of the

economic situation. After that, Fritz Zurbrügg will present the key messages from this year’s Financial Stability Report. Andréa Maechler will then comment on the situation on the

financial markets and the implementation of monetary policy. We will – as ever – be pleased to...

Read More »

Read More »

Fritz Zurbrügg: Introductory remarks, news conference

In my remarks today, I will present the key findings from the new Financial Stability Report, published this morning by the Swiss National Bank.

Read More »

Read More »

FED gibt düstere Prognose für die USA – “DAX Long oder Short?” mit Marcus Klebe – 16.06.22

FED gibt düstere Prognose für die USA - "DAX Long oder Short?" mit Marcus Klebe - 16.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de

#DAX #MarcusKlebe #Trading

ÜBER JFD:...

Read More »

Read More »

Swiss lower economic growth forecasts due to war and inflation

The Swiss Secretariat for Economic Affairs (SECO) has downgraded its economic growth forecast for 2022 to 2.6% due to the war in Ukraine and uncertainties in China.

Read More »

Read More »

Bribe Money for Ukrainian Officials?

In my blog post of May 18, 2022, I raised the possibility that the $40 billion aid package that Congress quickly approved for Ukraine was going to be used, at least in part, to pay multimillion dollar bribes to Ukrainian officials.

Read More »

Read More »

Ukraine war forces Swiss business to make choices on neutrality

Sanctions imposed on Russia have focused debate over the country’s long-cherished economic haven status. In the gleaming new Chipperfield extension of the Zurich Kunsthaus, all polished limestone and gold, is a room dedicated to expiating the moral debits of economic neutrality. The Bührle collection is one of the greatest privately-amassed troves of modern European art, and the pride of the new building.

Read More »

Read More »

Even When There Is Inflation, the Fed STILL Fights Falling Prices

Under any remotely sound money regime the aftermath of war and/or pandemic is highly likely to feature a sharp decline in the prices of goods and services on average. Even under unsound money regimes there are powerful forces operating towards lower prices once the war/pandemic recedes. Strong injections of monetary inflation, however, can overpower them.

Read More »

Read More »

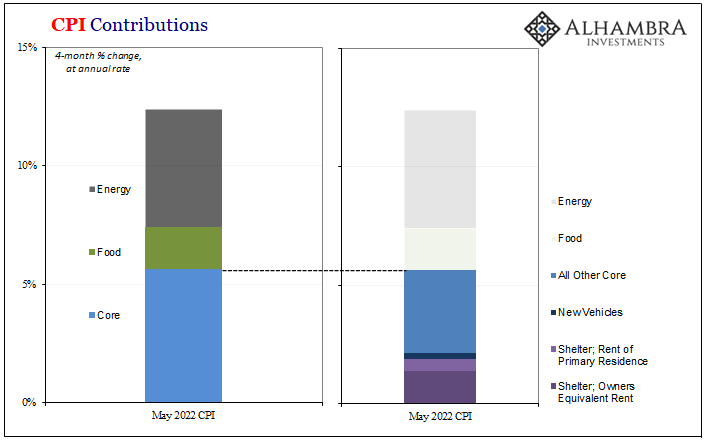

Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay.

Read More »

Read More »

Long oder Short? Nie mehr Geld an der Börse verlieren! | Mario Lüddemann

► KOSTENLOS: 2-tägiges Beginner-Seminar vom 6. und 7. August 2022. Mit dem Gutschein-Code RU100 Deinen Teilnahmeplatz sichern: https://www.digistore24.com/product/321357/?ds24tr=Youtube

► Von 50.000 € auf 1 Million in 10 Jahren

Willst du wissen, wie das auch für dich geht? Dann melde dich hier zum kostenfreien Beratungsgespräch an: https://deinmillionendepot.com/termin-buchen/

- - -

► Für Trader: sicher dir hier kostenfrei mein E-Book, damit du...

Read More »

Read More »

Euro On Brink Of Collapse | Alasdair MacLeod

The Euro and Yen have both collapsed against the U.S. Dollar. A crisis in either one of these currencies could bring down the system. The Euro could collapse by the end of the year, says Alasdair MacLeod, former bank director and current Head of Research at Gold Money. Following a Euro crisis, he sees a shutdown in markets across the board. Even the precious metals markets could close, he says. Preparation is imperative. "You have to prepare...

Read More »

Read More »

Euro On Brink Of Collapse | Alasdair MacLeod

Subscribe for our FREE newsletter - #1 place for gold & silver news & commentary: http://libertyandfinance.com

The Euro and Yen have both collapsed against the U.S. Dollar. A crisis in either one of these currencies could bring down the system. The Euro could collapse by the end of the year, says Alasdair MacLeod, former bank director and current Head of Research at Gold Money. Following a Euro crisis, he sees a shutdown in markets across...

Read More »

Read More »

Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting.

Read More »

Read More »

The World Economy is on the Edge of Crisis – Robert Kiyosaki, @George Gammon

“The bull walks up the stairs and the bear jumps out the window.” Seasoned investors know better. They know that markets always go up and down. They know that when a bull market is hot, it will come crashing down at some point in time—and the higher a market rises, the faster and harder it crashes. Today’s guest explains how financially educated people will survive the next crisis.

George Gammon, the host of The Rebel Capitalist Show, says, “In...

Read More »

Read More »

Why the book Principles, and the concept of Principles, had such a big impact

Why the book Principles, and the concept of Principles, had such a big impact. #principles #raydalio #shorts

Read More »

Read More »

Inflation und Energiewende (Interview Ricarda Lang und Clemens Fuest)

Ich war als Sprecher auf dem Ludwig-Erhard-Gipfel unterwegs, das deutsche WEF in Davos, dem Treffen der Eliten und habe für euch einmal versucht einige der Gäste vor die Kamera zu bekommen! Was dabei Clemens Fuest (Präsident des ifo-Institut München) und Ricarda Lang (Bundesvorsitzende Bündnis 90/Die Grünen) für Ansichten zu Inflation, Energiewende, Ukrainekonflikt, Atomausstieg und vielem mehr haben, erfahrt ihr in dieser besonderen Folge...

Read More »

Read More »