Tag Archive: Featured

The Illusion of Democracy: The “Iron Law of Oligarchy”

“Political globalism” bears the unmistakable signature of an oligarchized democracy. No matter how we vote, a small elite manages to get its way on its central issues.

Read More »

Read More »

Combating Wokeness: An Interview with Paul Gottfried

Richard McDaniel interviews Paul Gottfried, getting his perspective on wokeness and other shenanigans and hijinks that are coming from modern American higher education.

Read More »

Read More »

Es war keine Verschwörungstheorie – es ist WAHR! Beweise liegen vor!

Dieses Gespräch ist ein Gamechanger. Was lange nur vermutet wurde, ist jetzt schwarz auf Weiß bestätigt: Es existiert ein organisiertes Zensur-Netzwerk, das Meinung, Reichweite und öffentliche Debatten beeinflusst. Wir zeigen Belege, Strukturen und Hintergründe – exklusiv, detailliert und ohne Tabus.

Links zum Zensurnetzwerk:

Das Zensurnetzwerk Website: https://liber-net.org/germany/#deutsch

Das Zensurnetzwerk: als PDF:...

Read More »

Read More »

Das sagen Multimillionäre über mich

🔥 Ehrliche Meinung von @walter_temmerer zur Dealmaking Masterclass!

Der Mann hat über 100 Millionen Euro Immobilienportfolio und sagt er, er lernt noch immer von mir. So muss es sein. Egal wie reich du bist, Stillstand ist Tod.

Und das Beste?👉 Du brauchst keine Millionen, um einzusteigen.

In der Dealmaking Masterclass bekommst du mein Know-how, arbeitest Seite an Seite mit High Net Worth Individuals, und egal mit wienviel du gestartet hast, du...

Read More »

Read More »

Tag 140

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

Schweiz – Auswanderungsland für Deutsche? Erfahrungen, Volksabstimmungen, Russland, EU und NATO

Viele Deutsche sehen die #Schweiz als das #Auswanderungsland der Deutschen an. Es ist aber nicht alles eitel Sonnenschein. Dunkle Gewitterwolken ziehen über der Schweiz auf. Noch ignoriert die heimische Bevölkerung die Gefahren. #Sanktionen, militärische Planspiele mit der #NATO und die #Bilateral III mit der EU zeigen kommende Abgründe auf. Ich bin mir nicht sicher, ob die Schweiz an diesen Abgründen vorbei kommt.

-

✘ Werbung:

Mein Buch Politik...

Read More »

Read More »

Would Inheritance Taxes Drive Millionaires Out of Switzerland? | Truth or Tale

Would inheritance taxes trigger a mass exodus of millionaires from Switzerland? 🧐

After Swiss voters rejected a proposal to introduce a 50% tax on inheritances over CHF50 million, some of you started debating whether taxing the wealthy really drives them abroad, with some claiming it’s already happening in places like Norway and the United Kingdom.

Visit Swissinfo to find out what the experts say and check out examples from Norway and the...

Read More »

Read More »

Home Prices and Sales Fall. Can Sellers Count on Lower Interest Rates?

With employment fundamentals so weak, the real way to increase home sales is to cut prices further. That, of course, is not what sellers want to hear.

Read More »

Read More »

American Silver Eagle: The Best Investment In Precious Metals Silver Coins

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

American Silver Eagle: The Best Investment In Precious Metals Silver Coins

Mike Maharrey from Money Metals Exchange puts two generations of the Silver American Eagle on camera: a 1986 American Silver Eagle (the first year the series was minted) and a modern 2025 American Silver Eagle. Even if you’re not a savvy precious metals investor, you’ve probably heard of American...

Read More »

Read More »

Nebenkostenabrechnung muss bis Ende Dezember kommen 🧾

Nebenkostenabrechnung muss bis Ende Dezember kommen 🧾

🎥 Ausschnitt aus dem Video:

NEU im Dezember 2025: Wichtige Fristen, News, To-Dos!

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine...

Read More »

Read More »

Is it possible to disagree agreeably?

The Economist’s editor-in-chief, Zanny Minton Beddoes, explores the power of arguing in schools.

economistfoundation.org/donate

Read More »

Read More »

BASF setzt Frist, Bayer plant Umsatzverdoppelung, Ford zieht die Reißleine

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Inflation as a moral hazard

As I have argued many times in the past, the corruption of money itself and its purposeful devaluation is by far the most important problem facing not just investors and savers, but virtually every single citizen on the face of the planet. Taxation, especially the extremely predatory and aggressive kind that most governments enforce today, might indeed be theft, but inflation is even worse. This is because taxation might be robbery, but at least it...

Read More »

Read More »

Nestlé allowed to continue French Perrier operations

Nestlé Waters will be able to continue operating two boreholes in France for the production of Perrier natural mineral water in France. +Get the most important news from Switzerland in your inbox This follows a favourable opinion from the Prefect of the Gard region, where the Vergèze plant is located. However, restrictions and stricter monitoring …

Read More »

Read More »

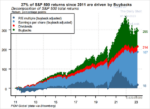

12-18-25 The Fed Turned the Liquidity Back On: Watch These Assets

The Fed is adding liquidity (QE), whatever label they use. The assets most tied to reserves are the ones that will move first: #Bitcoin, major indexes $SPX / $QQQ, transportation, and materials.

In contrast, defensive sectors, $GLD, and $SLV show little to no relationship to changes in reserves.

Please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Nagel on Reason

This week, Dr. Gordon explores some of the thought of Thomas Nagel on reason and how subjectivists who deny objective reason are inviting us not to believe them through their arguments.

Read More »

Read More »

ALEMANIA VIVE AHORA EL FUTURO DE ESPAÑA

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Why We Hate Thomas Hobbes

Ryan and Josh Mawhorter talk about how Thomas Hobbes, even nearly 400 years later, remains a popular spokesman for almost limitless state power. In fact, by Hobbes's logic, the world should by ruled by a single global dictatorship.

Read More »

Read More »

Truth or tale: Would inheritance taxes trigger a mass exodus of millionaires from Switzerland?

After Swiss voters rejected a proposal to introduce a 50% tax on inheritances over CHF50 million, Swissinfo readers began debating whether taxing the wealthy drives them abroad, with some even claiming this is already happening in countries such as Norway and the UK. We took a closer look. The “For a social climate policy” initiative, …

Read More »

Read More »

BLue Owl Roils The AI Narrative

Blue Owl Capital spooked AI investors on Wednesday when the Financial Times reported that the firm, one of Oracle's larger financing partners for major U.S. data centers, decided not to provide equity backing for a $10 billion data center Oracle is building in Michigan. This planned facility is part of Oracle's collaboration with OpenAI under …

Read More »

Read More »