Tag Archive: Featured

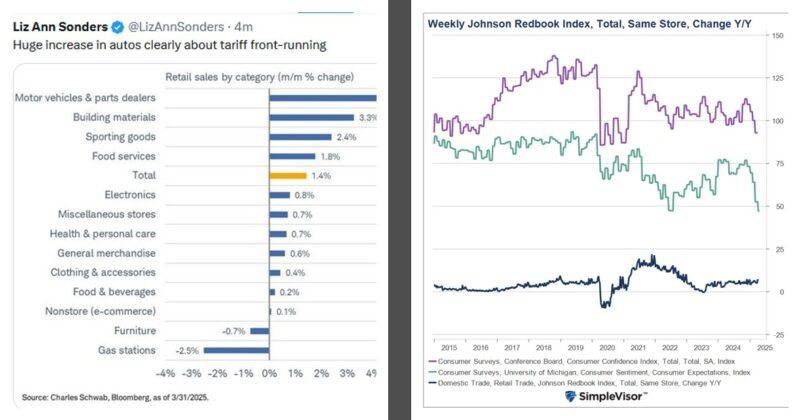

Frontrunning Tariffs Boosts Economic Activity

Recent consumer sentiment readings have been horrendous. For instance, the University of Michigan's latest consumer expectations and the Conference Board’s consumer confidence index are at or near their lowest levels in ten years. However, despite poor sentiment and concerning outlooks, recent consumer spending reports show increased spending. We, and many economists, believe this is a …

Read More »

Read More »

The Ultimate Guide to Social Security: When and How to Claim for Maximum Benefits

Social Security plays a crucial role in retirement income planning. Making informed decisions about when and how to claim benefits can maximize your Social Security benefits and significantly impact your long-term financial security. Claiming Social Security wisely requires a deep understanding of how benefits are calculated, the impact of different claiming ages, and the strategies …

Read More »

Read More »

Bärbel Bas völlig außer Kontrolle bei Lanz!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

EURJPY Breakout Incoming? Forex Trading Setup to Watch This Week | Market Outlook | 15.04.2025

Is the EURJPY pair gearing up for a breakout? This week’s Exness Market Outlook takes a closer look at the euro-yen dynamics and what could be setting the stage for a potential move. With shifting bond yields in Japan and some big economic releases on the calendar from both Japan and the Eurozone, this pair is worth watching. Will the euro gain enough momentum, or is the yen about to make a comeback? Find out what’s fueling the sentiment and how...

Read More »

Read More »

Gold Technical Analysis – The only game in town during stagflationary times

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:04 Technical Analysis with Optimal Entries.

2:06 Upcoming Catalysts...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #439

Kostenfreier Live-Workshop: Politische Turbulenzen ausnutzen und Profite an der Börse erzielen (02.+ 03. Mai 2025): 👉 https://www.oliverklemm.com/tradingworkshop/ Jetzt anmelden! Plätze begrenzt...

Klicke hier, um Dich direkt gemeinsam mit Oli durchs Trading unabhängig zu machen 👉 https://oliverklemmtrading.com/apply-now-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=2

►Folge...

Read More »

Read More »

Trumps Zölle: Was macht eigentlich der Bitcoin?

Wie haben sich eigentlich Trumps Entscheidungen zu Strafzöllen auf den Bitcoin-Kurs ausgewirkt? Wir haben es Dir hier in einer Timeline dargestellt.

#Finanztip

Read More »

Read More »

This Nails It: The Doom Loop of Housing Construction Quality

Add in the doom loop of an unprecedented credit-asset bubble and housing as a sector is in trouble.

Read More »

Read More »

To Understand the Present, You Must Understand The Past

The world order is now changing in a way that I described in my book and video Principles for Dealing with the Changing World Order. For a complete picture I encourage you to read the book or you can watch the animated video here:

#raydalio #principles #politics #economics

Read More »

Read More »

Deutscher General gibt Schock-Warnung an Merz!

Bildquelle: By Fraktion DIE LINKE. im Bundestag - 180613 Nein zur Nato, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=115729056

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien...

Read More »

Read More »

4-16-25 Percentages Are Really Bad to Use for Anything

People love throwing around percentages—“down 50%,” “up 200%”—but I’ve learned the hard way they can seriously mislead you. In this short, I break down why percentages often hide the full picture and how I look at real numbers instead when making smart financial decisions.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube...

Read More »

Read More »

¿GUERRA COMERCIAL O GUERRA MONETARIA? LO QUE NADIE TE CUENTA…

Atentos: lo que vivimos va más allá de aranceles. Claves como la liquidez y el precio del dinero explican más que los titulares.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y...

Read More »

Read More »

US-Aktien verkaufen? Das sieht nicht gut aus!

► Sichere Dir jetzt meinen Report „Gold-Rallye: Diese Aktien profitieren am stärksten“ – jetzt anmelden & Mittwoch lesen → https://www.lars-erichsen.de/

► Mein exklusives „Lars Erichsen“-Depot → https://www.rendite-spezialisten.de/video/depot/

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

Wisst Ihr gerade weil die Stimmung derzeit, zumindest ist das mein Eindruck, nicht so besonders gut ist,...

Read More »

Read More »

DAS erwartet uns als Nächstes – Ernst Wolff im Gespräch mit Krissy Rieger

Ein weiteres Gespräch mit @krissyrieger

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

📅 Alle Termine und die Links zu meiner Vortragsreihe finden Sie hier:

👉 https://ernstwolff.com/#termine

Auf dem offiziellen YouTube-Kanal vom...

Read More »

Read More »

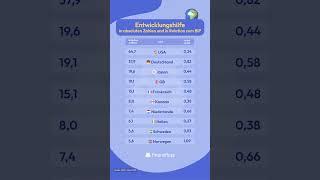

Entwicklungshilfe im Vergleich #top10

Entwicklungshilfe im Vergleich 🌍 #top10

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

Was kostet ‘ne Scheidung? | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_A9aCV-D74JE

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_A9aCV-D74JE

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_A9aCV-D74JE

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_A9aCV-D74JE

Justtrade* ►...

Read More »

Read More »

Gold: The Last Safe Haven Standing in This Bubble Economy

Last week was a wild roller coaster ride on Wall Street. When the dust settled and the cars came to a stop on Friday, gold was the last safe haven standing.

In this week's Money Metals' Midweek Memo podcast, host Mike Maharrey examines gold's performance and contrasts it with other havens, including the Treasuries and the U.S. dollar.

He also puts recent market and economic volatility driven by the trade war into a broader context—the...

Read More »

Read More »

Digitale Kontrolle statt Freiheit? Was uns mit dem E-Euro droht

Unsichere Zeiten erfordern klare Strategien. Sicher dir jetzt deinen kostenlosen Vermögenscheck: 👉 https://max-otte-fonds.de/vermoegenscheck/

In diesem spannenden Interview spricht Finanzanalyst Stephan Richter über die bemerkenswerte Entwicklung des Bitcoin, der trotz globaler Marktturbulenzen seine Stabilität beweist. Erfahren Sie mehr über das "Erwachsenwerden" der Kryptowährung, die kontroverse Einführung des digitalen Euro und die...

Read More »

Read More »