Tag Archive: Featured

Intel, MAHA, and Trump’s Similarities with Richard Nixon

Assistant editor Joshua Mawhorter joins Tho Bishop and Connor O’Keeffe on the Power and Market Podcast. The three discuss Trump’s acquisition of a stake in Intel, consider how monetary policy contributes to a lot of the national health problems MAHA is focused on, and react to Jerome Powell’s Jackson Hole speech.

Read More »

Read More »

Sparen bis der arzt kommt! ️ #sparen

Sparen bis der arzt kommt! 👨⚕️ #sparen

9 Anzeichen, dass du ZU VIEL sparst!:

?feature=shared

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

Investing in times of policy volatility

At the end of last month, a shock announcement came from the US Customs and Border Protection (CBP), declaring that one-kilogram and 100-ounce gold bars imported from Switzerland would be subject to a hefty 39% tariff, under the country’s “reciprocal tariffs” policy, which had already applied broadly to Swiss goods. This CBP decision came in response to a Swiss refiner’s request for clarity and guidance on whether gold would be part of the wider US...

Read More »

Read More »

Das höchstbewertete Unternehmen der Welt überrascht und verwirrt

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

8/29/25 Why Do Investors Hate to Sell?

Why do investors struggle when it comes to selling stocks?

Richard Rosso & Matt Doyle look at the psychology of investing—exploring concepts like loss aversion, behavioral finance traps, and the emotional biases that make it so hard to hit the sell button. Whether you’re a DIY investor or managing money professionally, understanding why we hold on too long is critical to protecting and growing your wealth.

* Why fear and regret drive poor...

Read More »

Read More »

The Seccedent Rests

In this week’s Friday Philosophy, Dr. David Gordon reviews The Woke Revolution: Up From Slavery and Back Again by H.V. Traywick, Jr., and finds Traywick’s observations have much credibility.

Read More »

Read More »

¿QUIÉN SE BENEFICIA REALMENTE DEL DISCURSO WOKE?

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

The Money Supply Flatlines as Employment Cools and Delinquencies Rise

As the Federal Reserve has delayed lowering the federal funds rate, the money supply has stabilized in recent months. This trend also reflects rising delinquencies, falling home sales, and stagnating employment.

Read More »

Read More »

Alarm in NRW: Nächster AfD Kandidat von Wahl ausgeschlossen!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Chop Fest in FX Continues

Overview: Ahead of the long holiday weekend in North America, the US dollar is trading with a slightly firmer bias in narrow trading ranges. The drama around the Fed has intensified with FHFA Director Pulte sending a new criminal referral against Governor Cook regarding a third mortgage, while Governor Waller reiterated his dissent from last …

Read More »

Read More »

Why do people hate vocal fry?

What do Kim Kardashian and James Bond have in common? Lane Greene, our language correspondent, explores the controversy behind their creaky vocal quality

Read More »

Read More »

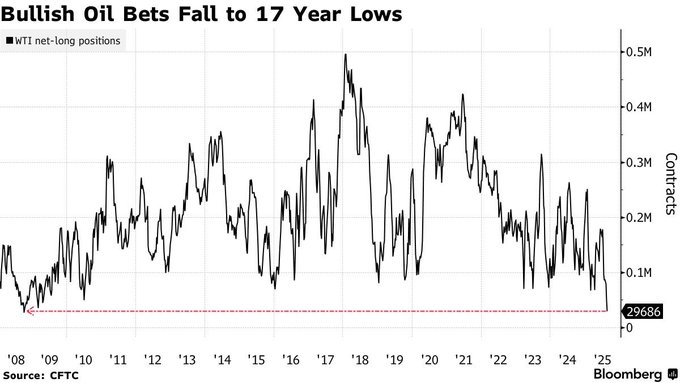

Energy Price As An Economic Indicator

What are energy prices telling us about the economy? A recent article on Bloomberg noted that: "Hedge funds slashed their bullish position on crude to the lowest in about 17 years as risks of additional sanctions on Russian crude oil waned, bringing concerns about a global supply glut back to the fore. Money managers’ net-long position on …

Read More »

Read More »

The Nvidia Earnings Train Keeps On Rolling

Once again, Nvidia continues to see its earnings and revenues grow at astonishing rates. Consider the following: As we noted, data center revenue is driving Nvidia's fantastic earnings and revenue growth. Helping maintain this growth is its Blackwell GPU architecture. In the last quarter, the new Blackwell products saw a 17% jump in revenue. As …

Read More »

Read More »

San Francisco’s Black Market for Housing

San Francisco politicians have made it so difficult to build new housing that a black market for apartments has emerged.

Read More »

Read More »

Swiss-Canadian Wrestler Keeps Schwingen Alive in Quebec 🤼🇨🇭🇨🇦

🇨🇭 Meet Thomas Badat, a Swiss-Canadian wrestler who’s travelled from Quebec to compete at the Swiss Wrestling and Alpine Festival—the biggest event in traditional Swiss sport, Schwingen. 🤼♂️

Thomas started Schwingen at just five years old, but in Canada, the sport is barely known and hard to practise. With only one club serving a vast region, keeping the tradition alive isn’t easy.

So what’s it like being a Swiss Abroad Schwinger? Thomas shares...

Read More »

Read More »

Wo ist die Work-Life Balance am besten? #worklifebalance

Wo ist die Work-Life Balance am besten? 😌 #worklifebalance

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Neue Nationalhymne: Ramelow verliert die letzte Selbstbeherrschung!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Bald das “freieste Land der Welt”? Prof. Dr. Bagus über Argentinien und Milei

Argentiniens neuer Kurs bietet Chancen & Risiken für Anleger | Interview Prof. Dr. Bagus über Milei

Homepage Prof. Dr. Philipp Bagus: https://philippbagus.de/de

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext-yt

Blaupause für Deutschland? Der argentinische Präsident räumt das „Rattennest“ auf

🇦🇷 Argentinien erlebt eine Revolution:

Präsident Javier Milei bricht mit Korruption und Selbstbedienungspolitik – in einem...

Read More »

Read More »