Tag Archive: Featured

Becks Kritik an Crashpropheten & Weltuntergangs-Jüngern // Andreas Beck im LoKr Room Talk spezial

Warum ist die Welt eigentlich noch nicht untergegangen, Herr Beck? In einer Spezial-Ausgabe des “LoKr Room Talks” sprechen wir mit dem Mathematiker und Portfolio-Experten über sein neues Projekt. Der Portfolio-Experte beschäftigt sich nämlich ausnahmsweise nicht mit Börse, sondern mit Logik und Wissenschaft. Dabei stellt Beck fest, dass der Priester mittlerweile vom Wissenschaftler abgelöst wurde. Denn die Angst vor dem Weltuntergang ist praktisch...

Read More »

Read More »

Notes from the Digital Gulag

As the author of Google Archipelago: The Digital Gulag and the Simulation of Freedom, I guess I should not be surprised to find myself squarely in the digital gulag—banished, perhaps permanently, from Twitter and Facebook. Twitter permanently suspended my account several weeks ago, mere days before Elon Musk took over the helm. Although I cannot be sure, I may have been banned because I suggested that the transgender movement is part of a...

Read More »

Read More »

Max Otte: Das Weltsystem wird crashen!

Max Otte: Das Weltsystem wird crashen!

Ich spreche mit Prof. Max Otte über Möglichkeiten, die Inflation zu schlagen, wie das System crashen wird, welche Aktien die richtigen in der jetzigen Situation sind, wie man sein Geld wirklich sicher anlegt und ob ein Lastenausgleich kommt!

-----------------------------------

? Schaue dir mein kostenloses Webinar an, verstehe das Finanzsystem und schütze dein Vermögen!

https://tobiaskaib.com/webinar

? Mein...

Read More »

Read More »

Elon Musk – Twitter – Tesla – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Du kannst ALLES SCHAFFEN!

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Titel

TEXT

# # #Finanzrudel

? TEXT ►► LINK

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die...

Read More »

Read More »

Wie kann ich ein Investment beurteilen? 5-Punkte-Checkliste

Diese 5 simplen Punkte sparen dir viel Lehrgeld bei Investments

Link zum 32-Punkte-Video: https://www.thorstenwittmann.de/yt-32-punkte-checkliste

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Diese 5 Checklistenpunkte kommen dich teuer – aber nur, wenn du sie nicht kennst!

Geldanlage ist kein einfacher Spielplatz. Wenn du nicht weißt, was du tust, verlierst du schnell viel Geld.

Dafür haben wir die „32-Punkte-Checkliste...

Read More »

Read More »

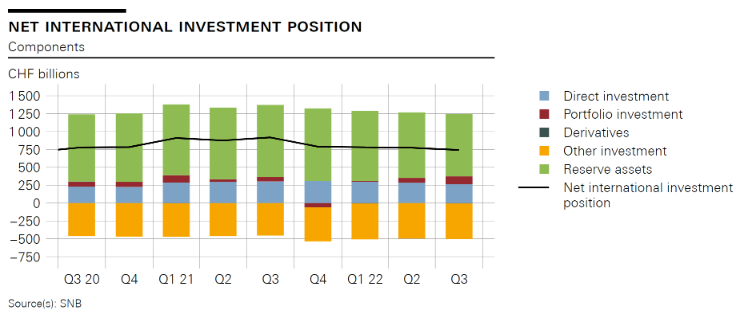

Swiss balance of payments and international investment position: Q3 2022

In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high.

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #25

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #24

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

So starten Sie ins neue Jahr | Weisheiten von Phillipp Green

Ein neues Jahr bietet viele Möglichkeiten sich richtig auszurichten.

One-line-a-day *https://amzn.to/3YLqFTF

_

3.? *https://amzn.to/3V6SbsO - jetzt vorbestellen!

2.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

1.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch *https://amzn.to/3nAM7IU

_

00:00 - Meine Tipps

06:20 - Thema - Phillipp Green

08:12 - Lieben...

Read More »

Read More »

Year End Message to Our Readers – Offline From 23rd December to 2nd January

Fintech News Switzerland would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year.

We will be taking a break from the 23rd December 2022 to the 2nd January 2023.

Until then, you can access some of our year-end articles that may be of interest to you. We look forward to seeing you all again on the 3rd January 2023!

Crypto Winter Wipes Out 72,000 Bitcoin Millionaires in 2022

BIS: New Global Bank...

Read More »

Read More »

Grover Cleveland Presented the Best Example of a True Liberal Populist

Six years after the election of Donald Trump, the Republican Party is still adrift. On the one hand, the GOP has embraced an antiestablishment and populist message. On the other hand, Republicans have not quite figured out how to balance populism with classically liberal values like constitutionalism and free markets. Indeed, populism and classical liberalism seem to be in direct conflict.

Read More »

Read More »

WIRD MEIN KANAL GESPERRT?

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Wie wird das Jahr 2023 für uns INVESTOREN sein? | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

Sind laut Andreas Beck die Märkte im Stress? #shorts

Andreas Beck erklärt, ob die Finanzmärkte aktuell unter Stress sind. #shorts #aktien #andreasbeck

Read More »

Read More »