Tag Archive: Featured

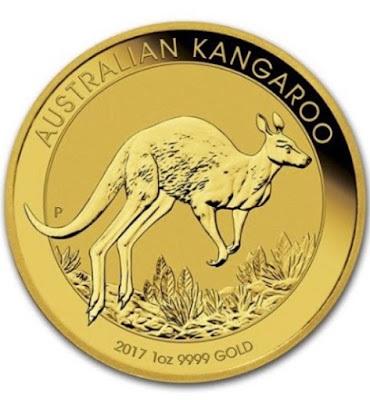

Why Gareth Soloway is “unbelievably bullish” on gold and silver

What’s going on with the gold price? Is the silver price set for a further pullback?

Technical analysis expert #GarethSoloway of InTheMoneyStocks joins Dave Russell of GoldCore TV for a monthly look at the gold and silver charts.

Volatility has returned to the precious metals markets with bot #gold and #silver having halted their bull run in the face of a stronger dollar and a return to the “risk-on” trade in stocks. But what does this mean for...

Read More »

Read More »

Klimapolitik, Tech-Korrektur, Inflation: Auf diese Aktien setzt Prof. Dr. Max Otte

Im Gesräch mit der freien Journalistin Krissy Rieger diskutierte Prof. Dr. Max #Otte aktuelle Investmenttrends:

Trotz der olitischen Zielsetzung einer „klimaneutralen“ Wirtschaft bleiben Ölkonzerne langfristig attraktiv. Bei Big Tech hat sich die Sreu vom Weizen getrennt; Unternehmen wie #Alhabet, #Ale und #Microsoft werden sich wieder erholen. Und schließlich sollten Anleger jetzt auf Unternehmen setzen, die genügend Preismacht haben, um höhere...

Read More »

Read More »

DEUTSCHLAND SCHAFFT SICH AB

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

Siemens Energy Hauptversammlung 2023 – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Unser Kanzler der alles verkackt hat… (Dunkle Aussicht für unser Land!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

00:00 Warum machen unsere Politiker DE kaputt?

09:09 Warum Deutschland in keinem Bereich mehr Weltmarktführer ist

14:53 Politische Inkompetenz

22:56 KI

24:58 Wie Deutschland von der Konkurrenz abgehängt wird

29:22 Schlusswort

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver...

Read More »

Read More »

PFIZER bestätigt: Gerüchte sind wahr! Weitere Enthüllung!

Pfizer hat in einem internen Dokument die Mitarbeit von Jordan Walker im eigenen Unternehmen bestätigt. Was das bedeutet und welche weiteren Enthüllungen gerade die Runde machen erfährst du im heutigen Video

? 20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

? bis zu 100 Euro bei Depoteröffnung ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser...

Read More »

Read More »

Chat GPT: Alle Finanzcoaches werden arbeitslos!

Mit ChatGPT wurde der breiten Masse eine Künstliche Intelligenz zur Verfügung gestellt, welche bereits jetzt Menschen bei ihrer Arbeit unterstützen, oder sogar ersetzen kann. Ob das im Finanzsektor auch der Fall ist, zeige ich dir im heutigen Video.

Sicher dir jetzt dein Ticket für den Börsen-Strategie-Tag:

https://jensrabe.de/boersenstrategietag2023

0:00 Katastrophe Türkei/Syrien

2:54 ChatGPT

4:47 Sinnvoll für die Börse?

8:36...

Read More »

Read More »

EU plant ENTEIGNUNG – Hausbesitzer aufgepasst!

Die EU plant mit neuen Gesetzentwürfen faktisch die Enteignung der Hausbesitzer. Was genau geplant ist, wie du dich vorbereiten kannst und worauf du jetzt schon achten solltest, das erfährst du im ganzen Video:

_8

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:...

Read More »

Read More »

Dr. Andreas Beck erklärt die Size-Prämie – #shorts #aktien #portfolio

Dr. Andreas Beck im Interview mit Nicolas Kocher über die Evolution von Wissenschaft und die daraus folgenden Chancen und Risiken für Anleger:

Read More »

Read More »

Feds Powell will speak today. The USD is higher vs the EUR and GBP ahead of Chair comments

In this video, we'll be discussing the latest updates on USDJPY, EURUSD, and GBPUSD.

The USD has been on a 4-day winning streak, but the JPY is lower as technical resistance was reached. The EURUSD is falling below a key support level and the GBPUSD is close to its 200-day moving average. Join us as we analyze the markets and see what traders should watch for in the coming days.

Read More »

Read More »

“Fundamentals and technical analysis are two sides of the same coin”

Interview with Laurent Halmos

For most die-hard physical gold investors and students of history like myself and most of my readers and clients, technical analysis is often seen as a bit of a taboo, or at best something irrelevant to our worldview and investment approach. Nevertheless, to paraphrase the old saying about politics, just because you are not interested in the charts doesn’t mean that the charts are not interested in you.

I met...

Read More »

Read More »

So Far No Signs of Pending Crash

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(2/6/23) President Joe Biden delivers his second State of the Union Address: Will he touch on Inflation (and whose responsibility is that)? Will Fed Chairman Jerome Powell correct misperceptions about his comments on Monetary Conditions? What are possible market outcomes? So far, no signs of imminent crash. Market Technicals will give...

Read More »

Read More »

No Turn Around, but Consolidation Featured

Overview: After large moves yesterday, the capital

markets ae quieter today. Stocks are mostly firmer, and the 10-year US yield is

a little softer near 3.62%. Strong nominal wage increases in Japan and a

hawkish hike by the Reserve Bank of Australia helped their respectively

currencies recover, though remain within yesterday's ranges. The euro briefly

traded below $1.07, and sterling has been sold through $1.20. That said, a

consolidative tone is...

Read More »

Read More »

Dr. Andreas Beck: Darum schätzt du den Bitcoin völlig falsch ein!

✘ Bestes Aktien Analyse-Tool► https://bit.ly/3wWKAT5 ?

✘ Günstigstes Aktien-Depot: https://bit.ly/3HtE5KP ?

✘ Seriös Krypto kaufen: https://bit.ly/3HxBlwR wir beide erhalten 9€ Bonus?

Andreas Beck spricht in mehreren Interviews über den Bitcoin. Seiner Ansicht nach hat der Bitcoin keinen Wert und er vergleicht den Bitcoin sogar mit einem Schneeballsystem. Da ich selbst im Bitcoin investiert bin, gehen wir auf die Argumente von Dr. Andreas Beck...

Read More »

Read More »

The Swiss view of free movement within the EU

Livia Leu, Switzerland's chief negotiator with the European Union, has been talking about the challenges ahead in 2023, especially when it comes to the free movement of people. For about 20 years, Switzerland has regulated its relations with the EU in bilateral agreements, an alternative to EU membership that it would like to maintain. But the rules governing EU market access have now changed so the bilaterals need updating. The EU and Switzerland...

Read More »

Read More »

How popular votes made Switzerland a global democracy leader

With its second federal constitution of 1874, Switzerland was suddenly catapulted to the forefront of democracy development worldwide. No canton had voted so strongly in favour of radical change as Schaffhausen.

Adopting the new federal constitution marked a milestone in Swiss history. It brought about several important improvements, making up for just about everything the original constitution lacked.

Many of these improvements would not have...

Read More »

Read More »

The most critical questions about the Swiss central bank’s huge losses

The Swiss National Bank (SNB) booked a CHF132 billion ($143 billion) loss in 2022 and suspended profit-sharing transfers to the Confederation and cantons. What does that mean exactly? And how does the SNB fare in international comparison?

Fabio Canetg

More from this author

Last year, the SNB lost more money than ever before. And it is not alone: central banks around the world also recorded heavy losses. As a...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #51

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments

Every so often, I check my investment portfolio to see how it is doing. (I stay out of stocks these days, but that is due to my personal situation and is not to be taken as investment advice.) Portfolios are collections of various financial instruments that one is holding, and one always hopes that their value will head in the right direction over time.

Read More »

Read More »