Tag Archive: Featured

Achtung DAX mit neuem Trend | der Blick auf die Woche KW 48

Achtung DAX mit neuem Trend | der Blick auf die Woche KW 48

Achtung der DAX hat wieder einen neuen Trend, weiteres erfährst du in meinem dies wöchigen Blick auf die Woche.

Trage dich jetzt in unseren Newsletter ein, um den "Blick auf die Woche" am Montag noch vor allen anderen zu erhalten: https://mariolueddemann.com/aktuelles/#newsletter

Basiskurs Trading: https://mariolueddemann.com/basiskurs-trading/

Screeningdienst für nur 1€ testen:...

Read More »

Read More »

FX Daily, November 23: Markets Look Past Near-Term Challenges

Overview: News that the AstraZeneca vaccine was 70% effective but could be enhanced by changing dosage is lifting spirits and boosting equities. Japan's markets were closed for a national holiday, but all the equity markets in the region advanced and many by more than 1%.

Read More »

Read More »

Revelation Of The Method

There is one question very few are asking. Even on the most obscure blogs or conspiracy forums, we don’t find serious discussion of it.

Read More »

Read More »

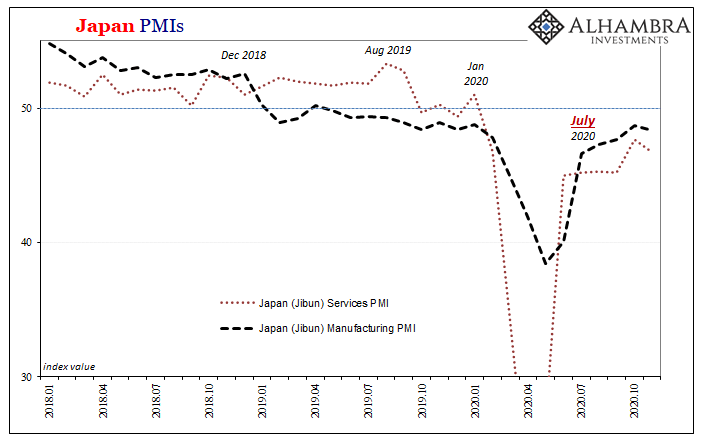

Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic.

Read More »

Read More »

The Impossibility of “Taxation with Representation”

Whether you have watched The Sopranos, Goodfellas, or The Godfather, the gist of those stories is always the same: a mafia boss gets involved with a private person or sometimes a businessowner and demands a fee to be paid by midnight tomorrow, otherwise said person will lose a finger or two and maybe a kneecap as well.

Read More »

Read More »

China’s New Five-Year Plan Exposes the Wishful Thinking behind Socialist Regimes

On October 29, the nineteenth Central Committee of the Chinese Communist Party concluded its fifth plenum, a four-day meeting devoted primarily to laying the groundwork for China’s fourteenth five-year plan, which covers the period from 2021 to 2025.

Read More »

Read More »

EM Preview for the Week Ahead

Most EM currencies were up last week, once again taking advantage of broad dollar weakness. In addition, EM equities also performed well, with MSCI EM up for the third week in a row and for seven of the past eight. We expect EM assets to continue benefiting from the global liquidity story as well as the weak dollar trend.

Read More »

Read More »

Covid: only the vaccinated get to travel abroad, suggests Swiss infectious disease expert

Resistance to vaccinations is significant in Switzerland. A survey done in November 2020 suggests only 16% of the population would get vaccinated immediately if there was an approved Covid-19 vaccine, reported 20 Minutes.

Read More »

Read More »

Swiss government promises one billion francs for Covid hit businesses

This week, Switzerland’s federal government decided to increase aid money to Covid hit businesses to CHF 1 billion.

Read More »

Read More »

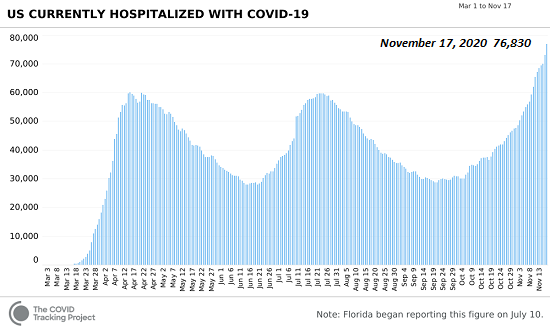

Vaccines–Too Little, Too Late?

Trust in institutions, authorities and Big Pharma is scraping the bottom of the barrel, and rushing these vaccines into mass use with extremely high expectations of efficacy is setting up the potential for a devastating loss of trust in the vaccines should they fail to live up to the claims of 100% safety and 95% effectiveness.

Read More »

Read More »

The United Nations and the Origins of “The Great Reset”

About twenty-four hundred years ago, the Greek philosopher Plato came up with the idea constructing the state and society according to an elaborate plan. Plato wanted “wise men” (philosophers) at the helm of the government, but he made it also clear that his kind of state would need a transformation of the humans.

Read More »

Read More »

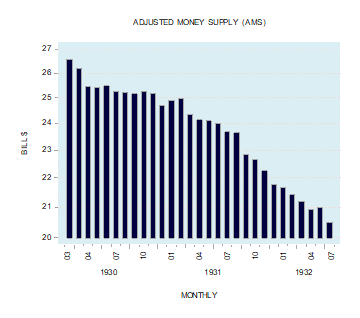

A Drop in the Money Supply Was Not the Cause of the Great Depression

In his writings, Milton Friedman blamed central bank policies for causing the Great Depression. According to Friedman, the Federal Reserve failed to pump enough reserves into the banking system to prevent a collapse in the money stock.1 The adjusted money supply (AMS), which stood at $26.6 billion in March 1930, had fallen to $20.5 billion by April 1933—a decline of 22.9 percent.

Read More »

Read More »

Coronavirus biggest concern among Swiss, according to survey

The coronavirus pandemic and its consequences rank at the top of the list of Swiss concerns in 2020, according to a recent survey.

Read More »

Read More »

What is “The Great Reset” and How to Prepare

“The Great Reset” is a term that we are hearing more frequently in the financial news today, but what exactly is “The Great Reset”?

In Episode 16 of The Goldnomics Podcast, Stephen Flood, Mark O’Byrne and Dave Russell discuss “The Great Reset” and how it could impact investors, what they can do now to prepare themselves and their finances and the role that gold plays in protecting your wealth.

Listen or watch the podcast here...

Read More »

Read More »

The US Savings Bond Scam

Remember savings bonds? They were popular before the central bank made sure that safe, low-interest investments became a thing of the past.

Original Article: "The US Savings Bond Scam".

This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros.

Read More »

Read More »

Dollar Bounce Likely to Fade

The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade. Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely.

Read More »

Read More »

FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks reeling.

Read More »

Read More »

Strategische Ziele 2021 bis 2024

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht ihre strategischen Ziele für die Periode von 2021 bis 2024. Diese wurden heute vom Bundesrat genehmigt. Die insgesamt zehn Ziele zeigen auf, wie die FINMA ihr gesetzliches Mandat erfüllen will und welche Schwerpunkte sie dabei setzt. Die Ziele betreffen verschiedene Bereiche des Kunden- und Systemschutzes, aber auch betriebliche Themen.

Read More »

Read More »

Nuclear plant worker’s cancer judged not to be a work-related illness

The Federal Court has dismissed the appeal of a former employee of two Swiss nuclear power plants who was diagnosed with bladder and prostate cancer. The man took legal action after the national accident insurance fund refused benefits for an occupational illness.

Read More »

Read More »

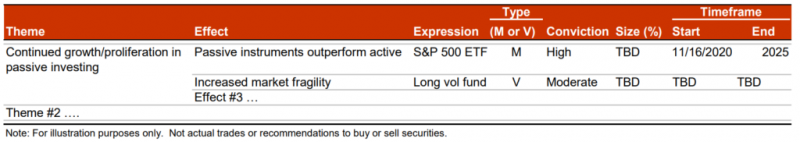

Seth Levine: How I Process Ideas Into Investments

Investing is incredibly hard. Mapping observations to security price movements are complex. Often, the relationships governing these moves are unknown. Yet, this is the investor’s task. I’ve used this blog as a tool for exploring some of these connections. It’s been incredibly rewarding.

Read More »

Read More »