Tag Archive: Fail

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »

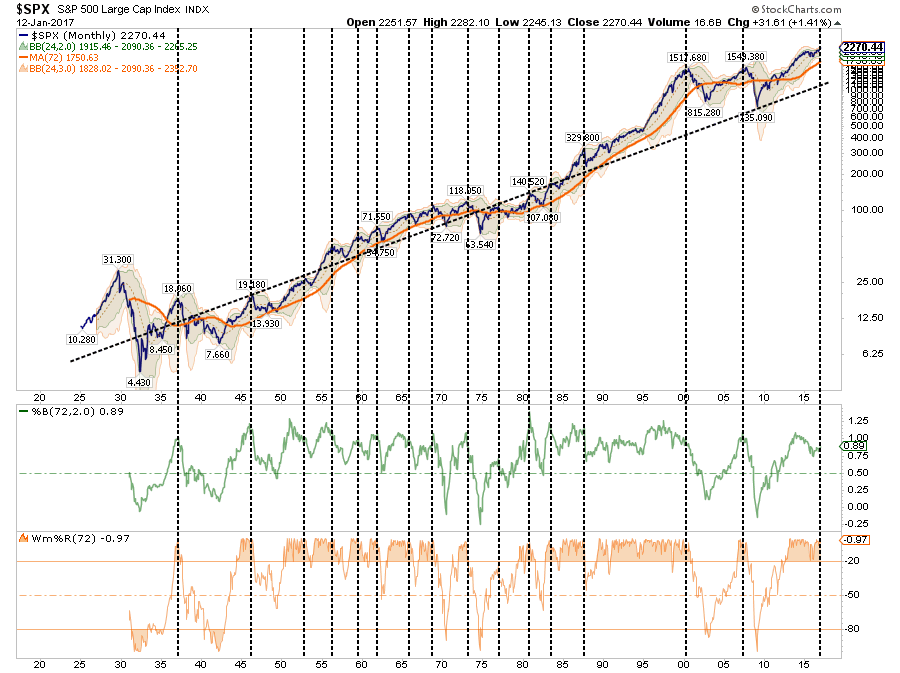

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

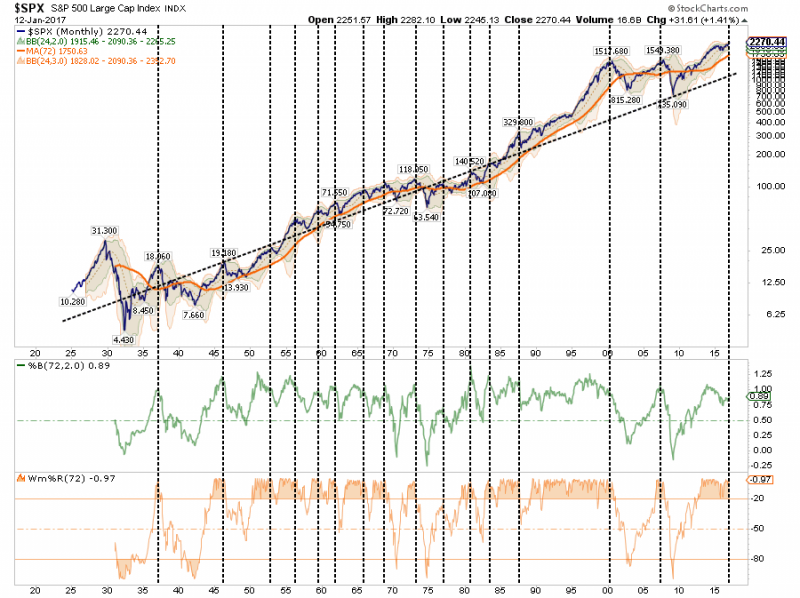

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we'll present the data and evidence that they've not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we're talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well...

Read More »

Read More »

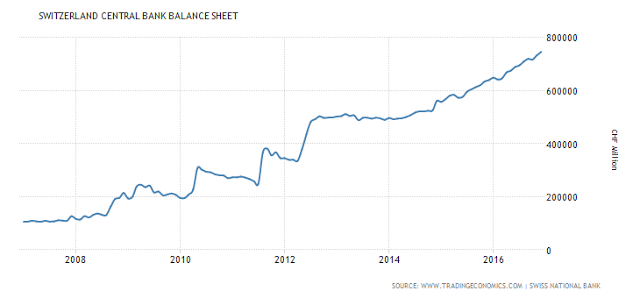

Video: The Swiss National Bank Is Acting Like A Hedge Fund

We discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy?

Read More »

Read More »

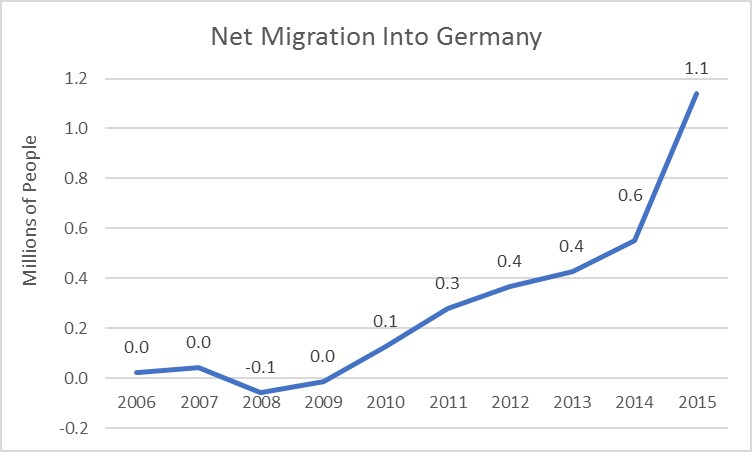

Martin Armstrong: “EU in Disintegration Mode”

Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong's piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that,

Read More »

Read More »

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

Destroying The “Wind & Solar Will Save Us” Delusion

Submitted by Gail Tverberg via Our Finite World blog, The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short … Continue reading »

Read More »

Read More »

The Psychological Impact Of Loss

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising.

Read More »

Read More »

Basic Income Arrives: Finland To Hand Out Guaranteed Income Of €560 To Lucky Citizens

Just over a year ago, we reported that in what was set to be a pilot experiment in "universal basic income", Finland would become the first nation to hand out "helicopter money" in the form of cash directly to a select group of citizens.

Read More »

Read More »

NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would "work" to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those European nations which had...

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

Migrant Rape Epidemic Reaches Austria

Submitted by Soren Kern via The Gatestone Institute,

A 20-year-old asylum seeker from Iraq confessed to raping a 10-year-old boy at a public swimming pool in Vienna. The Iraqi said the rape was a "sexual emergency" resulting from "excess sexual ene...

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »

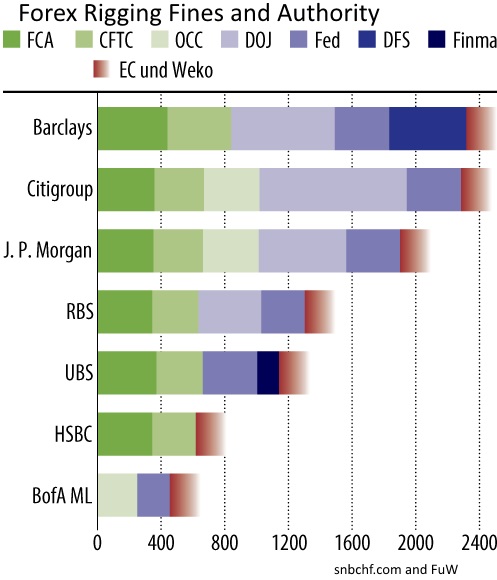

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

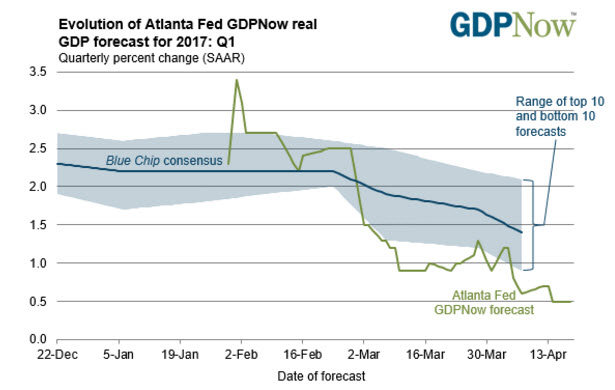

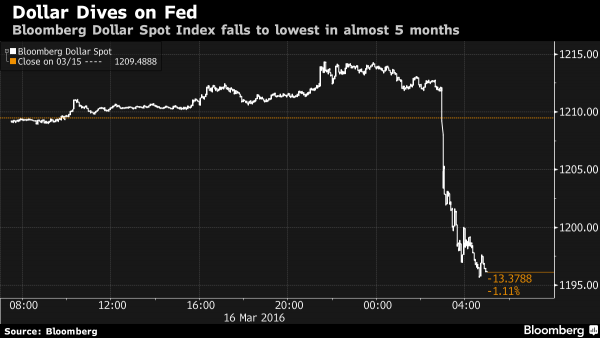

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »