Tag Archive: Eurozone Core Consumer Price Index

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, July 16: BOJ Tweaks Forecasts

The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland's cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European bourses are edging higher, while US futures are oscillating around unchanged levels.

Read More »

Read More »

FX Daily, June 17: Correction Phase does not Appear Over

Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday's highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11.

Read More »

Read More »

FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Overview: Another late sell-off of US equities, ostensibly on questions over Moderna's progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split.

Read More »

Read More »

FX Daily, March 18: Bonds Join Equities in the Carnage

Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Daily, January 17: China and the UK Surprise in Opposite Directions

Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe's Dow Jones Stoxx 600 is at new record highs and appears set to take a four-day streak into next week. US shares are trading firmly.

Read More »

Read More »

FX Daily, December 18: Markets Turn Quiet Ahead of Central Bank Meetings

Overview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased. European equities are off to a firm start, and the Dow Jones Stoxx 600 is consolidating near the record high set Monday.

Read More »

Read More »

FX Daily, November 29: Equities Slip While Investors Mark Time

Overview: Global equities are trading heavily. Both the MSCI Asia Pacific and the Dow Jones Stoxx 600 snapped four-day advancing streaks yesterday and have seen some follow-through selling today. In the Asia Pacific region, all the markets fell but Jakarta. Hong Kong's Hang Seng slipped a little more than 0.2% yesterday but dropped 2% earlier today to record its biggest decline in three weeks.

Read More »

Read More »

FX Daily, November 15: Market Runs with US Line that US-China Deal is Close

Comments by US presidential adviser Kudlow playing up the prospects of a trade agreement between the US and China, with other reports suggesting a key call be held today, is helping to underpin sentiment into the weekend. The MSCI Asia Pacific Index pared this week's loss today, with China the only main market not participating, despite the PBOC's unexpected injection of CNY200 bln of the Medium-Term Lending Facility.

Read More »

Read More »

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

FX Daily, October 16: Fickle Market Tempers Enthusiasm

Overview: Fading hopes that a Brexit agreement can be struck is seeing sterling trade broadly lower, while China's demand that US tariffs be rescinded in exchange for a commitment to buy $40-$50 bln of US agriculture goods over two years, makes the handshake agreement less secure. At the same time, Hong Kong is becoming another front in the US-Sino confrontation.

Read More »

Read More »

FX Daily, October 1: Dollar Jumps to Start New Quarter

Overview: The US dollar is rising against nearly every currency today as global growth concerns deepen. Japan's Tankan Survey showed large manufacturers confidence is a six-year low. The Reserve Bank of Australia cut 25 bp as widely expected and kept the door open for more. The final EMU PMI ticked up from the flash, but it is still at a seven-year low.

Read More »

Read More »

FX Daily, September 18: FOMC Meets Amid Money Market Pressures

Overview: News that Saudi Arabia was able to restore 40%-50% of the oil capacity lost by the weekend strike coupled with the Fed's efforts to offset the squeeze in the money markets are allowing the global capital markets to trade quietly ahead of the conclusion of the FOMC meeting. Equities are little changed with a lower bias that has been seen in the first few sessions this week.

Read More »

Read More »

FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains. The Nikkei gapped higher for the third time in six sessions, and the first two were followed by lower gaps.

Read More »

Read More »

FX Daily, July 17: Back to the Well Again

Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo.

Read More »

Read More »

FX Daily, June 04: Nervous Calm Settles Over Markets

The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between the US and China, and the threat of anti-trust action against the largest digital platforms.

Read More »

Read More »

FX Daily, May 17: China Questions US Sincerity

Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and...

Read More »

Read More »

FX Daily, May 03: Ahead of US Jobs Report, the Greenback Remains Firm

Overview: The US April jobs data stand before the weekend, and the greenback is holding on to most of yesterday's gains as participants wait for the report. Equities in the Asia Pacific region were mixed without leadership from China and Japan, where the markets remain closed for the extended holiday. On the week, Australia's ASX was the worst performing.

Read More »

Read More »

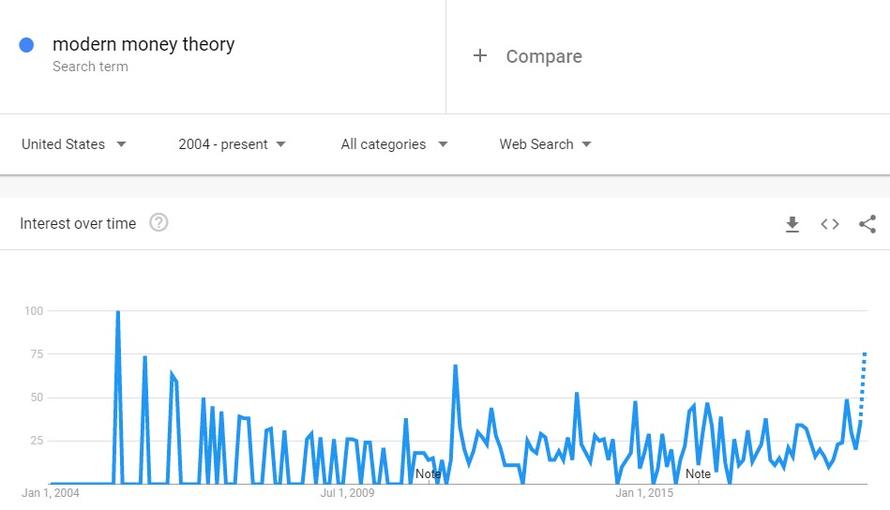

Albert Edwards: Investors Should Brace For A World Of Negative Rates, 15percent Budget Deficits And Helicopter Money

Eariler this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative "empirical evidence" that greenlights this unprecedented NIRPy step (in addition to QE of course).

Read More »

Read More »

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »