Tag Archive: Europe

Europe’s Woes Multiply

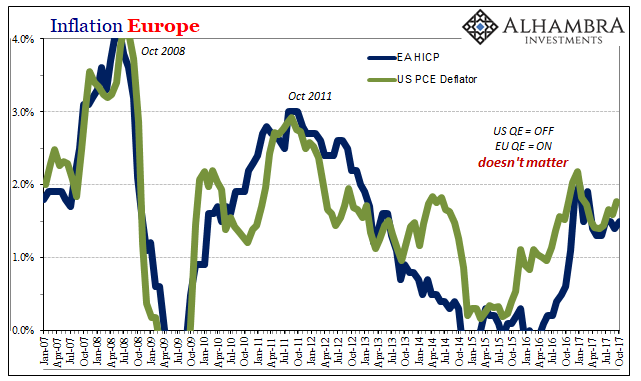

The Markit group that provides many of the PMI surveys noted with today's reports that the eurozone outlook has "darkened dramatically." This makes for a poor backdrop for the ECB, which meets next week. However, with price pressures recovering from the Easter-related distortions, the ECB is still on track to finish its asset purchases at the end of the year. This seems largely taken for granted.

Read More »

Read More »

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

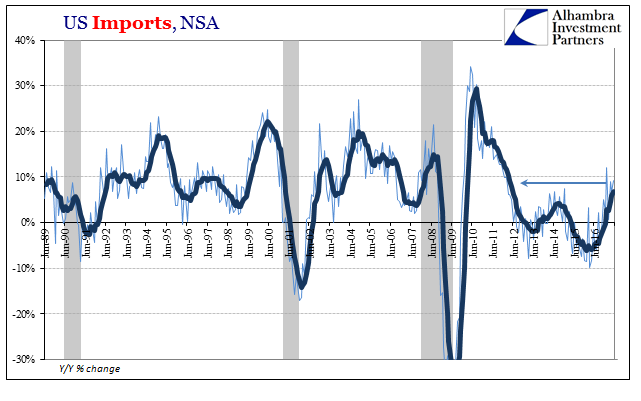

US Imports: A Little Inflation For Yellen, A Little More Bastiat

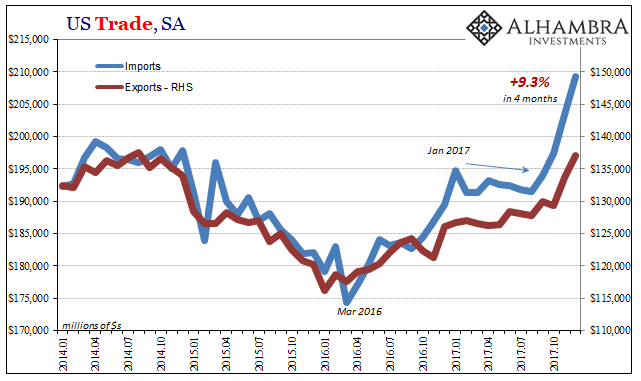

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn.

Read More »

Read More »

Switzerland Is Well-Prepared For Civilizational Collapse

More than any other country, Switzerland’s ethos is centered around preparing for civilizational collapse. All around Switzerland, for example, one can find thousands of water fountains fed by natural springs. Zurich is famous for its 1200 fountains, some of them quite beautiful and ornate, but it’s the multiple small, simple fountains in every Swiss village that really tell the story. Elegant, yes, but if and when central water systems are...

Read More »

Read More »

Demographic Dysphoria: Swiss Village Offers Families Over $70,000 To Live There

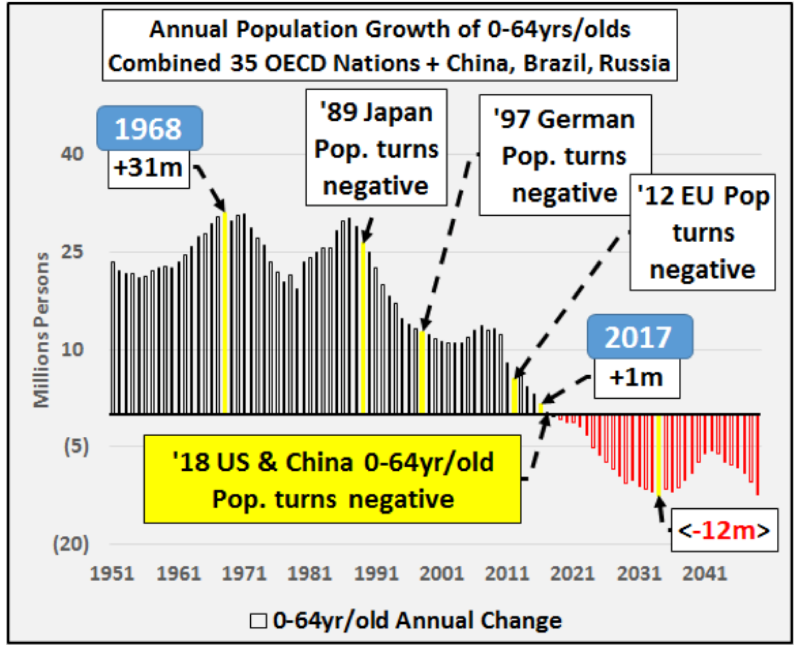

Across the world, demographic dysphoria is taking shape, creating numerous headaches for governments. To avoid the next economic downturn, governments are searching for creative measures to increase population growth and deliver a sustainable economy. In Europe, a near decade of excessive monetary policy coupled with a massive influx of refugees have not been able to reverse negative population growth– first spotted in 2012.

Read More »

Read More »

Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »

Europe Is Booming, Except It’s Not

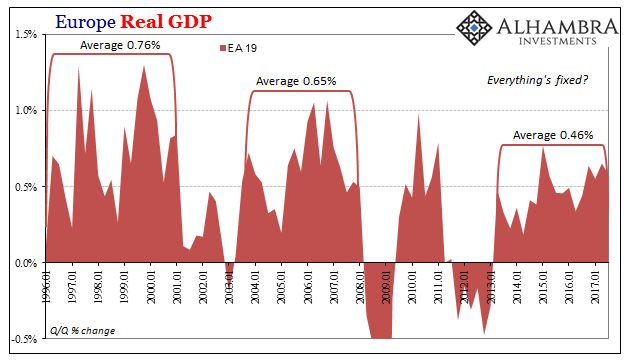

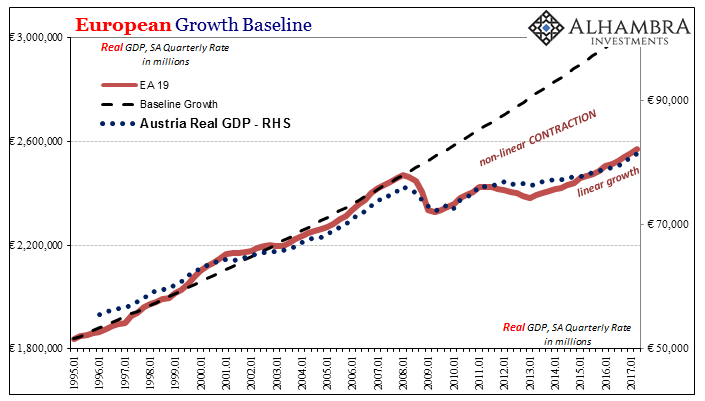

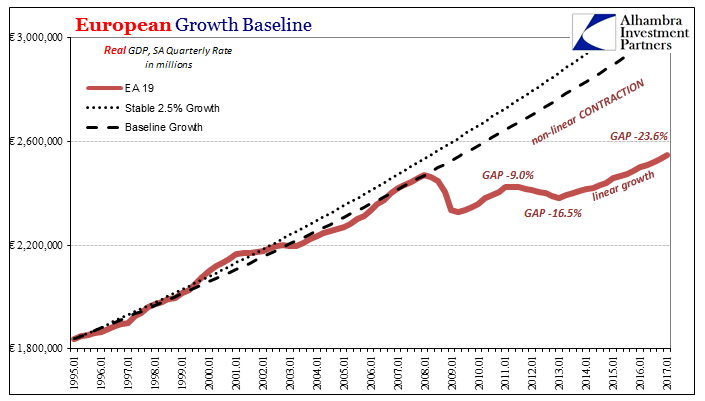

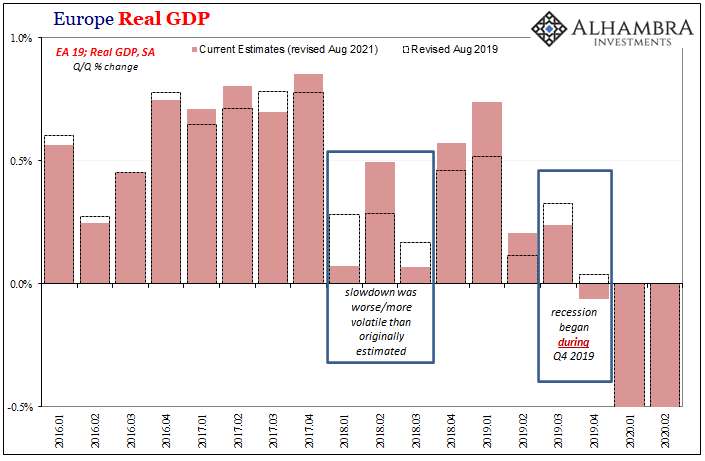

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

Read More »

Read More »

If American Federalism Were Like Swiss Federalism, There Would Be 1,300 States

In a recent interview with Mises Weekends, Claudio Grass examined some of the advantages of the Swiss political system, and how highly decentralized politics can bring with it great economic prosperity, more political stability, and a greater respect for property rights. Since the Swiss political system of federalism is itself partially inspired by 19th-century American federalism, the average American can usually imagine in broad terms what the...

Read More »

Read More »

Three Developments in Europe You may have Missed

The focus in Europe has been Catalonia's push for independence and the attempt by Madrid to prevent it. Tomorrow's ECB meeting, where more details about next year's asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many are seeing convergence,...

Read More »

Read More »

Distinct Lack of Good Faith, Part ??

It was a busy weekend in retrospect, starting with Janet Yellen and other central bankers uncomfortably facing a global media that has become (for once) increasingly unconvinced. Reporters, really, don’t have much choice. The Federal Reserve Chairman might not be aware of just how much she has used the “transitory” qualifier since 2015, but others can’t be helped from noticing.

Read More »

Read More »

Global Inflation Continues To Underwhelm

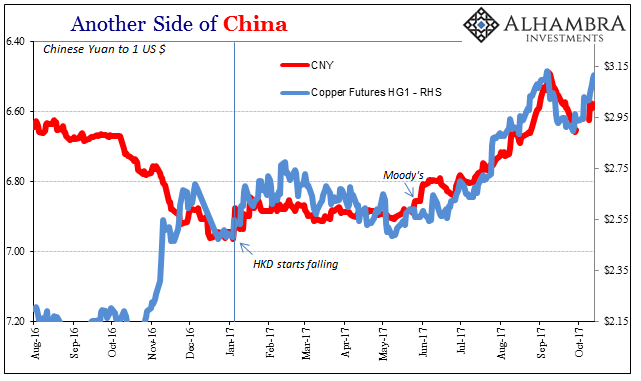

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence...

Read More »

Read More »

Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was continued denial especially on the...

Read More »

Read More »

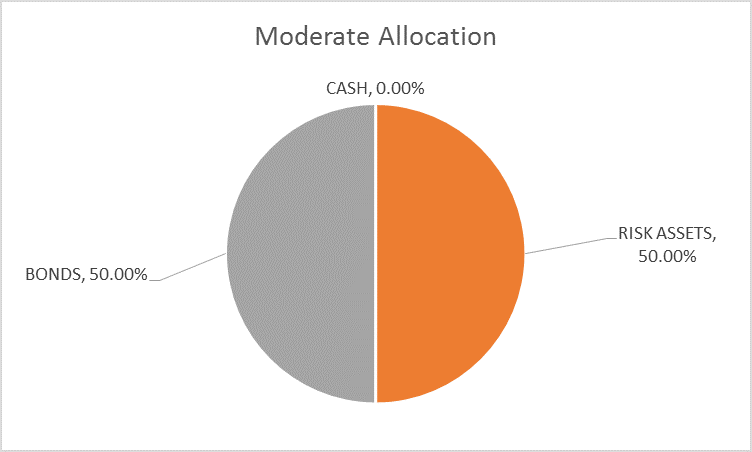

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

Boris Johnson Threatens To Resign If Theresa May “Goes Against His Brexit Demands”, Pound Rises

In confirmation that Theresa May's upcoming Florence speech this Friday is not only what many have called "the most important day for Brexit since the referendum", but also the most opaque, the Telegraph reports that UK Foreign Secretary Boris Johnson will resign as before the weekend if Theresa May veers towards a “Swiss-style” arrangement with the EU in her upcoming speech.

Read More »

Read More »

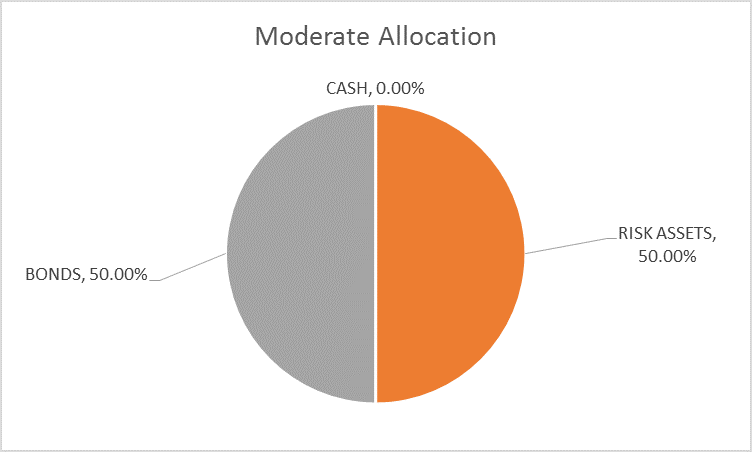

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

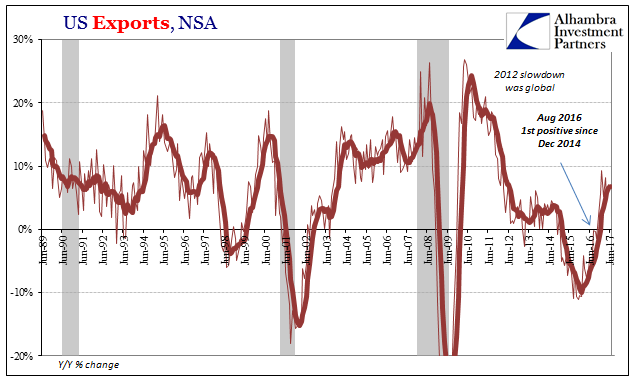

U.S. Export/Import: Losing Economic Trade

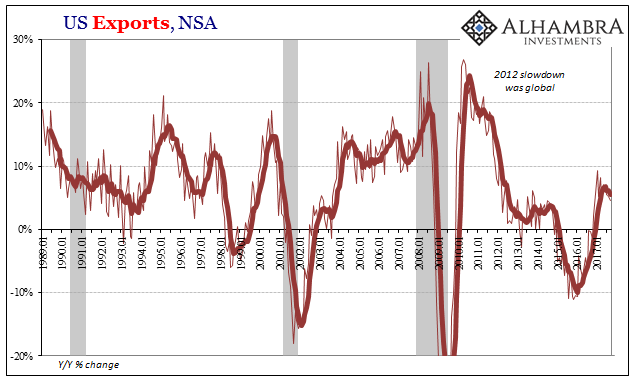

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter.

Read More »

Read More »

US Imports, Exports and Trade Stalls, Too

US imports rose year-over-year for the seventh straight month, but like factory orders and other economic statistics there is a growing sense that the rebound will not go further. The total import of goods was up 9.3% in May 2017 as compared to May 2016, but growth rates have over the past five months remained constrained to around that same level. It continues to be about half the rate we should expect given the preceding contraction.

Read More »

Read More »

Global Manufacturing PMI’s, Inflation and CPI: Some Global Odd & Ends

When it comes to central bank experimentation, Japan is always at the forefront. If something new is being done, Bank of Japan is where it happens. In May for the first time in human history, that central bank’s balance sheet passed the half quadrillion mark.

Read More »

Read More »