Tag Archive: EuroDollar

The Big Picture Doesn’t Include ‘Trade Wars’

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors.

Read More »

Read More »

Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances.

Read More »

Read More »

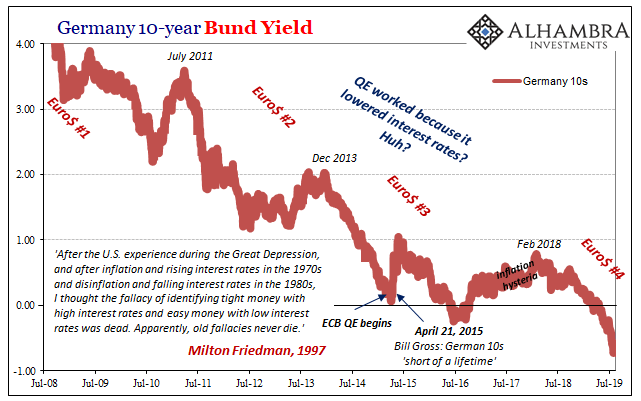

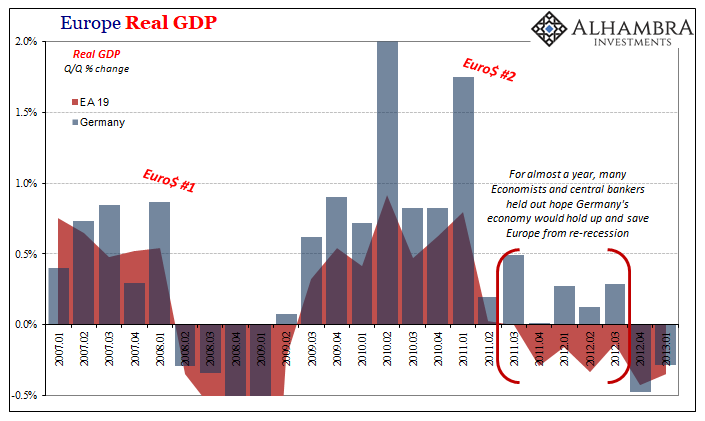

The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

Read More »

Read More »

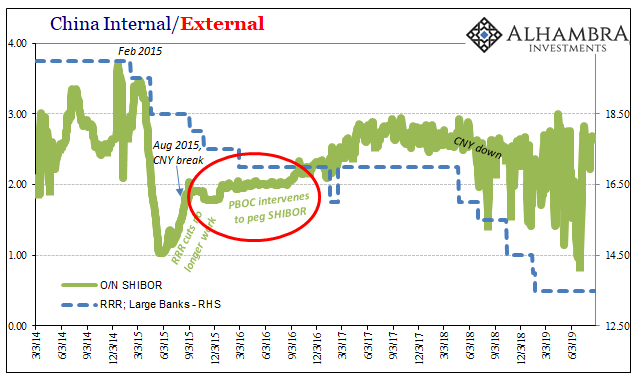

Dollar (In) Demand

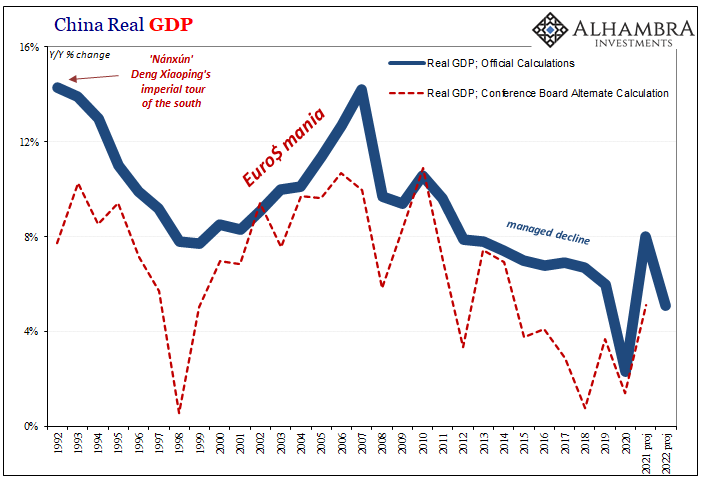

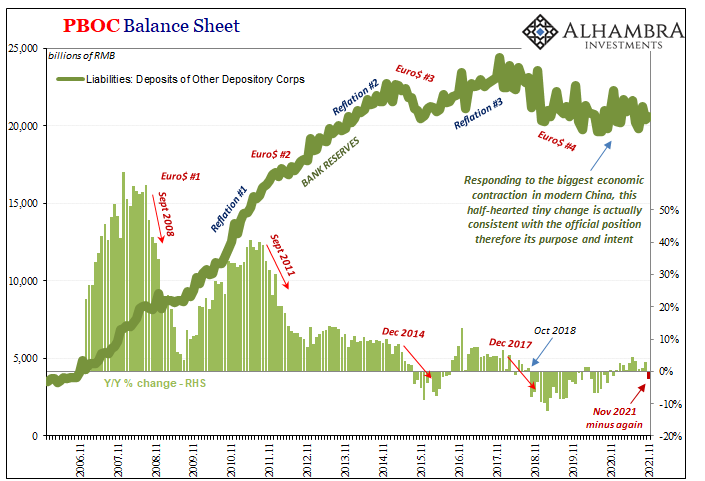

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness.

Read More »

Read More »

Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »

That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers.

Read More »

Read More »

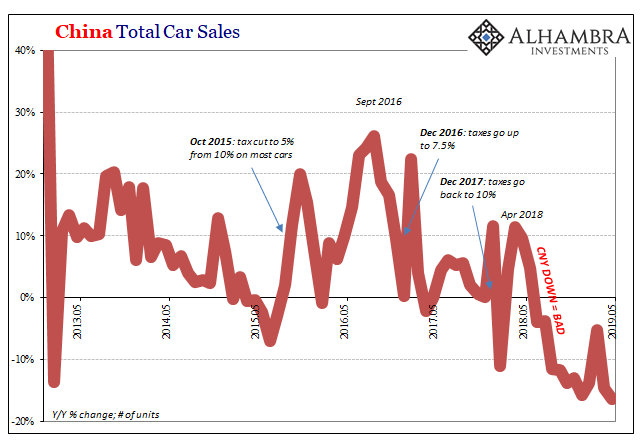

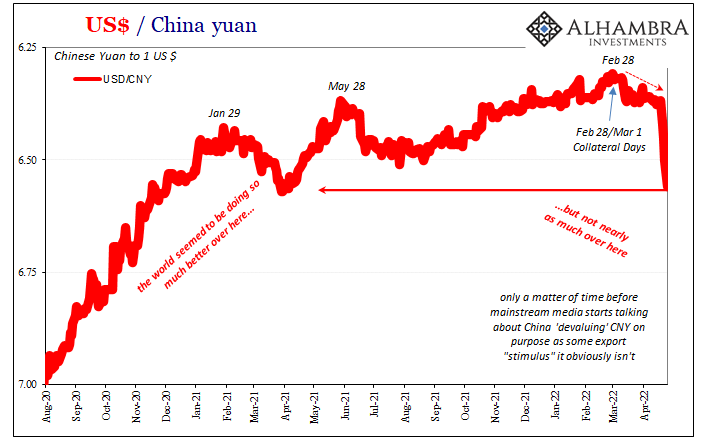

The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out.

Read More »

Read More »

China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter.

Read More »

Read More »

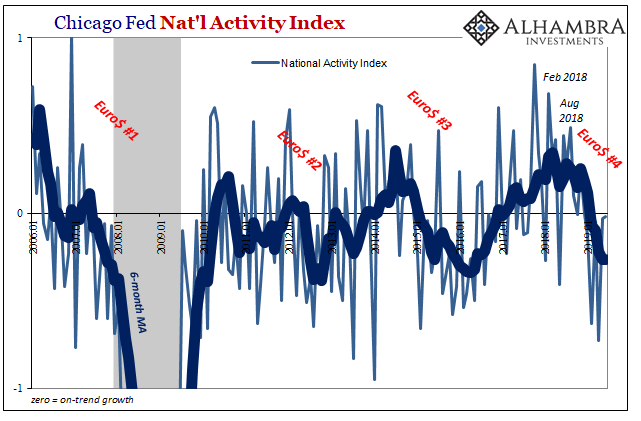

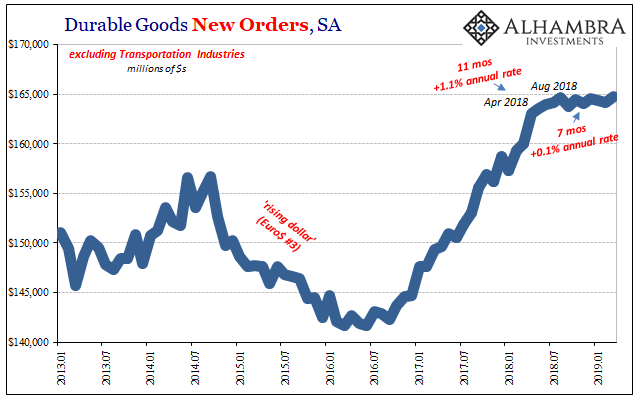

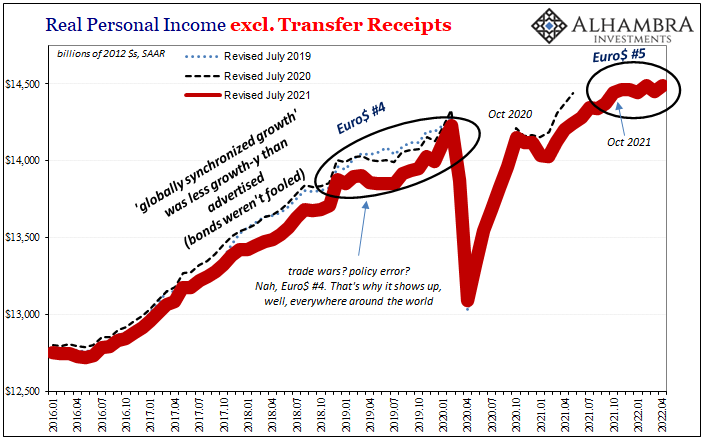

US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat.

Read More »

Read More »

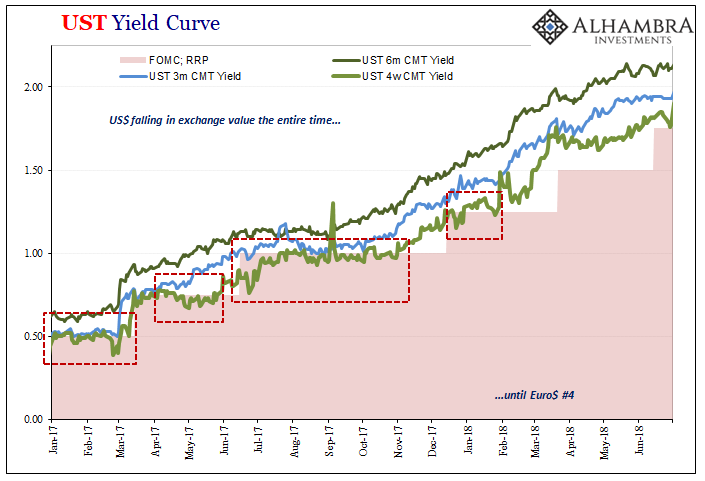

How To Properly Address The Unusual Window Dressing

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses.

Read More »

Read More »

Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each.

Read More »

Read More »

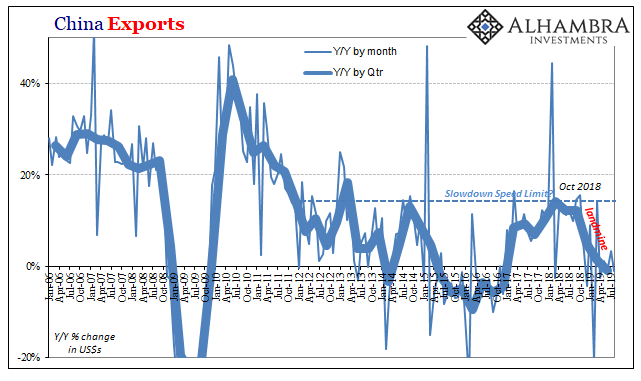

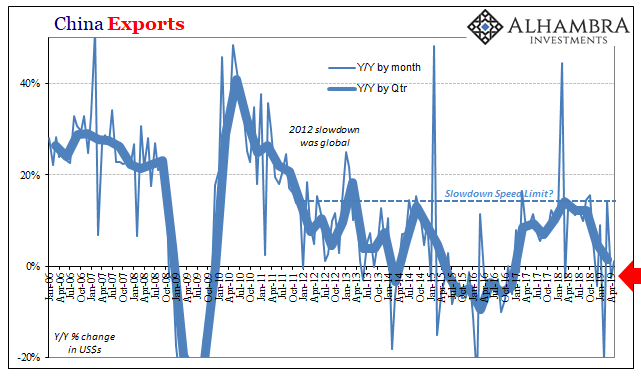

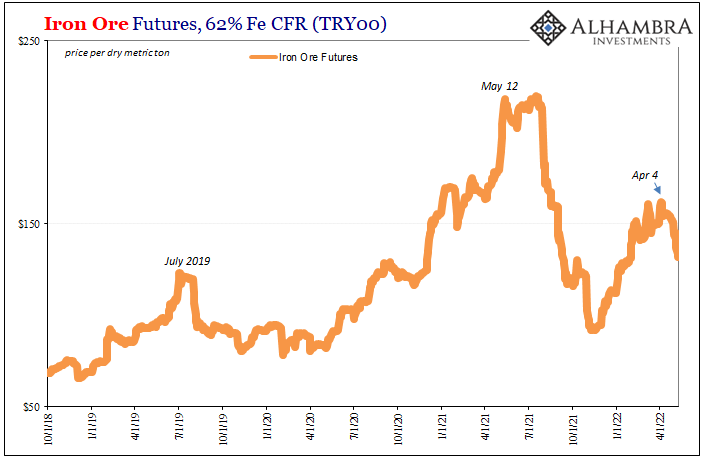

Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016.

Read More »

Read More »

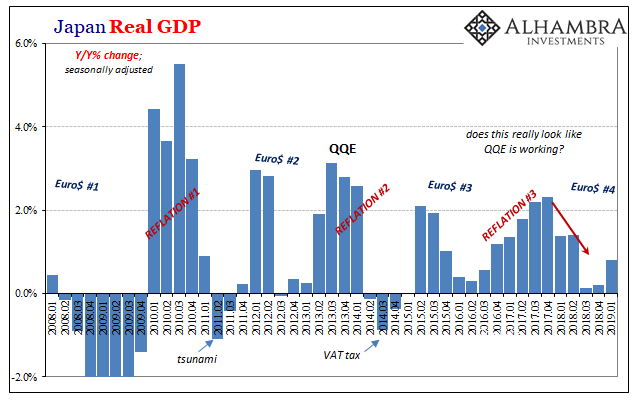

Japan’s Surprise Positive Is A Huge Minus

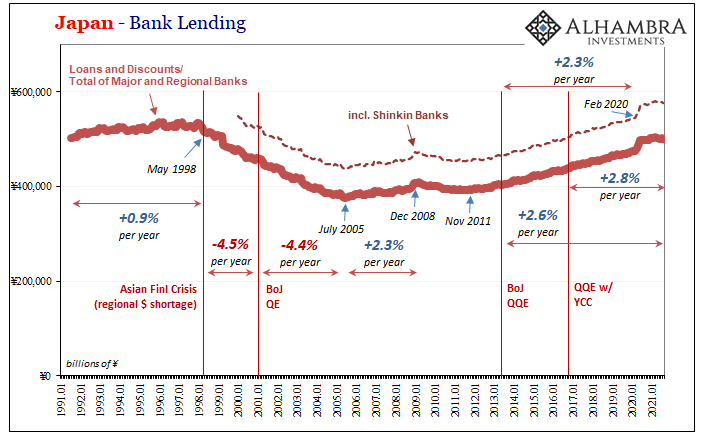

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five.

Read More »

Read More »

Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so straightforward.

Read More »

Read More »

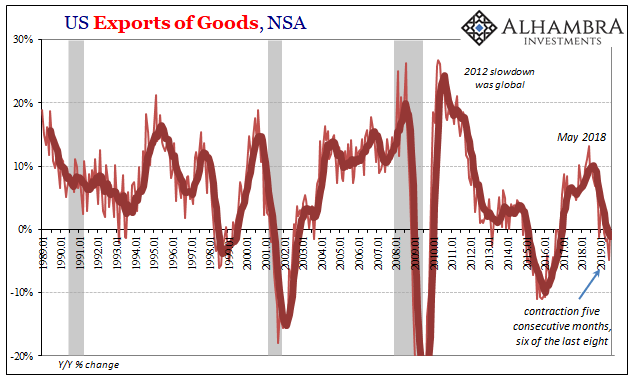

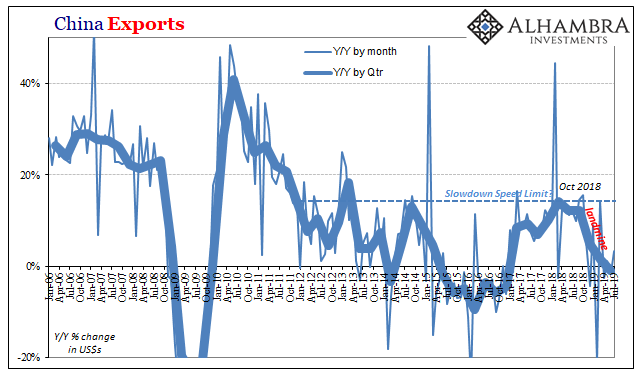

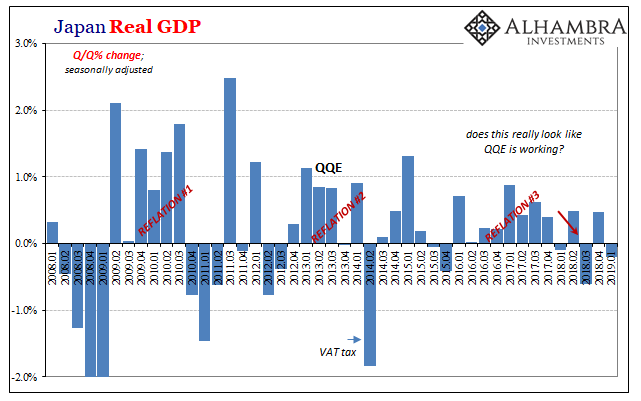

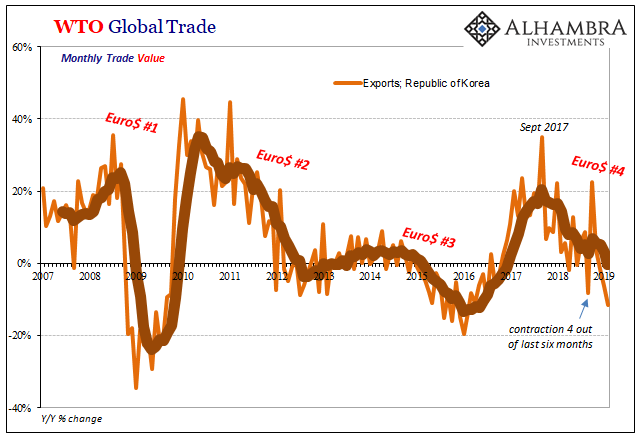

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

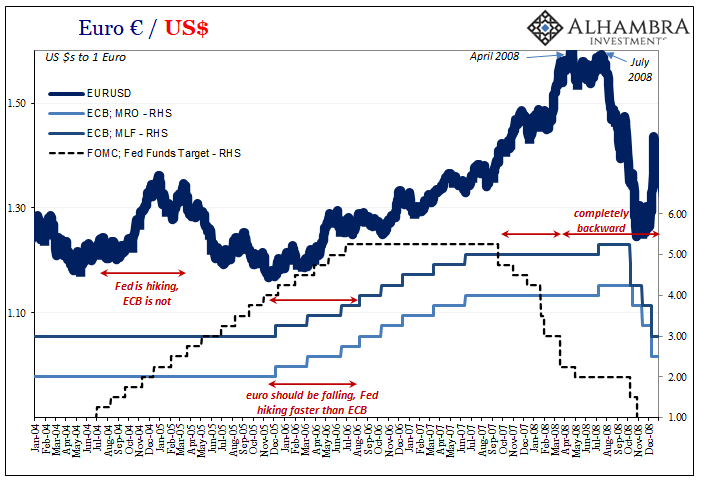

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

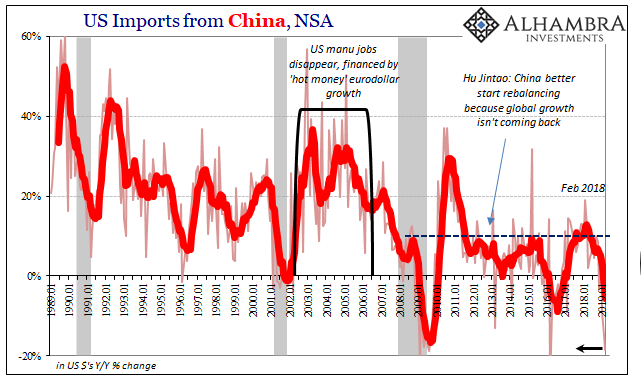

What’s Germany’s GDP Without Factories

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of crisis and economic weakness...

Read More »

Read More »

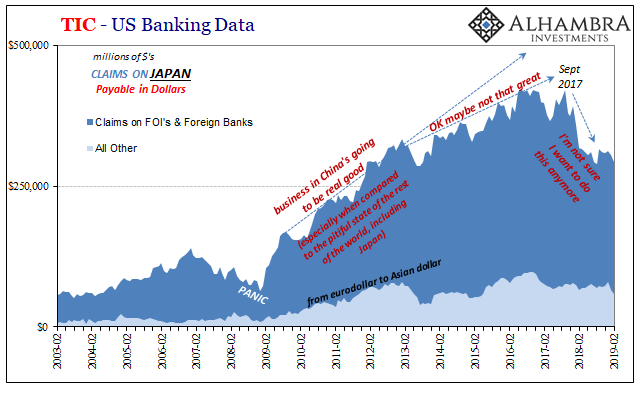

What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective.

Read More »

Read More »

Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death.

Read More »

Read More »

Durably Sideways

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted.

Read More »

Read More »