Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Tag Archive: Euro exit

8a) Italy and the Euro Exit

Italy, other peripheral economies and later France will follow Japan for a decade or more of balance sheet recession: stagnant wages, falling real estate prices and a reduction of private debt.

Read More »

Read More »

All roads lead to a euro zone break-up

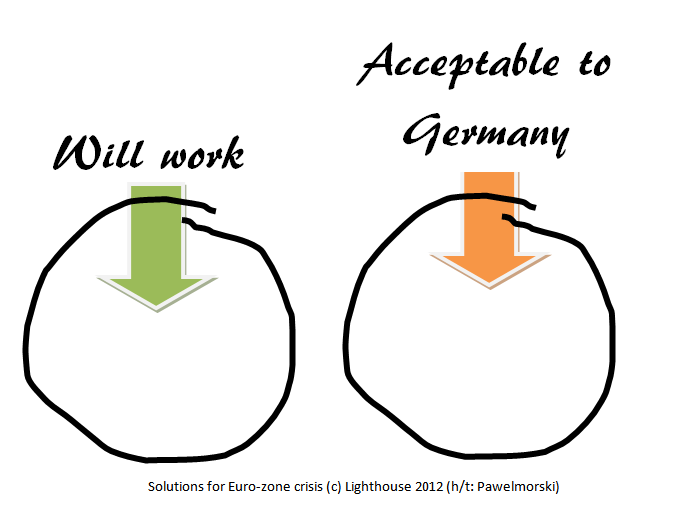

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

The other risk for the SNB: Will German Bund yields double ?

In the latest post we started discussing the implications of a German euro exit for the Swiss National Bank, this time we will look on another risk: The rising German Bund yields.

Read More »

Read More »

Is the SNB prepared for the black swan ?

Will the SNB printing policy lead to inflation and a housing bust when Germany leaves the Euro ? Recently the voices for a German euro exit have become louder and louder. The most recent voice comes from Biderman , the FT says that the rise of German Bunds holds the secret how the eurozone crisis will … Continue reading...

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »