Tag Archive: euro area growth

Euro area manufacturing is not out of the woods

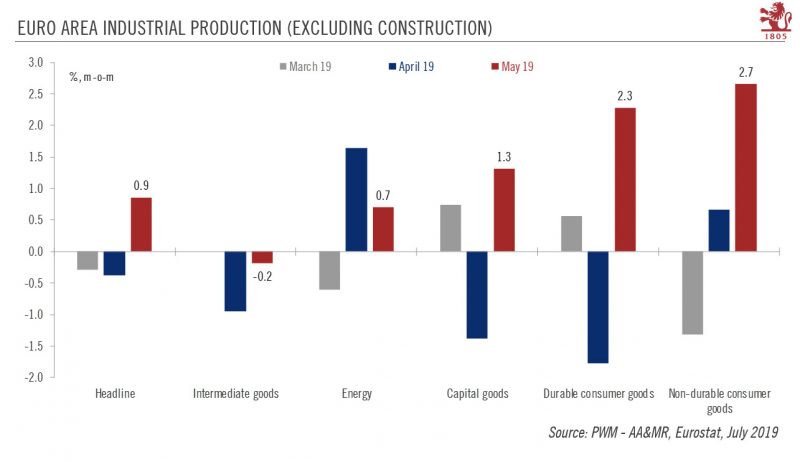

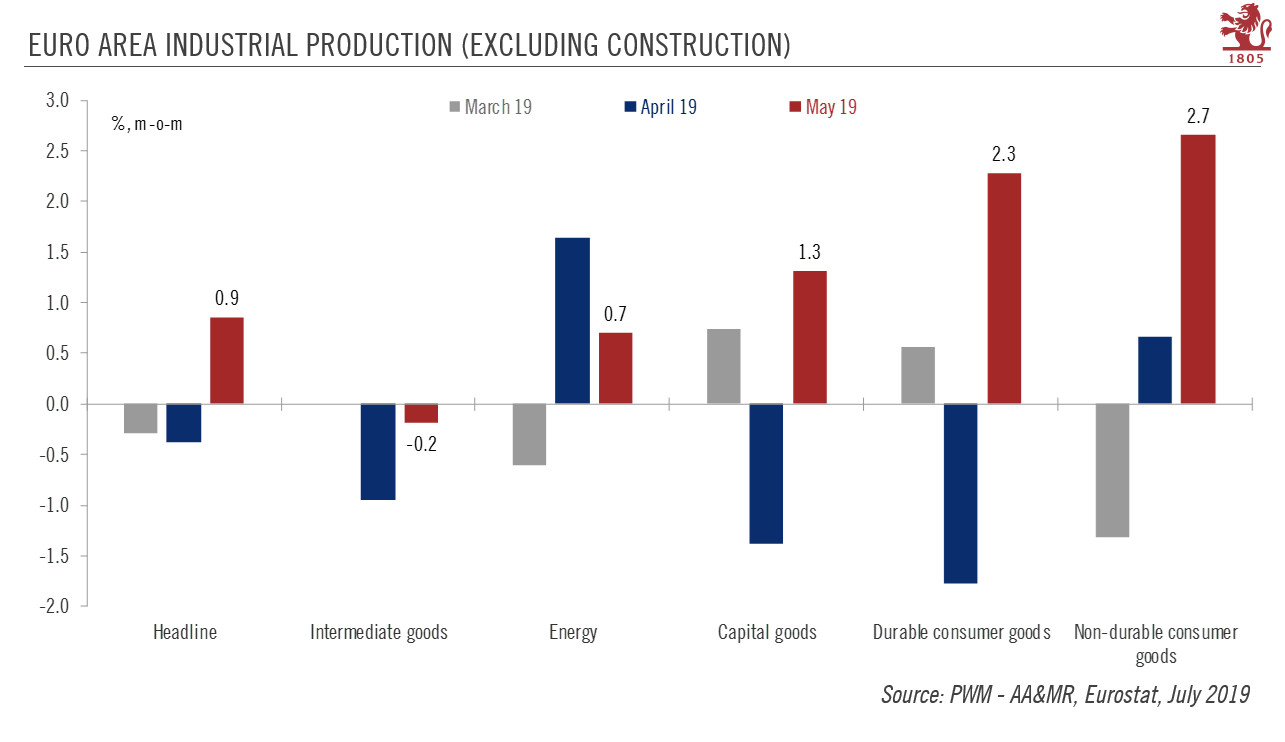

Industrial production rebounded in May. But a closer look shows that the improvement was narrowly spread, and euro area manufacturing faces numerous challenges ahead.After two consecutive months of contraction, euro area industrial production (IP, excluding construction) rose by 0.9% month on month (m-o-m) in May, above consensus expectations.

Read More »

Read More »

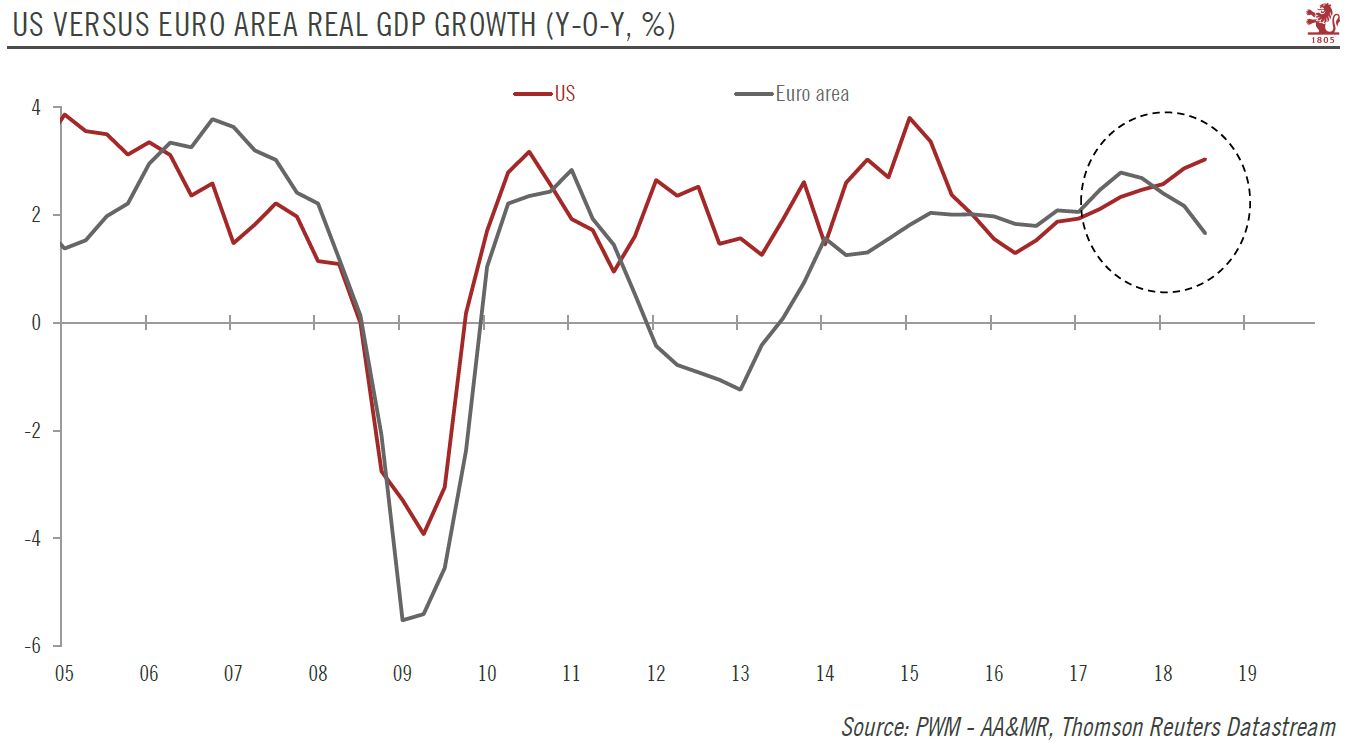

Rising downside risks to euro area growth

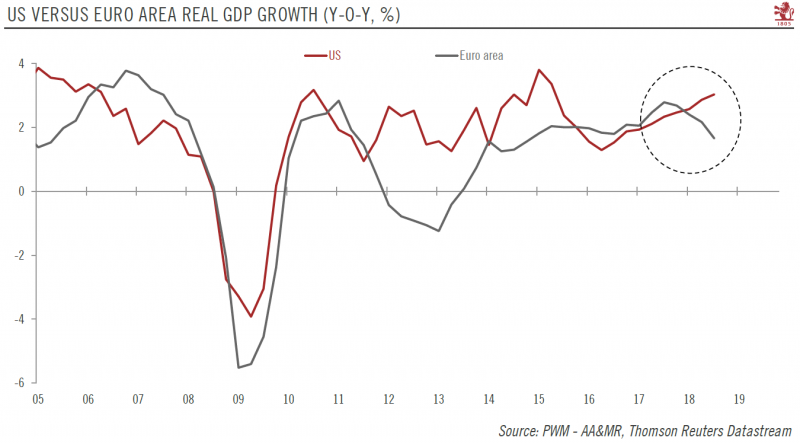

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected.A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China.

Read More »

Read More »

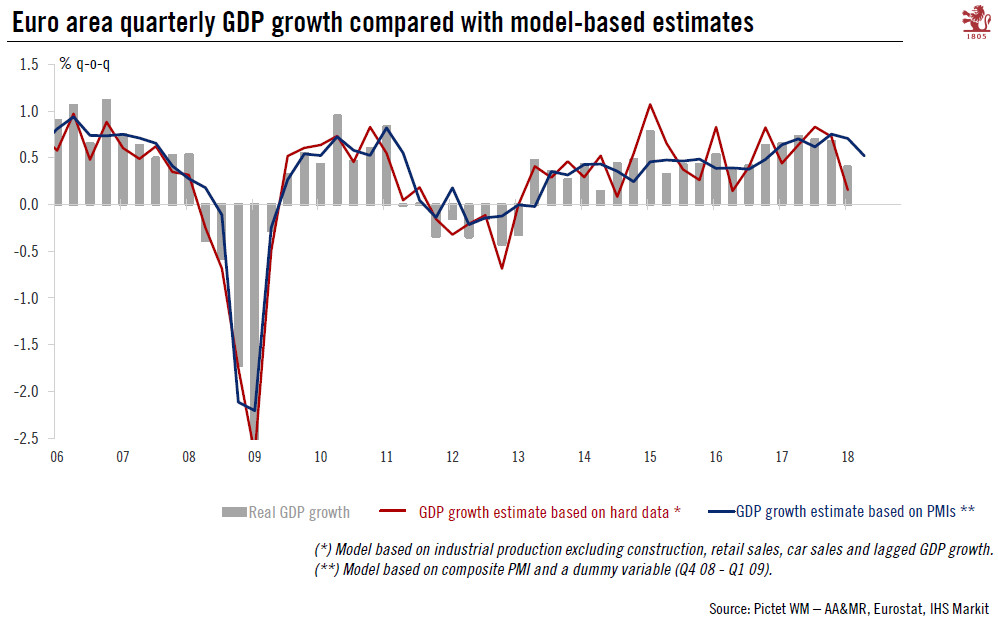

Euro area’s initial growth figures for Q3 prove disappointing

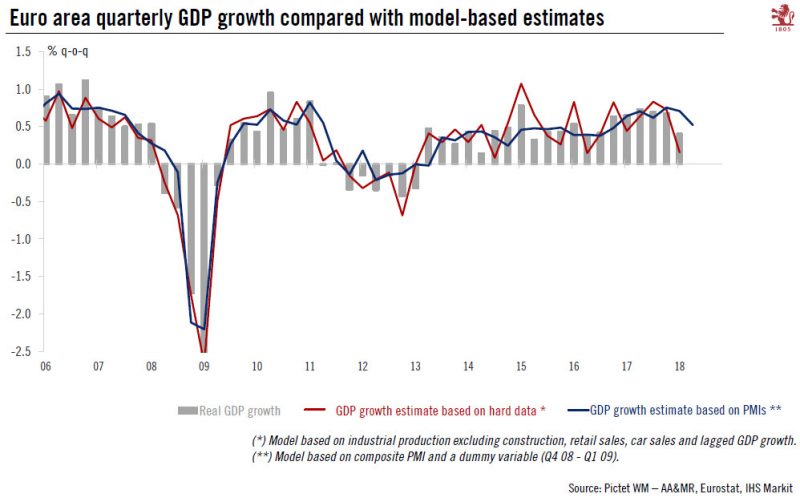

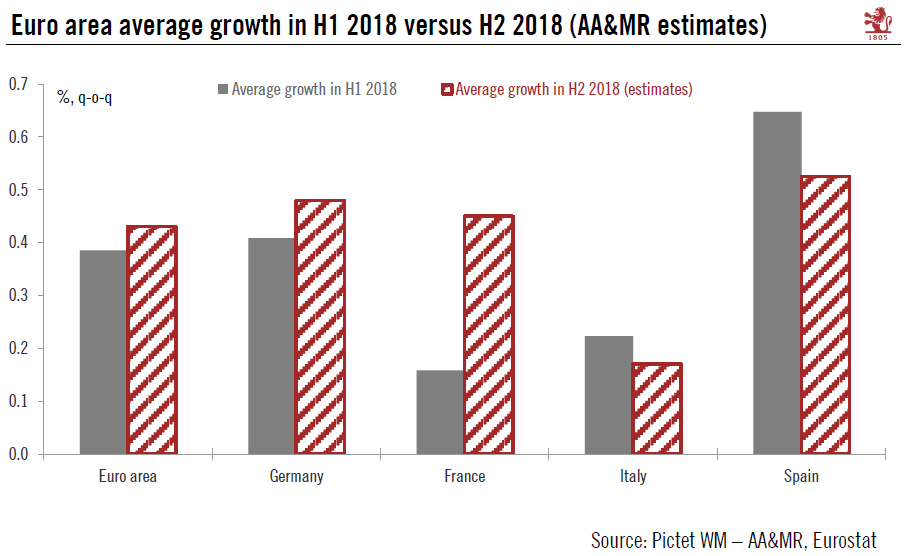

While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk.According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast.

Read More »

Read More »

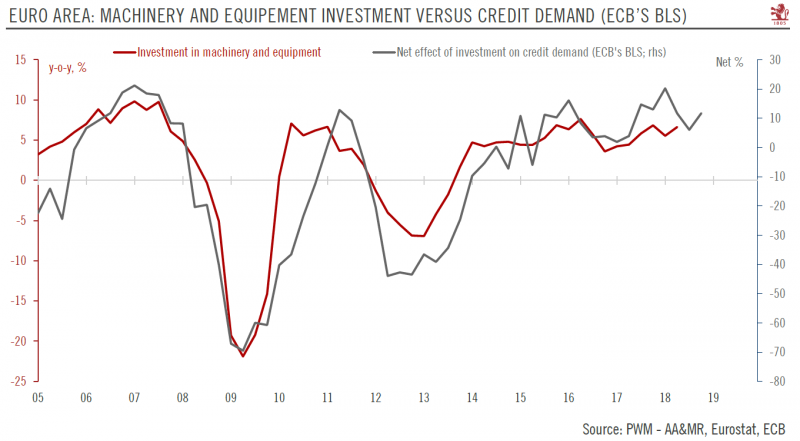

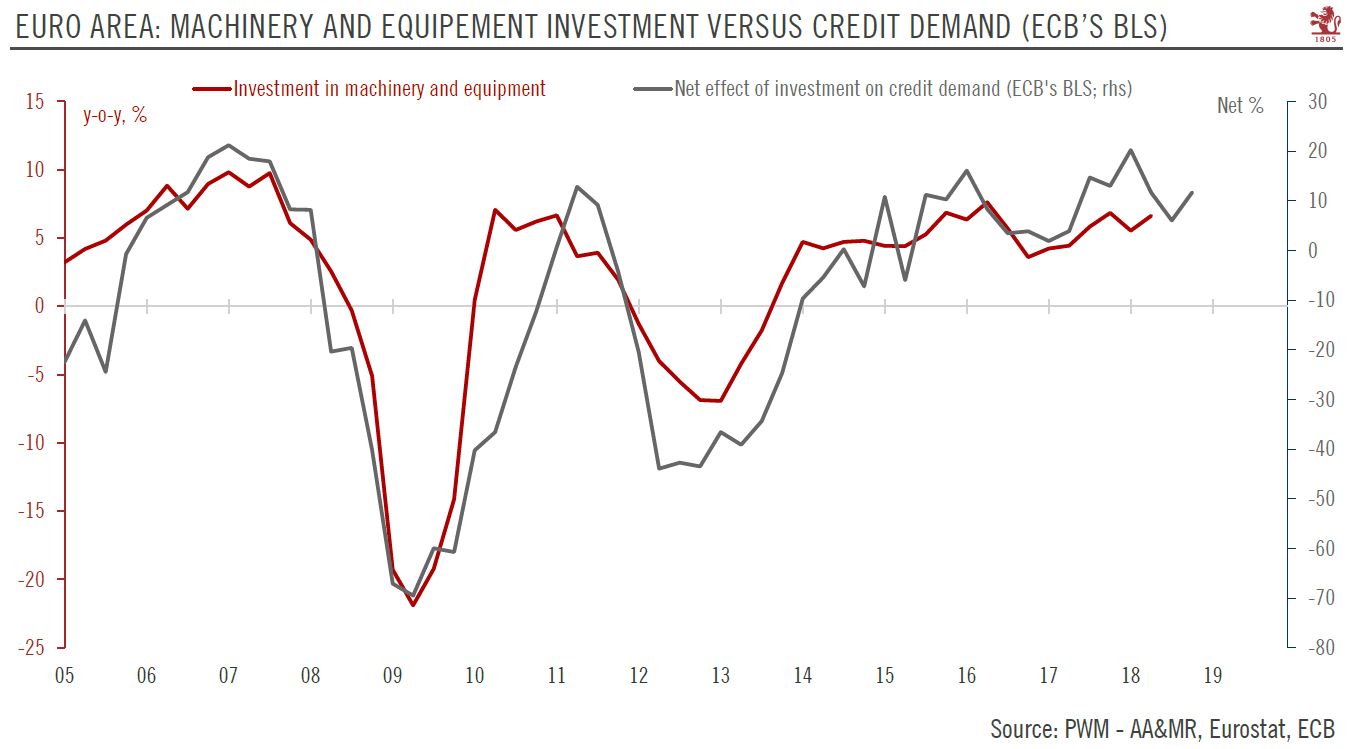

Credit Conditions in the Euro Area Remain Supportive of Investment Recovery

Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for 48%, 32%, 18% and 2% of total investment.

Read More »

Read More »

Gloomy Signals for Euro Area Manufacturing

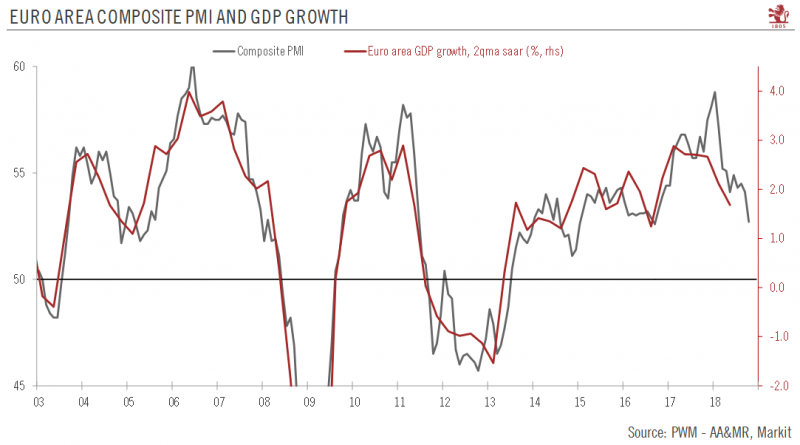

The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines.

Read More »

Read More »

Contrasting Fortunes within the Euro Area

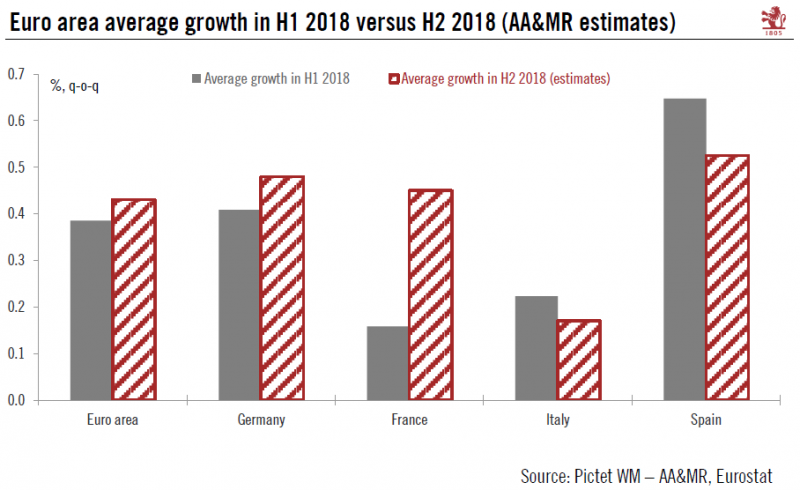

The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face weaknesses both in export-led manufacturing and services, due domestic political uncertainties (including the upcoming state budget) as well as...

Read More »

Read More »

PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.

Read More »

Read More »

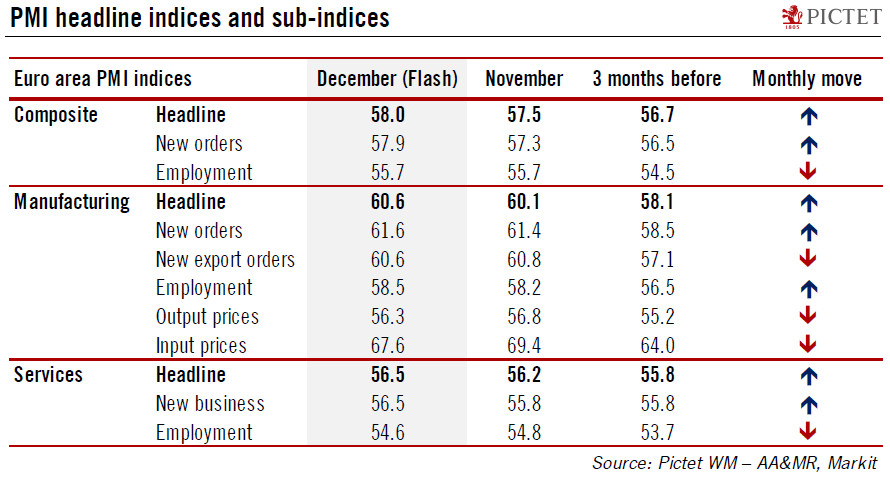

Euro area: The sky is the limit

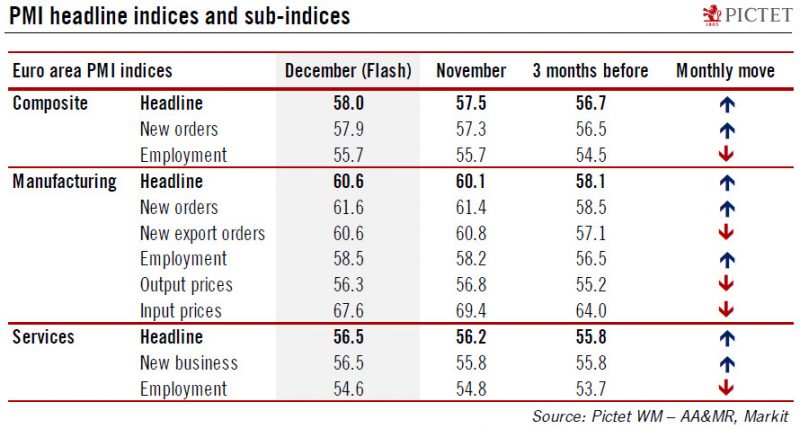

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors.

Read More »

Read More »