Tag Archive: Euro

Weekly Market Pulse: Peak America?

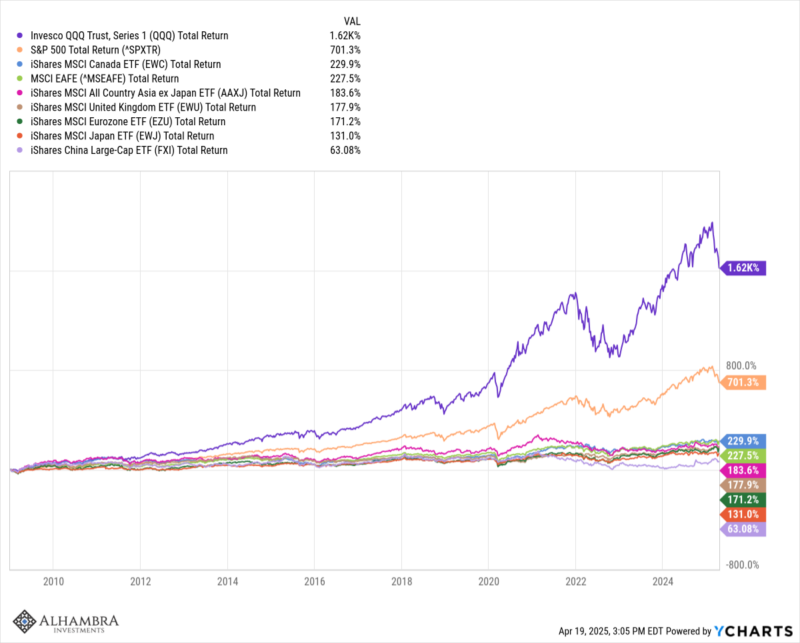

The US economy has been the envy of the world for a long time, especially after the 2008 financial crisis and the COVID pandemic. Our economy has grown faster than just about any other in the developed world thanks in large part to the extraordinary performance of our technology sector. Our markets for debt and equity are the largest and most liquid on the planet. The US economy represents roughly 25% of global GDP but our stocks make up over 50%...

Read More »

Read More »

Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

Escalating tensions in Europe and comments from Bank of Japan Ueda that spurred speculation of a December hike are the main drivers of the foreign exchange market today. The yen is the strongest of the G10 currencies, up about 0.65%, while the euro is the weakest, off a little more than 0.25%, and sterling is down almost as much.

Read More »

Read More »

China Equity Slump Continues, while Dollar Extends Consolidation

Overview: The foreign exchange market is quiet to

start the new week. As the North American session is about to begin, the dollar

is mostly +/- 0.10% against most of the G10 currencies. The Swedish krona is

the notable exception, rising about 0.25% against the US dollar amid good

demand for its bonds today. Emerging market currencies are mostly lower. The

Taiwanese dollar is the strongest in the complex so far today, rising about

0.30% against the...

Read More »

Read More »

Weekly Market Pulse: A Fatal Conceit

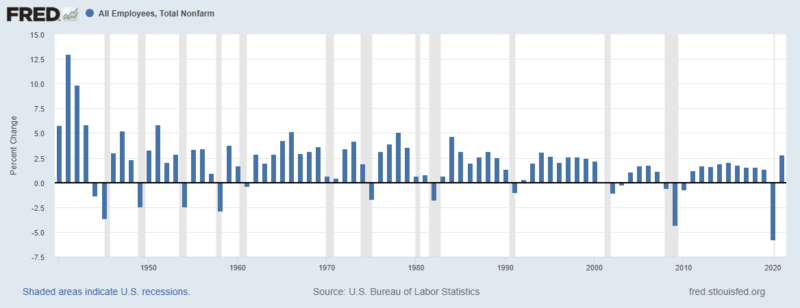

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

FX Daily, July 8: Abe’s Assassination Shocks the World

News that former Prime Minister Abe was assassinated while campaigning in Japan ahead of the weekend election shocked the nation and world. The immediate market impact looks minimal. Asia Pacific equities mostly advanced.

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

Greenback Softens Ahead of CPI

Overview: It appears that investors have become more concerned about growth prospects and less about inflation in recent days. The US 10-year yield that had flirted with 3.20% at the start of the week is now around 2.93%.

Read More »

Read More »

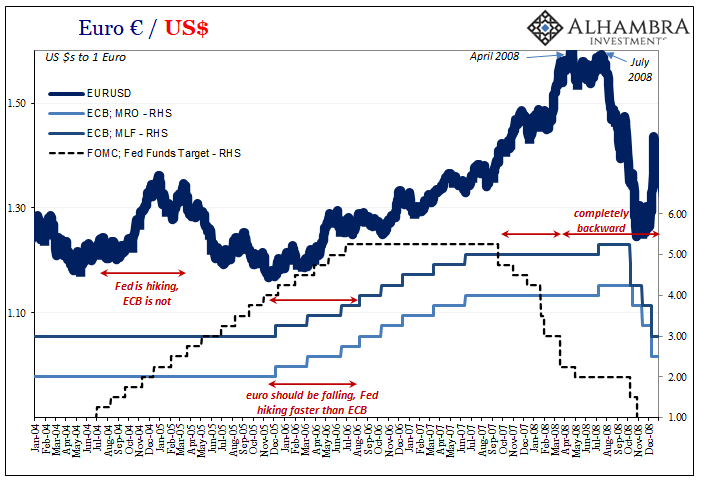

What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials.

Read More »

Read More »

Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around.

Read More »

Read More »

Flash PMIs Play Second Fiddle to US PCE Deflator and Accelerating Inflation

The flash November PMIs would be the main focus in the week ahead if it were more normal times. But these are not normal times, and growth prospects are not the key driver of the investment climate. This quarters' growth is largely baked into the cake. The world's three largest economies, the US, China, and Japan, are likely to accelerate for different reasons in Q4 from Q3. Europe is the weak sibling, and growth in the eurozone and UK may slow...

Read More »

Read More »

Cool Video: CNBC-Asia–Brexit, Sterling, the Euro, and Dollar

I had the privilege to join Sri Jegarajah at CNBC Asia at the start of today's Asia Pacific session. We had a broad chat about the dollar, Brexit, and the euro. He gave me the opportunity to sketch out my views:1. The dollar's entered a cyclical decline, and the "twin deficit" issue will likely frame the narrative.

Read More »

Read More »

Speculative Positioning in Selected Currency Futures

With the media playing up the US dollar's negatives, one would think speculators are short the greenback like there is no tomorrow. Yet a review of the Commitment of Traders report that covers the week through last Tuesday, August 4, shows that this is not really the case.

Read More »

Read More »

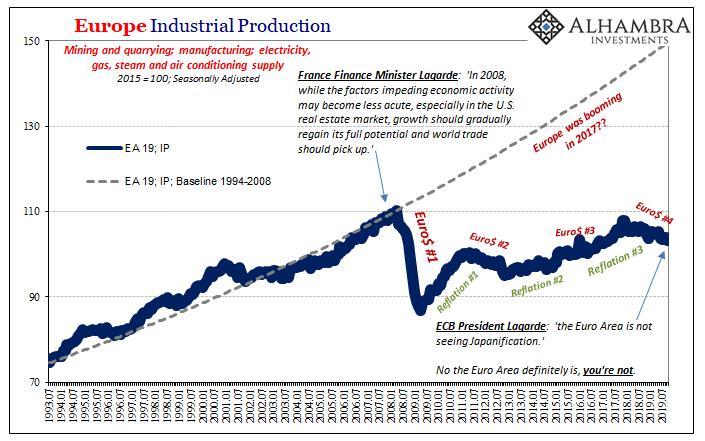

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

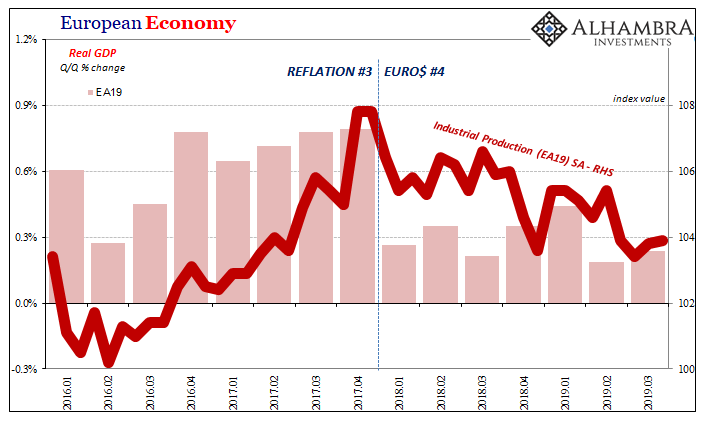

European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before.

Read More »

Read More »

Cool Video: Thoughts on ECB

A few hours after the ECB announced a new package of monetary accommodation, I joined a discussion on CNBC Asia with Nancy Hungerford and Sir Jegarajah. Here is a clip of part of our discussion. I make two points. The first is about the euro's price action. What impressed me about it was that the euro posted an outside up day, trading on both sides of the previous day's range and closing above its high.

Read More »

Read More »

Is Gold Starting to Behave Itself?

2022-05-14

by Stephen Flood

2022-05-14

Read More »