Tag Archive: ETC

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes?

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

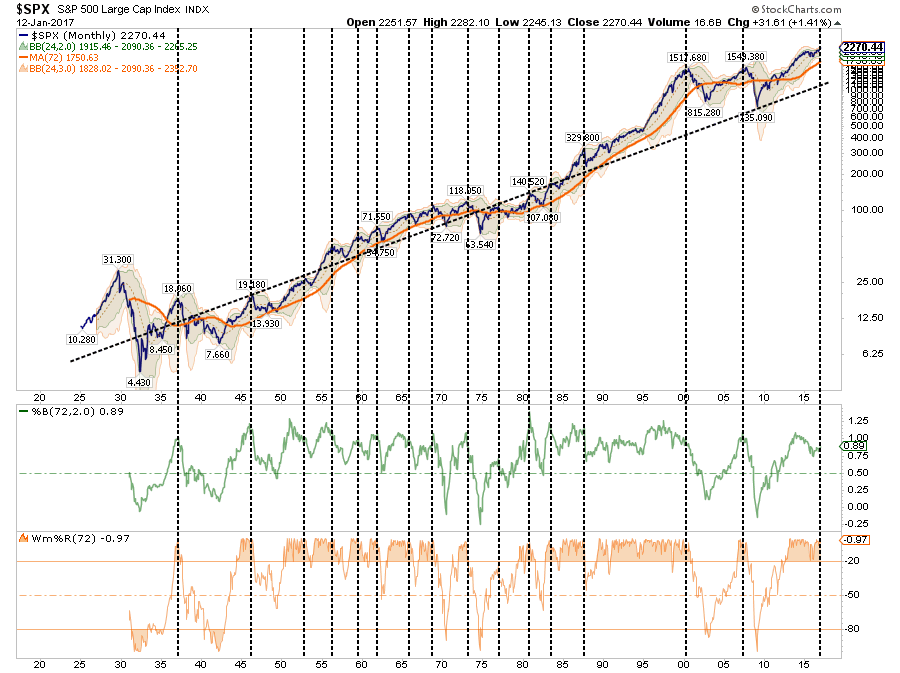

Financial Repression Is Now “In Play”

A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for...

Read More »

Read More »

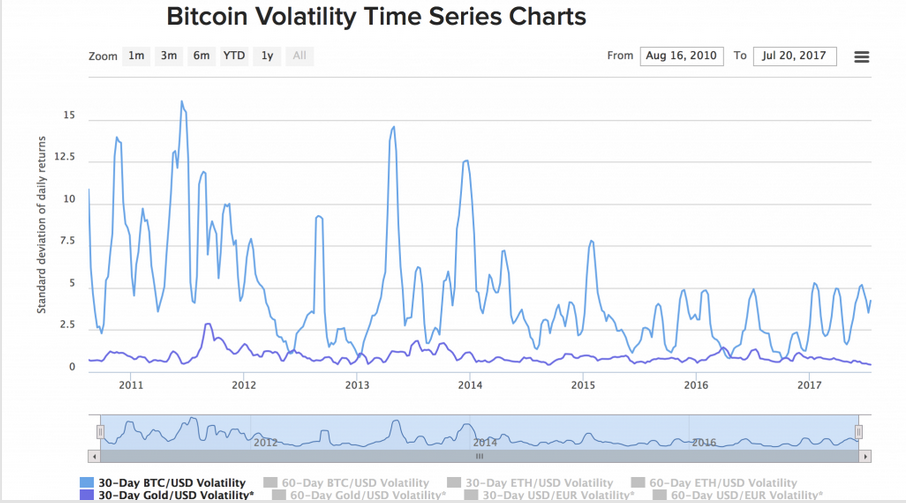

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization”

All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing of productive people for the benefit of unproductive people. They tax people, who have earned their income and accumulated their wealth by producing goods or services purchased voluntarily by consumers (and of course...

Read More »

Read More »

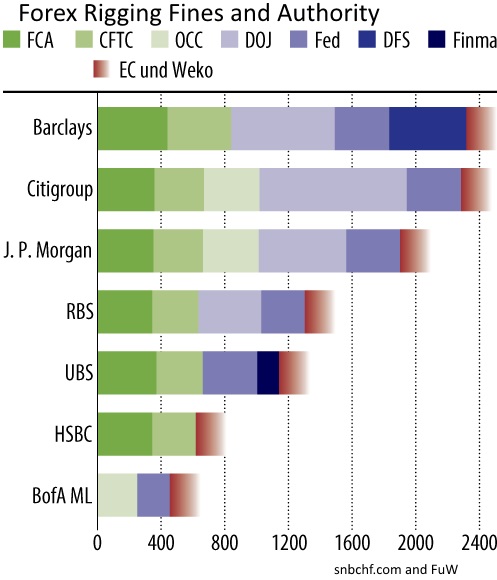

SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full.

Read More »

Read More »

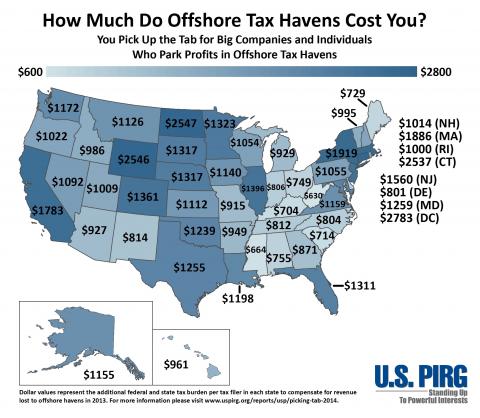

Panama Tax Haven Scandal: The Bigger Picture

The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Ass...

Read More »

Read More »

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »