Tag Archive: Emerging Markets

A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around.

Read More »

Read More »

EM Preview for the Week Ahead

We are beginning to become more constructive on EM. The main trigger for some optimism is the shifting US-China dynamic. In our view, the partial trade deal reveals weakness on the part of the US. Reports suggest China will begin pushing for all existing tariffs to be dropped as part of Phase 2, which would be very positive for EM. That is still likely months away but this shifting dynamic bears watching.

Read More »

Read More »

EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect.

Read More »

Read More »

Drivers for the Week Ahead

The dollar rally has been derailed by weak US data and rising recession fears. The September jobs data was not a game-changer and so we are left waiting for more clues. Believe it or not, the US economy remains solid; however, the US repo market has not fully normalized yet. The Chinese trade delegation arrives in Washington Thursday for two days of trade talks.

Read More »

Read More »

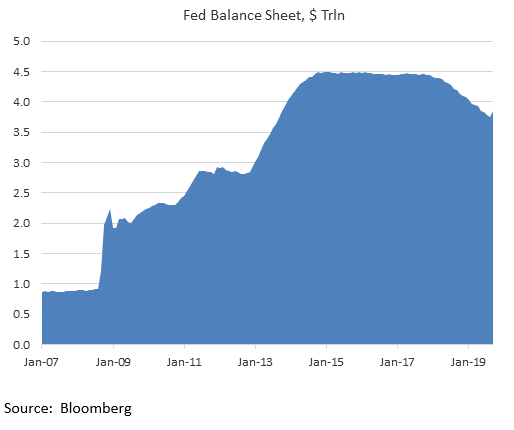

Musings on the Repo Market, Fed Policy, and the US Economy

The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid.

Read More »

Read More »

Drivers for the Week Ahead

We continue to think that the US economy is in better shape than most appreciate, and that underpins our strong dollar call. Tensions are likely to remain high after reports emerged last week that the US will look into limiting capital flows into China. US September jobs data Friday will be the data highlight of the week; there is a heavy slate of Fed speakers this week.

Read More »

Read More »

EM Preview for the Week Ahead

We think the Fed has signaled that the bar to another cut is high. Unless the US data weakens considerably, we see rates on hold for now and this means the liquidity story for EM has worsened. Elsewhere, US-China trade talks appear to be going nowhere. With no end in sight to the trade war, we remain negative on EM.

Read More »

Read More »

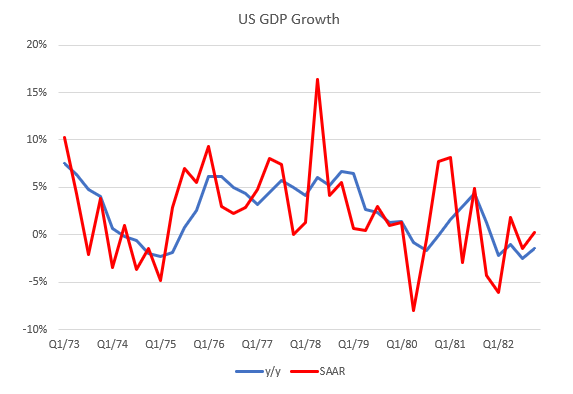

Some Thoughts on the Fed and Oil Shocks

Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken.

Read More »

Read More »

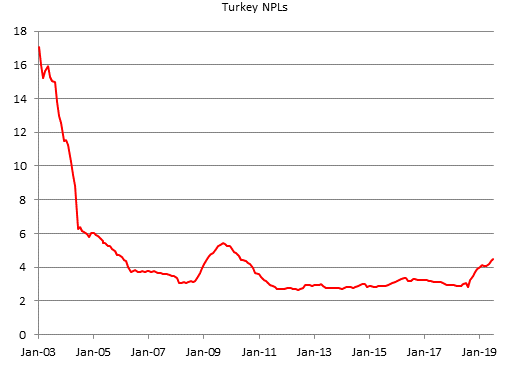

Turkey Monetary Policy Planting Seeds of Future Crisis

Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK

President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough.

Read More »

Read More »

EM Preview for the Week Ahead

Despite some positive developments last week, we think the three key issues for risk assets have not been resolved yet. Hong Kong protests continue, while reports suggest the US and China remain far apart. Even Brexit has likely been given only a three month reprieve. We remain negative on EM until these key issues have been ultimately resolved.

Read More »

Read More »

Latest Thoughts on the US Economic Outlook

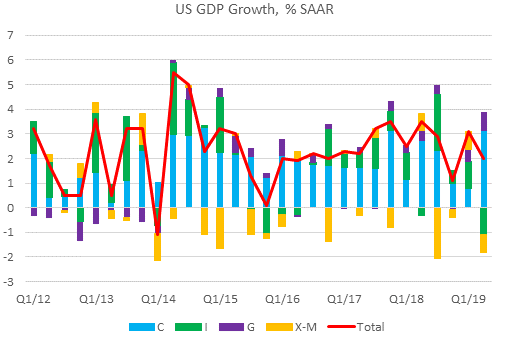

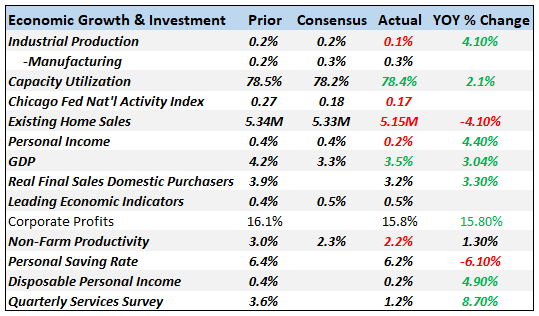

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising.

Read More »

Read More »

Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US. Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week. RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75%.

Read More »

Read More »

Emerging Markets: FX Model for Q3 2019

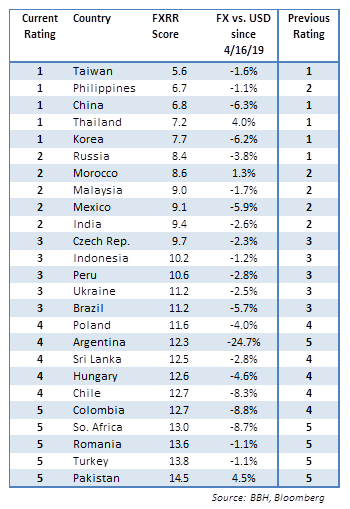

The broad-based dollar rally remains intact despite the market’s overly dovish take on the Fed. We still believe markets are vastly overestimating the Fed’s capacity to ease in 2019 and 2020. What’s clear is that the liquidity story is not enough to sustain EM. MSCI EM FX is on track to test the September 2018 low near 1575 and then the April 2017 low near 1568.

Read More »

Read More »

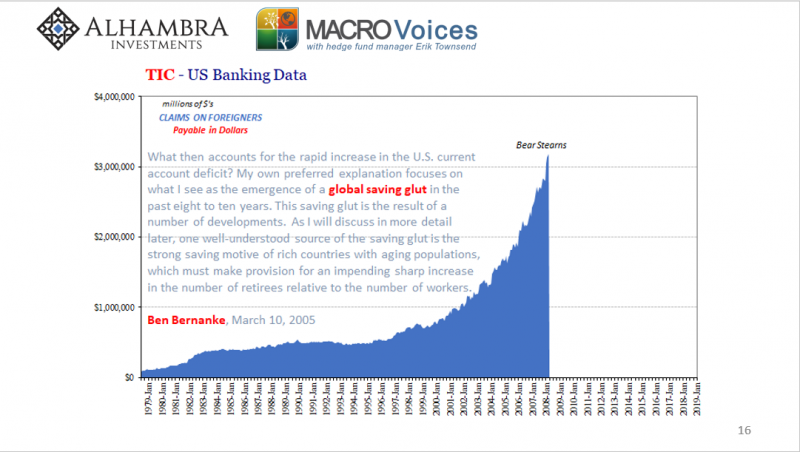

Why 2011

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing.

Read More »

Read More »

Living In The Present

It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable health care or Miami Dolphin playoff games? Will China’s economy succumb to the pressure of US tariffs and make a deal?

Read More »

Read More »

Emerging market currencies: idiosyncratic risks strike back

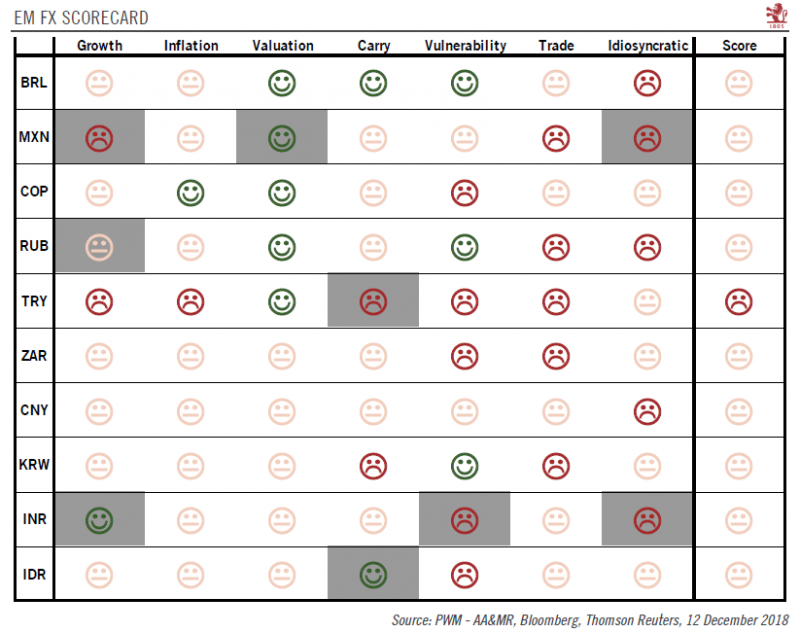

The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the...

Read More »

Read More »

Monthly Macro Monitor – November 2018

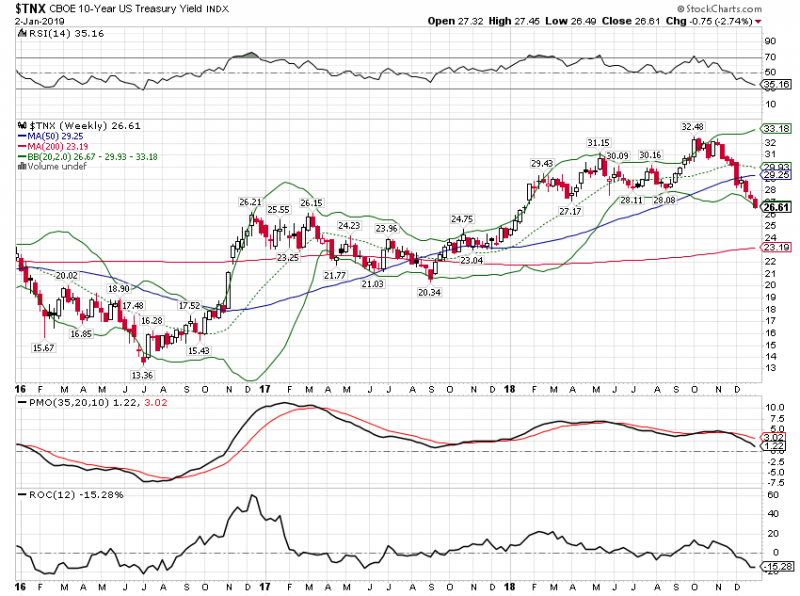

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral.

Read More »

Read More »

Cool Video: Bloomberg Clip from Discussion on Emerging Markets

In my first television appearance since joining Bannockburn Global Forex, I joined Tom Keene and Francine Lacqua on the Bloomberg set. In this nearly 2.5 min clip, we talk about the Indonesia rupiah and the dollar's move above the IDR15000 level for the first time since the 1997-1998 Asian financial crisis.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly.

Read More »

Read More »