Tag Archive: Emerging Markets

Emerging Market Preview for the Week Ahead

EM ended the week on a firm note, which should carry over into this week. The biggest near-term risk to EM is the US jobs data on Friday, as the weekly claims data points to another strong gain. Otherwise, the global liquidity backdrop remains EM-supportive. Thailand reported April CPI earlier today. It rose 0.07% year-over-year. …

Read More »

Read More »

FX Daily April 25: Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the … Continue reading...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a soft note. Perhaps the main driver was rising US yields, as markets become wary of a more hawkish Fed this Wednesday. Perhaps it was technical, as the EM rally became over-extended. Wh...

Read More »

Read More »

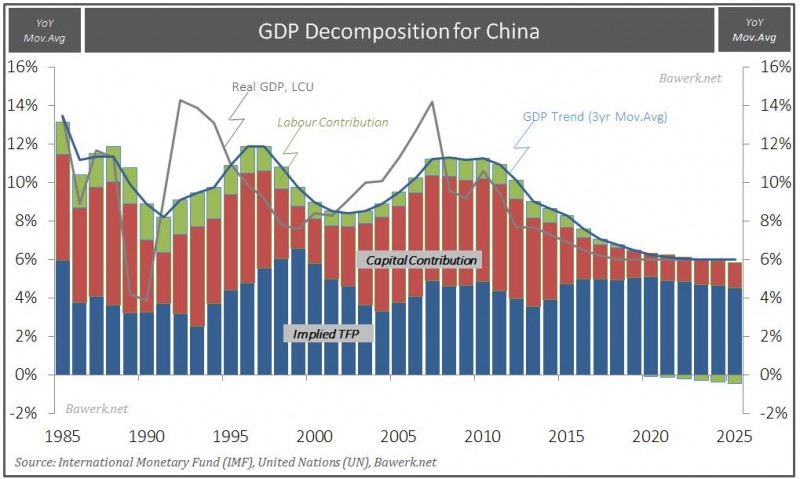

Chinese Dragon: Breathing Credit Fumes

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate.

Read More »

Read More »

Emerging Markets: What has Changed

(from my colleague Dr. Win Thin)China’s central bank may be leaning less dovish

Turkey has a new central bank governor

Argentina issued external debt for the first time since it defaulted 15 years ago

Brazil's lower house voted to impeach Preside...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a firm note. Given the absence of any Fed-specific risks or any major US data releases, that firmness could carry over into this week. The failure to reach an agreement in Doha by oil pro...

Read More »

Read More »

Weekly Emerging Markets: What has Changed

Bank Indonesia will use the 7-day reverse repo rate as its new benchmark policy rate The ruling party in South Korea unexpectedly lost parliamentary elections The Monetary Authority of Singapore eased monetary policy to recession settings Turkey has nominated its next central bank chief The Brazilian special lower house committee voted 38-27 in favor of …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed?...

Read More »

Read More »

Weekly Emerging Markets: What has Changed

Bank Indonesia signaled it may pause its easing cycle. Senior Deputy Governor Adityaswara said “We want to see the impact on growth and inflation before we do the next cut.” Elsewhere, Governor Martowardojo said that the central bank must be carefu...

Read More »

Read More »

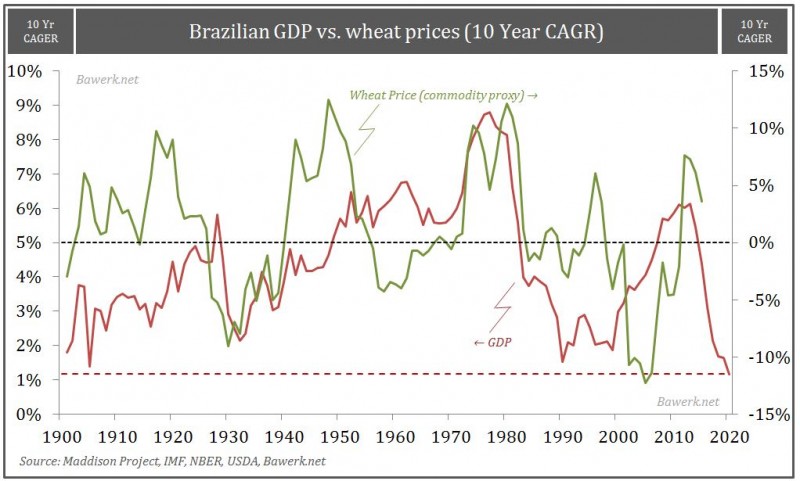

Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended the week on a mixed note after posting strong post-FOMC gains. The bounce in risk seems likely to continue this week, with little on the horizon to derail it. Specific country risk remains in play, however, with heightened political concerns in Brazil and South Africa. Taiwan reports February export orders Monday, which are …

Read More »

Read More »

Weekly Emerging Markets: What has Changed?

China press is reporting that policymakers are drafting rules for a so-called Tobin tax on yuan transactions. This would seem to go against China’s efforts at making the yuan more accessible and liquid. While it could deter speculative activity, th...

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM enjoyed an extended rally last week, and it should carry over to the early part of the week. The Wednesday FOMC meeting poses a risk to EM, especially if markets continue to price in a more hawkish Fed. The dot plots and press conference will be very important. BOE and the Norges Bank also … Continue reading »

Read More »

Read More »

Emerging Markets Preview: Week Ahead

(from my colleague Dr. Win Thin)Risk sentiment ended last week on a strong note, and that should carry over into this week. The global liquidity backdrop remains positive for EM, with the ECB widely expected to add more stimulus on Thursday. I...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, Brazil (+17.8%), Singapore (+7.1%), and India (+6.4%) have outperformed this week, while Qatar (+0.6%), Poland (+1.1%), and Malaysia (+1.7%) have underperformed. To put this in better context, MSCI EM rose 6.8% this week whil...

Read More »

Read More »

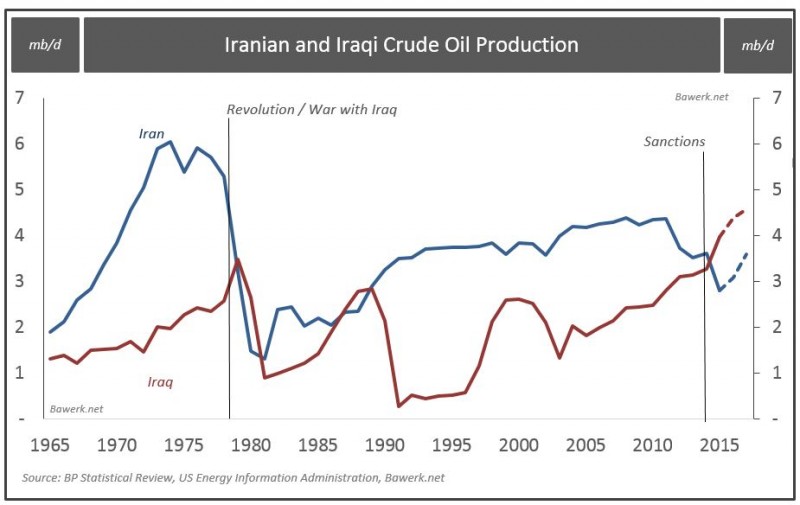

Revolutionary Guards: The Way of the Iranian Future

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for Pres...

Read More »

Read More »

Emerging Market Preview, First Week of March

EM ended last week on a soft note, due to a variety of both external and internal factors. Firm US data continue to support our call for resumed Fed tightening, and this gave the dollar a bit of a bid. With the dollar gaining against the majors, this spilled over into generalized dollar gains … Continue reading »

Read More »

Read More »

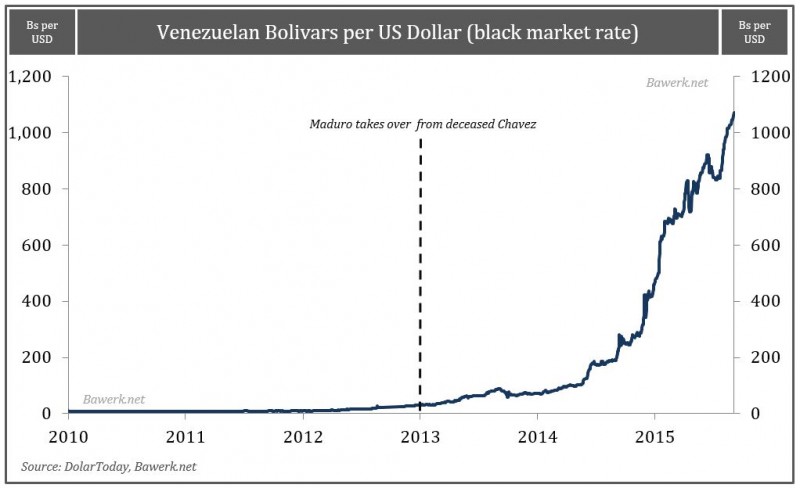

Can Maduro Mayhem Last to 2017

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legi...

Read More »

Read More »

Weekly Emerging Markets: What has Changed?

In the EM equity space, Colombia (+0.3%), Chile (+0.2%), and Poland (-0.6%) have outperformed this week, while India (-6.6%), Czech Republic (-5.5%), and Hong Kong (-5.0%) have underperformed. To put this in better context, MSCI EM fell -3.9% this w...

Read More »

Read More »