Tag Archive: economy

What Will Trump Do About The Central-Bank Cartel?

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

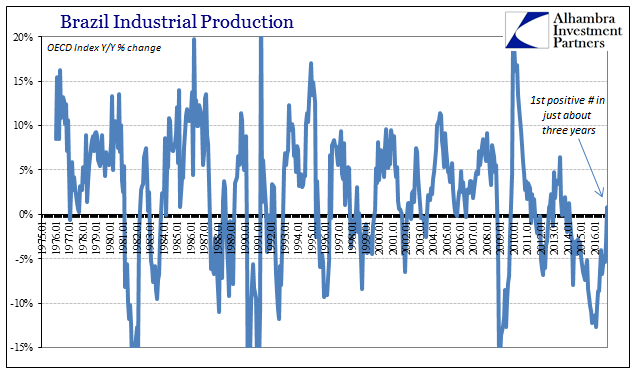

Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

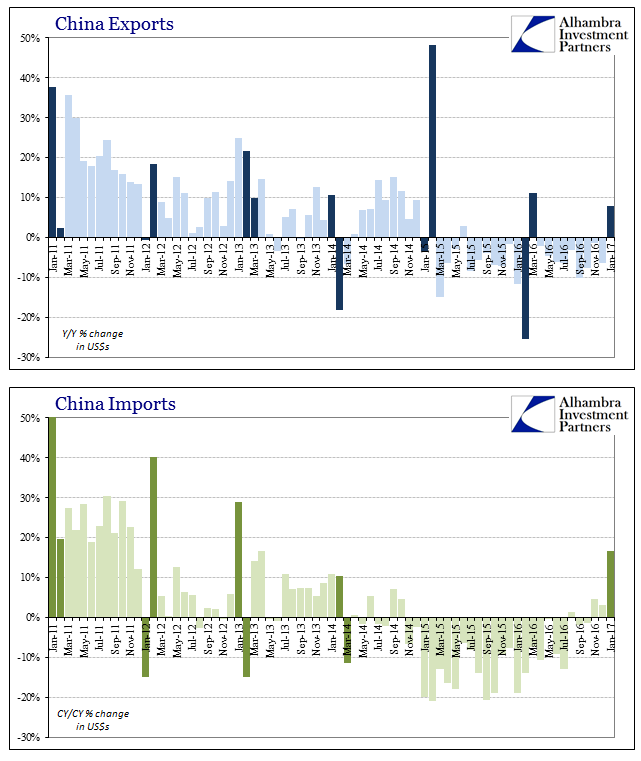

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »

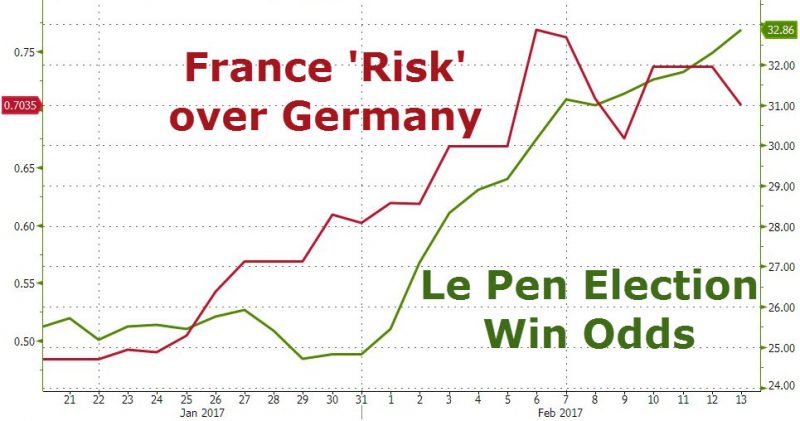

Martin Armstrong: “EU in Disintegration Mode”

Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong's piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that,

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

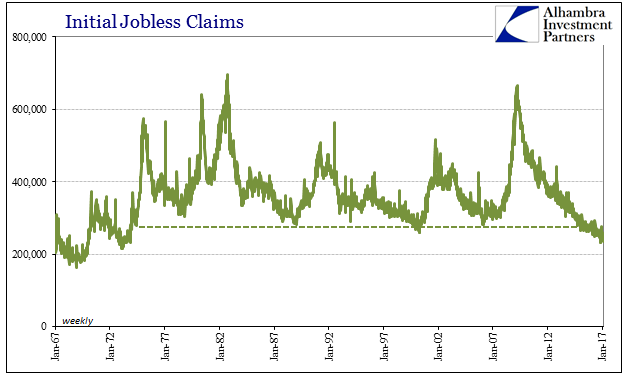

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

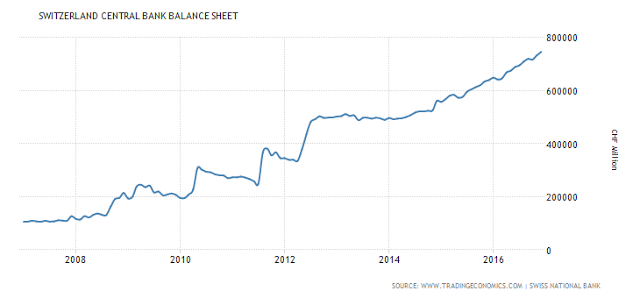

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

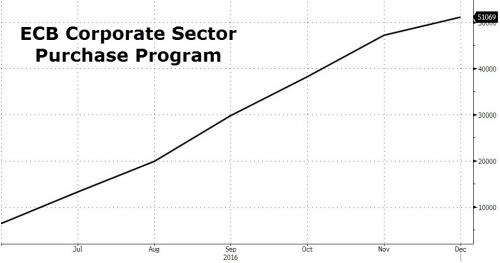

ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB's nationalization of the European corporate bond sector continues. In the ECB's latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding.

Read More »

Read More »

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

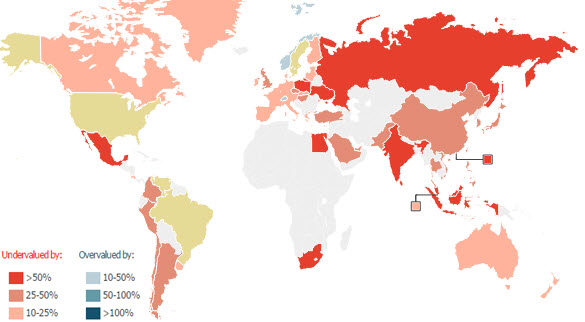

The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto.

Read More »

Read More »

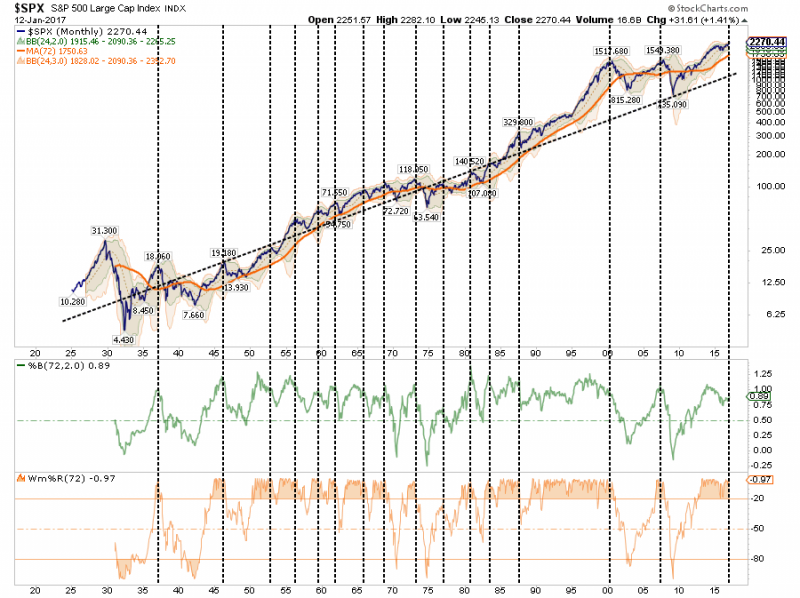

The Psychological Impact Of Loss

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising.

Read More »

Read More »

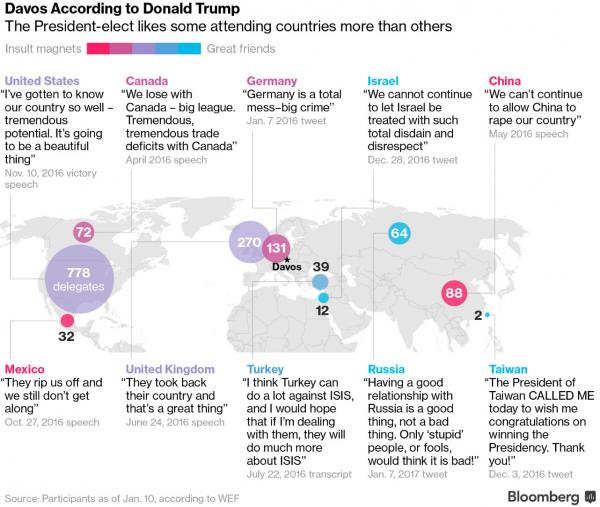

Davos (According To Donald Trump)

Bloomberg's Anne Swardson, Zoe Schneeweiss, and Andre Tartar perfectly summed up the state of play right now during their discussion of the World Economic Forum's annual get-together: "Never before has the gap between Davos Man and the real world yawned so widely."

Read More »

Read More »

Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system.

Read More »

Read More »

Lagarde Urges Wealth Redistribution To Fight Populism

As we scoffed oveernight, who better than a handful of semi, and not so semi, billionaires - perplexed by the populist backlash of the past year - to sit down and discuss among each other how a "squeezed and Angry" middle-class should be fixed. And so it was this morning as IMF Managing Director Christine Lagarde, Italian Finance Minister Pier Carlo Padoan and Founder, Chairman and Co-CIO of Bridgewater Associates, Ray Dalio, espoused on what's...

Read More »

Read More »

While Davos Elites Address Populism, Just “Eight Men Own Same Wealth As Half The World”

As political and business elite gather at the Swiss ski resort of Davos, a new report is shining light on the shocking reality of the wealth gap between the very rich and poor that is “pull our societies apart.” A report by Oxfam released ahead the World Economic Forum in Davos shows the gap between the ultra-wealthy and the poorest half of the global population is starker than previously thought, with just eight men owning as much wealth as 3.6...

Read More »

Read More »

Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum.

Read More »

Read More »

Davos: In Defense Of Populism

DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism, Pepper Spray Davos”

Read More »

Read More »