Tag Archive: economy

Pending Home Sales: Home Attitude Adjustments

The National Association of Realtors (NAR) reported today that pending home sales declined for the third straight month. As with so many other accounts, it’s not really the downside that is relevant but how instead there has been little to no growth for quite some time now. The NAR’s index value, which is how the organization reports the level of pending sales, was 108.5 in May 2017. That’s up 42% from the low in 2010, but also slightly less than...

Read More »

Read More »

Maybe Deep Dissatisfaction Has A Point

To complete a trifecta, maybe someone could interview Alan Greenspan about rational exuberance. The last of the latest Fed Chairmen, Janet Yellen, purports today that the next financial crisis will not be in “our lifetimes.” The issue, however, isn’t even crisis so much as credibility. Given that she and the rest of them had no idea about the last one until it was almost over, we might be forgiven for rejecting her thesis outright – and it having...

Read More »

Read More »

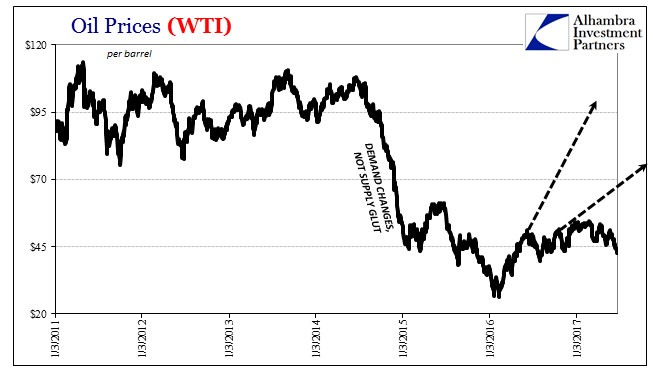

Oil Prices and Manufacturing PMI: No Backing Sentiment

When the price of oil first collapsed at the end of 2014, it was characterized widely as a “supply glut.” It wasn’t something to be concerned about because it was believed attributable to success, and American success no less. Lower oil prices would be another benefit to consumers on top of the “best jobs market in decades.”

Read More »

Read More »

Weird Obsessions

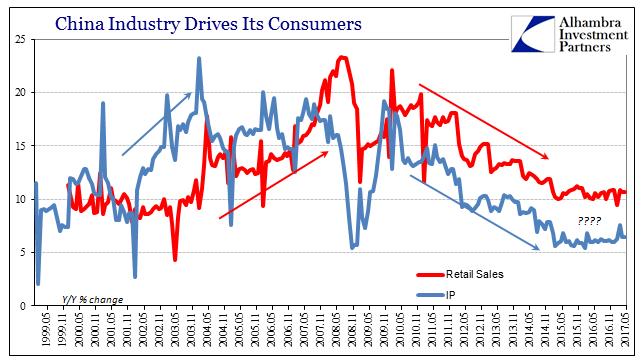

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

Read More »

Read More »

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

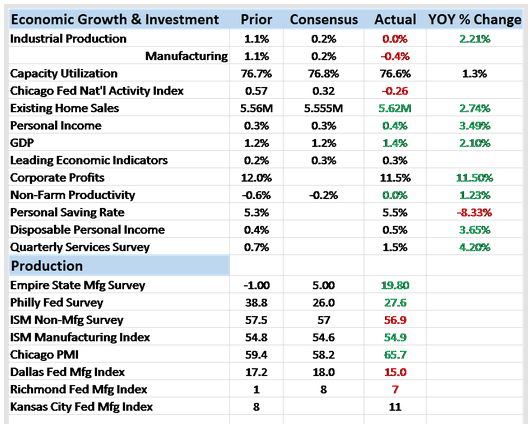

Bi-Weekly Economic Review: Draghi Moves Markets

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

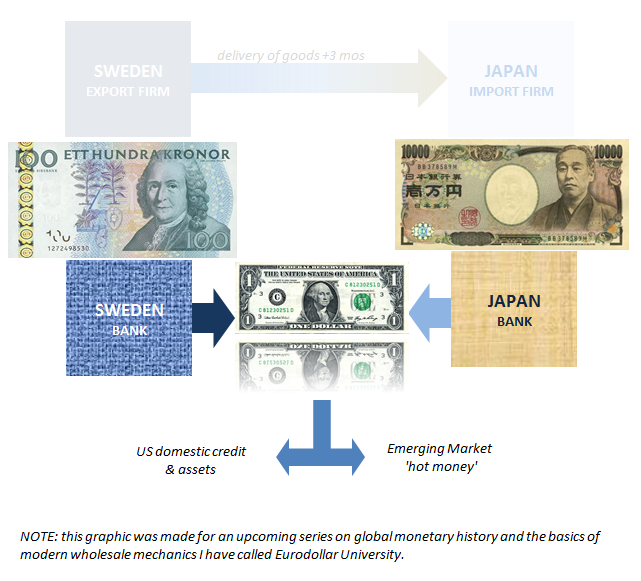

Brazil’s Reasons

Brazil is another one of those topics which doesn’t seem to merit much scrutiny apart from morbid curiosity. Like swap spreads or Japanese bank currency redistribution tendencies, it is sometimes hard to see the connection for US-based or just generically DM investors. Unless you set out to buy an emerging market ETF heavily weighted in the direction of South America, Brazil’s problems can seem a world away.

Read More »

Read More »

Basic China Money Math Still Doesn’t Add Up To A Solution

There are four basic categories to the PBOC’s balance sheet, two each on the asset and liability sides of the ledger. The latter is the money side, composed mainly of actual, physical currency and the ledger balances of bank reserves. Opposing them is forex assets in possession of the central bank and everything else denominated in RMB.

Read More »

Read More »

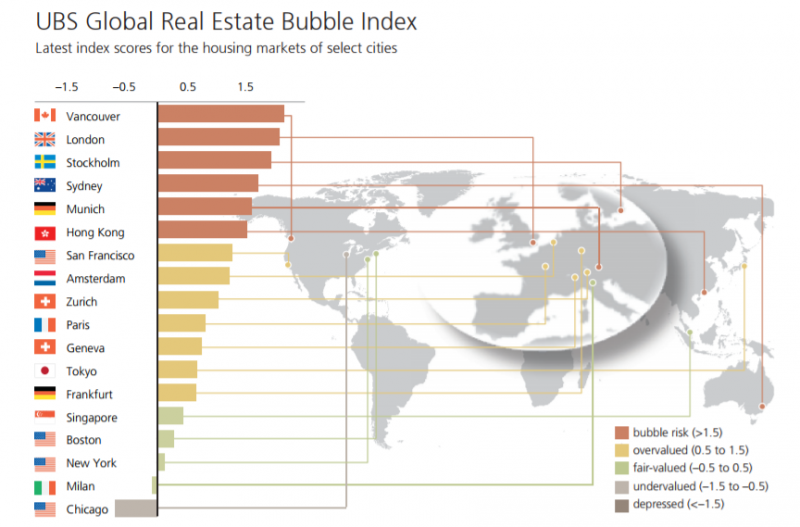

London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April.

Read More »

Read More »

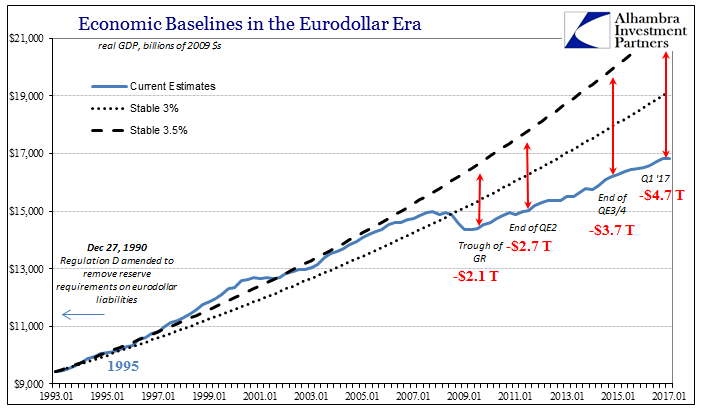

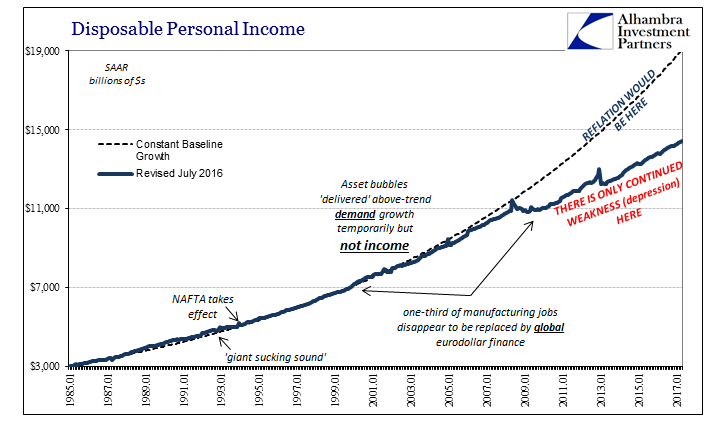

Fading Further and Further Back Toward 2016

Earlier this month, the BEA estimated that Disposable Personal Income in the US was $14.4 trillion (SAAR) for April 2017. If the unemployment rate were truly 4.3% as the BLS says, there is no way DPI would be anywhere near to that low level. It would instead total closer to the pre-crisis baseline which in April would have been $19.0 trillion. Even if we factor retiring Baby Boomers in a realistic manner, say $18 trillion instead, what does the...

Read More »

Read More »

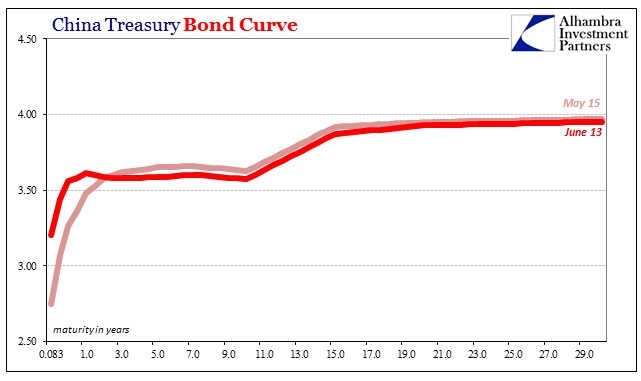

Now China’s Curve

Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Read More »

Read More »

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

More Pieces of Impossible

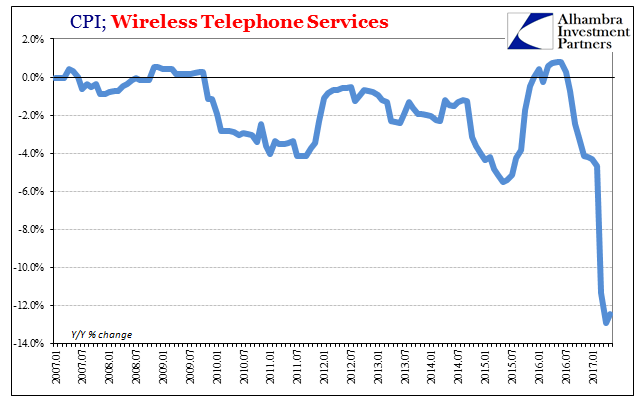

On his company’s earnings conference call back on Valentine’s Day, T-Mobile CEO John Legere was unusually feisty. Never known for shyness, Legere had reason behind his bluster. T-Mobile had practically built itself up on price, being left the bottom tier of the wireless space practically to itself. That all changed, however, as both Verizon and Sprint were set to escalate the wireless price war.

Read More »

Read More »

Chinese Basis For Anti-Reflation?

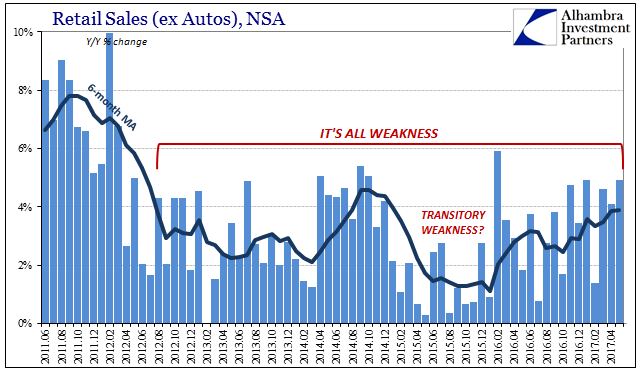

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

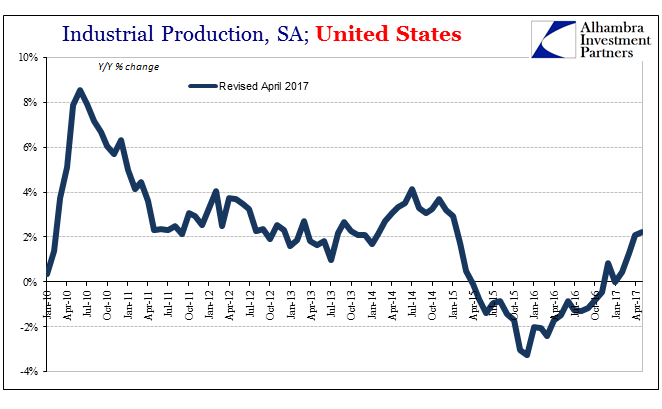

Defying Labels

Last month US Industrial Production rose rather quickly. Gaining more than 1.1% month-over-month, it might have appeared that the US economy once dragged into downturn by manufacturing and industry was finally about to experience its belated upturn. But frustration is how it has always gone, not just in this latest phase but for all phases since around 2011. Each good month is followed immediately by a disappointing one. What should be...

Read More »

Read More »

Repeat 2015; An Embarrassing Day For The Fed

Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

Read More »

Read More »

Retail Sales Weren’t All That Bad, Meaning They Were The Worst

Taken in comparison to the last few years, today’s retail sales report wasn’t that bad. Total sales for May 2017, including autos, grew by 5.17% year-over-year (NSA). That was the highest growth rate since last February. The 6-month average is now just shy of 4%, the best since early 2015. It is clear the US economy has shrugged off the effects of last year’s downturn.

Read More »

Read More »

Repeat 2014: Praying Again To The God of ‘Global Growth’

One of the more troubling aspects of mainstream commentary in 2014 was its blandness. Statements were made with a purpose but also purposefully avoiding specifics. It was common to hear or read “the economy is improving” without being shown why or how in convincing fashion. After suffering a second bout of weakness in 2012 and 2013, unexpected of course, everyone simply believed those words because why not.

Read More »

Read More »

The ‘Dollar’ Devil Shows Itself Again In China

Some economic and financial conditions leave a yield curve as a more complex affair.Then there are others that are incredibly simple.The UST yield curve is the former, while right now the Chinese Treasury curve is the latter.

Read More »

Read More »