Tag Archive: economy

From JOLTS Series Shift To Series of Rate Cuts

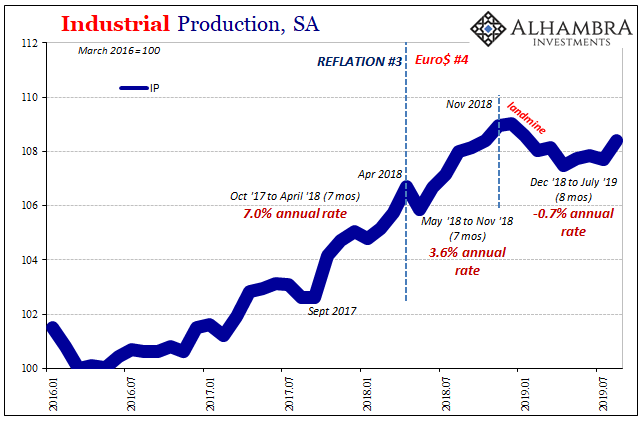

I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it.

Read More »

Read More »

Head Faking In The Empty Zoo: Powell Expands The Balance Sheet (Again)

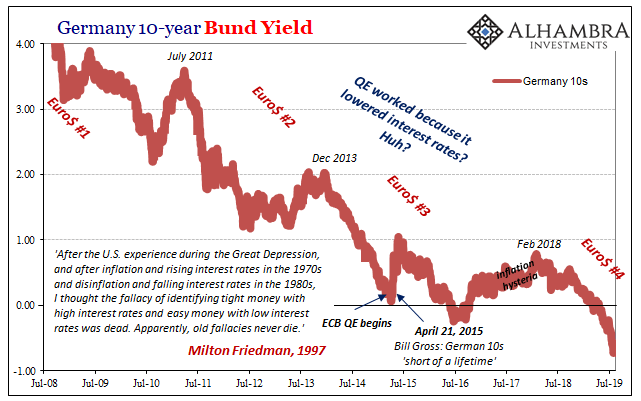

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing.

Read More »

Read More »

The Consequences Of ‘Transitory’

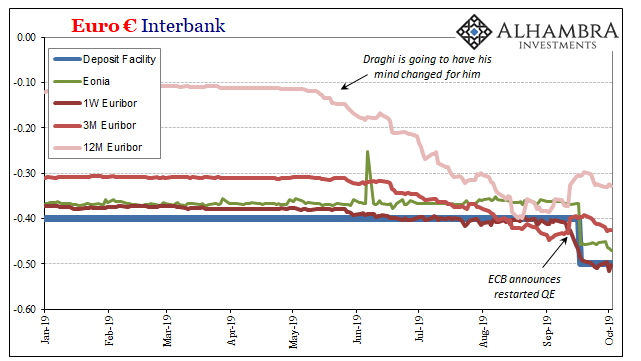

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Read More »

Read More »

Big Trouble In QE Paradise

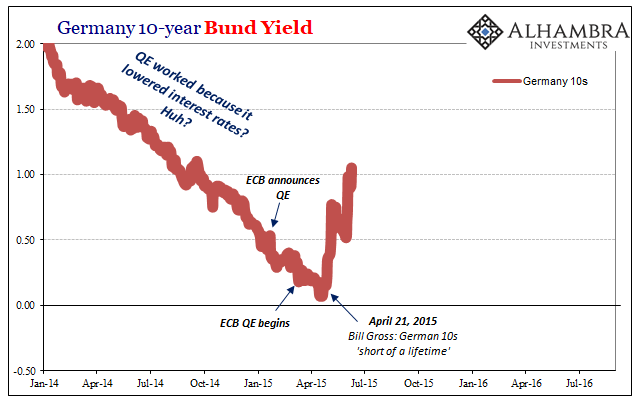

Maybe it was a sign of things to come, a warning how it wasn’t going to go as planned. Then again, when it comes to something like quantitative easing there really is no plan. Other than to make it sound like there is one, that’s really the whole idea. Not what it really is and what it actually does, to make it appear like there’s substance to it.

Read More »

Read More »

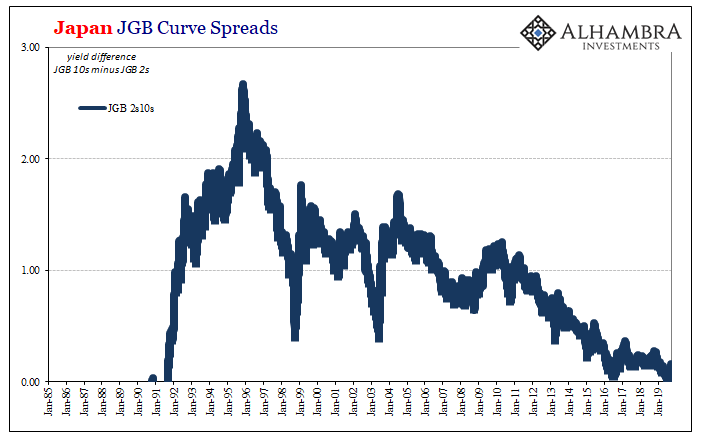

Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more.

Read More »

Read More »

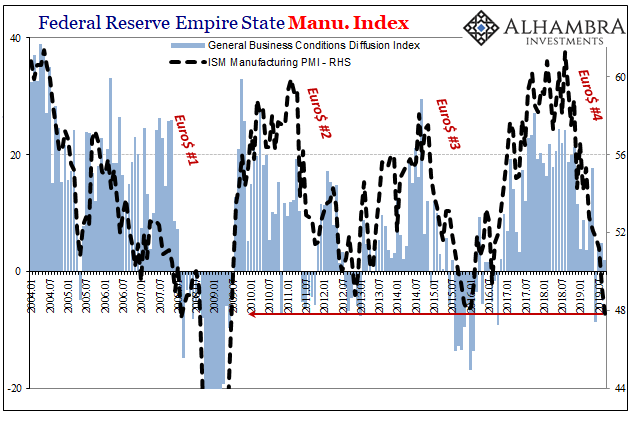

ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers.

Read More »

Read More »

The Big Picture Doesn’t Include ‘Trade Wars’

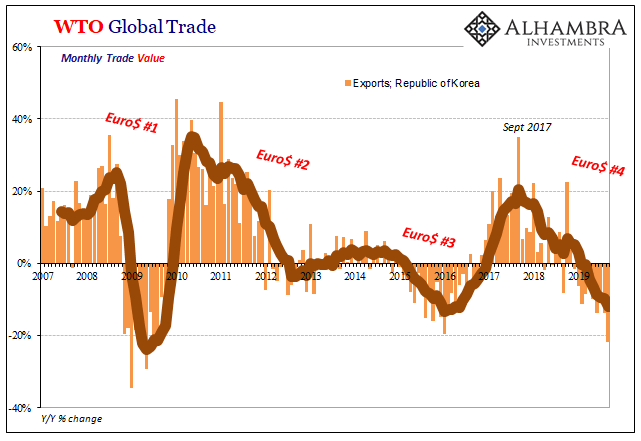

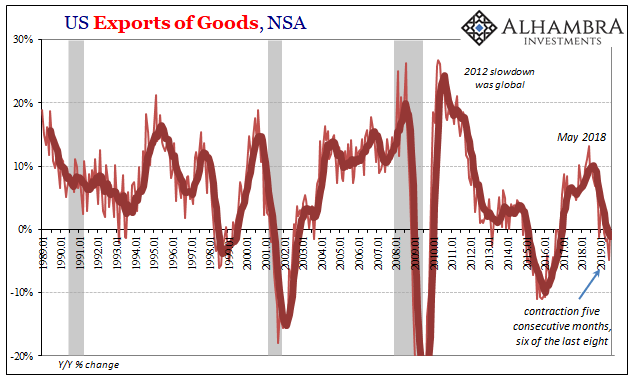

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors.

Read More »

Read More »

ISM Spoils The Bond Rout!!!

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out.

Read More »

Read More »

Waiting on the Calvary

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction.

Read More »

Read More »

Money Markets: Sizing Up the Cavalry

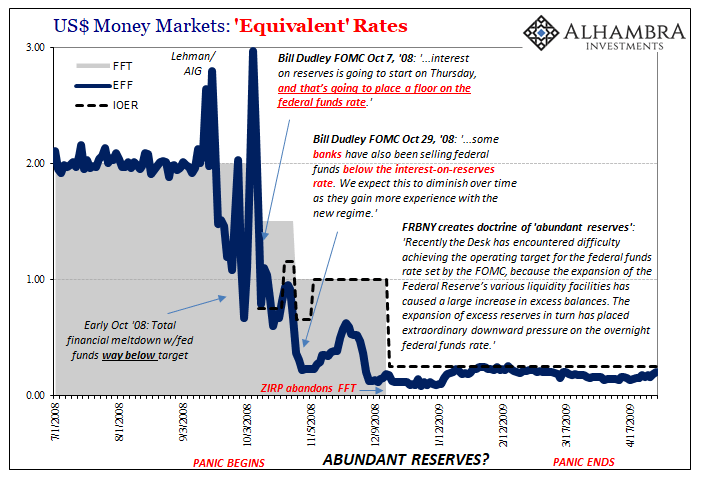

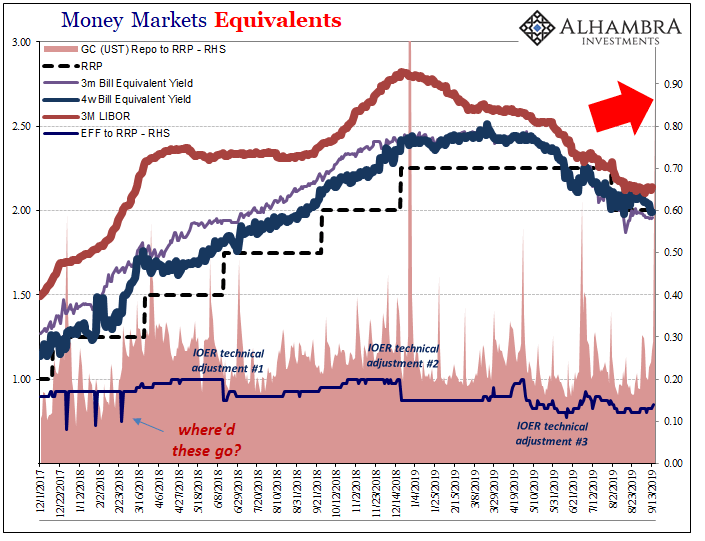

There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press.

Read More »

Read More »

No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their...

Read More »

Read More »

More Than A Decade Too Late: FRBNY Now Wants To Know, Where Were The Dealers?

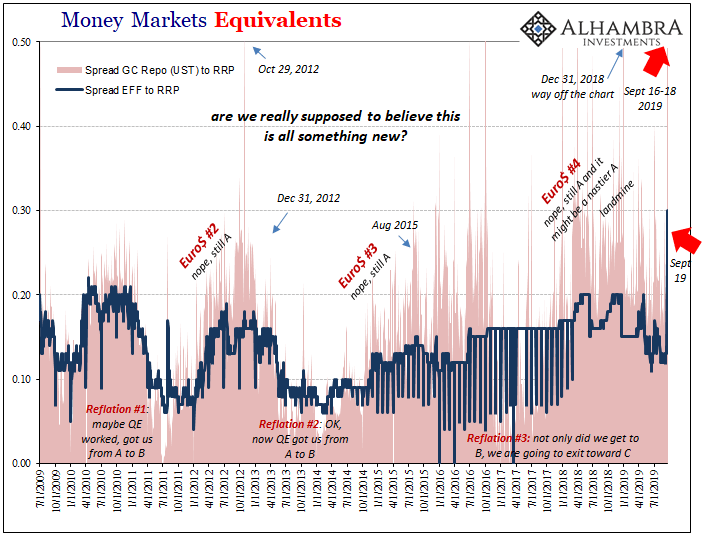

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global.

Read More »

Read More »

What’s The Verdict On This Week?

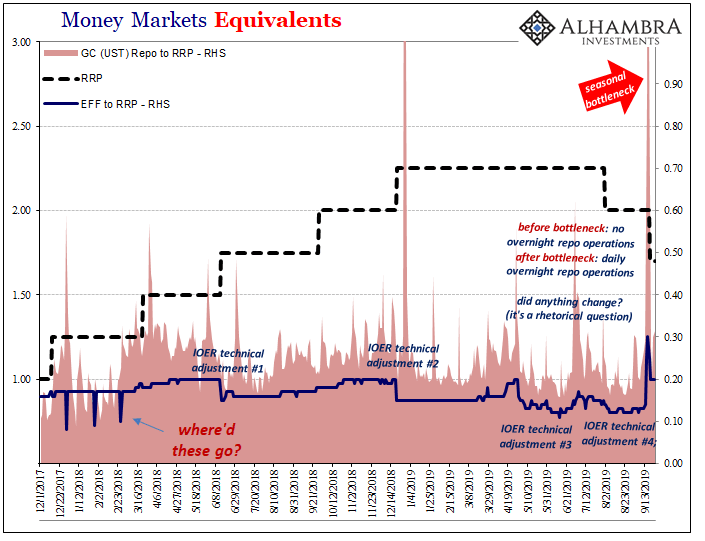

Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it.

Read More »

Read More »

Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession.

Read More »

Read More »

Where The Global Squeeze Is Unmasked

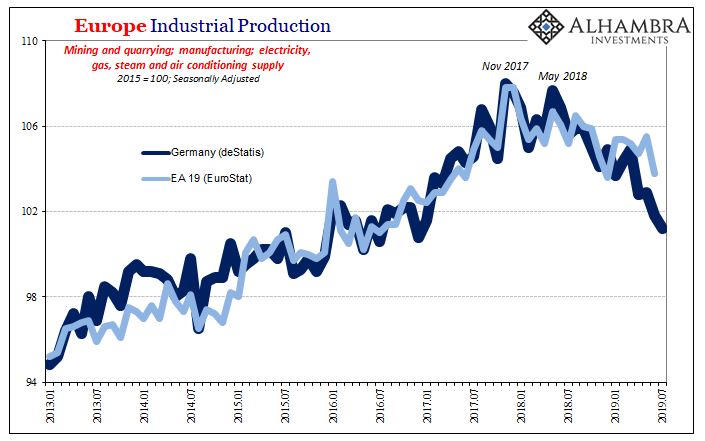

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances.

Read More »

Read More »

Stuck at A: Repo Chaos Isn’t Something New, It’s The Same Baseline

Finally, finally the global bond market stopped going in a straight line. I write often how nothing ever does, but for almost three-quarters of a year the guts of the financial system seemed highly motivated to prove me wrong. Yields plummeted and eurodollar futures prices soared. It is only over the past few weeks that rates have backed up in what has been the first real selloff since last year.

Read More »

Read More »

Your Unofficial Europe QE Preview

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking.

Read More »

Read More »

The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

Read More »

Read More »

Dollar (In) Demand

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness.

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »