Tag Archive: economy

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

Weekly Market Pulse: Big Rate Cuts? Not Right Now

“I think we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September”. “If you look at any model” it suggests that “we should probably be 150, 175 basis points lower.”

Treasury Secretary Scott Bessent in a Bloomberg interview, 8/13/25

President Trump and others in his administration have been pushing for lower interest rates for months – one wonders what they’re worried about – and are doing and saying...

Read More »

Read More »

Weekly Market Pulse: The Turkey Leg

Note: I wrote most of this commentary prior to the US strike on Iran and I decided to go ahead with it anyway. I don’t know any more than you do about what is going on in the Middle East and trying to predict what will happen in the coming days and weeks is a fool’s errand. We have a strategic allocation to commodities in our portfolios exactly because we can’t predict things like this.

Read More »

Read More »

Weekly Market Pulse: No Free Lunches

Moody’s Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable New York, May 16, 2025 — Moody’s Ratings (Moody’s) has downgraded the Government of United States of America’s (US) long-term issuer and senior unsecured ratings to Aa1 from Aaa and changed the outlook to stable from negative.

Read More »

Read More »

Weekly Market Pulse: On The Road Again

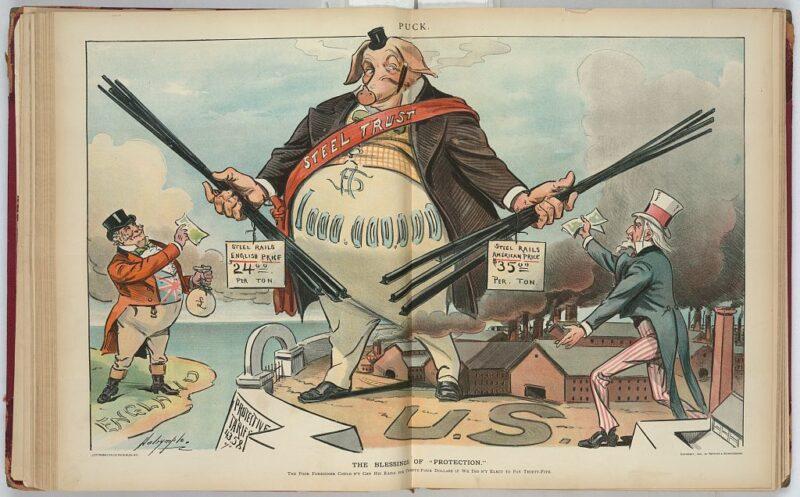

“Our freedom of choice in a competitive society rests on the fact that, if one person refuses to satisfy our wishes, we can turn to another. But if we face a monopolist we are at his absolute mercy.

Read More »

Read More »

Speculator Or Investor? 10-Rules From Legendary Investors

Are you a "speculator" or an "investor"? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles.

Read More »

Read More »

Weekly Market Pulse: Tune Out The Noise

Okay, I confess. It was my fault. I decided to take a couple of days off. I took my eye off the ball and the stock market fell a quick 2% while I was relaxing, eating too much, and seeing some great art in the Holy City, Charleston, SC. I promise it won’t happen again, at least until my wife tells me where we’re going next.

It is a running joke within Alhambra that every time I go away for a few days the market takes a hit. Of course, that isn’t...

Read More »

Read More »

Weekly Market Pulse: Questions

As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual.

Read More »

Read More »

Weekly Market Pulse: Did The Fed Just Make A Mistake?

Well, they did it. The Fed cut the Fed Funds rate by 50 basis points last week and indicated that there is likely more to come. Stock investors liked it, bidding up small cap stocks (S&P 600) by 2.25%, large caps (S&P 500) by 1.4% and the NASDAQ by 1.5%.

Read More »

Read More »

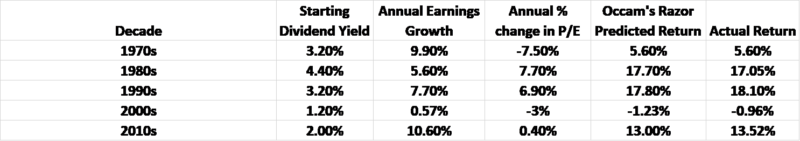

S&P 500 – A Bullish And Bearish Analysis

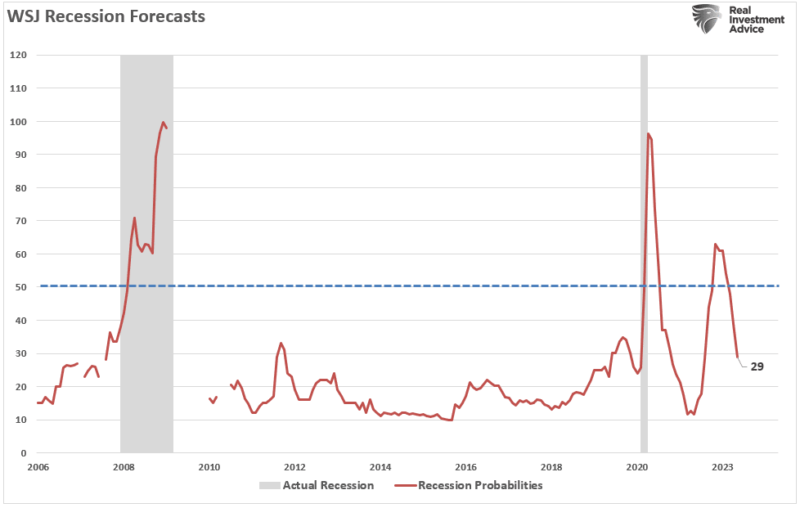

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

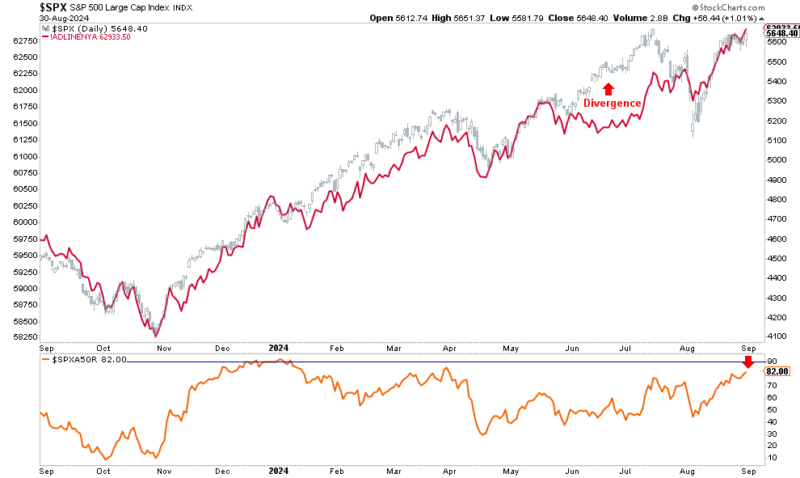

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

Weekly Market Pulse: It’s An Uncertain World

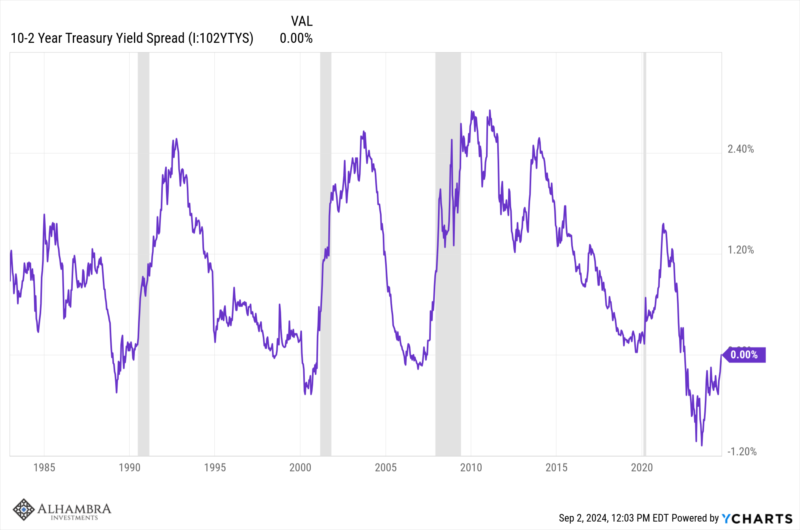

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year.

Read More »

Read More »

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

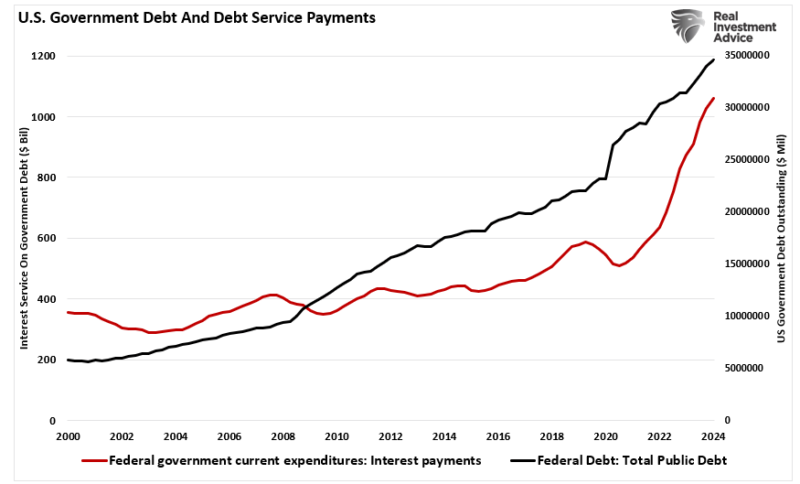

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

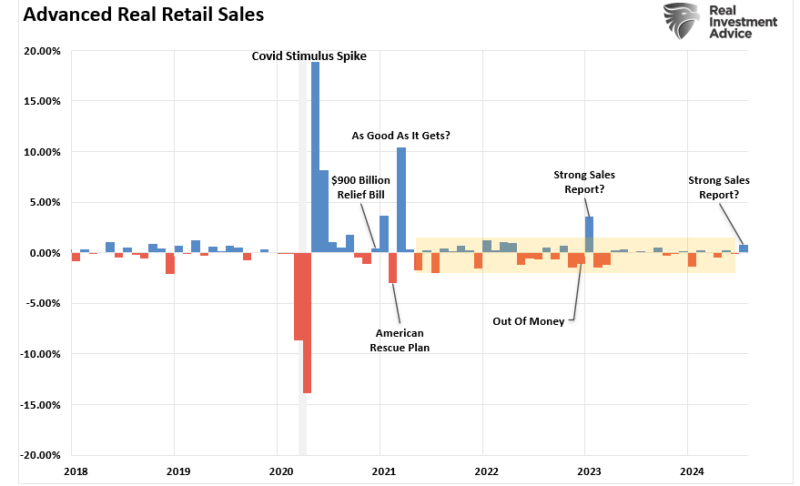

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

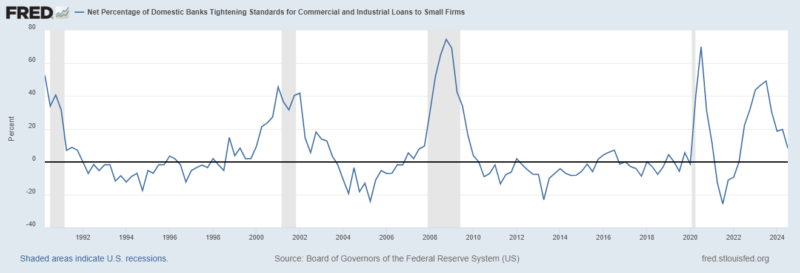

Market Morsel: SLOOSing

The Senior Loan Officer Survey came out yesterday and I’m sure you’ve been waiting on pins and needles, as I have, to see the results. Okay, maybe you had better things to do. I sure hope so because it isn’t exactly riveting.

Read More »

Read More »

Q3 Cyclical Outlook

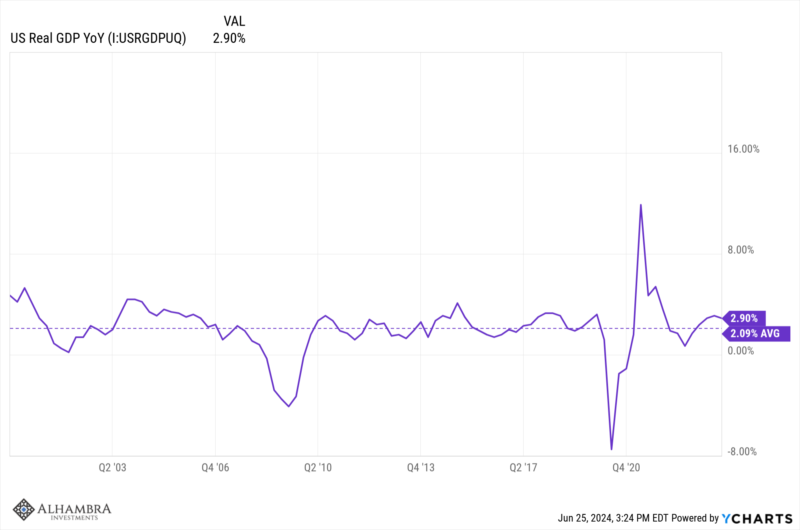

Growth peaked on a quarter over quarter seasonally adjusted annual rate in Q3 last year at 4.9%. The preferred reading is on an annual basis where growth peaked in Q4 of last year at 3.13%. Growth in Q1 was 2.88% and growth in Q2 has risen some and is trending at right about 3%.

Read More »

Read More »

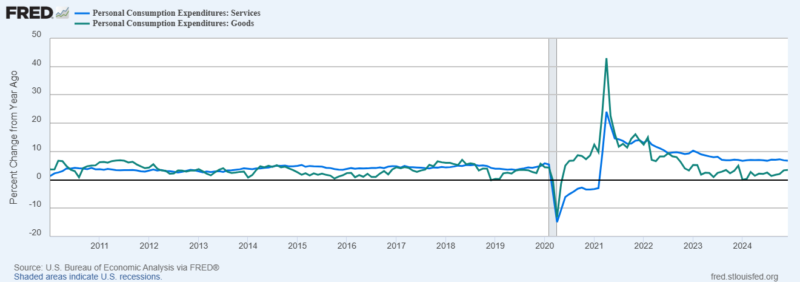

Weekly Market Pulse: The Sober Spending Of Drunken Sailors

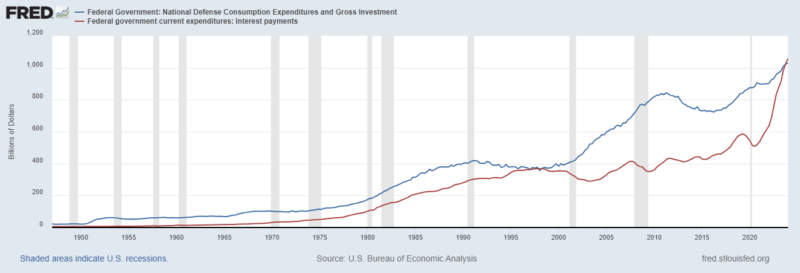

Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.

Read More »

Read More »

Wichtige Trends für Schweizer Investoren

Die Finanzmärkte durchlaufen derzeit eine Phase beträchtlicher Veränderungen, die von verschiedenen globalen und lokalen Faktoren beeinflusst werden. Wirtschaftliche Unsicherheiten und geopolitische Spannungen haben die Märkte volatiler gemacht, was sowohl Risiken als auch Chancen für Investoren mit sich bringt. Insbesondere die Schweizer Wirtschaft, bekannt für ihre Stabilität und Robustheit, muss sich an diese neuen Herausforderungen anpassen, um...

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »