Tag Archive: Economics

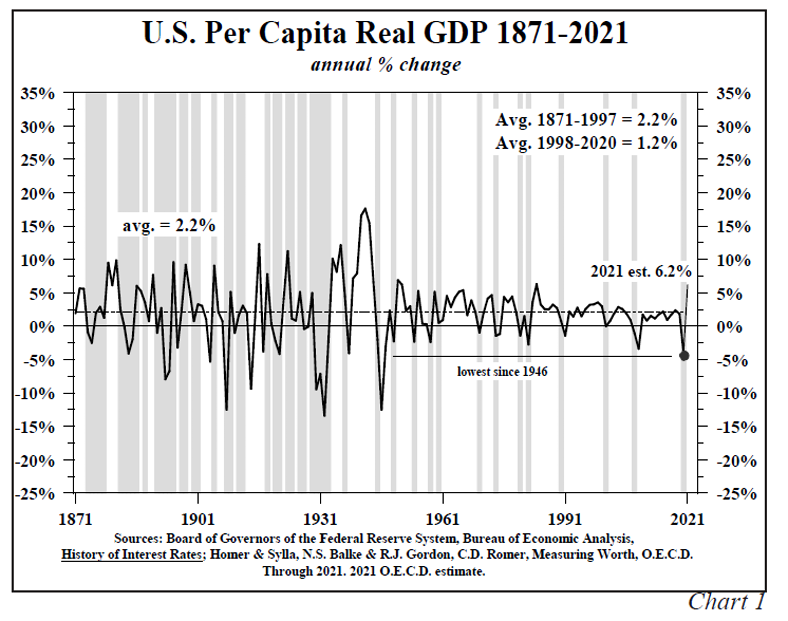

Reality check: The “miracle recovery” narrative

Over the last few weeks, we’ve been constantly bombarded by news reports and “expert” analyses celebrating an incredible global economic recovery. They’re not even presented as projections or expectations anymore, but as a fact, as though the return to vibrant growth is already underway.

Read More »

Read More »

Lacy Hunt & Expectations For Decelerating Inflation

Lacy Hunt at Hoisington Management has some interesting thoughts regarding the inflation debate and the potential for decelerating inflation. Case For Decelerating Inflation In its Quarterly Review and Outlook for the First Quarter of 2021 Lacy Hunt makes a case for decelerating inflation.

Read More »

Read More »

Precious metals are and always have been the ultimate insurance

As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens that were...

Read More »

Read More »

The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things.

Read More »

Read More »

“Self-control and self-respect have become undervalued”

After a year of lockdowns, social isolation, financial uncertainty and extreme political polarization, a lot of people are finding it very difficult to remain optimistic and to see a way back to some kind of normalcy. While the economic, social and political impact of the covid crisis can be easily identified and frequently discussed, the unseen, psychological pressures that millions of people are struggling with often go undiscussed.

Read More »

Read More »

“The bank and the government have essentially blended into one entity”

A lot has been said and written about the impact of the Covid crisis on the global economy and on the prospects of a strong recovery in 2021. Especially since the start of the year, there seems to be a consensus among government officials, institutional leaders and mainstream market analysts and pundits, pointing to an extremely positive outlook.

Read More »

Read More »

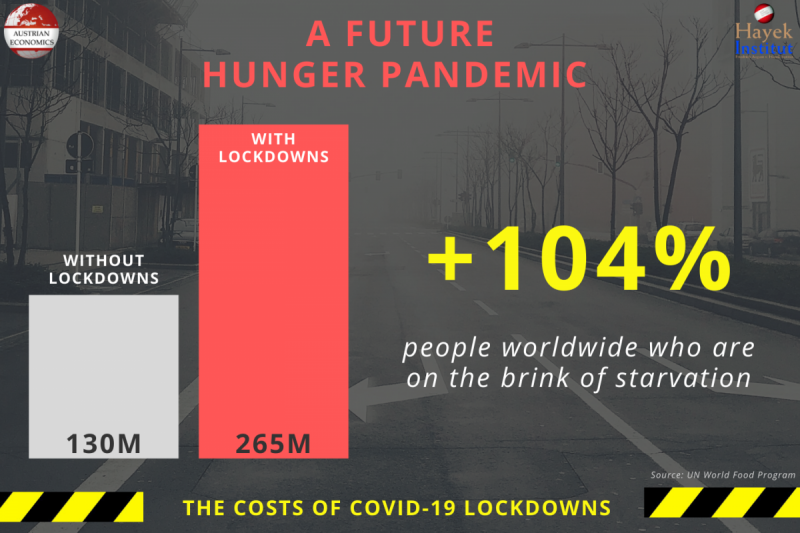

A Future Hunger Pandemic

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

Swiss direct democracy in action

On the last Sunday of November the Swiss citizens once again rejected efforts staged by left-leaning groups and NGOs to chip away at the nation’s long tradition of free enterprise, respect for private property and financial freedom. Two important proposals were brought before the Swiss people in a set of referendums, both targeting private companies and attempting to place unprecedented burdens, threatening their ability to operate freely and...

Read More »

Read More »

The Costs of Coronavirus Lockdowns

Throughout the next weeks, we will regularly feature statistics showing some of the costs of the prevailing lockdown politics. This article is an introduction to this new series. All over Europe, life has come to a halt again. As a second wave of Coronavirus infections has arrived, social and economic life has largely once more, as was already the case in spring when COVID-19 first spread across the world.

Read More »

Read More »

The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West.

Read More »

Read More »

“Gold is Money, Everything Else Is Credit” – J.P. Morgan

By now it is probably obvious, even to the most naive of mainstream narrative followers, that we are well past the point of no return on many fronts. Politics, on a national and global level, are never getting back to “normal”, the economy is already knee-deep in a severe recession, while social frictions and public discontent with governments, institutions and all kinds of rulers and central planners is on a sharp and dangerous trajectory.

Read More »

Read More »

Unless the US stops printing money, the dollar will collapse

Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about?

Read More »

Read More »

“Unless the US stops printing money, the dollar will collapse.”

We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss.

Read More »

Read More »

We don’t have to kill the king, if we just can ignore the king

“The right of self-determination in regard to the question of membership in a state thus means: whenever the inhabitants of a particular territory, whether it be a single village, a whole district, or a series of adjacent districts, make it known, by a freely conducted plebiscite, that they no longer wish to remain united to the state to which they belong at the time, but wish either to form an independent state or to attach themselves to some...

Read More »

Read More »

How High is Too High for Rising Government Bond Yields?

2021-02-27

by Stephen Flood

2021-02-27

Read More »