Tag Archive: ECB

FX Daily, March 25: Relief, but…

Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan's Nikkei's 8% gain. It was third consecutive gain, during which time the Nikkei has rallied 17%. Europe's Dow Jones Stoxx 600 is up about 3.5% after bouncing 8.4% yesterday.

Read More »

Read More »

FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Overview: In HG Wells' "War of the Worlds," the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities.

Read More »

Read More »

FX Daily, March 20: Markets Ending the Week on Better Note

Overview: Dramatic price action continues but in the other direction. Stocks and bonds have rallied strongly, and the US dollar is snapping a strong advance with a sharp and broad setback. The immediate trigger is hard to identify. Some accounts linking it to fears that the California shutdown will be repeated throughout the country, deepening the coming downturn.

Read More »

Read More »

FX Daily, March 19: ECB’s Bazooka Support Bonds but not the Euro

Overview: It is not just that the dollar soared while stocks and bonds continued to plunge. The dollar's strength is, in effect, a powerful short-covering rally. It was used to fund a great part of the global circuit of capital. The circuit of capital is in reverse now, and the funding currency is being bought back. The dollar's strength is a function of the sell-off of other assets.

Read More »

Read More »

FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and the Reserve Bank of Australia is preparing for new measures that will be announced Thursday.

Read More »

Read More »

FX Daily, March 12: Trump Dump as Market Turns to ECB

Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump's national address in the Asian session failed to reassure investors.

Read More »

Read More »

FX Daily, March 4: Equities Trade Higher, While Yields Continue to Fall

Overview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday's dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the markets closed, equities began recovering, and the recovery carried over to the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, January 23: ECB’s Strategic Review and the Coronavirus Command Investors’ Attention

The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China's week-long Lunar New Year celebration when markets will be closed, which may have also spurred today's drama that aw the Shanghai Composite tumbled 2.75%, bringing the week's loss to 3.2%, the most in five months.

Read More »

Read More »

FX Weekly Preview: Central Bank Meetings Featured

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion.

Read More »

Read More »

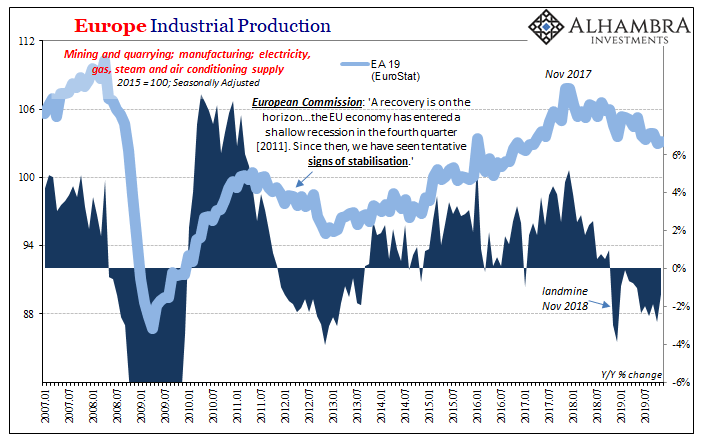

Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global...

Read More »

Read More »

FX Daily, January 16: Markets Look for New Cues with US-China Trade Pact Signed

Overview: The global capital markets are calm today as investors await fresh trading incentives. New record highs in the US equity indices gave Asia Pacific stocks a lift, though China and Taiwan were notable exceptions. Europe's Dow Jones Stoxx 600 is firm new record highs set last week. US equities are edging higher in Europe. Benchmark bond yields are little changed.

Read More »

Read More »

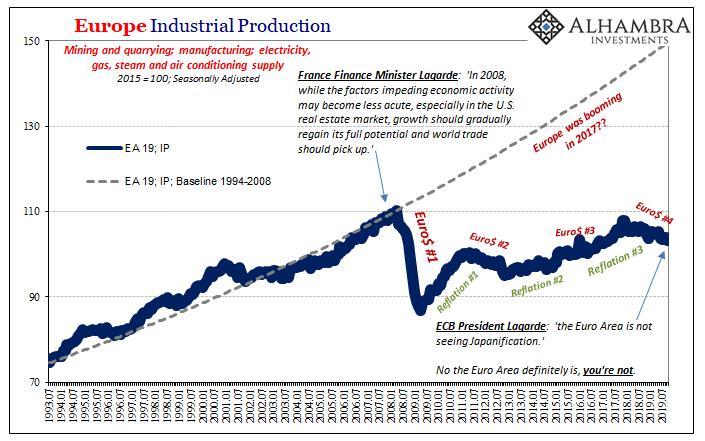

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

You Will Never Bring It Back Up If You Have No Idea Why It Falls Down And Stays Down

It wasn’t actually Keynes who coined the term “pump priming”, though he became famous largely for advocating for it. Instead, it was Herbert Hoover, of all people, who began using it to describe (or try to) his Reconstruction Finance Corporation. Hardly the do-nothing Roosevelt accused Hoover of being, as President, FDR’s predecessor was the most aggressive in American history to that point, economically speaking.

Read More »

Read More »

FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year.

Read More »

Read More »

The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies.

Read More »

Read More »

FX Weekly Preview: Is Conventional Wisdom Too Optimistic?

There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations.

Read More »

Read More »

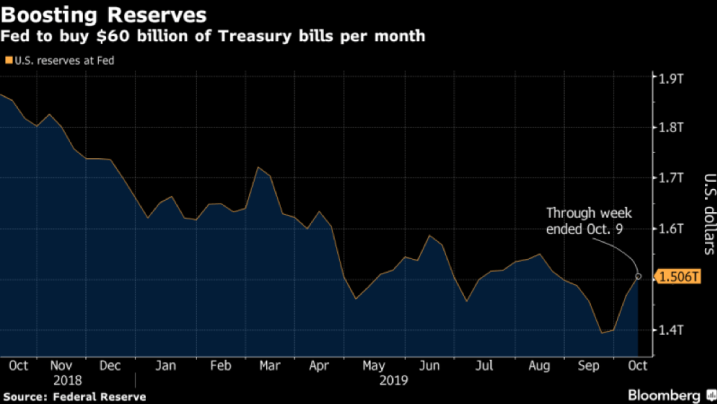

QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since.

Read More »

Read More »

FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU.

Read More »

Read More »

The Growing Opposition Against the ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone.

Read More »

Read More »