Tag Archive: earnings

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

S&P 500 – A Bullish And Bearish Analysis

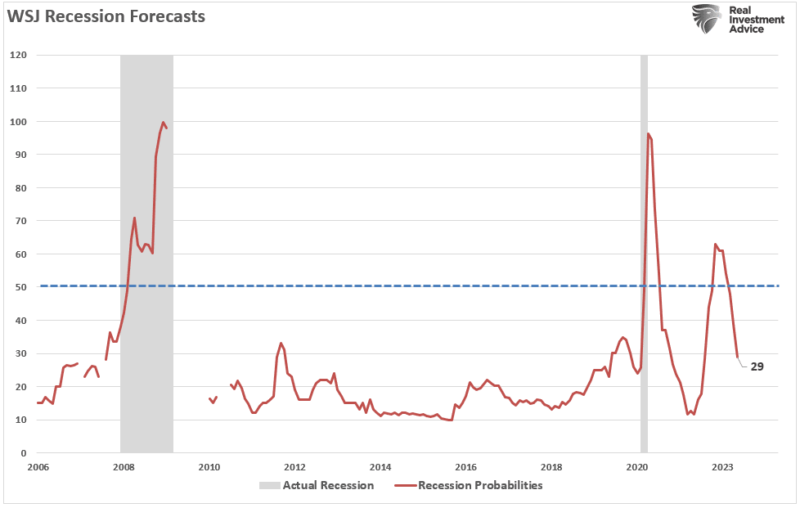

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

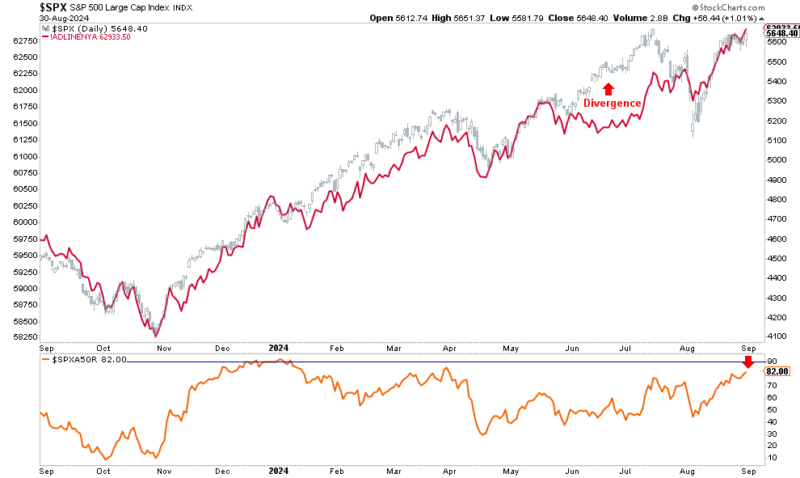

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

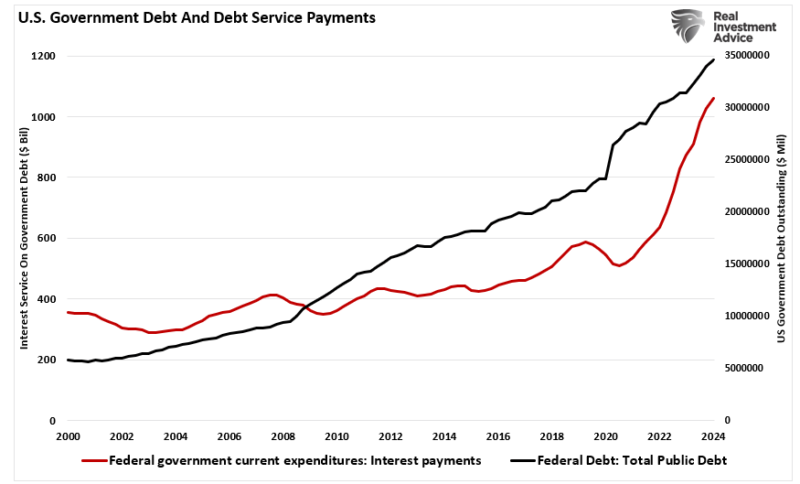

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

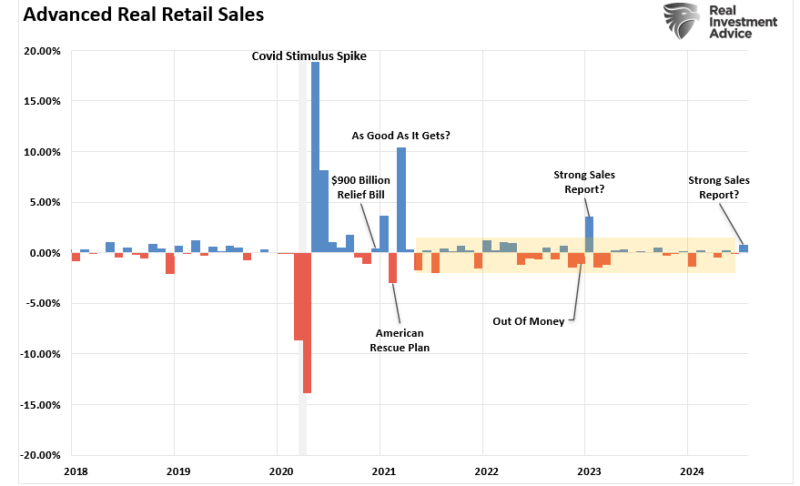

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

Immigration And Its Impact On Employment

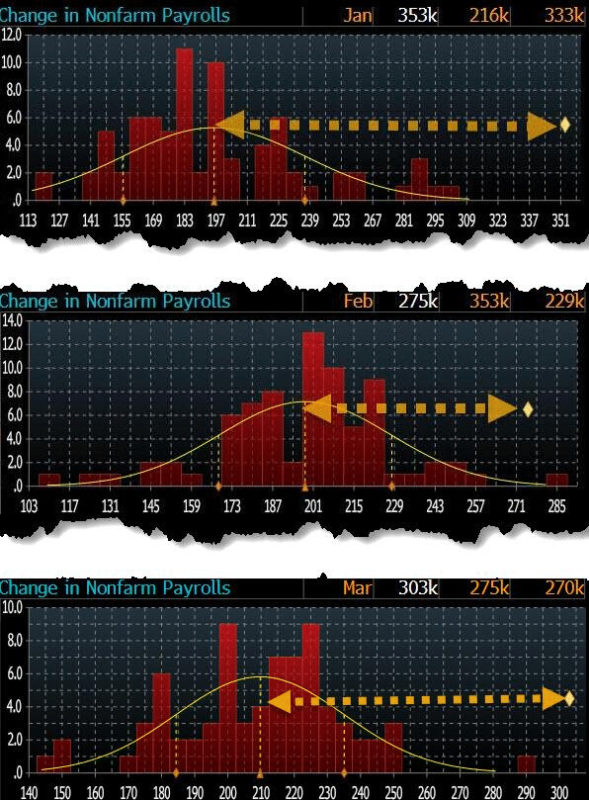

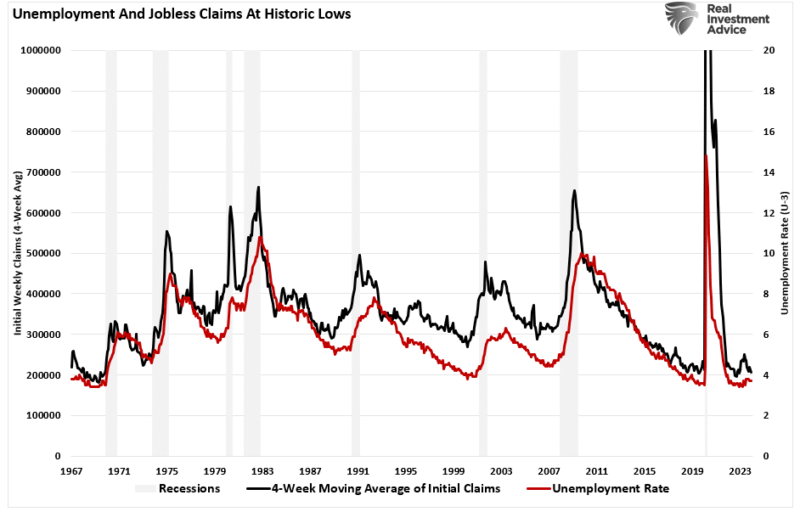

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

Valuation Metrics And Volatility Suggest Investor Caution

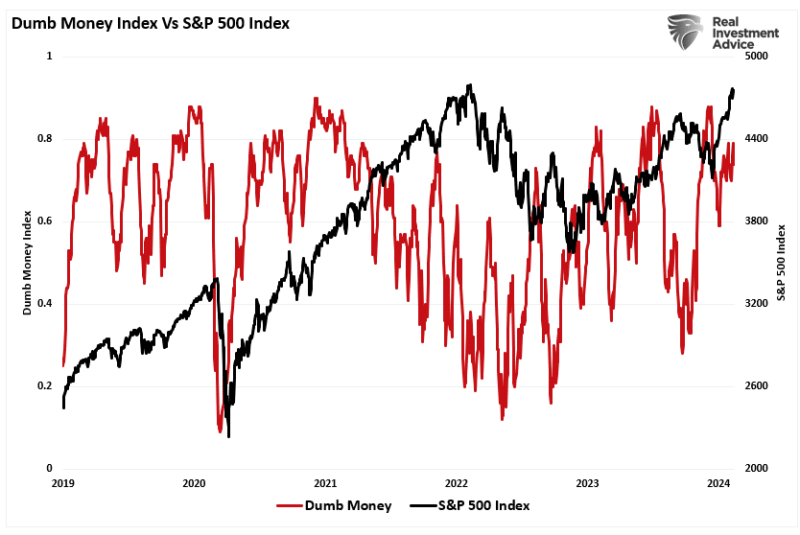

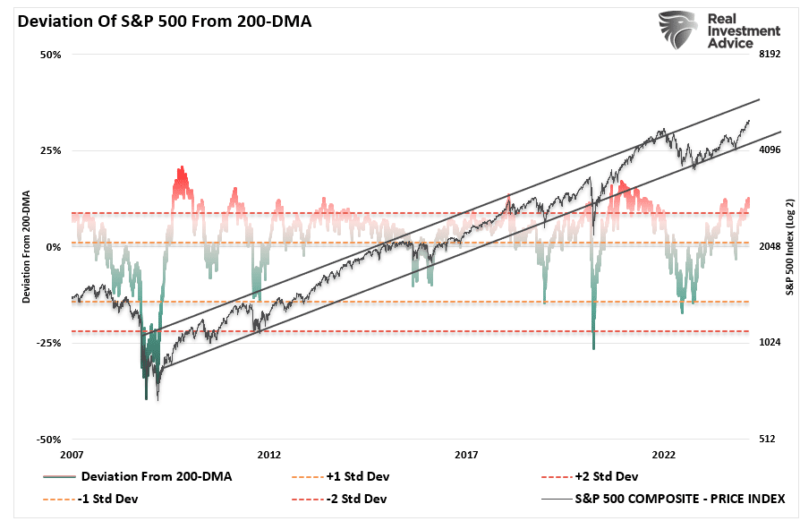

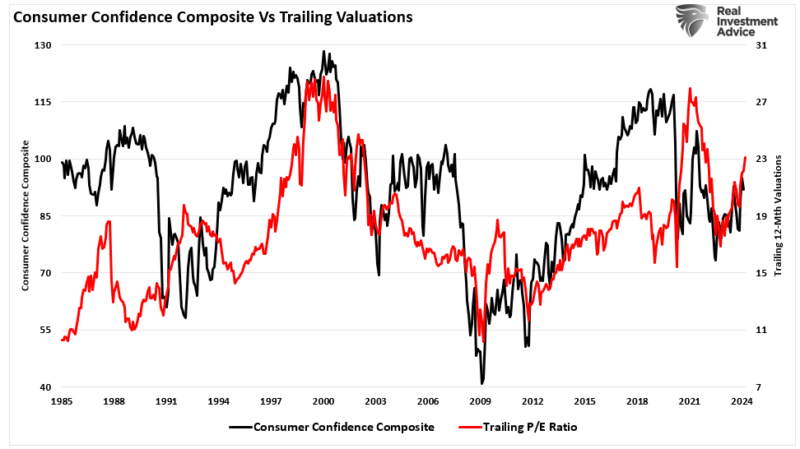

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

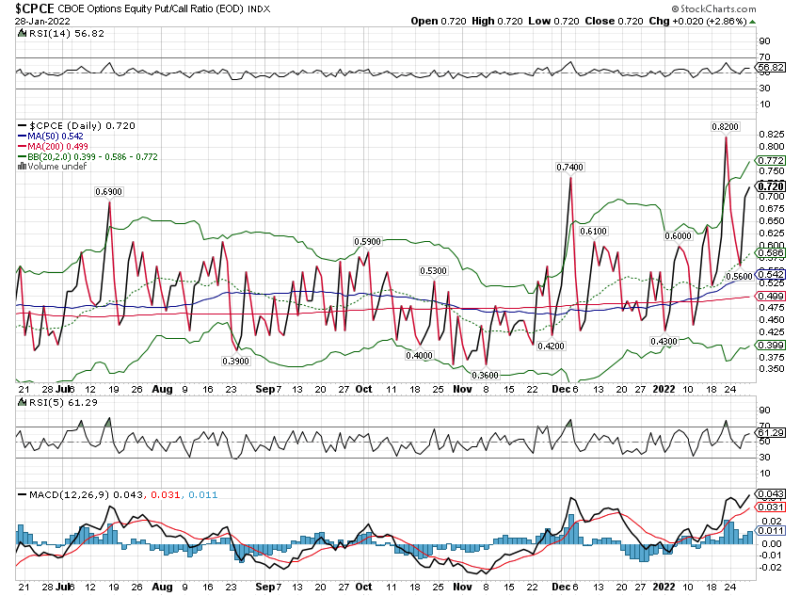

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

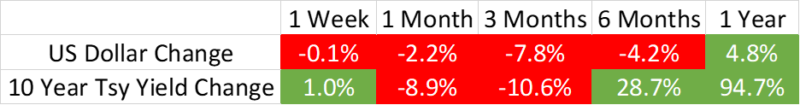

Weekly Market Pulse: Expand Your Horizons

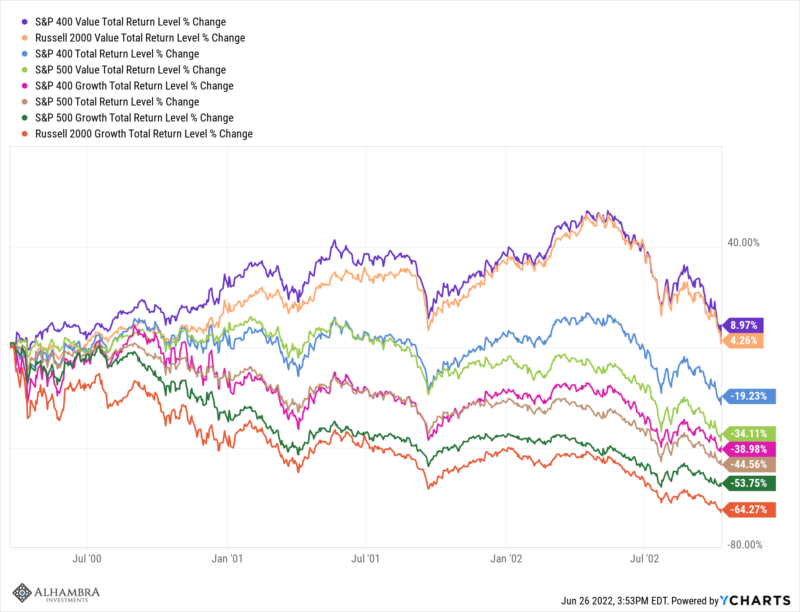

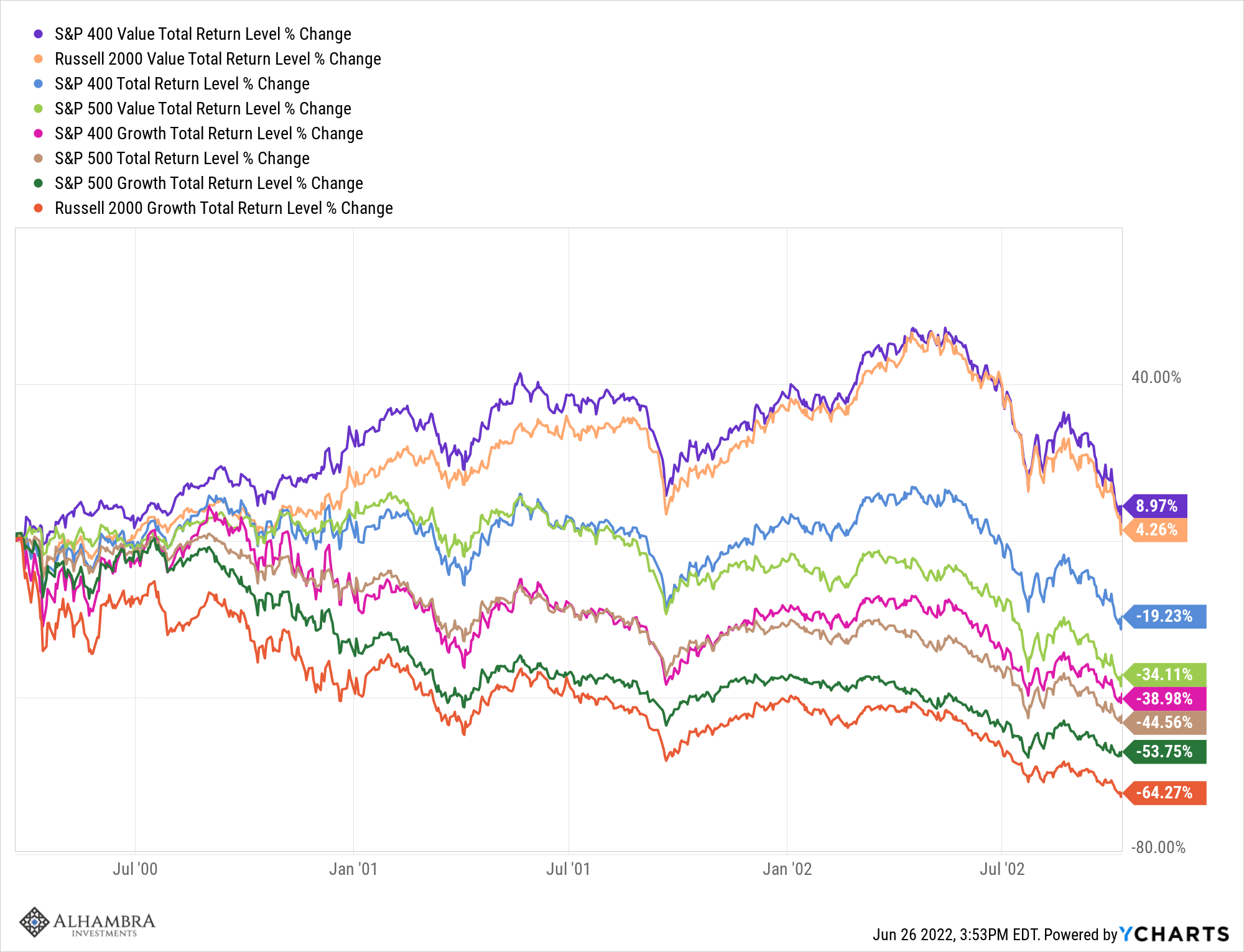

Late last year I wrote a weekly update that focused on the speculative nature of the markets. In that article, I focused on the S&P 500 because I wanted to make a point, namely that owning the S&P 500 did not absolve investment advisers of their fiduciary duty.

Read More »

Read More »

Weekly Market Pulse: Are We There Yet?

I’ll just get this out of the way right at the beginning. The question in the title of this post refers to the end of the ongoing stock market correction and the answer is likely no. There are no sure things in this business so it isn’t an unequivocal no, but based on history, the odds favor more weakness.

Read More »

Read More »

Weekly Market Pulse: Buy The Dip, If You Can

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

QE’s and Rate Cuts: Two Very Different Sets of Sentiment Drawn From Them

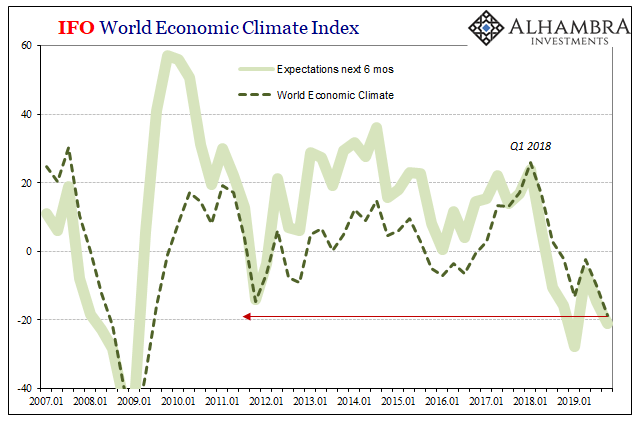

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work.

Read More »

Read More »

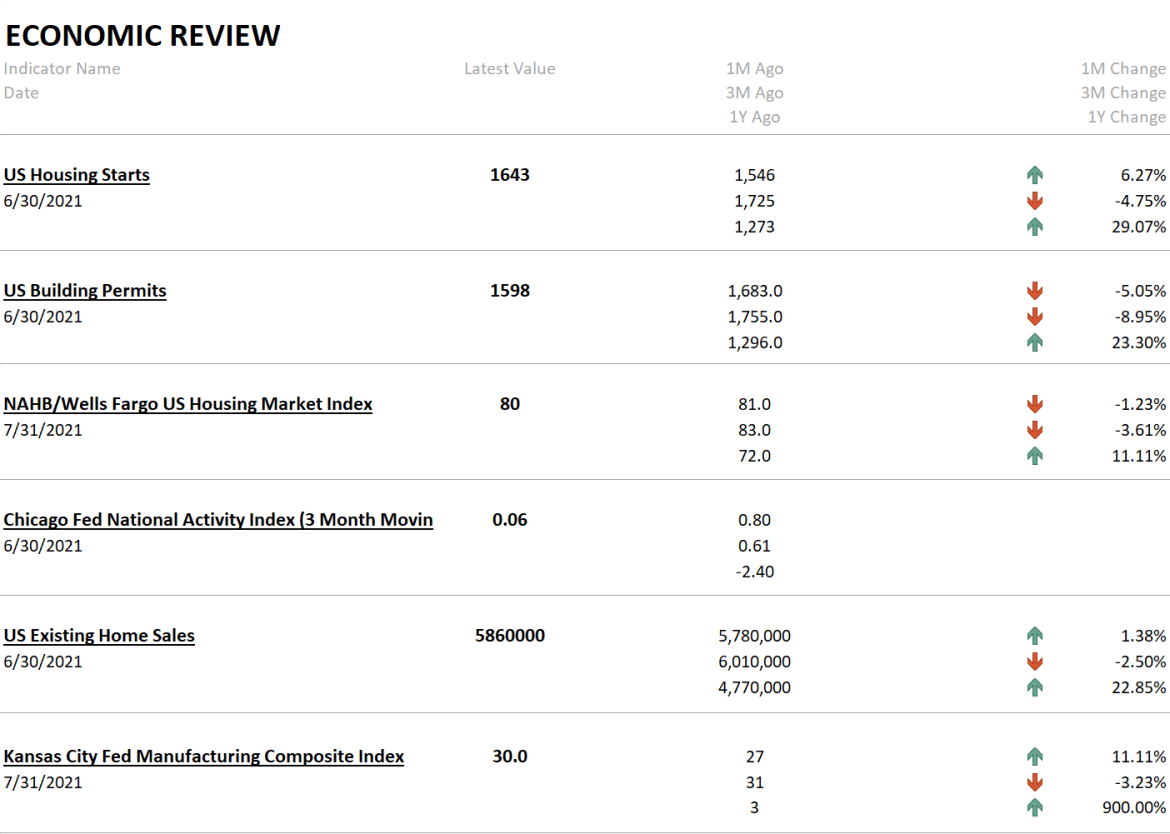

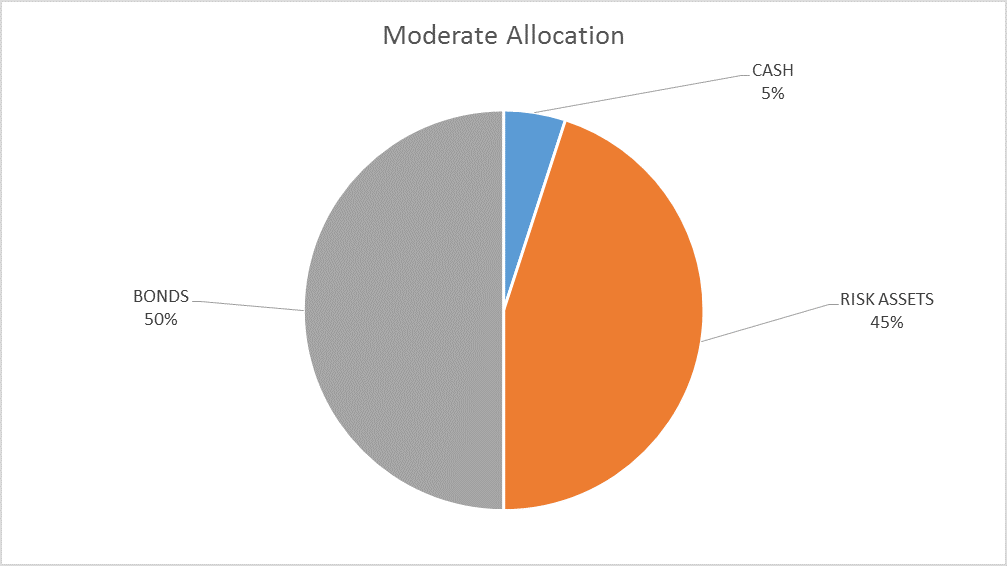

Global Asset Allocation Update:

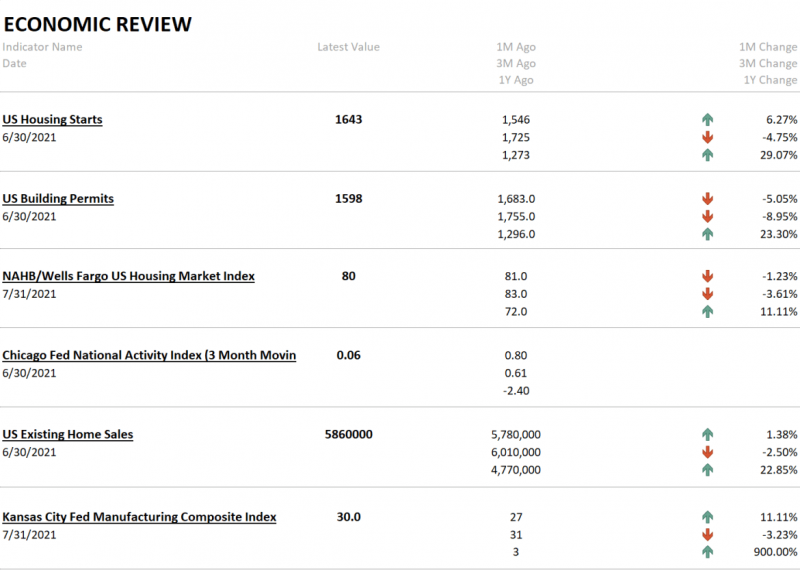

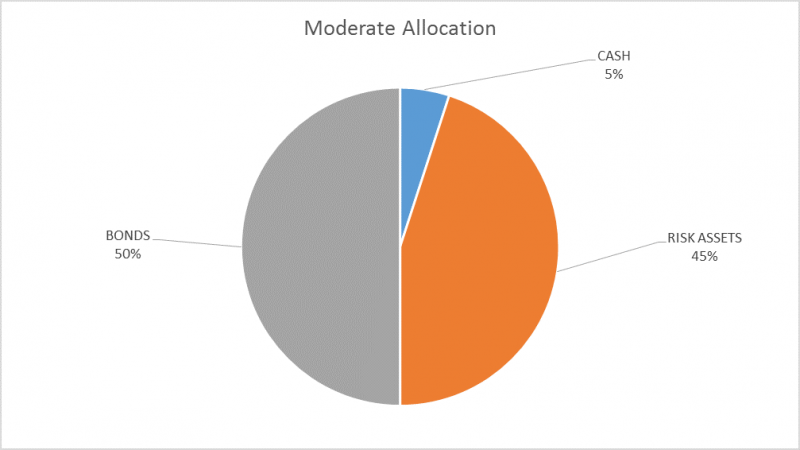

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »