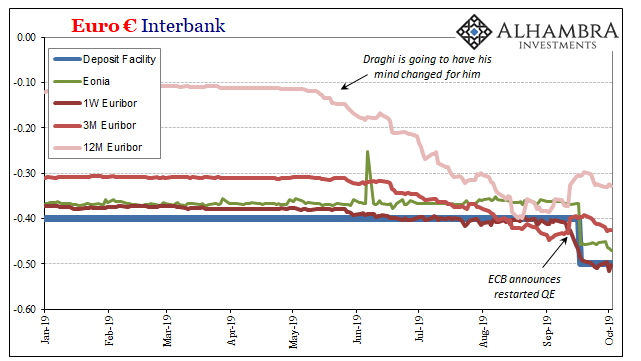

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Read More »

Tag Archive: Draghi

FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The … Continue...

Read More »

Read More »

The Dollar, the ISM, Buy American and Irrational Exuberance

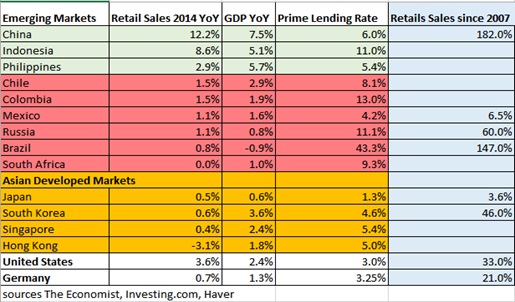

In this Cross Asset Global Macro Analysis we name our reasons for the current dollar strength. The main causes are ECB’s euro “downtalk”, tight monetary policy in Emerging Markets, rising savings of the aging populations. This leads to weak global spending and growth. With the help of Fed-financed higher asset prices and falling gasoline prices, …

Read More »

Read More »

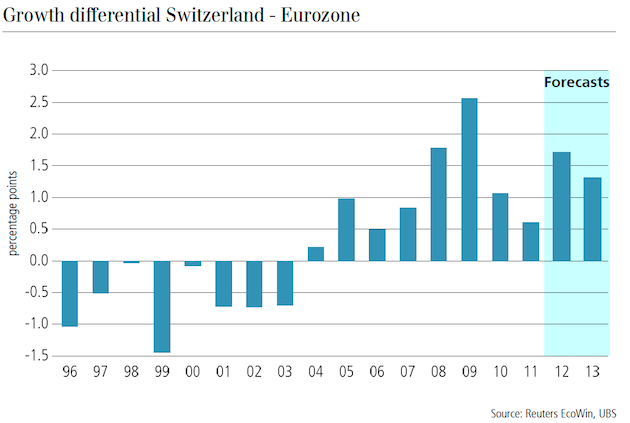

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

Potential losses due to money printing are for the Fed: 1.2% of GDP, Bundesbank: 5% of GDP, SNB: 12% of GDP.

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »

Eurobonds, fiscal or banking union are all pure utopia

Germany’s stance in the euro crisis: More than ESM will not be possible for many years updated on August 31, 2012 German politicians and the German Bundesbank believe that the Euro crisis can be only solved by supply side reforms as formulated in the Euro Plus Pact, reforms that were already successfully introduced during the Thatcher/Reagan era in the …

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »