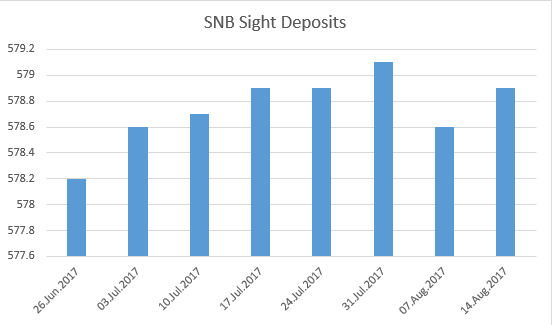

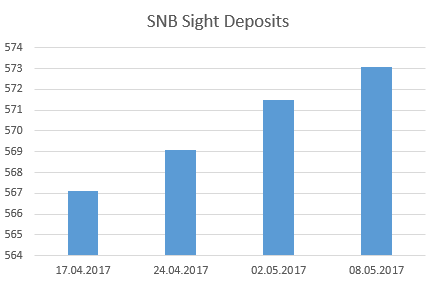

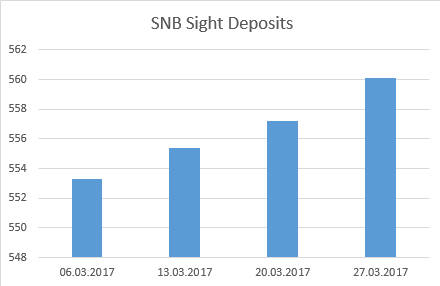

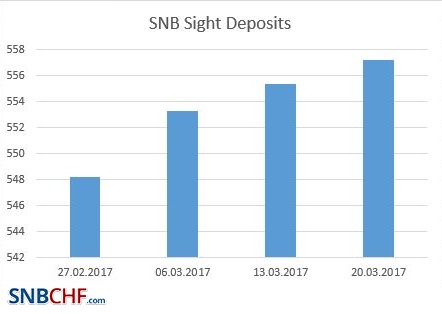

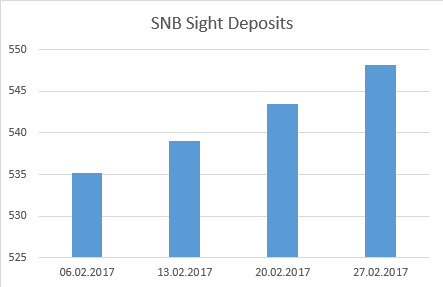

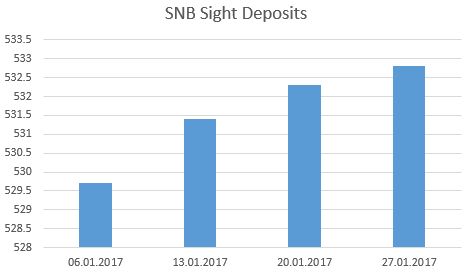

Last week's data: FX: EUR/CHF was between 1.07 and 1.0750. SNB sight deposits: SNB intervenes for 0.7 bn. CHF at the EUR/CHF 1.07 level. CHF Speculative Positions Speculators went net short CHF with 10K contracts, this is still far from the 26.K contracts record.

Read More »

Tag Archive: currency reserves. intervention

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

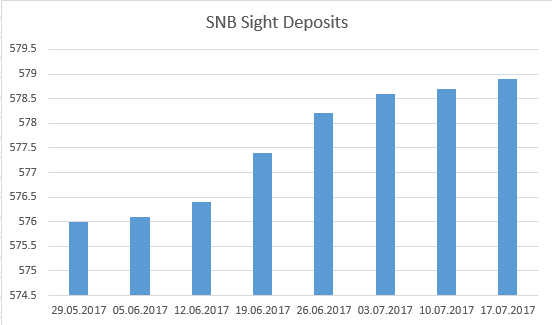

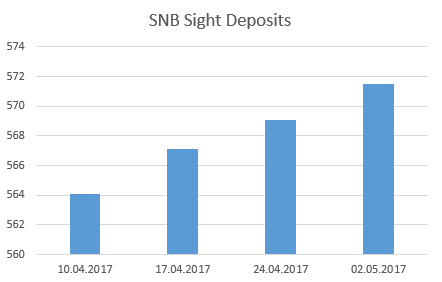

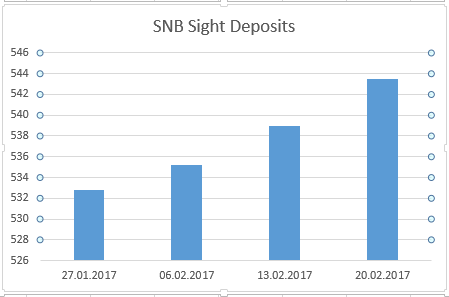

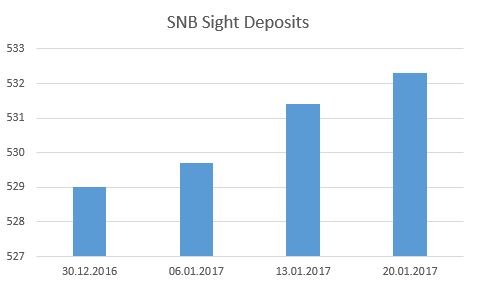

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »

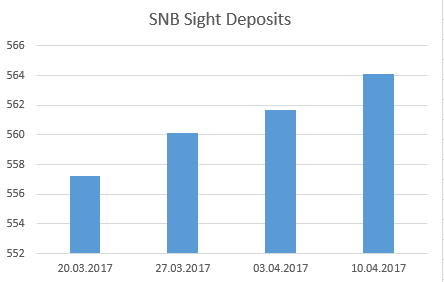

Weekly Sight Deposits: No SNB Interventions, Short CHF nearing records

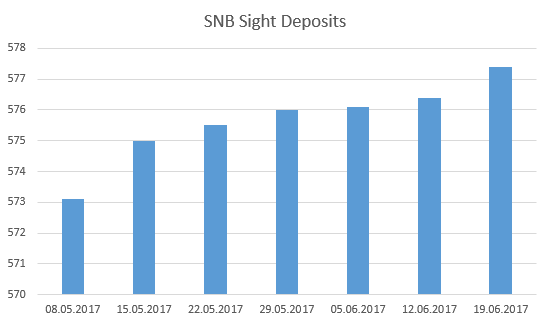

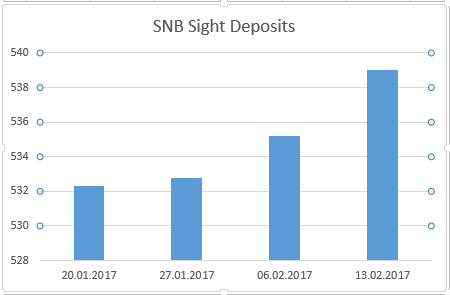

Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later.

Read More »

Read More »

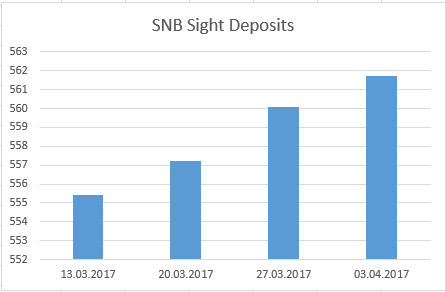

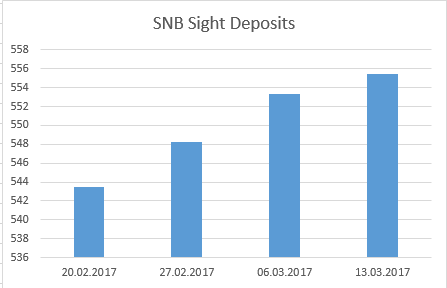

Weekly Sight Deposits: Investors hedge with Swiss Franc again for the coming inflation cycle.

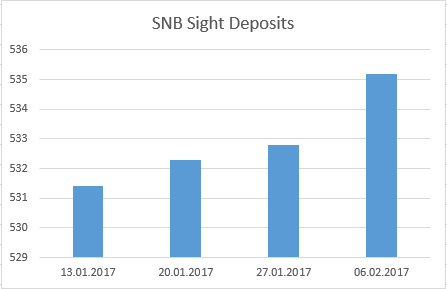

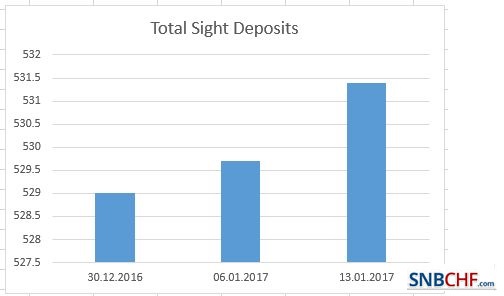

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up U.S. wages.

Read More »

Read More »

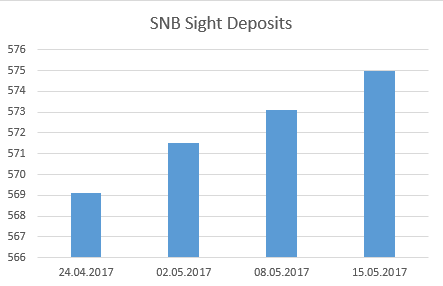

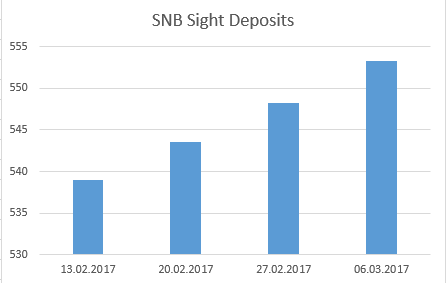

Weekly Sight Deposits: Investors hedge against Trump’s inflationary policy with Swiss Franc.

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts - i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump would push for a more jobs and a dovish Fed, same as his fellow...

Read More »

Read More »

SNB Sight Deposits November 7: No interventions, EUR/CHF under 1.08 with political jitters

Sight Deposits: show that the SNB has not intervened to sustain the euro, that dipped under EUR/CHF 1.08. We considered the 1.08 as line in sand for the SNB. The odds of Trump are rising. This causes fear and demand for Swiss Franc. The EUR/CHF fell to 1.0750. Speculators were net short CHF January 2015, shortly before the end of the peg, with 26K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25K contracts. We see...

Read More »

Read More »