Tag Archive: Currency Movement

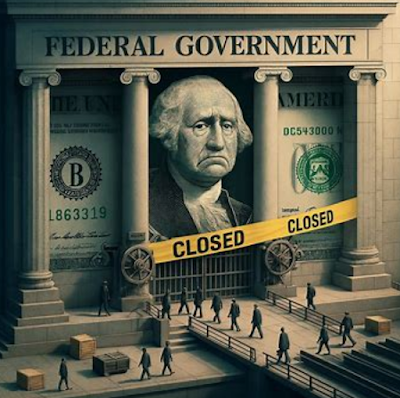

Greenback is Firm: Government Still Closed

Overview: The US dollar is beginning the new month on a firm note. It has edged higher against most currencies. Among the G10, the Australian dollar and Norwegian krone are leading the pack with negligible gains. Among emerging market currencies, the Mexican peso's gain of around 0.15% puts its atop the complex. The news stream …

Read More »

Read More »

Bullish Dollar Consolidation

Overview: After extending this week's rally yesterday, the US dollar is consolidating yesterday's gains in what appears to be favorable price action. The pullback from greenback's best level has been shallow. The US struck several trade deals this week, and secured a trade truce with China, even if many are skeptical of its longevity, and …

Read More »

Read More »

US-China Agree to Unwind Recent Actions, while Greenback Consolidates Post Fed Move, and Yen Slumps after BOJ Stands Pat

Overview: The US agreed to not to block subsidiaries of Chinese companies that were sanctioned and not to enforce the port fee on Chinese ships that had ostensibly triggered the tightening of China's rare earth/magnet export restrictions. China agreed to suspend those for a year and dropped its levy on US made/operated ships port calls. …

Read More »

Read More »

Japanese Verbal Intervention was More Effective than Bessent’s, and the Dollar is Bid Ahead of FOMC Outcome

Overview: The market is optimistic a deal will be struck between the US and China tomorrow. A reduction in the fentanyl tariff is expected, and a one-year delay in the broad export licensing requirement for rare earths and related technology has been tipped. Reports suggest China purchased two cargoes of US soy for the first …

Read More »

Read More »

Japan’s Warning and Successful US-Japan Talks See Yen Snap Seven-Day Slide

Overview: The dollar is mixed against the G10 currencies today. Fanned by Japanese official caution about exchange rate developments, and perhaps what seems like a successful between President Trump and Japanese Prime Minister Takaichi, the dollar is snapping a seven-day advance against the yen. The dollar bloc and sterling are under-performing, while the roughly 1.75% …

Read More »

Read More »

Risk-On as US-China Take Step Away from Brink, Market Shrugs off new US Levy on Canada, and Milei Does Better than Expected in Argentina

Overview: A combination the US and China moving away from the trade brink, more US trade agreements (and frameworks) in Southeast Asia (Cambodia, Thailand, Vietnam, and Malaysia), and a strong showing by Milei's party in Argentina have boosted risk appetites in today's activity. The US S&P 500 and Nasdaq are poised to gap higher for …

Read More »

Read More »

Trump Cancels Trade Talks with Canada even as US Seeks Broad Alliance to Check China’s Rare Earth Dominance

Overview: The US dollar is trading higher against all the G10 currencies today, but it has not broken out of this week's ranges. The Dollar Index is rising for the fourth session this week and has recovered last week's 0.55% decline. The greenback is more mixed against emerging market currencies. While the JP Morgan Emerging …

Read More »

Read More »

Tighter Sanctions on Russia Spurs Oil’s Surge and Lifts Yields

Overview: The dollar is trading quietly in mostly narrow ranges against the most of the G10 currencies. The key development has been the escalation of pressure on Russia from a new round of sanctions by the US and EU. The US sanctioning of two of Russia's largest oil companies will disrupt Chinese and Indian buyers …

Read More »

Read More »

Flat September CPI Boosts Speculation of a BOE Rate Cut While Weighing on Sterling

Overview: The US dollar is mostly narrowly mixed among the G10 currencies. Sterling is the exception, and it is off about 0.35% after the softer than expected CPI spurred speculation of a rate cut. The 10-year Gilt yield is off seven basis points while most European bond yields are narrowly mixed, less than one basis …

Read More »

Read More »

Yen Sold as Takaichi becomes Japan’s Prime Minister

Overview: The US dollar is mostly firmer today as its pullback from last week's highs is retraced. Although the US 10-year yield is spending more time below the 4.0% floor, the yen is the weakest of the G10 currencies, off about 0.70%, as Takaichi became Japan's first woman prime minister and the many investors are …

Read More »

Read More »

Eerie Calm in the Foreign Exchange Market

Overview: The foreign exchange market is quiet, and the US dollar is slightly softer against most of the G10 currencies, though the Australian and Canadian dollar are struggling. Most emerging market currencies are also firmer. The market seems optimistic that the US-China trade tensions can de-escalate with Beijing re-assigning Li Chenggang who apparently annoyed the …

Read More »

Read More »

Fear Grips the Capital Markets

Overview: The pendulum between fear and greed is swinging toward the former today. The large write-downs at a couple of US regional banks follow high-profile collapses of Tricolor and First Brands. They play on fears of mounting late-cycle stress. US bank reserves have also fallen through a key threshold ($3 trillion) and some fear a …

Read More »

Read More »

FX Moves Tentatively, While Equities and Gold Continue to March Higher

Overview: The US dollar is mostly a little softer ahead of the start of the North American session. Participants do not seem to have much short-term conviction amid the heightened tensions between the US and China and wary of political developments in France and Japan. Against several pairs, the greenback has frayed its recent ranges …

Read More »

Read More »

US Dollar Returns Offered While Bonds and Stocks Rally, Gold’s Ascent Continues

Overview: The dollar is heavy today. It is weaker against nearly all the world's currencies. The ongoing elevated trade tensions between the US and China continue to be the main talking point today. US rates were soft before Fed Chair Powell spoke yesterday and remain soft, at the same moment when market participants seem to …

Read More »

Read More »

No Relaxation of US-China Tensions, Japanese Political Challenges, and a Rise in UK Unemployment, Send Ripples Through the Capital Markets

Overview: The markets wanted to believe that the President Trump and Treasury Secretary Bessent were right, China overreacted with the broadening and tightening of export licensing requirements for critical materials and de-escalation would result. But this does not seem to be the case. The risk-off mood has sent stocks tumbling and bonds rallying. The dollar …

Read More »

Read More »

Market Sees “Escalation to De-Escalate”

Overview: Neither the US nor China have backed away from the brink approached before the weekend, but many market participants have concluded that this is an "escalation to de-escalate". The foreign exchange market has unwound some of the pre-weekend price action. The dollar-bloc currencies and Norwegian krone, which suffered before the weekend, are firmer, while …

Read More »

Read More »

China Takes Dramatic Measures, While Japan’s MOF Warns Against Excessive Yen Moves

Overview: The US dollar has stabilized after yesterday's surge. Following words of caution by Japan's finance minister, the yen is the strongest of the G10 currencies today, with around a 0.15% gain. The slowest underlying inflation in Norway in four months has weighted on the krone, which is off about 0.35%. Excluding the krone, the …

Read More »

Read More »

North American Leadership Awaited in FX

Overview: There was some, albeit limited follow-through dollar buying today, but the early gains have been pared as the European morning progressed. That leaves the greenback narrowly mixed among the G10 currencies, with the Scandis, sterling, and the New Zealand dollar underperforming. North American leadership is awaited. Emerging market currencies are also mixed. News that …

Read More »

Read More »

Dollar Jumps by Default

The US dollar's recovery accelerated today, and it has not deterred gold from surging through the $4000-mark in the spot market. With the US government still shut and no apparent negotiations to end it, greenback's gains seem to be a reflection of poor developments elsewhere.

Read More »

Read More »

The Greenback Remains Bid

Overview: The dollar has come back bid. It is trading near session highs late in the European morning. The French crisis has not been resolved and the policy mix advocated by the new head of the LDP and soon-to-be prime minister continues to weigh on the yen. The US government remains closed, and the White … Continue reading »

Read More »

Read More »