Keith Weiner zeigt, dass Griechenland bankrott gehen wird, egal ob es im Euro bleibt oder auf Dollar oder eine neue Drachme umstellt. Er schlägt eine Umstellung auf gold-denominierte Obligationen vor. Nur die Sicherheit von Gold wird Kapital wieder in das Land locken.

Read More »

Tag Archive: Currency Board

Keith Weiner: Open Letter to Alexis Tsipras

The troika wants you to accept another bailout deal, to service Greek debts a while longer. Since bailouts mean borrowing more, you cannot avoid default in the end. Going deeper into debt is no good for anyone.

However, Greece has no future so long as it clings to the euro.

Read More »

Read More »

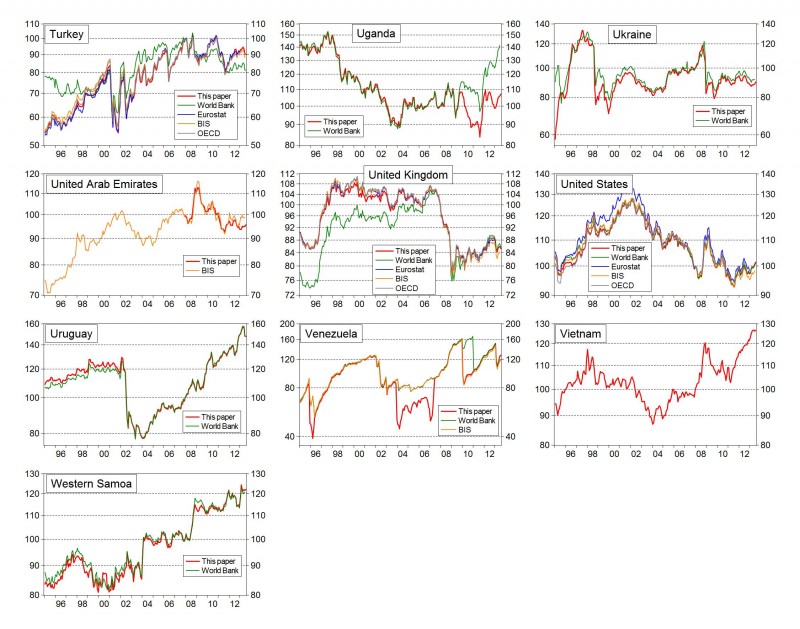

(2.7) The Most Complete Real Effective FX Rate Comparison

In August 2013 the Bruegel blog offered one of the best comparison of long-term real effective exchange rates (REER). The data is CPI based and therefore not as good as the producer price index (PPI) that reflects tradable goods better.

However the data is huge with three different sources - BIS, World Bank, Eurostat, OECD and Bruegel. The data indicates how the real value of the currencies of China and many other Emerging Markets (EM) have...

Read More »

Read More »

Why the SNB will not Imitate Hong Kong, but Potentially Singapore

The SNB will not be able to realize a fixed currency peg over the long-term. The consequence would be that Switzerland loses its competitive advantage, lower Swiss rates, if it follow euro inflation.

Read More »

Read More »

Warum die SNB nicht Hongkong, sondern Singapur imitieren wird

Im Gegensatz zu Hongkong mit dem USD/HKD-Peg kann die Schweiz ein Currency Board, einen fixen Kurs zum Euro nicht für Jahre durchhalten. Die Gründe auf snbchf.com

Read More »

Read More »