Tag Archive: CPI

Soft US CPI Today Paves Way for Fed Pivot Tomorrow

Overview: The US dollar is trading softer against all the

G10 currencies ahead of what is expected to be a soft November CPI report,

which paves the way for a pivot by the FOMC tomorrow. It is expected to signal

that policy may be sufficiently restrictive and anticipate being able to cut

rates next year more than it thought in September, even if not as much as is

priced into the market. Among emerging market currencies, central European

currencies...

Read More »

Read More »

Dollar Recovers After Losses Extended in Asia

Overview: On the back of lower interest rates, the greenback's

slide was extended in early Asia Pacific turnover, but it has recovered. As

North American trading begins, the dollar is firmer against all the G10

currencies but the New Zealand dollar, which has been aided by the hawkish hold

of the central bank, and an immaterial gain in the Swiss franc. Emerging market

currencies are mixed. Central European currencies and the Mexican peso are...

Read More »

Read More »

Corrective Forces Help the Dollar Stabilize

Overview: Corrective

forces helped the dollar stabilize yesterday and it enjoys a firmer today. The

euro has slipped below $1.09, and the dollar has resurfaced above JPY149.00. The

FOMC minutes seem dated by the more than 30 bp decline in the US 10-year yield,

the 7% rally in the S&P 500 and roughly 3% drop in the Dollar Index. The

implied year-end 2024 Fed funds rate has fallen by 10 bp to 4.51% (5.33%

currently). The Japanese government...

Read More »

Read More »

Is the Market Putting on Risk Ahead of the Weekend?

Overview: The US dollar is trading with a softer

bias. Among the G10- currencies, only the euro and Swiss franc are the laggards

and are nearly flat. In shifting expectations, the market sees the Reserve Bank

of Australia as the most likely to hike rates again, while the swaps market

appears to be bringing forward cuts by the European Central Bank and the Bank

of Canada. The Australian dollar is the strongest G10 currency today and this

week. After...

Read More »

Read More »

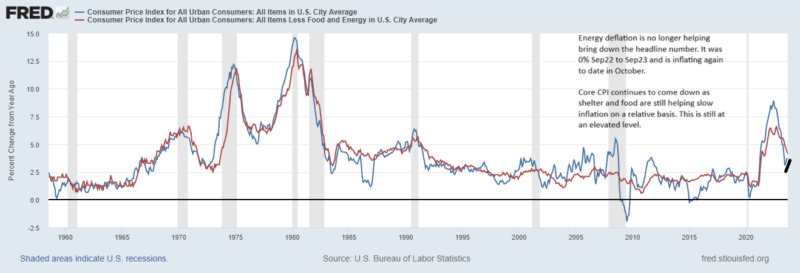

Macro: Sep CPI stuck at 3.7% YOY

The most anticipated release of the week came in … “Unchanged” or sticky stuck from the August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed...

Read More »

Read More »

Market Awaits US Data and Leadership

Overview: The dollar staged a major technical

reversal yesterday, in a dramatic reaction to a considerably weaker JOLTs

report than expected, spurring a large drop in US interest rates. And this is

despite press reports that the participation rate in the survey is half of what

was three years ago. We suspect the price action said as much about market

positioning as it did about the data. The path to the US jobs data on Friday

goes through...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

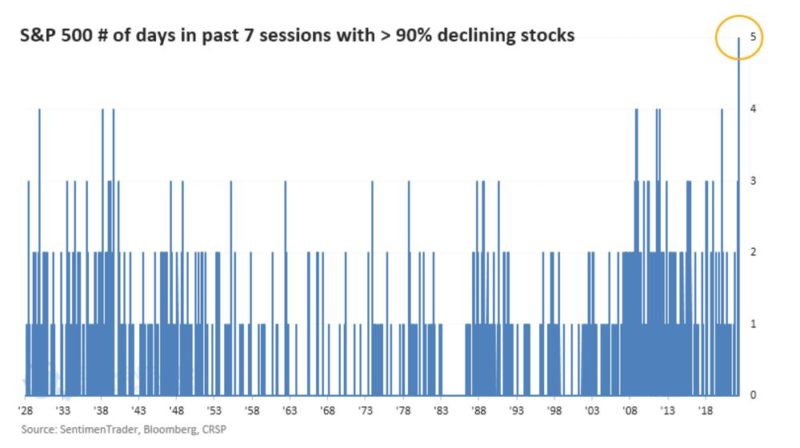

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

Is it All Really about Today’s US CPI Print?

Overview: The US dollar is trading with a heavier bias ahead of the July CPI report. The intraday momentum indicators are overextended, and this could set the stage for the dollar to recover in North America.

Read More »

Read More »

Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record.

Read More »

Read More »

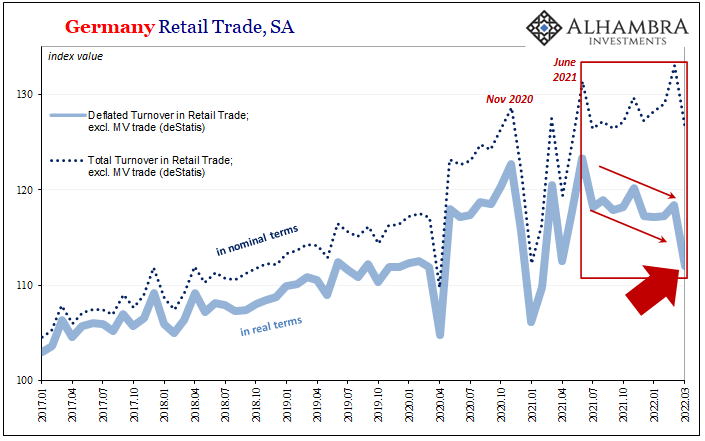

Eurodollar Futures Interpretation Is Everywhere

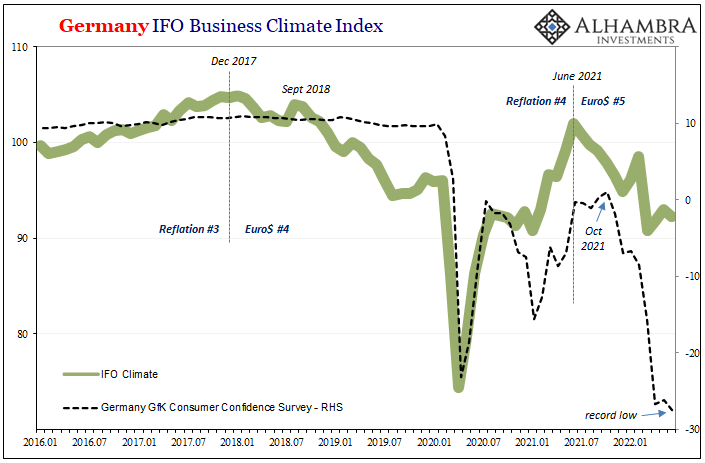

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation.

Read More »

Read More »

Market Pulse: Mid-Year Update

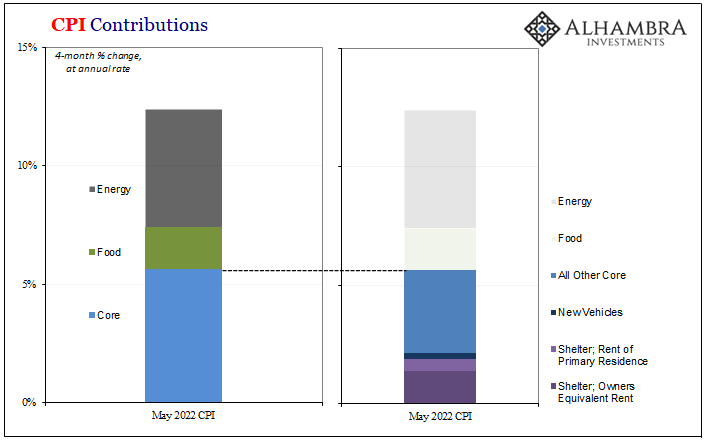

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay.

Read More »

Read More »

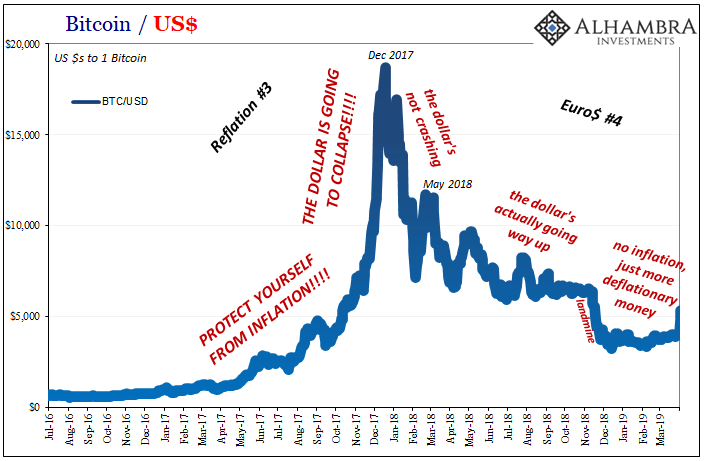

It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

US CPI Data Release Update

2022-09-17

by Stephen Flood

2022-09-17

Read More »