Tag Archive: Copper

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

Weekly Market Pulse: The More Things Change…

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

Weekly Market Pulse: Things That Need To Happen

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Read More »

Read More »

Market Pulse: Mid-Year Update

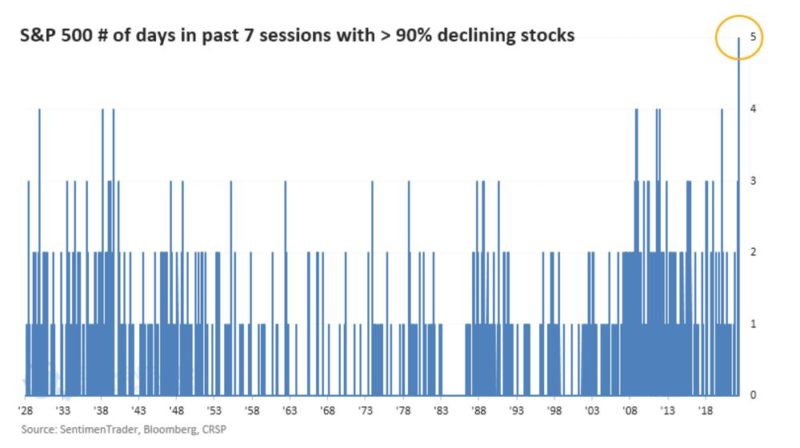

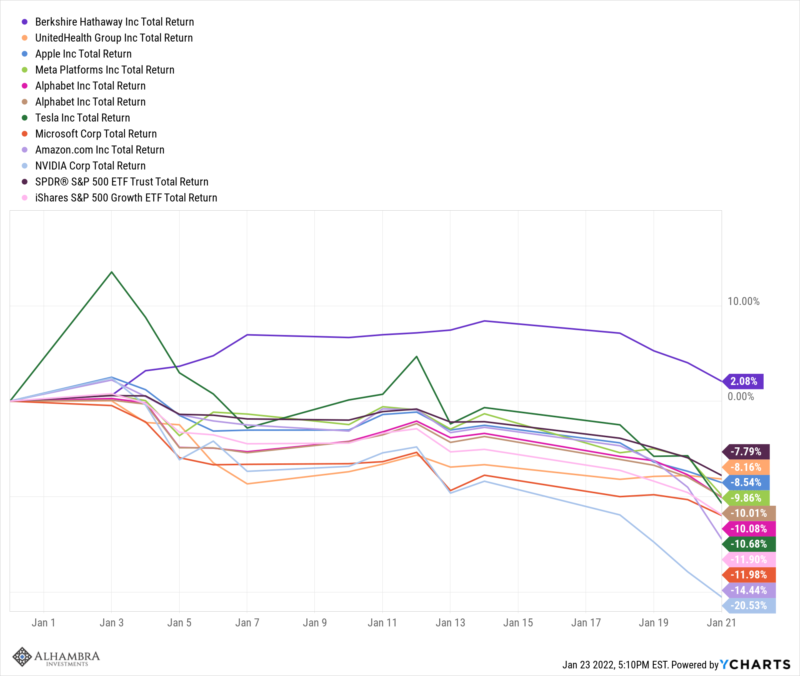

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

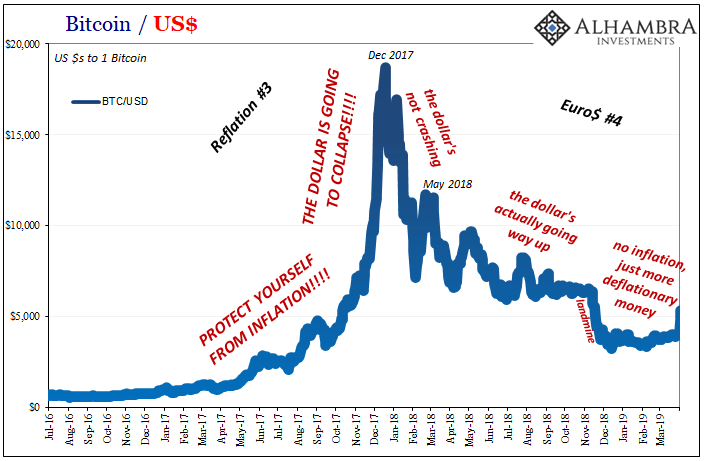

It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

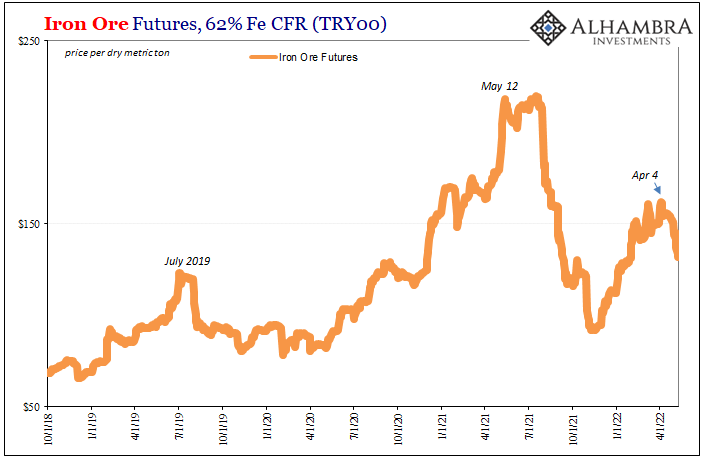

Industrial Synchronized Demand

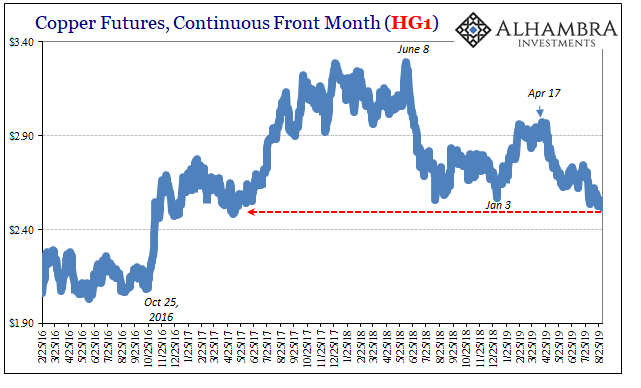

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week.

Read More »

Read More »

Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline.

Read More »

Read More »

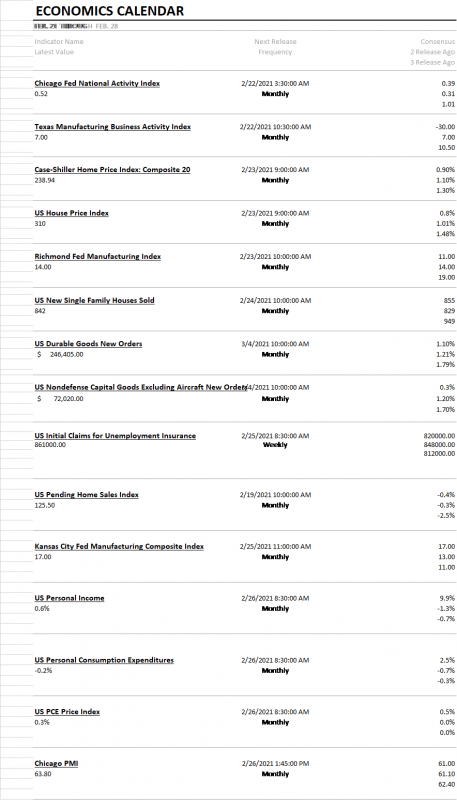

Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached...

Read More »

Read More »

What’s The Real Downside To Some of These Key Commodities?

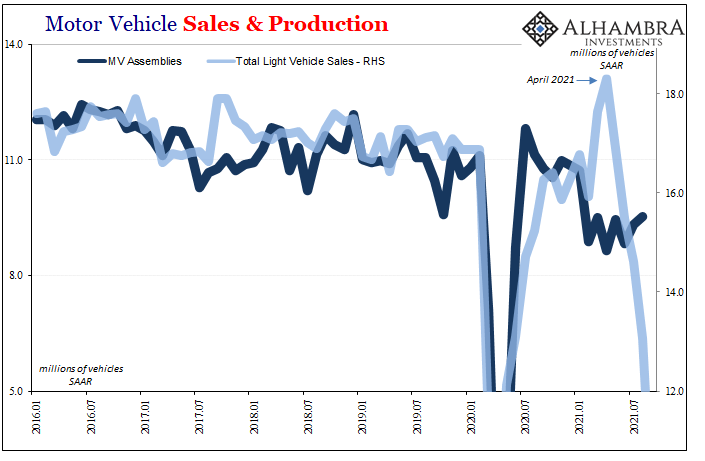

Last night, Autodata reported its first estimates for September auto sales in the US. According to its own as well as those compiled by the Bureau of Economic Analysis (the same government outfit which keeps track of GDP), vehicle sales have been sliding overall ever since April.

Read More »

Read More »

Weekly Market Pulse: As Clear As Mud

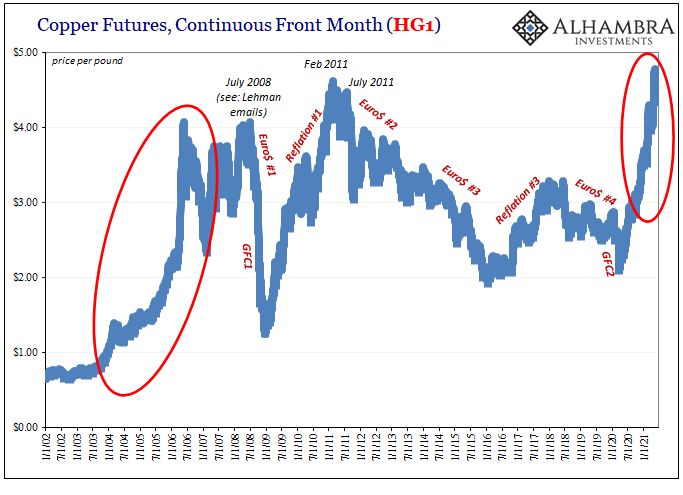

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

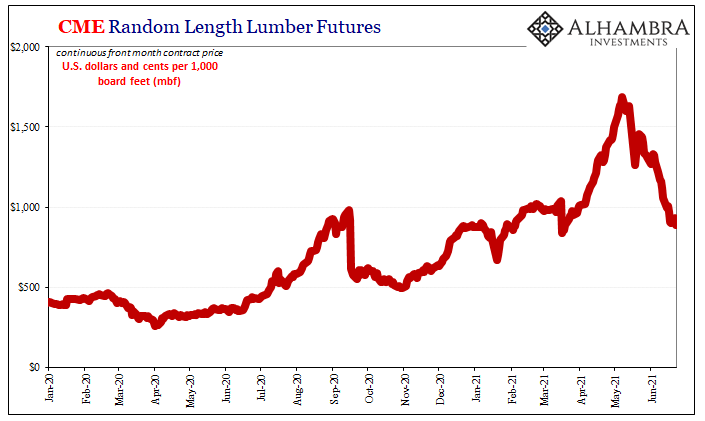

Sure Looks Like Supply Factors

If it walks like a duck and quacks like a duck, then it must be inflationary overheating. Or not? As more time passes and the situation further evolves, the more these recent price deviations conform to the supply shock scenario rather than a truly robust economy showing no signs of slowing down.

Read More »

Read More »

Copper Corroding PPI

Yesterday, lumber. Today, copper. The “doctor” has been in reverse for better than two months now, with trading in the current session pounding the commodity to a new multi-month low. Down almost $0.19 for the day, an unusual and eye-opening loss, this brings the cumulative decline to 9.2% since the peak way back on May 11.

Read More »

Read More »

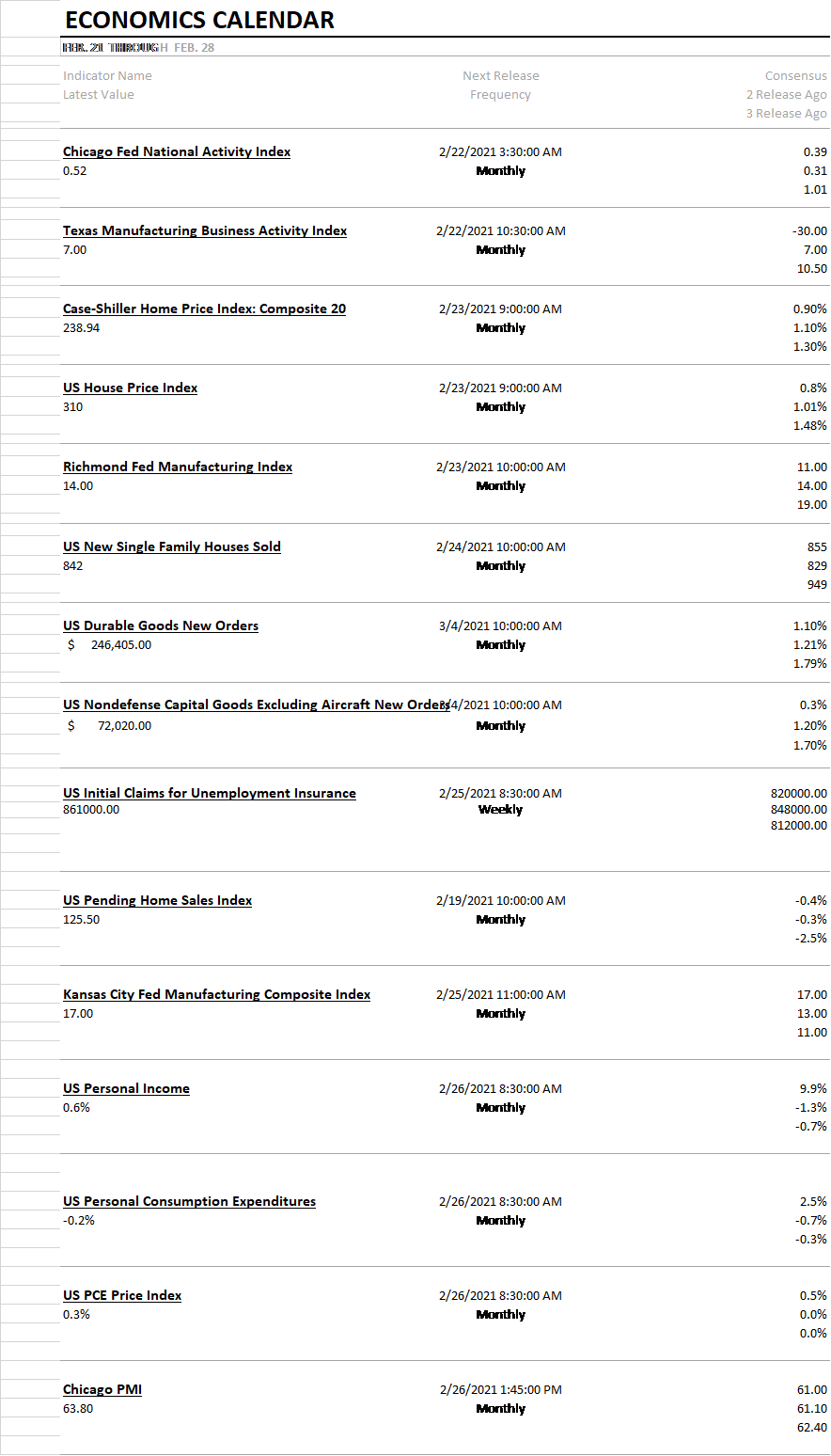

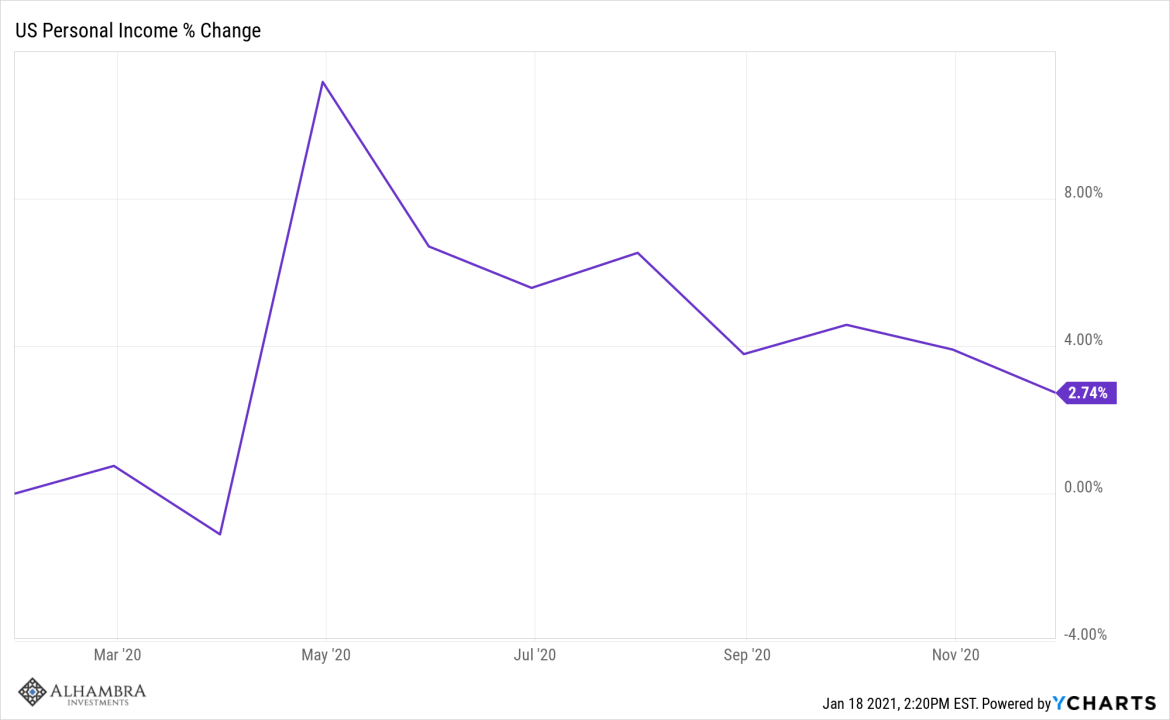

Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag.

Read More »

Read More »

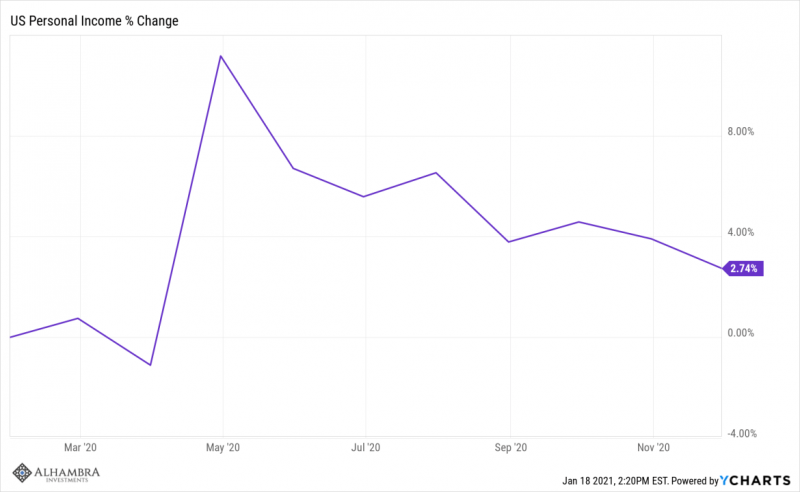

If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data.

Read More »

Read More »

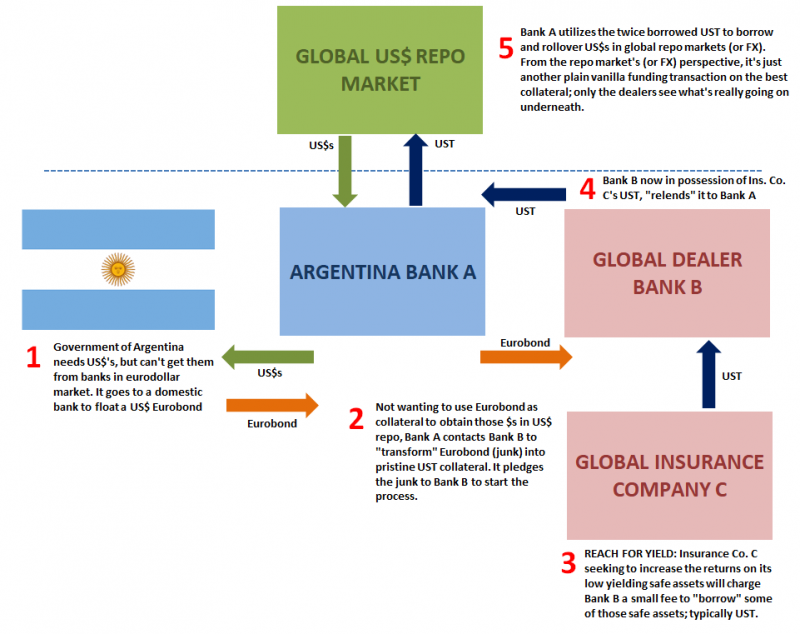

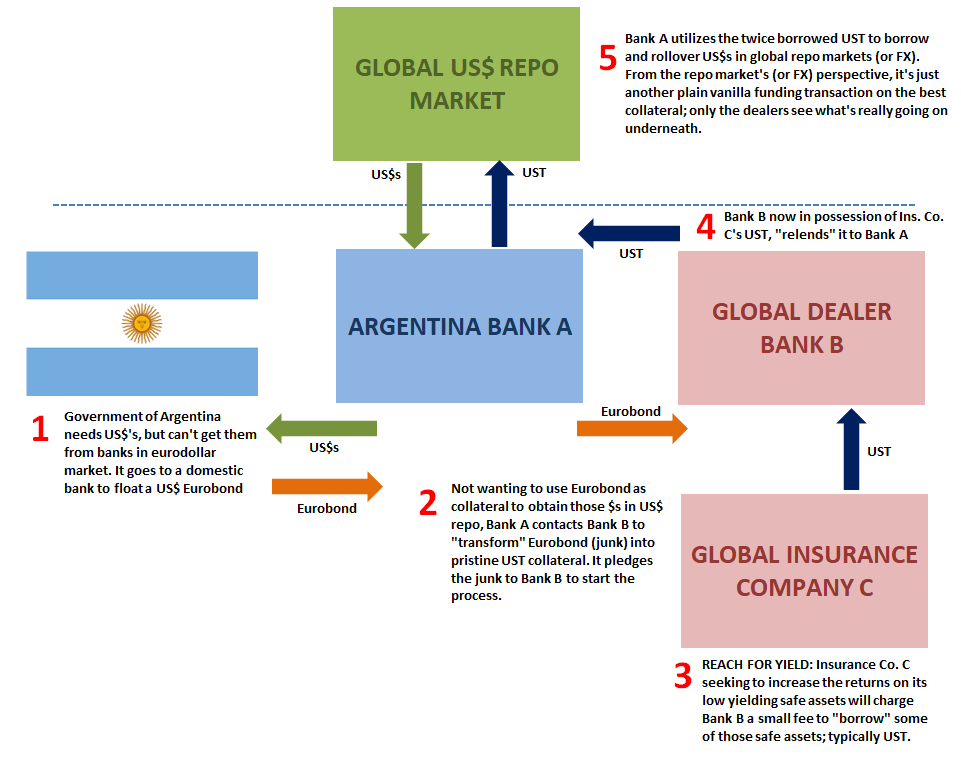

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

Copper Confirmed

Copper prices behave more deliberately than perhaps prices in other commodity markets. Like gold, it is still set by a mix of economic (meaning physical) and financial (meaning collateral and financing). Unlike gold, there doesn’t seem to be any rush to get to wherever the commodity market is going. Over the last several years, it has been more long periods of sideways.

Read More »

Read More »

Monthly Macro Monitor: Market Indicators Review

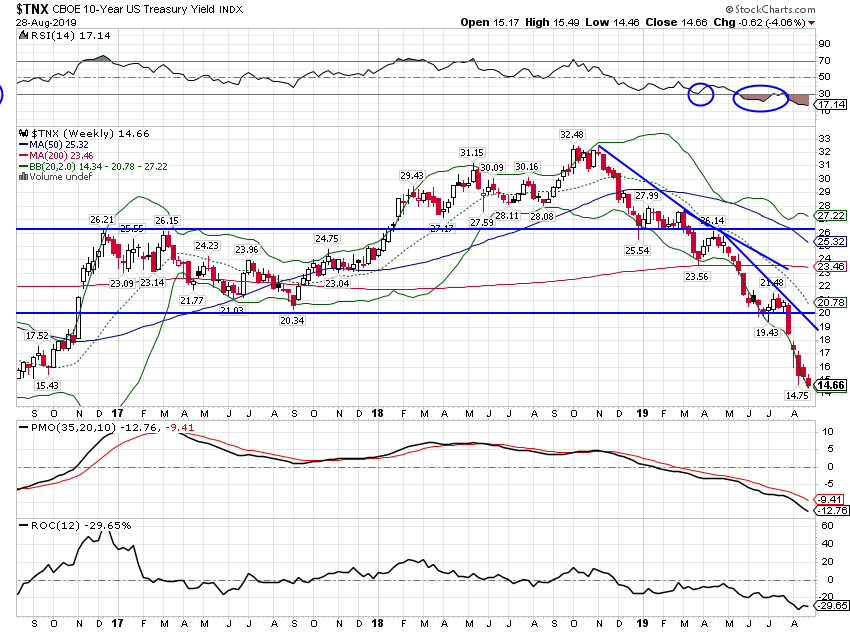

The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic.

Read More »

Read More »

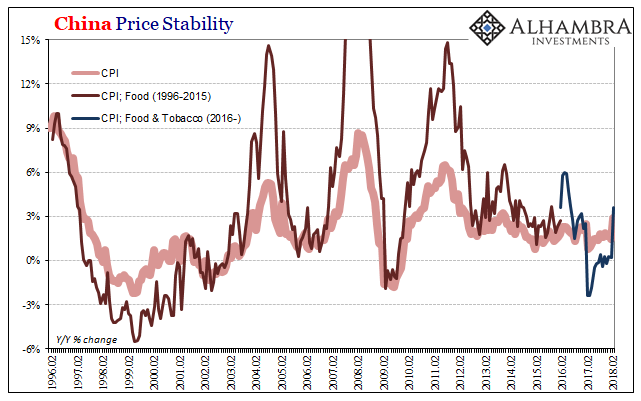

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »